In our opinion the following forex trading positions are justified - summary:

- EUR/USD: long (stop-loss order: 1.2527; initial price target: 1.3188)

- GBP/USD: none

- USD/JPY: short (stop-loss order: 110.73; initial price target: 105.20)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

While we usually cover individual currency pairs in our Forex Trading Alerts, today we decided to cover the thing that affects all of them – the USD Index. The rally in the US currency is something that has not only caused moves in world’s key currency pairs, but it has also impacted moves in the commodity markets (and that perhaps is responsible for the decline on the stock market). It’s important for investors and traders to keep monitoring the USD on a continuous basis.

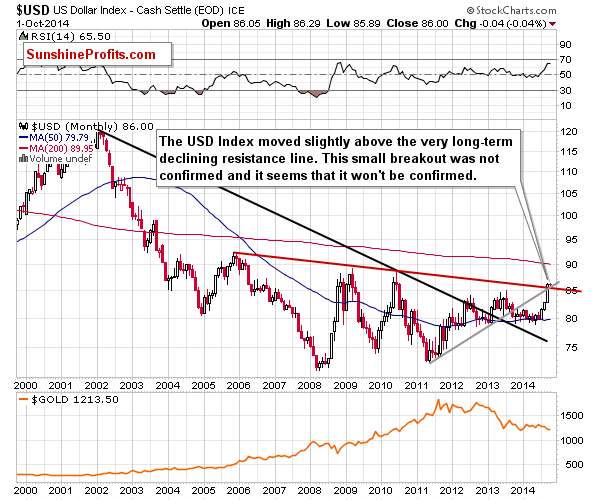

Let’s start today’s alert with the long-term USD Index (charts courtesy of http://stockcharts.com). First of all, we think that it’s important to keep the long-term perspective in mind.

In the alert that we published on August 12, we commented on the above chart in the following way:

The long-term resistance line was broken at the beginning of 2013 and the currency index has spent the following year in a consolidation pattern – verifying the breakout. The most profound attempt to move lower was seen in the second half of 2013, when the USD declined below the 50-month moving average and almost touched the previously broken resistance line. The line held and the move below the above-mentioned moving average was invalidated. The latter later served as support many times and was not successfully broken.

Based on the long-term breakout, we have been expecting the next significant move to be to the upside and it seems that the waiting is over. The rally that we’ve seen in July was significant enough to look like a start of a new big rally.

The rally had indeed started at that time - USD Index rallied from 81.51 to over 86 since August 12.

Is the rally over? Not likely – from the long-term perspective, the rally was still not that big, and we would expect it to be, given about a yearly post-breakout consolidation.

However, the rally has been very sharp and a corrective downswing would be something quite natural at this time. Is it likely? Based on the weekly perspective – it is.

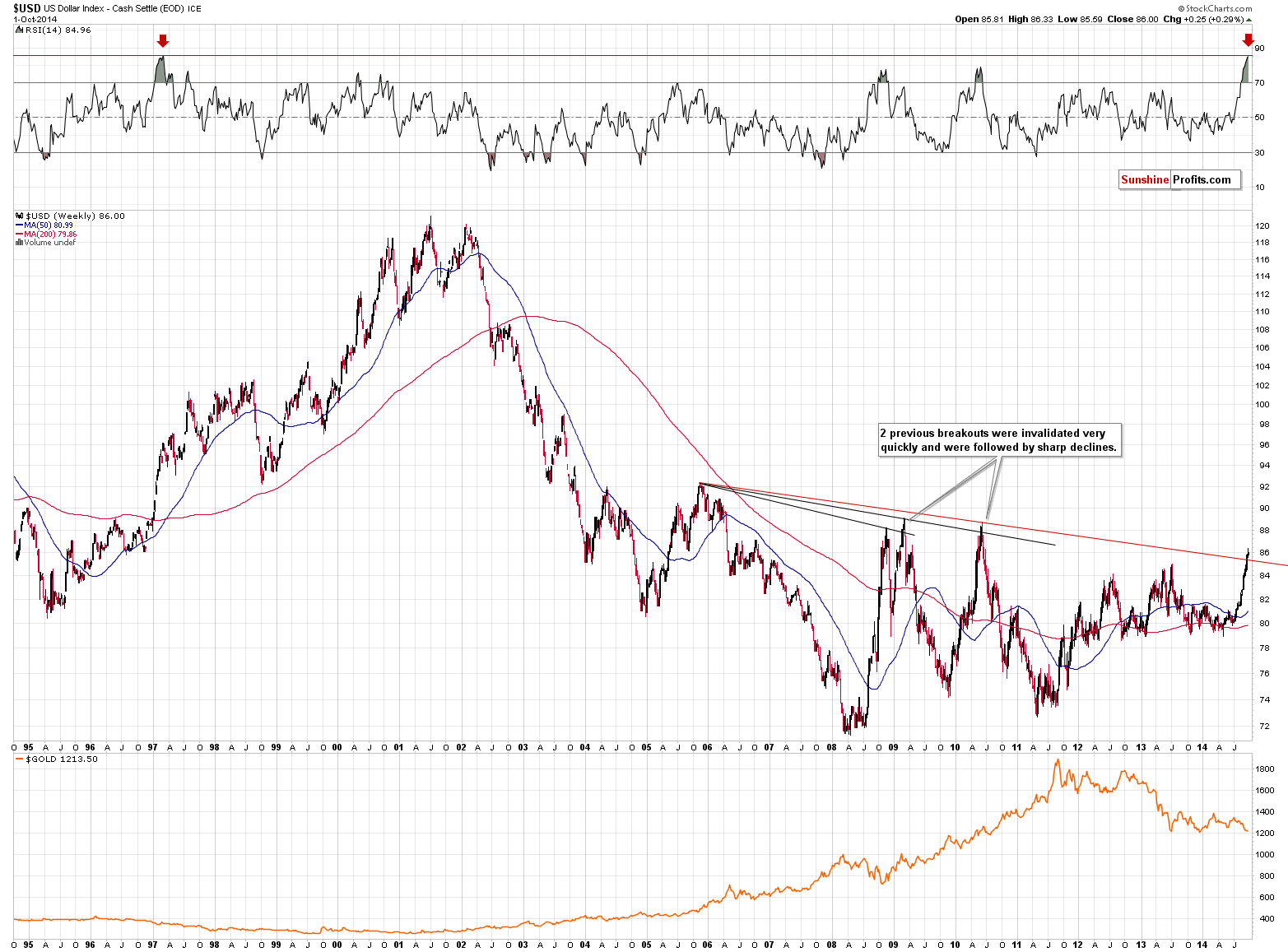

We have discussed the above chart in today’s Gold & Silver Trading Alert in the following way:

From the monthly perspective (and when you take a look at the above chart without enlarging it), the breakout is rather small. Enlarging the above chart, however, reveals that the breakout is indeed visible and similar to the previous 2 “breakouts.” The key thing here is that both previous breakouts above lines based on the 2005 high were followed by invalidations and sharp declines. That’s quite a good reason not to be bullish at this time or excited about the breakout.

There’s also another – perhaps even more important – interesting fact about the above perspective. The RSI indicator is at its 20+-year high. In other words, the sharpness of the most recent rally and absence of corrections have caused the USD Index to be extremely overbought from the medium-term perspective. We have been expecting the rally in the USD Index to be significant and we wrote on multiple occasions that given the long-term breakout that we saw over a year ago, the surprises would be to the upside, but no market could move in only one direction without periodical corrections. The RSI indicator tells us that such a correction is likely just around the corner.

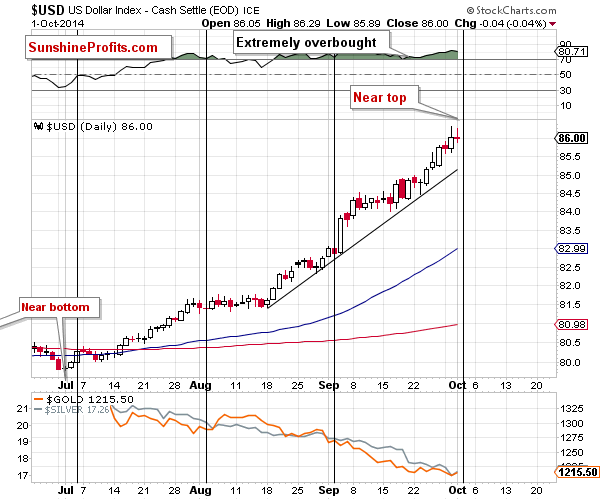

The short-term outlook was also discussed:

From the short-term perspective, we see that the USD Index didn’t move higher yesterday (except for the intra-day attempt) and the move was rather small. The cyclical turning point is today, so it’s highly likely that we will see a turnaround today or very soon.

What does all of the above mean for the USD Index? That it’s quite likely to rally further, but not without correcting first. The correction is likely to be something tradable and that’s why we have opened trading positions that will likely profit from correcting the USD Index. We might open additional positions if their respective technical pictures justify it. As always, we will keep you informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts