Yesterday 's Fed pronouncements triggered volatility in the currency markets. Is it a knee-jerk reaction to reverse itself shortly or will the USD suffer meaningfully? Let's take a look what it means for us.

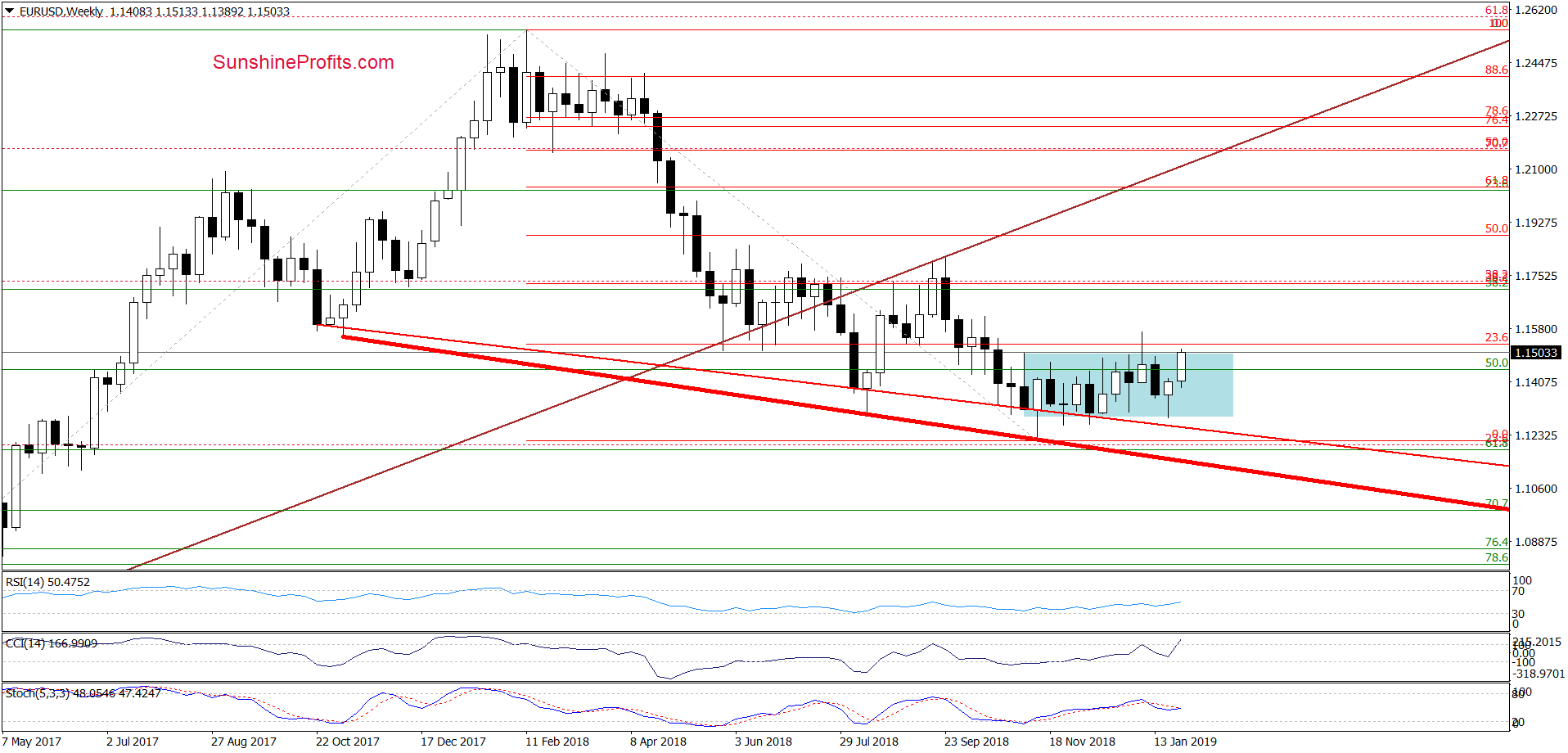

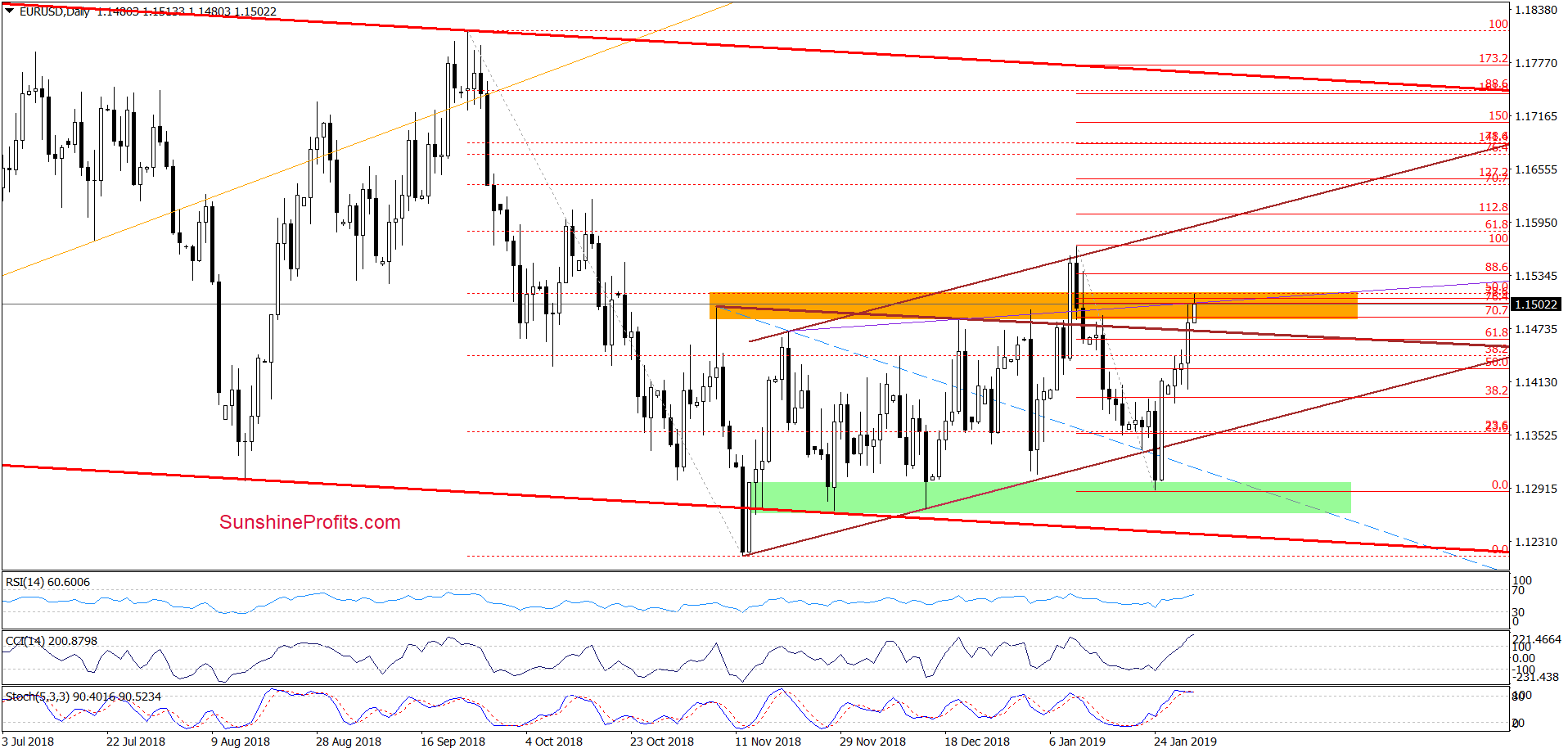

EUR/USD

The weekly chart shows that the pair is still trading inside the blue consolidation, currently testing its upper border in the proximity of 23.6% Fibonacci retracement. There was no breakout let alone besting previous intraday breakout attempt highs.

On Monday, we wrote:

(…) If (…) the pair extends gains from the current levels, we’ll likely see a test of the upper border of the brown triangle and the orange resistance zone in the coming days.

Yesterday, EUR/USD moved to our upside targets and closed the day above the brown triangle, which would suggest further improvement. Although this is bullish per se, we should keep in mind that we have seen similar breakout at the beginning of the month already. The price moved above the upper border of the blue consolidation, but the gains were given back shortly.

That invalidation gave us a good opportunity to open short positions that soon became profitable. Will the history repeat itself in the very near future? Or at least rhyme, as Mark Twain would say?

Considering the very short-term situation in other currency pairs and in the USD Index, we think that another profitable opportunity is just around the corner. The USD Index is a good way to look at the strength of the world's leading currency because other currencies often move in tandem against it.

Nevertheless, we want to see the buyers’ weakness (for example, an invalidation of the breakout above the 76.4% and 78.6% Fibonacci retracements and preferably also a return into the brown triangle) before we decide to go short. This would correspond to the indicators getting positioned really bearishly as currently only Stochastics shows internal deterioration. It is the multitude of signals all in one place, at one time, that gives us the confidence to act after a careful examination.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

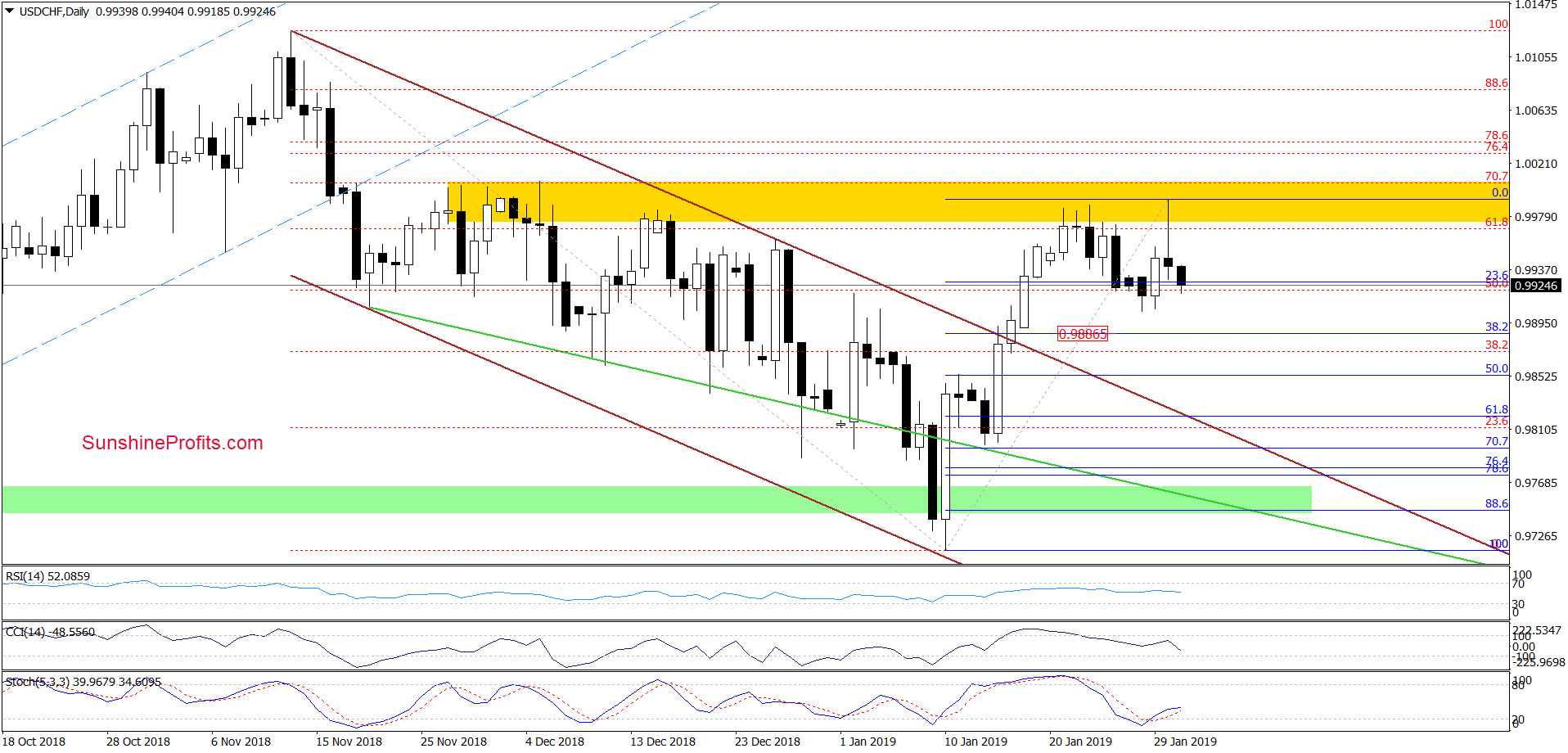

USD/CHF

Although currency bulls took USD/CHF higher during yesterday’ session, the yellow resistance zone stopped them again, triggering a sharp reversal. Earlier today, the pair extended losses, which suggests further deterioration and a test of this week’s lows or even the 38.2% Fibonacci retracement in the following day(s). The odds favor the bears here but it is too early to make a responsible call to open a trade.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

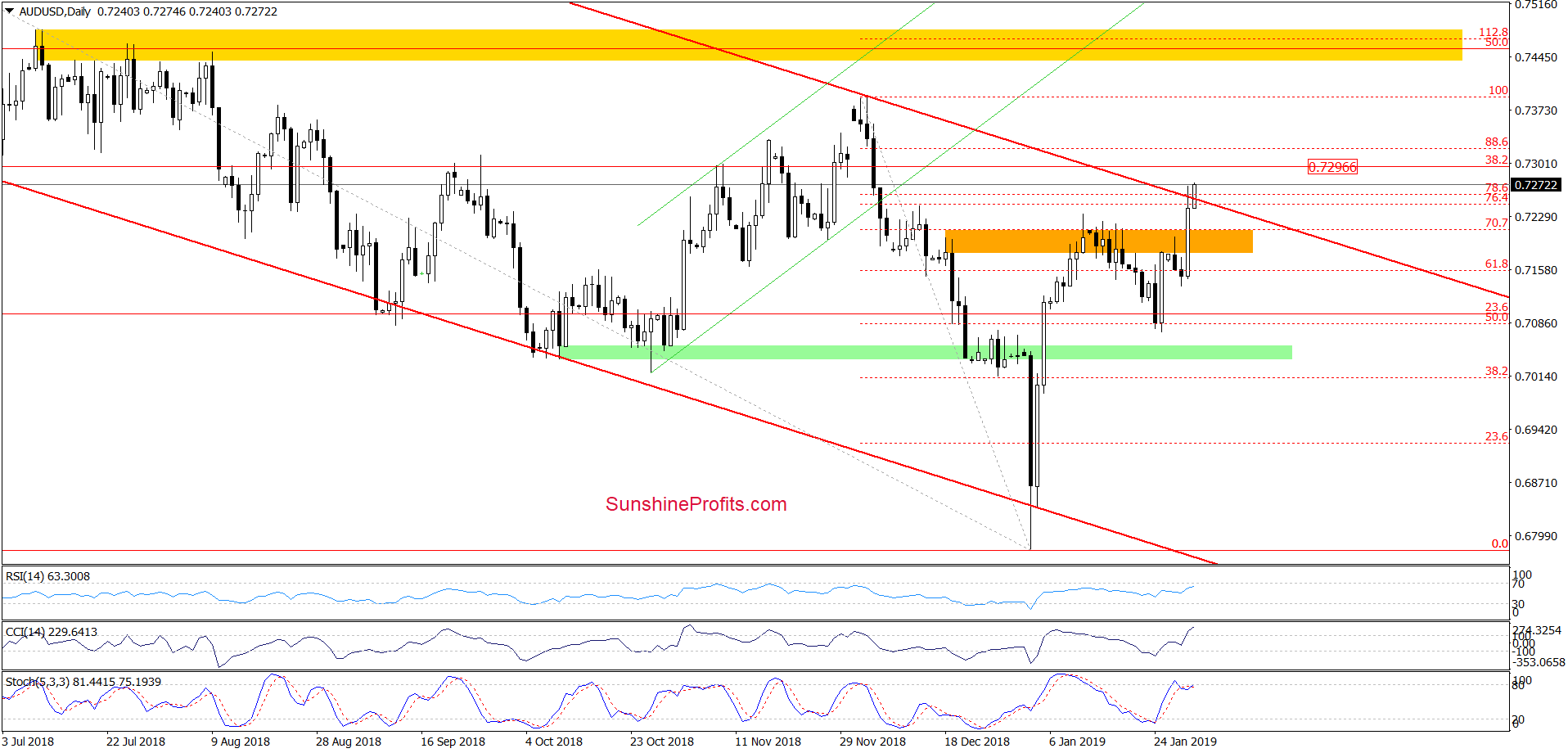

AUD/USD

Two prominent features on the weekly chart are the green support zone and the red declining trend channel. The former one has held on a repeated basis and breakdowns below were shortly invalidated. The latter has stopped the bullish momentum previously, too. As long as the price is trading inside the channel, we should assume it would stop the bulls again.

Does the daily chart provide more clues?

Yesterday, AUD/USD broke above the orange resistance zone and tested the upper border of the red declining trend channel.

Earlier today, the exchange rate extended gains, which suggests a climb to the 38.2% Fibonacci retracement based on the entire 2018 downward move in the very near future. Even if bullish at first sight, the position of the daily indicators is deteriorating as Stochastics is on the verge of repeating its sell signal and CCI registered values that proved unsustainable for more than a few days. This is supported on the weekly timeframe with the Stochastics approaching overbought levels presaging deterioration down the road.

Therefore, the potential for further gains looks limited. Reversal in the coming day(s) should not surprise us. If the bulls show weakness around the above-mentioned 38.2% Fibonacci retracement, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Focus on the USD Index

Finishing today’s alert, we would like to draw your attention to the USD Index chart. USD Index is a construct measuring USD performance against a basket of other currencies. Out of these, euro and yen feature most prominently.

From its daily perspective, we see that the greenback invalidated earlier breakouts above both previously-broken declining lines and made an unconfirmed breakdown back below the brown one. Unconfirmed, because it has not been accompanied by preferably three daily closes below the line. The downside momentum looks waning based on a pure price action view.

Notice the proximity of the major green support zone which suggests limited room for further declines. Anyway, this would tie in well with our watchful approach as to the potential for an upswing in the euro and Australian dollar before the reversal – patience remains the name of the game today also. Such price action in combination with the lack of buy signals suggests that the index still has space (but not a bit at the first sight) for declines. A good entry point (not only at a higher price but more importantly when buyers look exhausted) improves the RRR (risk reward ratio). Caring about capital means caring about the RRR.

If this is the case, we’ll see another test of the green zone, which serves as the major support since October.

Taking all the above into account, we believe that one more upswing in EUR/USD and AUD/USD is very likely before we see reversals.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager