The cautious movements within the currencies universe are sending new subtle signs for those willing and able to listen. They did so yesterday and today is no exception either. Actually, the promising situation ripened to such a degree that it’s making us act with confidence. Yes, now. Putting knowledge to good use, we’re happy to share the fresh details with you.

In our opinion, the following forex trading positions are justified – summary:

- EUR/USD: short (a stop-loss order at 1.1435; the initial downside target at 1.1228)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 112.32; the initial downside target at 109.82)

- USD/CAD:long (a stop-loss order at 1.3228; the initial upside target at 1.3530 – a slight stop-loss change reflecting yesterday’s heightened volatility in the pair)

- USD/CHF: none

- AUD/USD: none

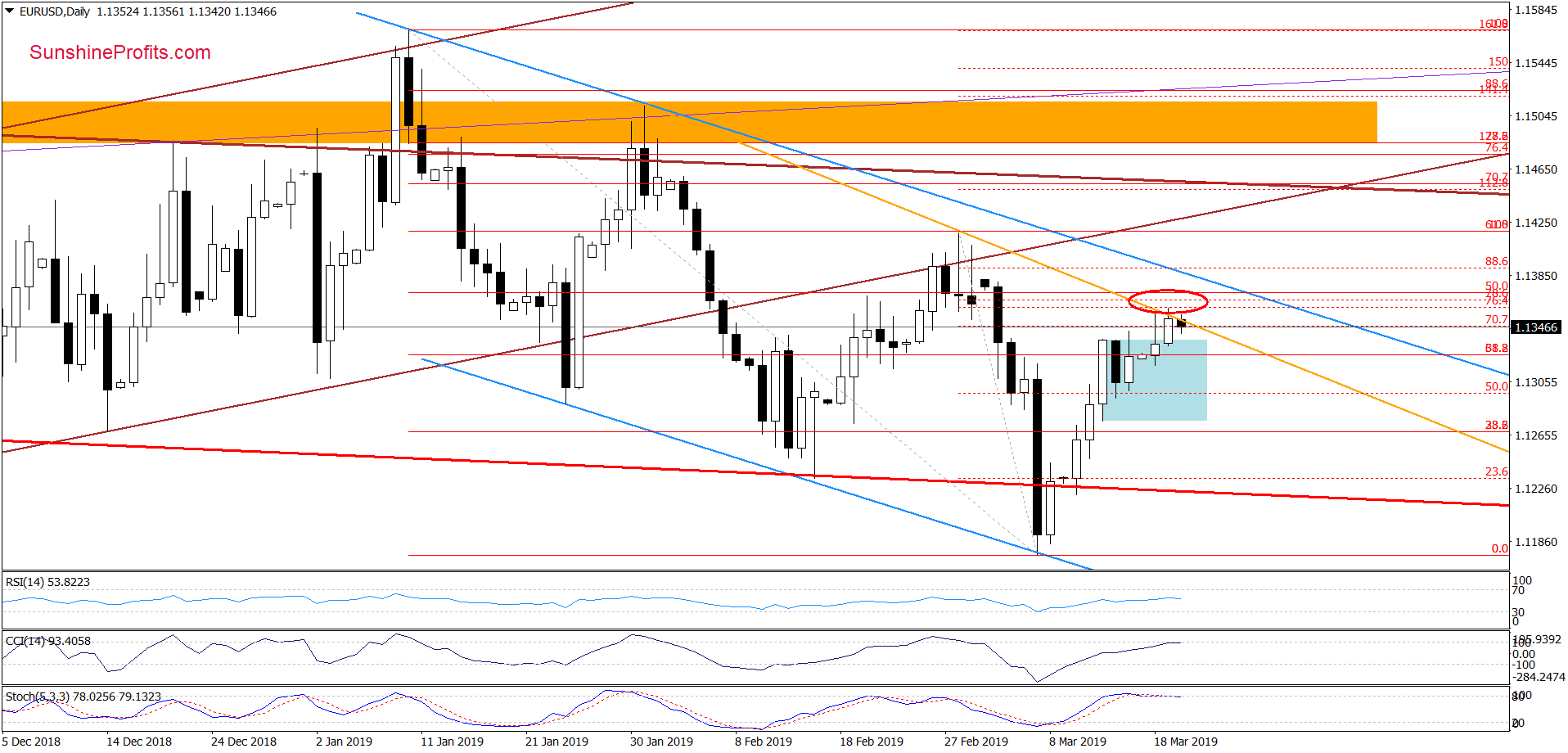

EUR/USD

We wrote the following yesterday:

(…) The technical picture hasn‘t changed much and EUR/USD trades at around 1.1360 at the moment of writing these words. That‘s exactly where the declining orange resistance line is. After yesterday‘s reversal at it (evidenced by the long upper knot), the pair is currently touching the orange line again.

The CCI is at the bearish divergence between the indicator and the exchange rate still. Stochastics remains flat after its climb above 80, which suggests that the space for further increases may be limited and reversal later this week should not surprise us in the least.

Further on yesterday, the bulls went on to have issues building on their gains. The combination of the two nearest resistances (the declining orange line and the strong assortment of Fibonacci retracements) have stopped them for a second day in a row. Earlier today, we saw another unsuccessful attempt to break above. Looks like the bulls are running out of steam.

Additionally, the Stochastic Oscillator generated its sell signal. At a minimum, this suggests that the following bigger move would rather be down than up. Taking all the above into account, we think that opening short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1435 and the initial downside target at 1.1228 are justified from the risk/reward perspective.

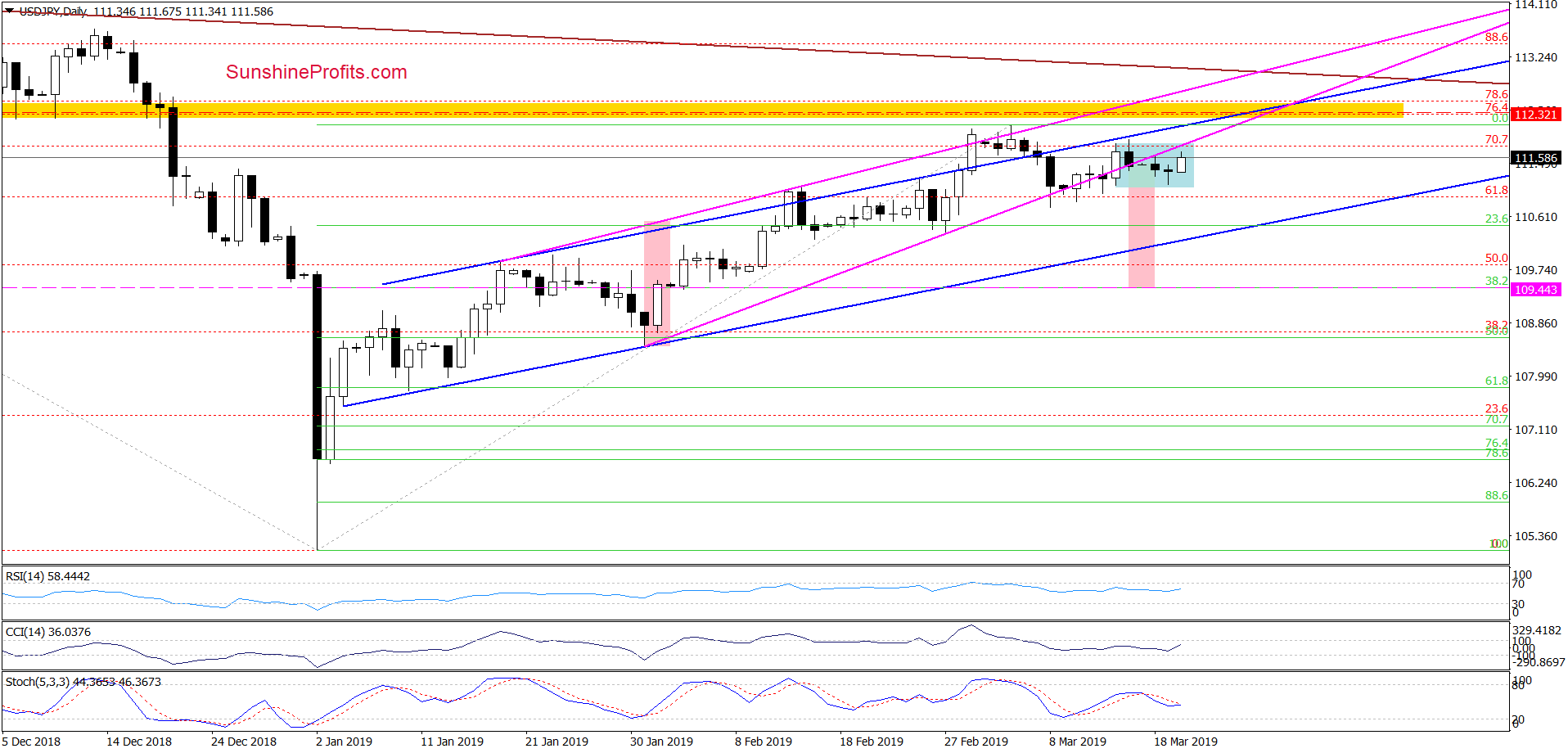

USD/JPY

We wrote these words on Monday:

(…) On Friday, the upper line of the blue rising trend channel encouraged the sellers to act. The pair reversed lower, slipped slightly below the pink rising wedge line and closed the day below it. Earlier today, the bulls tried to push the exchange rate higher, but look to have failed after touching the lower border of the pink rising wedge, which suggests that today’s upswing probably is just a verification of Friday’s breakdown below it.

The bears managed to move the price lower earlier this week, but not significantly lower. The rate stalled and price action became confined in the blue consolidation. As the pair moved slightly higher earlier today, this upswing may turn out to be a verification of the above mentioned breakdown and also a test of the upper border of the consolidation.

Should the buyers fail in this area, the exchange rate will likely extend losses. The lower border of the blue rising trend channel (currently at around 110.19) is a primary retest candidate here – such a downswing in the following days wouldn’t surprise us in the least.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 112.32 and the initial downside target at 109.82 are justified from the risk/reward perspective.

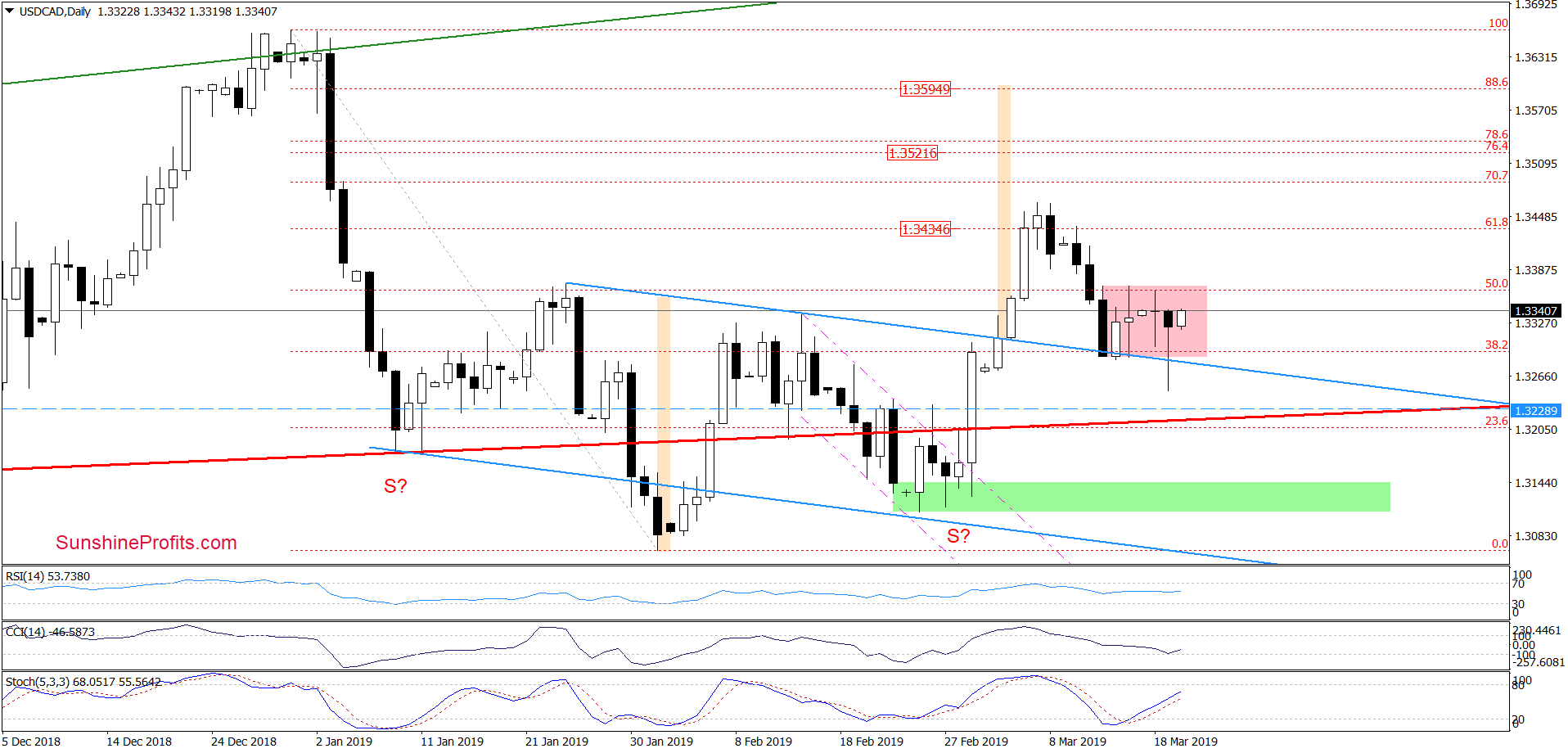

USD/CAD

In our Monday’s Alert, we have mentioned that the par is still trading inside the pink consolidation but:

(…) The buy signal generated by the Stochastic Oscillator suggests that another attempt to move higher may be just around the corner.

Looking at the force with which yesterday‘s downswing was rejected, the observation looks justified. After retesting the previously broken upper border of the blue declining trend channel, the pair reverted back into the consolidation.

This way, the attempted breakdown below the consolidation was invalidated and can bring further improvement in the following days – especially when we factor in the buy signals generated by the daily indicators. If this is indeed the case, the first upside target will be the upper border of the pink consolidation, and if it is broken, the journey to the March peaks can follow.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3228 (reflecting volatility, we decided to move it a bit lower after yesterday’s intraday’s drop) and the initial upside target at 1.3530 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist