The USD Index is approaching its highs while the euro looks quite stable today after its Friday's drop. This decline has taken it below an important support. Is it high time for the pair to move higher, for a change? Its daily indicators have a thing or two to say on that. Time for some action. And what about our other open positions? Wait, there is one more thing: a promising opportunity in yet another pair.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a new stop-loss order at 1.1204; the next downside target at 1.1130)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3545; the initial downside target at 1.3363)

- USD/CHF: none

- AUD/USD: none

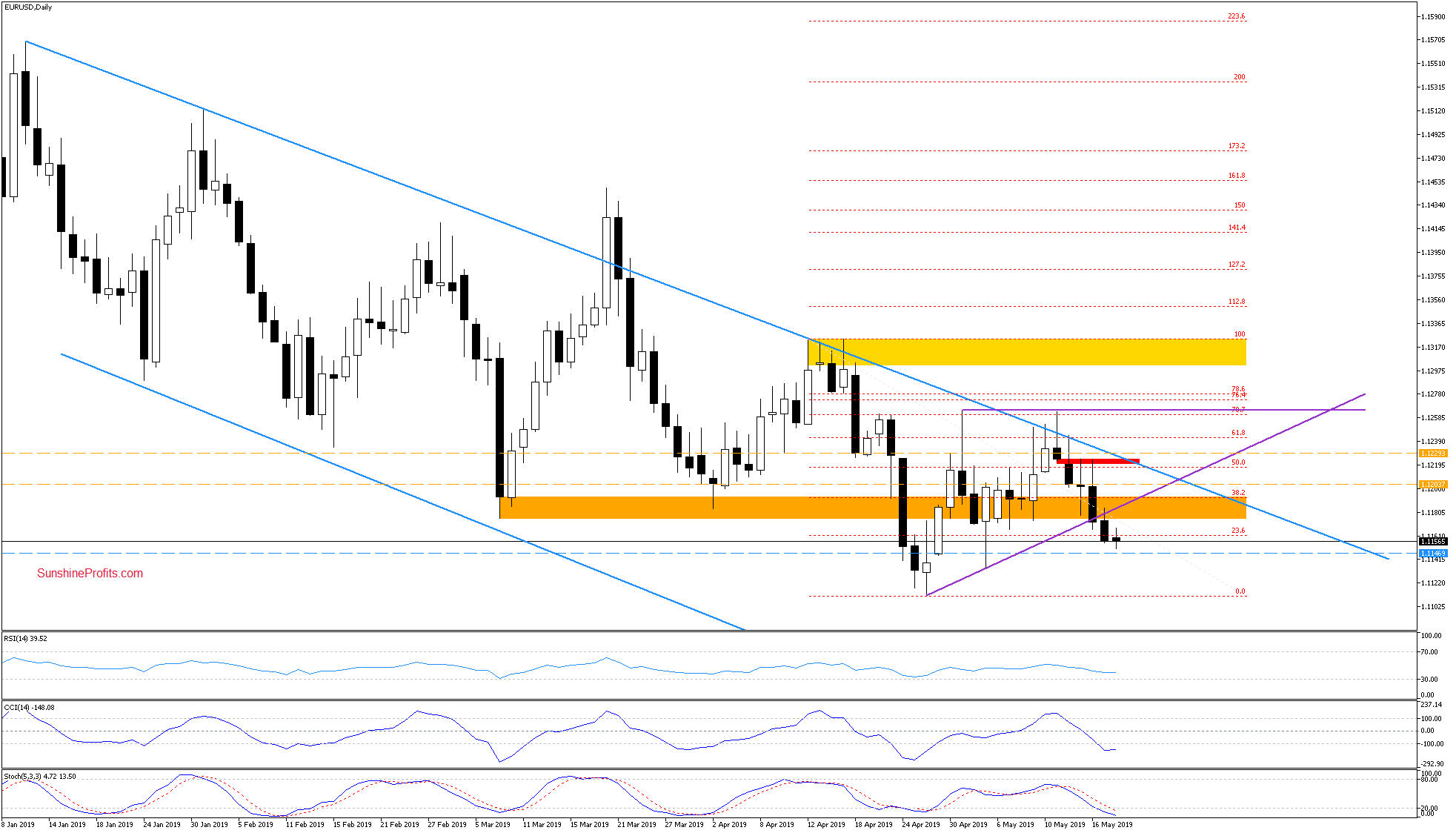

EUR/USD

On Friday, EUR/USD verified the earlier breakdown below the rising purple support line. Another downswing followed and the pair closed the day below this resistance.

The weekly chart below reveals the full picture. The weekly close lies below the previously-broken lower border of the red declining trend channel. This doesn't bode well for the bulls going forward.

The green support line has however been strong enough to stop the sellers in the previous weeks. Just as EUR/USD approached our initial downside target, the CCI and the Stochastic Oscillator slipped to their oversold areas. The position of these two indicators suggests that a reversal could be just around the corner.

Therefore, we decided to close 50% of our short position and take profits off the table if EUR/USD drops to our downside target (at 1.1147). Additionally, we moved lower the stop-loss order for the remaining 50% of our short positions to 1.1204 to protect the rest of our profits.

Trading position (short-term; our opinion): short positions with a new stop-loss order at 1.1204 and the next downside target at 1.1130 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

The situation on the weekly chart remains almost unchanged. USD/CAD is still trading inside the blue consolidation located around the upper border of the previously-broken upper line of the yellow consolidation. The sell signals of the weekly indicators continue to favor the sellers.

The daily perspective shows that despite Friday's upswing, the strong combination of resistances have stopped the buyers. Namely, it was the 70.7% Fibonacci retracement, the upper border of the rising purple trend channel, the previous highs and the upper border of the declining red trend channel. Another reversal followed.

As a result, the pair invalidated the earlier tiny breakout. Further deterioration followed earlier today (the pair trades at around 1.3440 currently). Additionally, the Stochastic Oscillator generated a new sell signal, increasing the probability of a testing recent lows in the coming days.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.3545 and the initial downside target at 1.3363 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

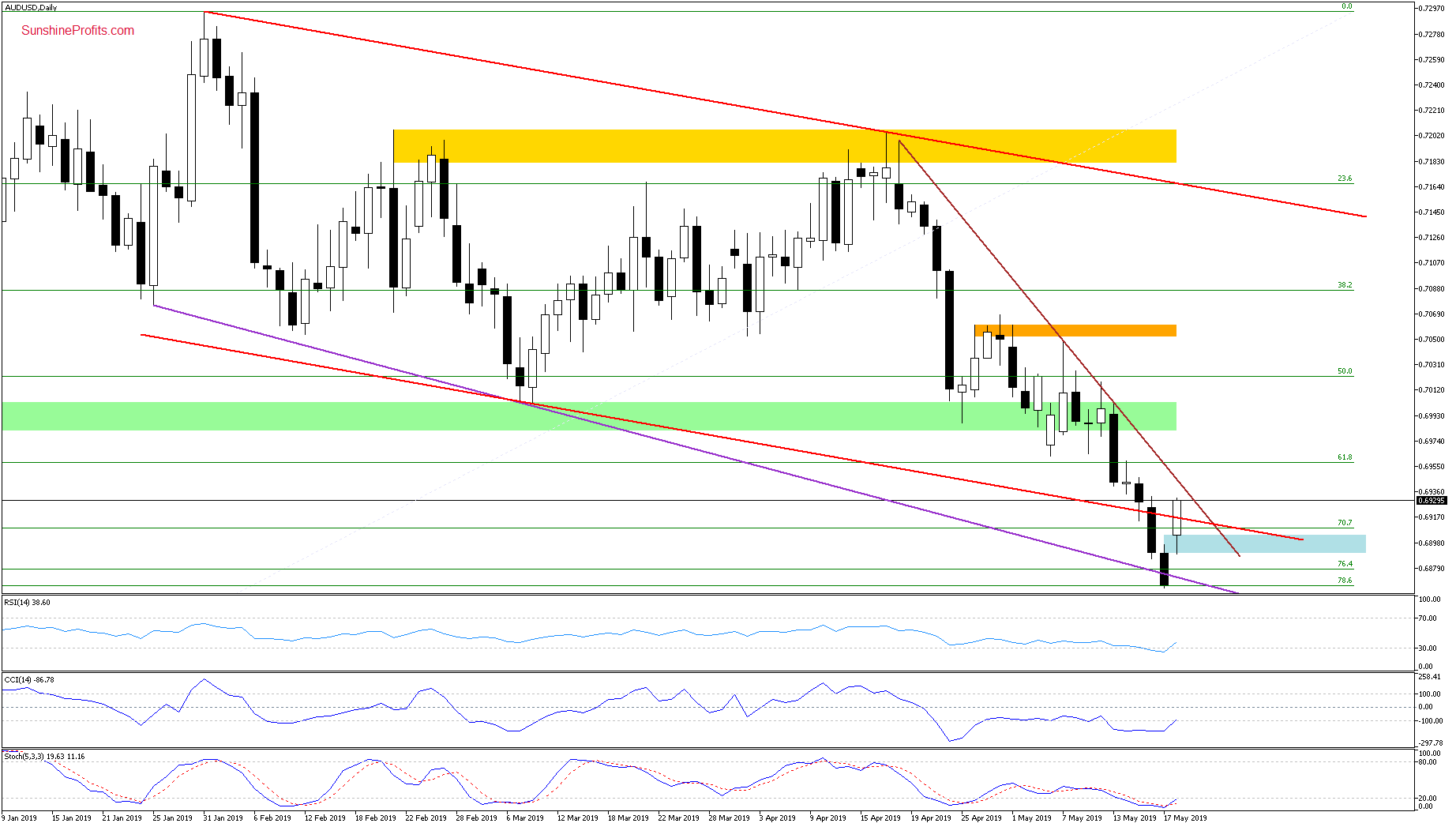

AUD/USD

AUD/USD's losing streak continued also on Friday and the pair tested a strong support area. This area is marked by the 76.4%, 78.6% Fibonacci retracements and the declining purple support line based on the late-January and early-March lows.

Despite the daily close below the declining purple line, the bulls triggered a move to the upside earlier today. This created a significant gap (marked with blue), which serves as the nearest support at the moment of writing this Alert.

Additionally, the RSI and the Stochastic Oscillator generated their buy signals, while the CCI is very close to doing the same. Coupled with the blue price gap created earlier today, higher values of the exchange rate in the near future look to be just around the corner.

Should we see a daily close above the lower border of the declining red trend channel and a breakout above the declining brown resistance line, we'll likely open long positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but if we see a daily close above the lower border of the declining red trend channel and a breakout above the declining brown resistance line, we'll likely open long positions. Stay tuned.

Summing up the Alert, the strong Friday's downswing in the euro combined with the positioning of the daily indicators leads us to taking 50% of the open profits off the table should the pair reach our initial downside target (at 1.1147). We're also moving down our stop-loss order to protect the remaining part of our euro profits. We're also issuing a new initial downside target. The USD/CAD upswing has fizzled out at the strong combination of resistances and our profitable short position remains justified. Should AUD/USD bulls show strength in overcoming both nearest resistances, we'll consider opening a long position. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist