What’s happening with the euro? Up and down, down and up. What kind of sense does it make? What type of outcome do the odds favor here? We better not forget about the others pairs on our watch and the stories they offer. So many questions… Let’s dive in to look for the answers.

- EUR/USD: short (a stop-loss order at 1.1410; the initial downside target at 1.1258)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (a stop-loss at 0.7228; the exit target at 0.7042)

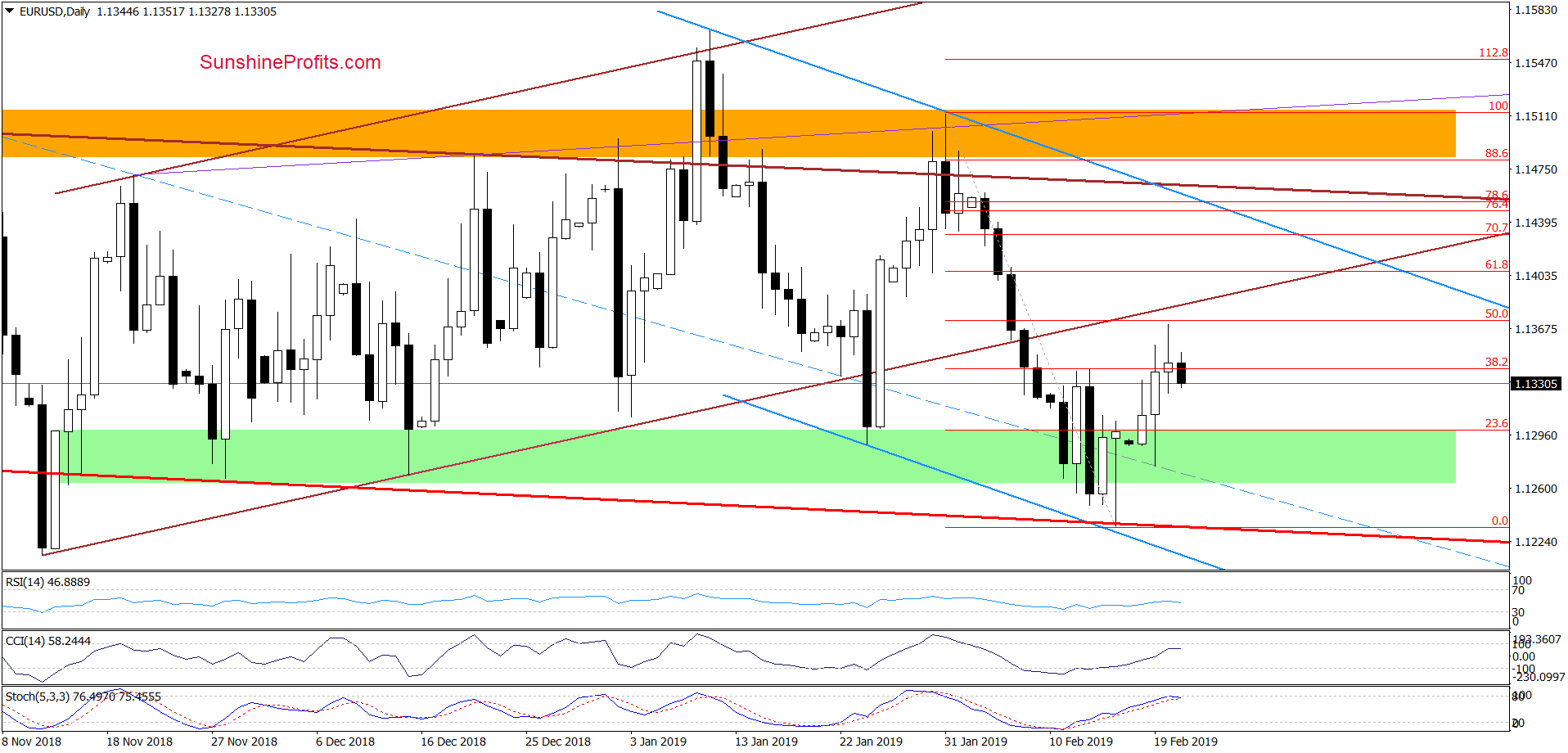

EUR/USD

Yesterday, we wrote:

(…) we’ll pay close attention to the bulls’ strength. Their likely targets would be the 50% Fibonacci retracement followed by the previously broken lower border of the brown rising trend channel. If they fail, another retest of the major supports and latest lows will be in cards once again and thus we’ll consider reopening short positions.

Indeed, the buyers took EUR/USD higher once again yesterday and almost reached the 50% Fibonacci retracement. However, the sellers returned vigorously to the trading floor.

As a result, the pair pulled back and erased some of earlier gains. Attempts to go any lower were not successful yesterday, and today’s trading (after another failed attempt to go higher) so far still has a flair of the bears not pulling a noticeably shorter end of the stick. The rate spent most of the day today back below the previously broken 38.2% Fibonacci retracement, invalidating the earlier breakout.

Additionally, the Stochastic Oscillator is on the verge of flashing a sell signal, which suggests that lower values of EUR/USD are just around the corner. A retest of the green support zone would be the likely outcome here. Taking all the above into account, re-opening short positions seems justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1410 and the initial downside target at 1.1258 are justified from the risk/reward perspective.

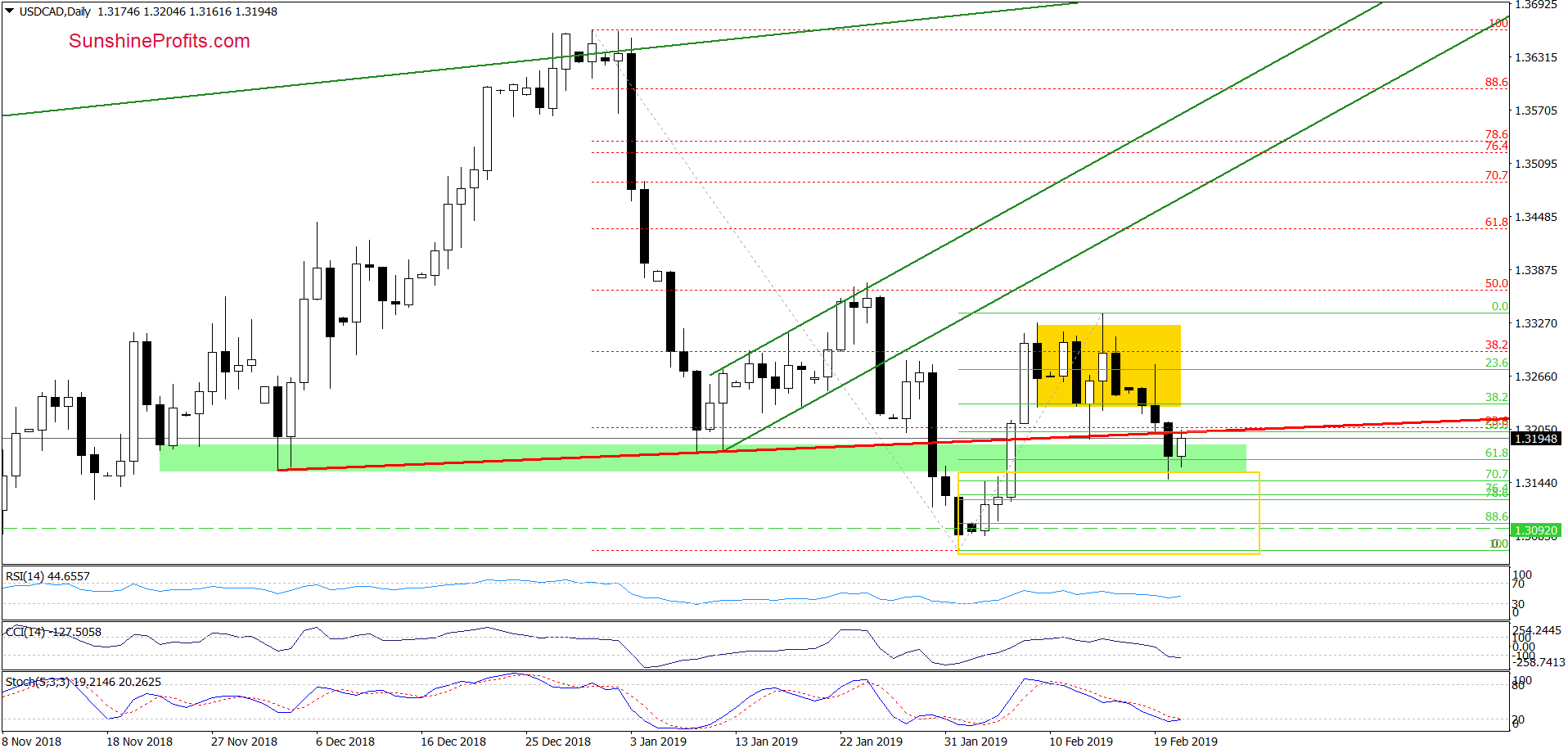

USD/CAD

The highlight of yesterday’s session was the breakdown followed by the daily close below the rising red support line. The pair reached the 70.7% Fibonacci retracement and tested the upper border of the yellow-contoured consolidation that it decidedly broke above at the beginning of February.

Bulls came back to life earlier today, which resulted in a comeback to the red line. This line now serves as the nearest resistance.

On one hand, such price action looks like a verification of yesterday’s breakdown below this support-turned-resistance, but taking into account the current position of the daily indicators, we wouldn’t be surprised in the least by further improvements down the road.

Such a bullish scenario would nonetheless be more likely only if the bulls take the price back above the red line. If we see such an invalidation of yesterday’s breakdown, a comeback to the yellow consolidation, possibly followed by a test of its upper border can’t be ruled out.

If the situation develops in tune with the pro-growth scenario, we’ll consider opening long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

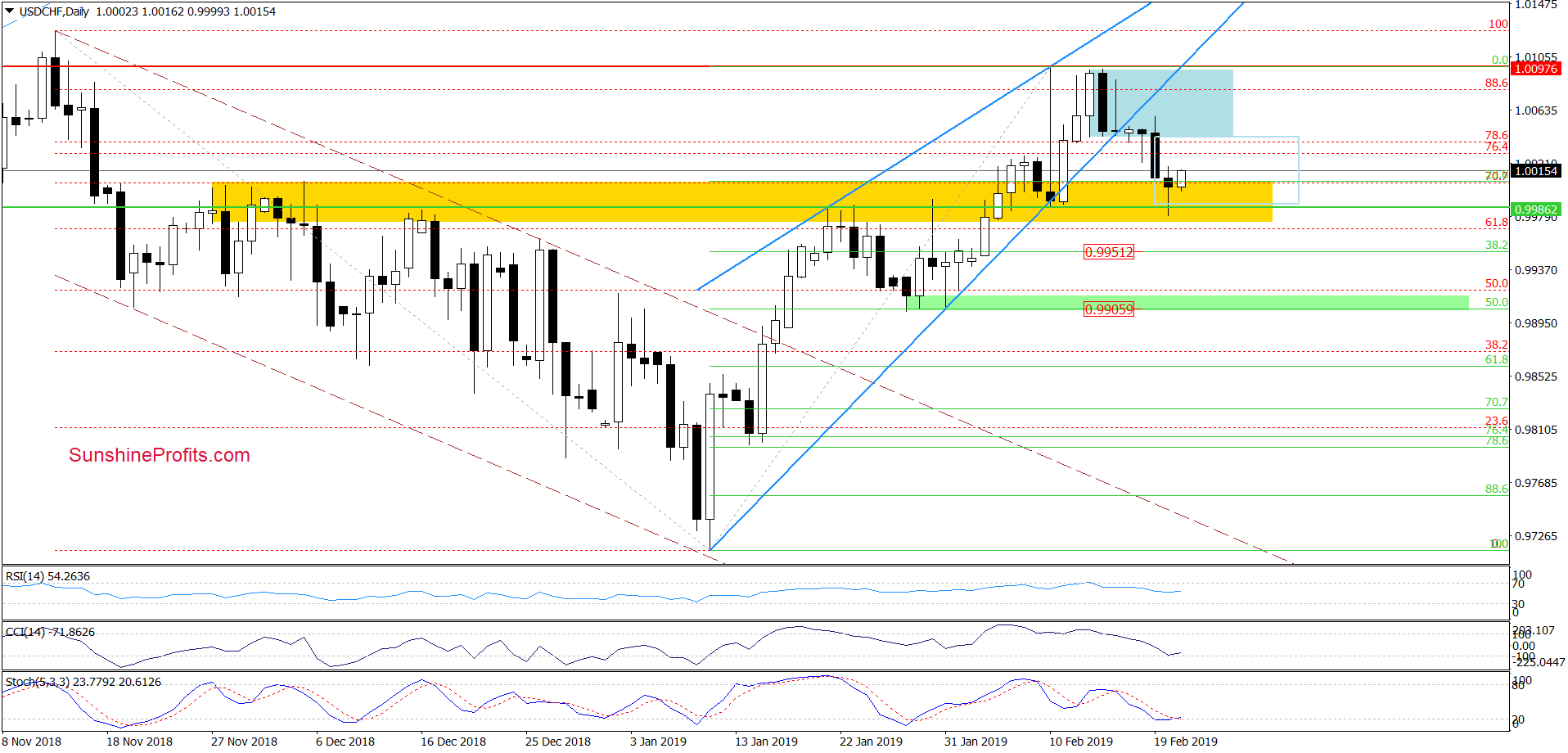

USD/CHF

On Tuesday, USD/CHF dropped below the lower border of the blue consolidation and went on to test the yellow support zone. Yesterday, the pair almost tested the lower border of the yellow support zone which also happens to be the local bottom of the previous downswing (when the pair attempted a breakdown below the blue rising wedge on Feb, 10th). At yesterday’s lows, the size of the downward move corresponded to the height of the blue consolidation and therefore can be viewed as a technical target reached.

Earlier today, currency bulls pushed the exchange rate higher. Combined with the buy signals generated by the CCI and the Stochastic Oscillator, it suggests that another attempt to move higher is just around the corner. If that’s the case, we’ll likely see a retest of the blue consolidation’s lower border, or even of the mid-Feb peaks. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist