Earlier today, the British pound moved lower against the U.S. dollar after data showed that retail sales rose 1.1% in March (above expectations for a 0.8% rise) and core retail sales (without automobiles) rose 0.7% last month (analysts had expected 0.5% increase). Thanks to these better-than-expected numbers, cable declined to its initial downside target. What’s next? Will it drop any further?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (stop-loss order: 1.6855)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

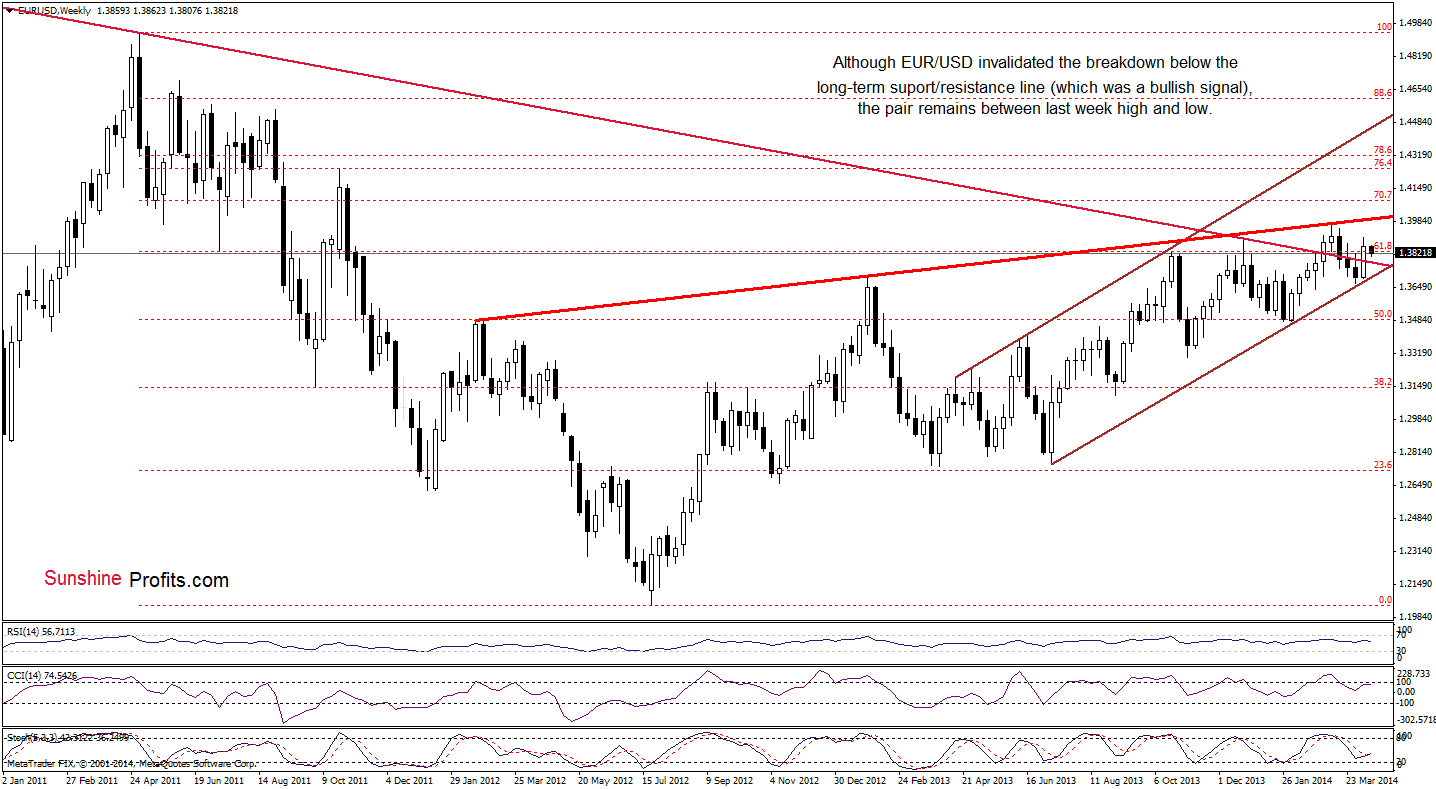

EUR/USD

Looking at the weekly chart, we see that EUR/USD gave up some gains, but it still remains above the previously-broken long-term declining resistance line and the lower border of the rising trend channel (marked with brown). These two important lines still serve as major support. As you see on the above chart, the exchnge rate remains below the 2014 high and the rising resistance line (marked with red), which succesfully stopped growth in the previous month. From this perspective, it seems that as long as these key lines are in play, a bigger upward or downward move is not likely to be seen.

Before we summarize this currency pair, let’s take a look at the daily chart.

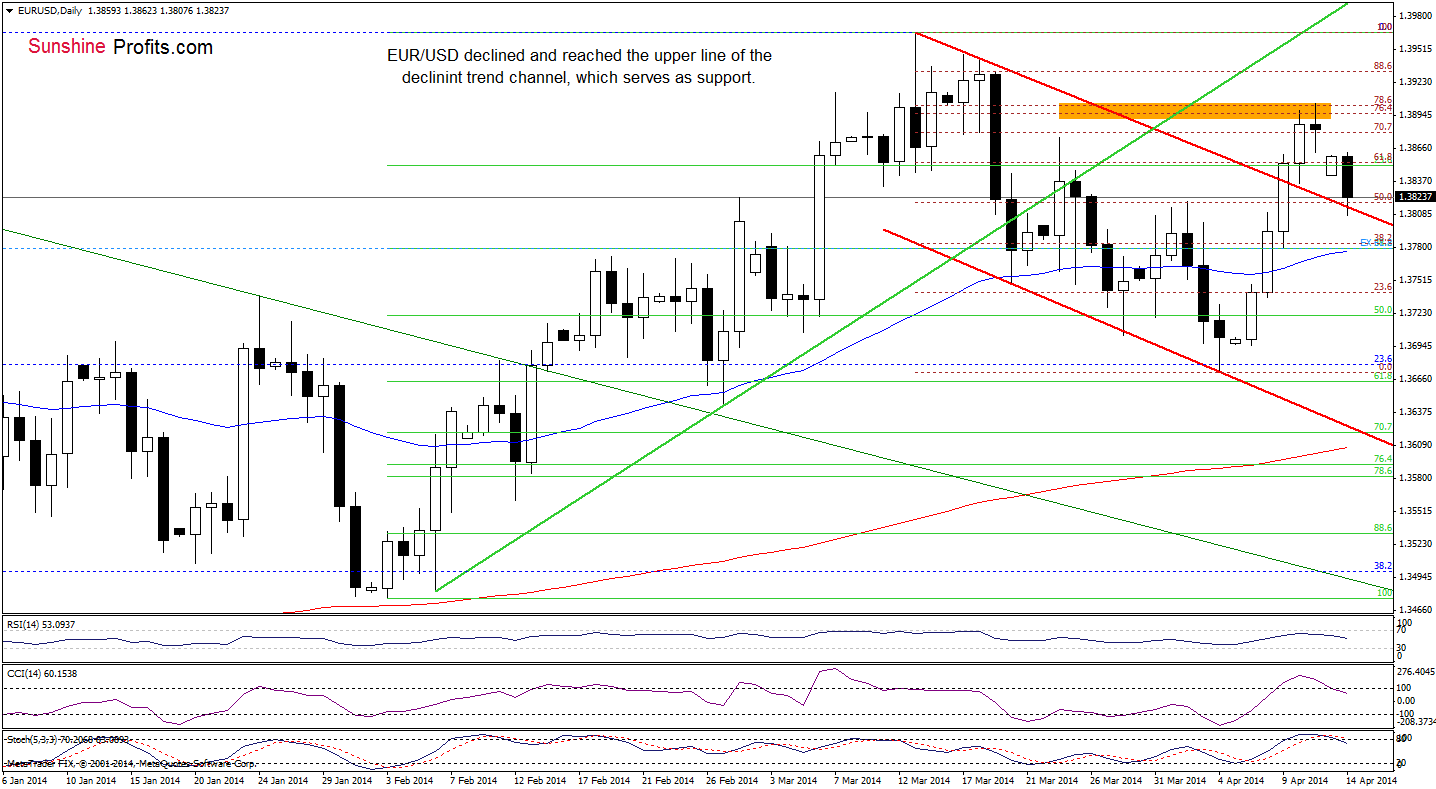

In our last Forex Trading Alert, we wrote the following:

(…) the pair still remains in the resistance zone created by the 76.4% and 78.6% Fibonacci retracements (around 1.3896-1.3900). (…) if this resistance area encourages sellers to act, we may see a pullback in the coming days and the first downside target will be the upper line of the declining trend channel (which serves as support at the moment).

As you see on the above chart, the sellers realized this bearish scenario as EUR/USD slipped (only temporarily) below the upper line of the declining trend channel earlier today. Although the exchange rate rebounded, it still remains quite close to an intraday low of 1.3807. If this strong support encourages buyers to act, we may see a corrective upswing in the near future. However, if it is broken, we will likely see further deterioration in the coming days and the initial downside target will be around 1.3777, where the long-term declining line is (please note that in this area is also the 50-day moving average). Additionally, the position of the indicators (sell signals remain in place) favors sellers at the moment.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position: In our opinion no positions are justified from the risk/reward perspective. We are not opening short positions just yet, because of the divergence on the long-term charts (we wrote more about this situation in our Forex Trading Alert posted on Thursday), however we will quite likely open it once we see some kind of confirmation. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

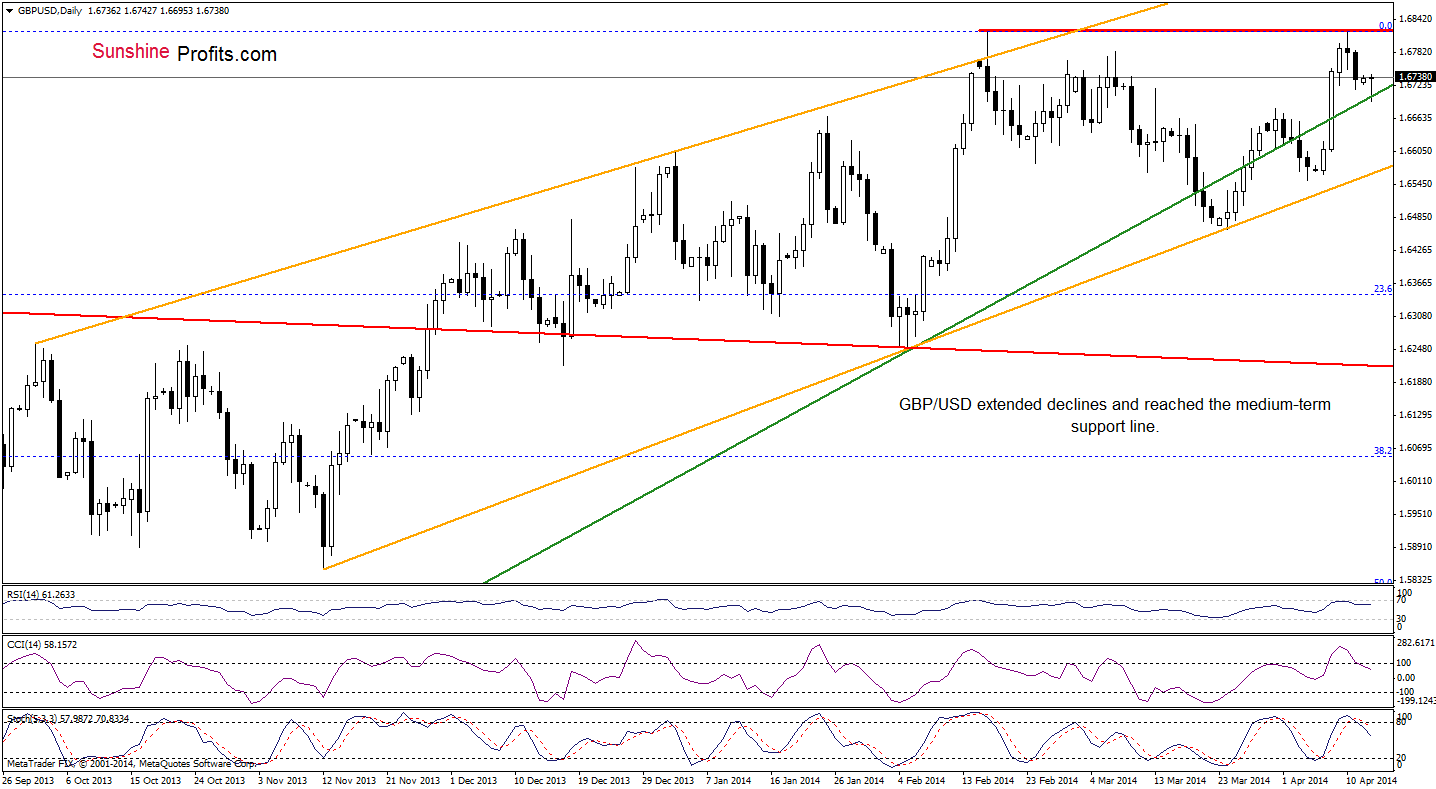

GBP/USD

From the weekly perspective, we see that the situation hasn’t changed much. So, what we wrote in our previous Forex Trading Alert is still up-to-date.

(…) GBP/USD still remains below the strong resistance zone created by the 2009, 2011 and 2014 highs, which suggests that further deterioration should not surprise us. In fact, it’s likely enough to justify having a speculative short position open (the one that was opened yesterday is already profitable).

To have more complete picture of the current situation in GBP/USD, let’s take a look at the daily chart.

In our Forex Trading Alert posted on Thursday, we wrote the following:

(…) GBP/USD (…) reached the 2014 high earlier today. If this strong resistance level holds, we will likely see a bearish double top pattern. In this case, the initial downside target will be the medium-term rising green line (currently around 1.6676). If it is broken, we may see a drop to the lower border of the orange rising trend channel (around 1.6550), which corresponds to the April low. (…) Please note that the current position of the indicators suggests that correction is just around the corner (…)

As you see on the above chart, GBP/USD extended declines and reached the initial downside target earlier today. If this support line encourages buyers to act, we may see a corrective upswing in the near future. However, if it is broken, the above-mentioned downside target will be in play. At this point, it’s worth noting that all indicators generated sell signals, which suggests further deterioration in the coming day (or days).

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short. Stop-loss order: 1.6855. Please note that even if GBP/USD breaks above the 2014 high (and stop-loss order works), we’ll consider re-opening short positions around the 2009 high. At this time, however, it seems that these levels will not be reached before we see another sizable downswing – and thus the current short positions are still justified. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

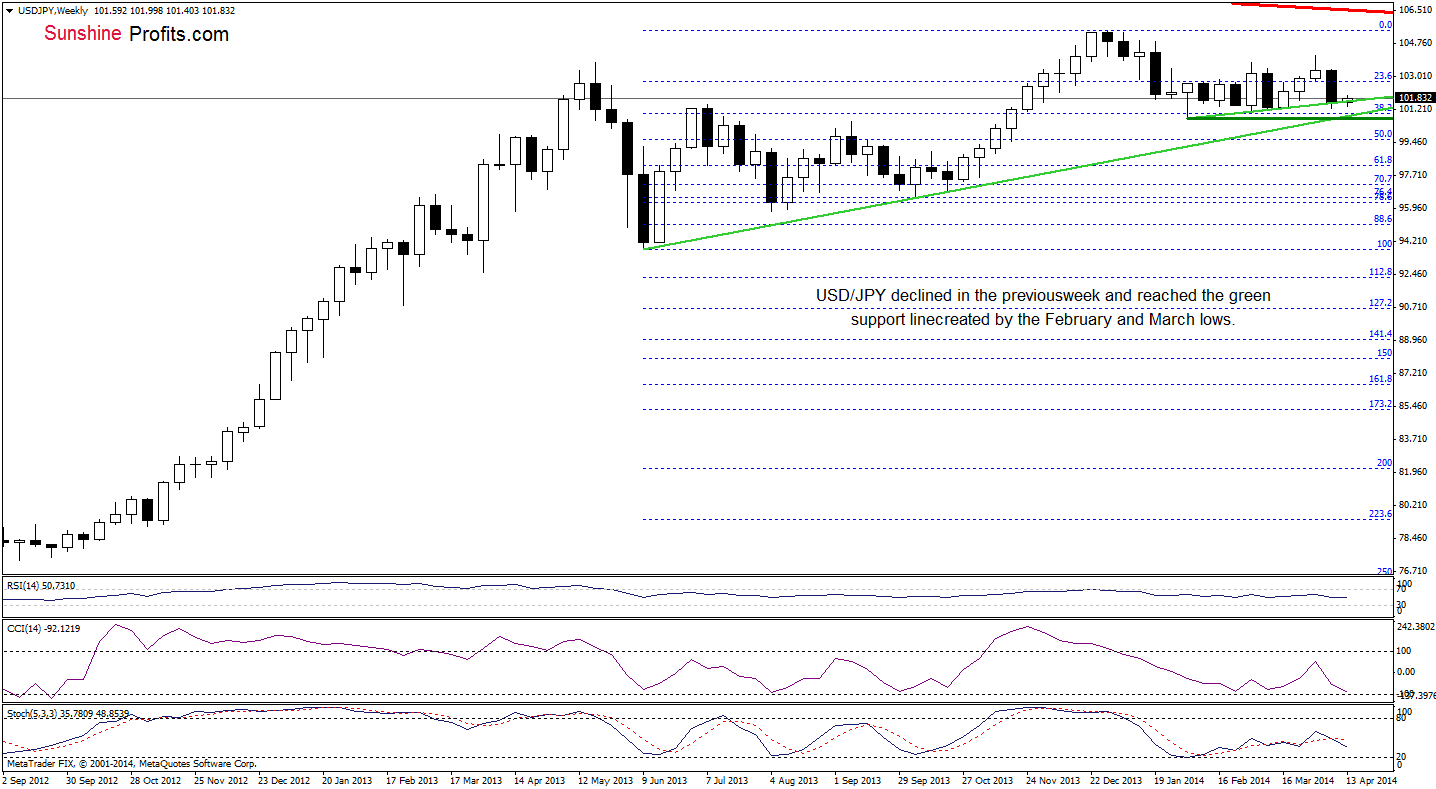

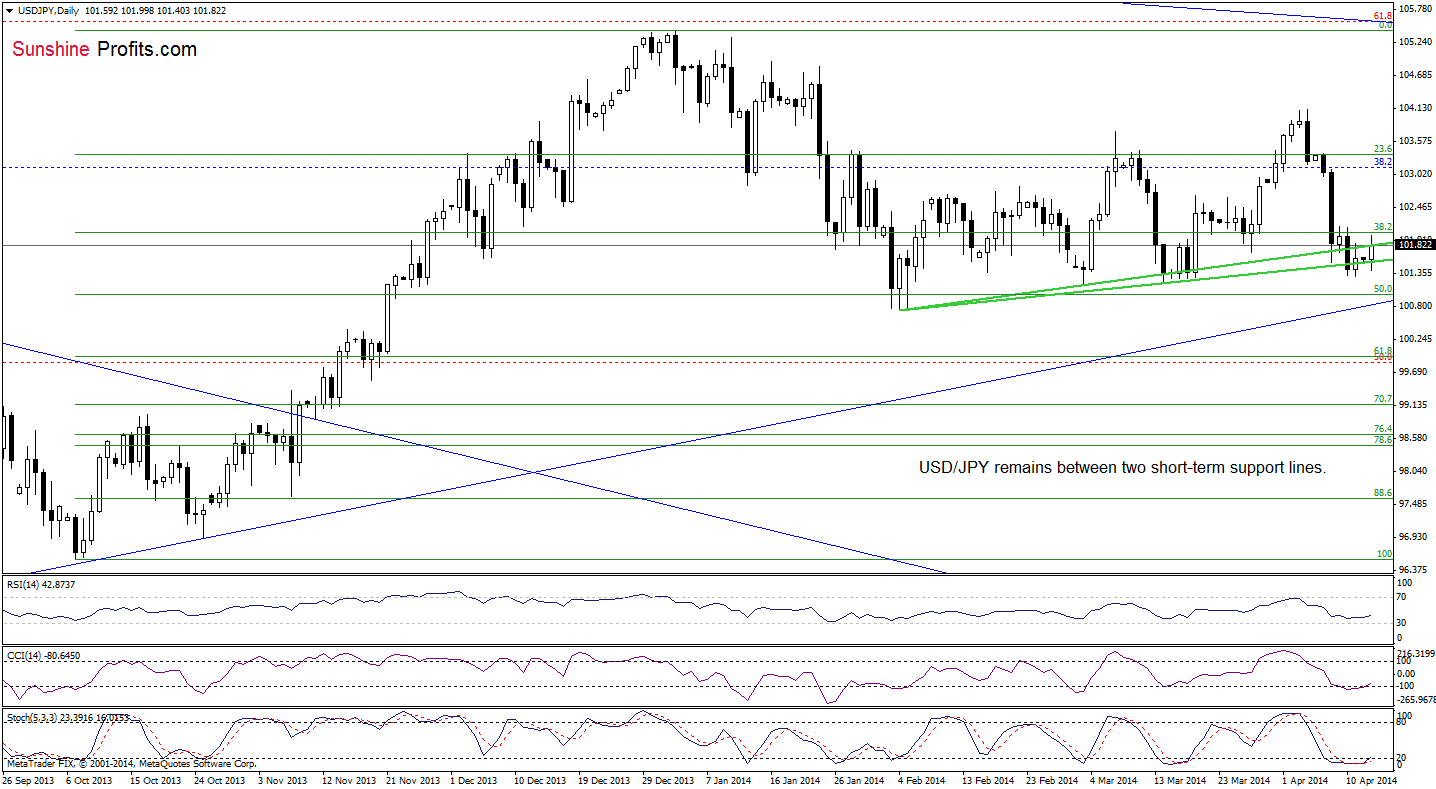

USD/JPY

Looking at the USD/JPY from the weekly perspective, we see that the exchange rate extended declines in the previous week and reached the green support line created by the February and March lows. As you see on the above chart, this strong support encouraged buyers to act in mid-March, which resulted in a corrective upswing in the following weeks. If history repeats itself, we may similar upward move in the coming week (or weeks). At this point, it’s worth noting that even if the pair drops lower, the medium-term support line (based on the June and October lows) in combination with the February low will likely stop further deterioration.

Having discussed the above, let’s take a closer look at the daily chart.

Earlier today, we saw the situation similar to the one that we noticed on Friday. As you see on the above chart, although the buyers pushed USD/JPY above the upper green line, the pair reversed and slipped below the resistance line. However, this time, such price action didn’t trigger another drop below the lower green support line, which is a positive signal (at least at the moment when these words are written). Additionally, the CCI and Stochastic Oscillator are oversold (and very close to generating buy signals), which suggests that a pause or a corrective upswing in the coming days should not surprise us. Nevertheless, we should keep in mind that if the lower support line is broken, we will likely see a drop to the March 14 low or even to the February low.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

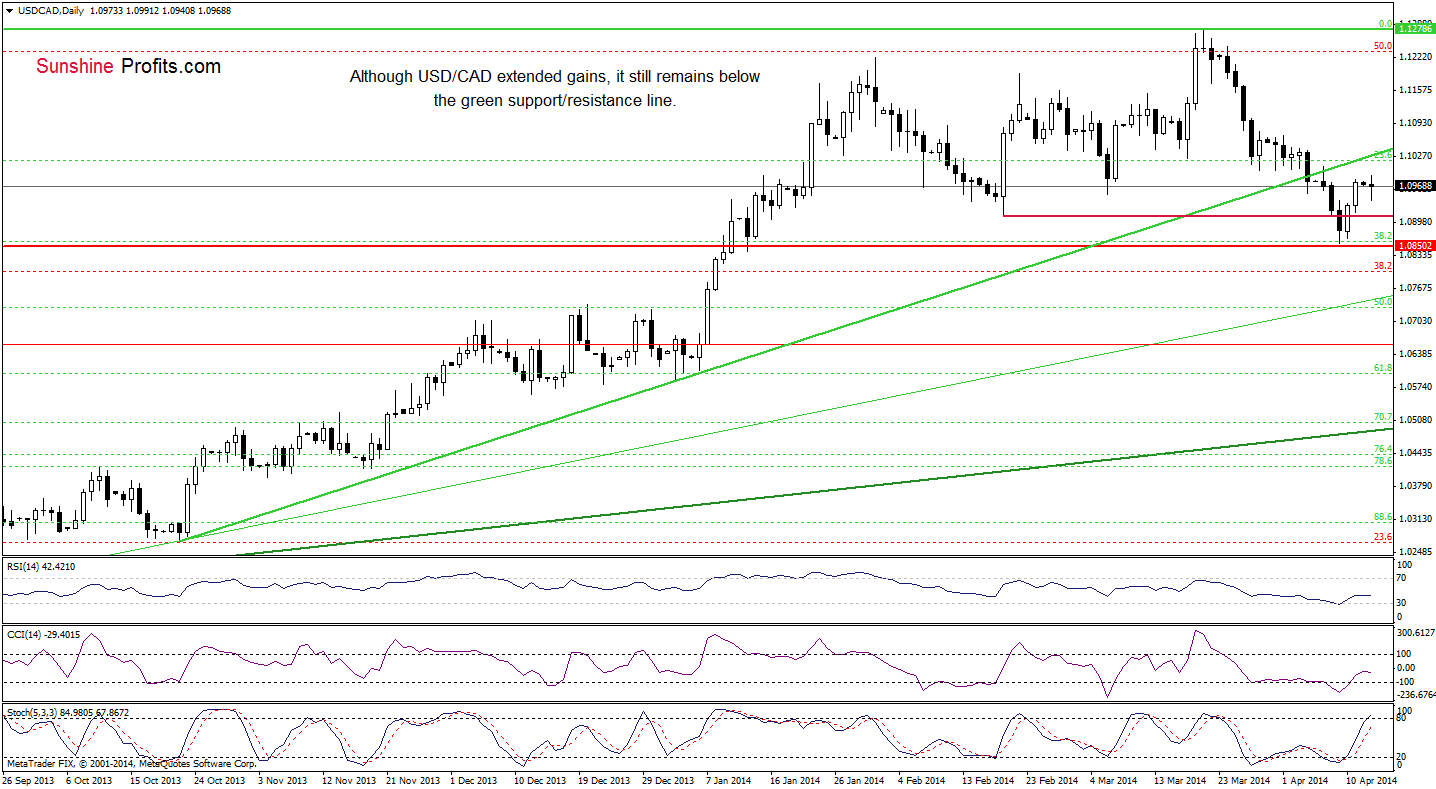

USD/CAD

As you see on the above chart, the exchange rate extended gains and climbed above Friday’s high, which was a positive sign. However, despite this improvement, USD/CAD gave up the gains and reversed as the proximity to the previously-broken green support line encouraged sellers to act. If the pair extends losses, we may see a pullback to around 1.0909 (where the Feb.19 low is) or even to the April low of 1.0857. On the other hand, if the buyers manage to push the exchange rate higher, we may see an increase to the major resistance line (currently around 1.1026). Please note that the pro growth scenario is reinforced by the current position of the indicators (the RSI bounced off the level of 30, while buy signals generated by the CCI and Stochastic Oscillator remain in place).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

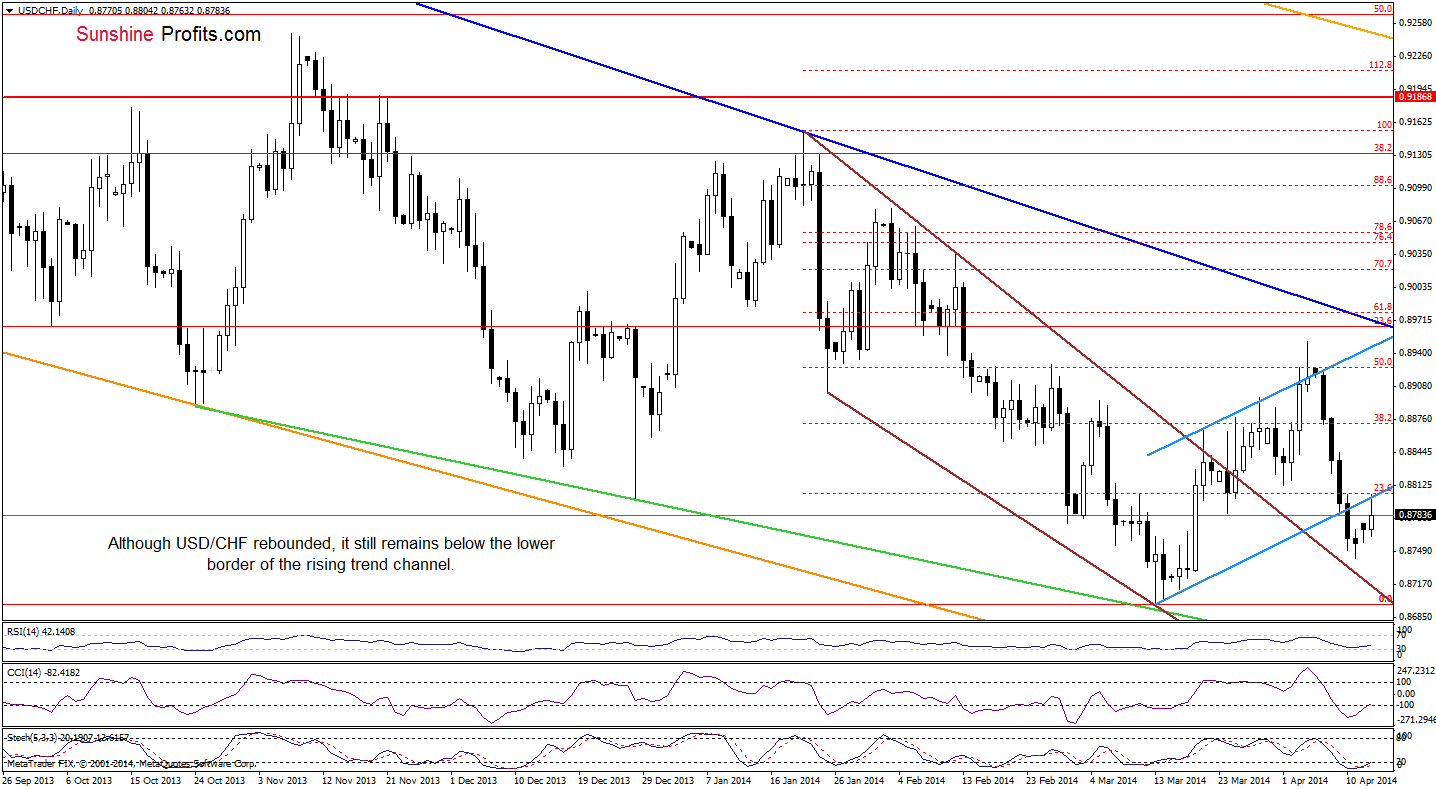

USD/CHF

As you see on the above chart, the proximity to the declining brown line (which is also the upper line of the declining trend channel) encouraged buyers to act and triggered a corrective upswing that took USD/CHF to the previously-broken lower border of the blue rising trend channel. If the buyers do not give up and break above this resistance line, we may see an increase to (at least) 0.8813, where the Apr.1 low is. However, if the fail, we will likely see a pullback to the April low or even to the declining brown line (currently around 0.8718). Please note that the RSI bounced of the level of 30, while the CCI and Stochastic Oscillator generated buy signals, which suggests that another attempt to move higher should not surprise us.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

On the above chart, we see that although AUD/USD declined on Friday, the exchange rate rebounded and erased losses. Despite this positive event, the pair still remains below the resistance zone created by the 70.7% Fibonacci retracement (based on the entire Oct.-Jan. decline). If it holds, we may see a pullback in the coming days. In this case, the downside target for the sellers will be the previously-broken upper line of the trend channel. Taking into account the current position of the indicators (the RSI is overbought, while the CCI and Stochastic Oscillator generated sell signals), it seems that we will see another attempt to realize the bearish scenario in the following days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts