In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1218; the initial downside target at 1.1058)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 110.40; the initial downside target at 108.04)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

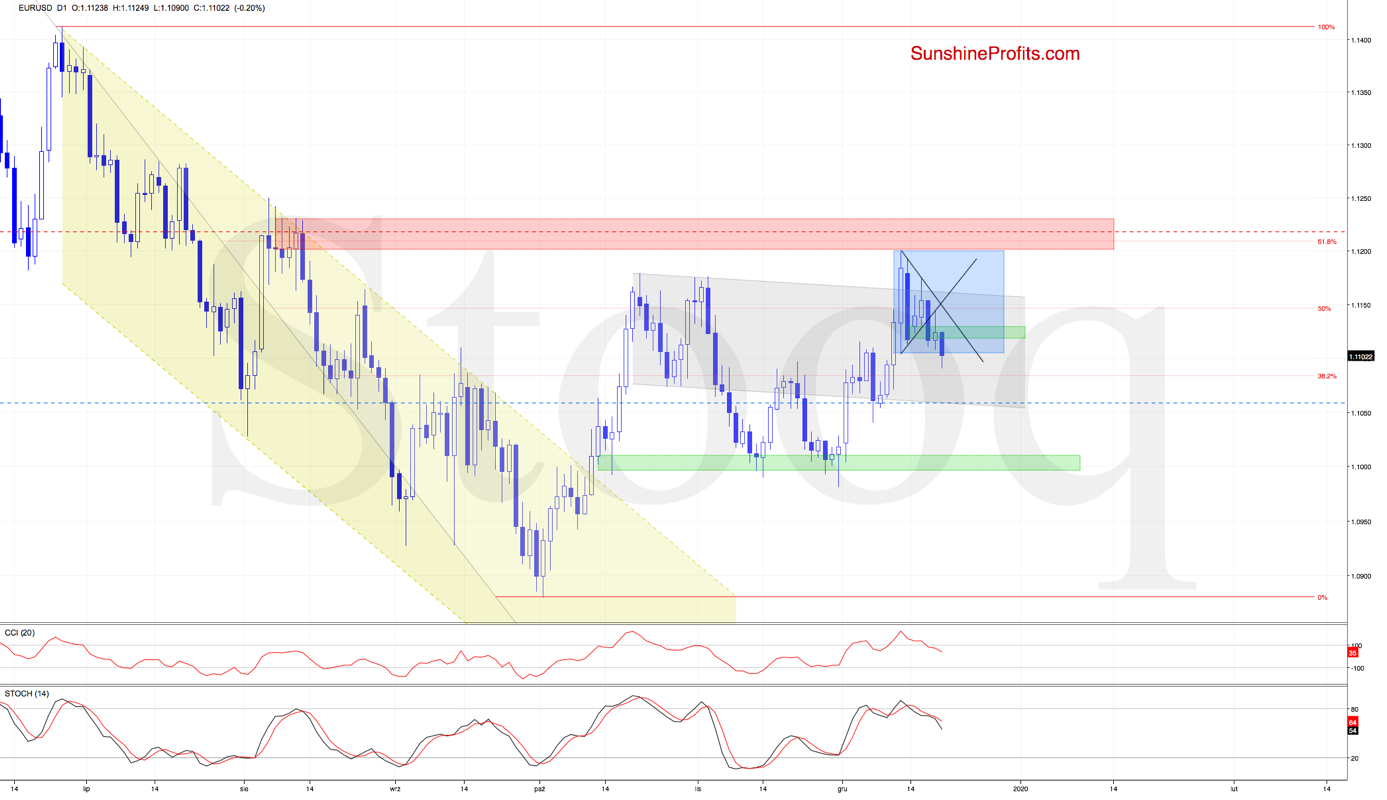

EUR/USD

The euro was stuck in some back-and-forth trading recently, yet some downward bias was palpable. The breakdown from an important pattern has been verified, and a logical question then follows - what is the right thing to do from the risk-reward perspective now?

EUR/USD moved lower on Wednesday, breaking below the lower border of the black triangle. This bearish development resulted also in the green gap getting closed.

The euro bulls pushed the pair higher yesterday, but upon reaching the previously-broken lower line of the triangle, the exchange rate pulled back.

Thanks to this price action, the exchange rate verified the earlier breakdown from the triangle, which increases the probability of further deterioration in the coming days. This is especially so when we factor in the sell signals generated by the daily indicators and also the breakdown below the lower border of the blue consolidation.

Should it be the case and the pair extends losses from here, the initial downside target for the sellers will be the lower border of the declining grey trend channel.

Taking all the above into account, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1218 and the initial downside target at 1.1058 are justified from the risk/reward perspective.

GBP/USD

The first thing that catches the eye on the above chart, is the breakdown below the lower border of the blue consolidation. Despite this bearish turn of events and the daily indicators' sell signals, let's keep in mind that the pair approached the green support zone created by the upper border of the purple consolidation and the previous peaks.

This zone could encourage the buyers to step in in the very near future. Should we however see signs of their weakness, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

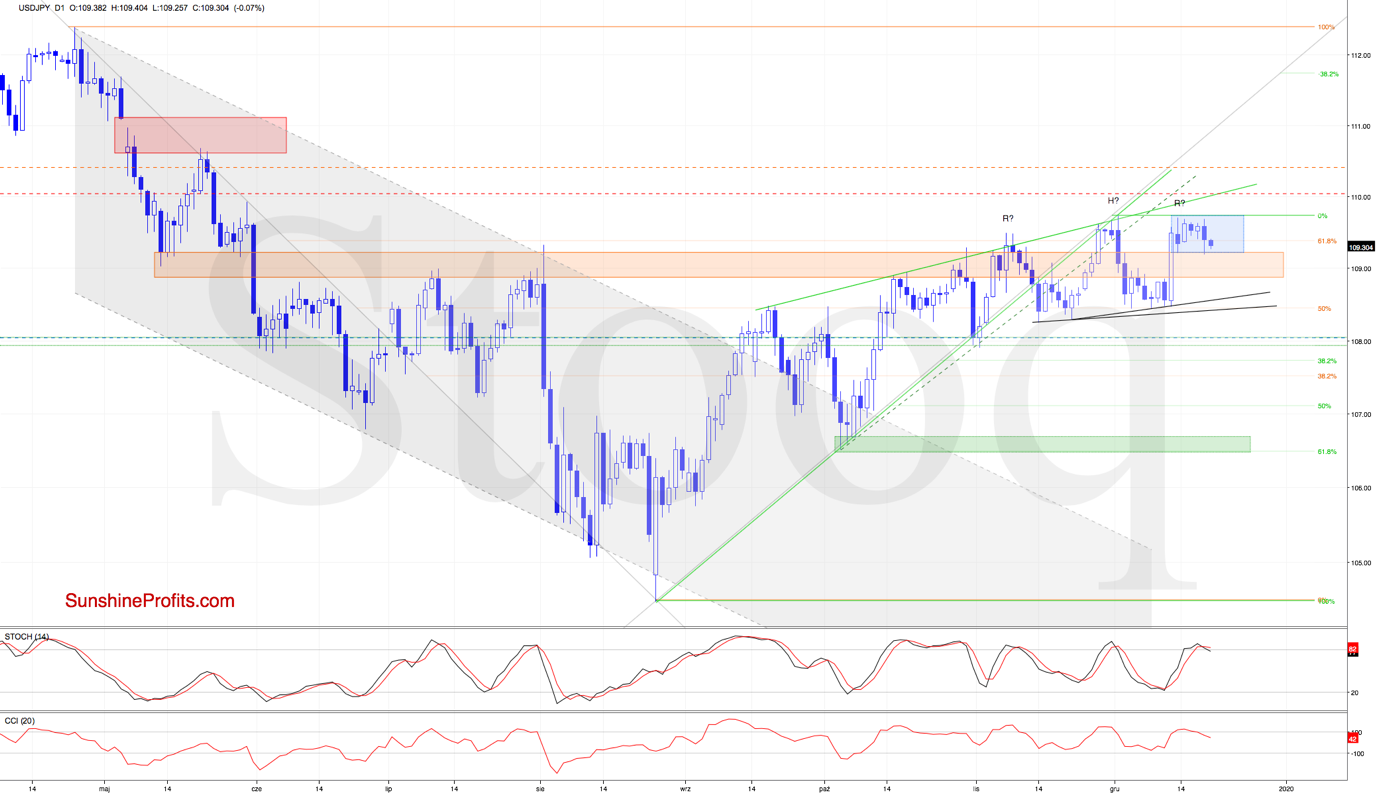

USD/JPY

USD/JPY's short-term situation hasn't really changed since our Wednesday's commentary. The pair keeps trading inside the blue consolidation slightly below the recent peaks and also below the rising green wedge.

Let's quote our latest observations as they are still up-to-date also today:

(...) the exchange rate is still trading below the rising green wedge, which suggests that another reversal may be just around the corner. This is especially the case when we factor in a potential head-and-shoulders formation.

Should it be the case and the pair moves lower from here, thus creating the right arm of the formation, the first downside target will be the support area created by last week's lows.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.40 and the initial downside target at 108.04 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist