The euro situation is tense. Little wonder, the ECB has issued its monetary policy statement today and it’s the market’s turn to digest it. Have we seen the low? The euro bulls look to be taking the initiative in the wake of the ECB moves. Across the currencies, we see interesting action with plenty to share. Let’s jump in.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1099; the initial upside target at 1.1311)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

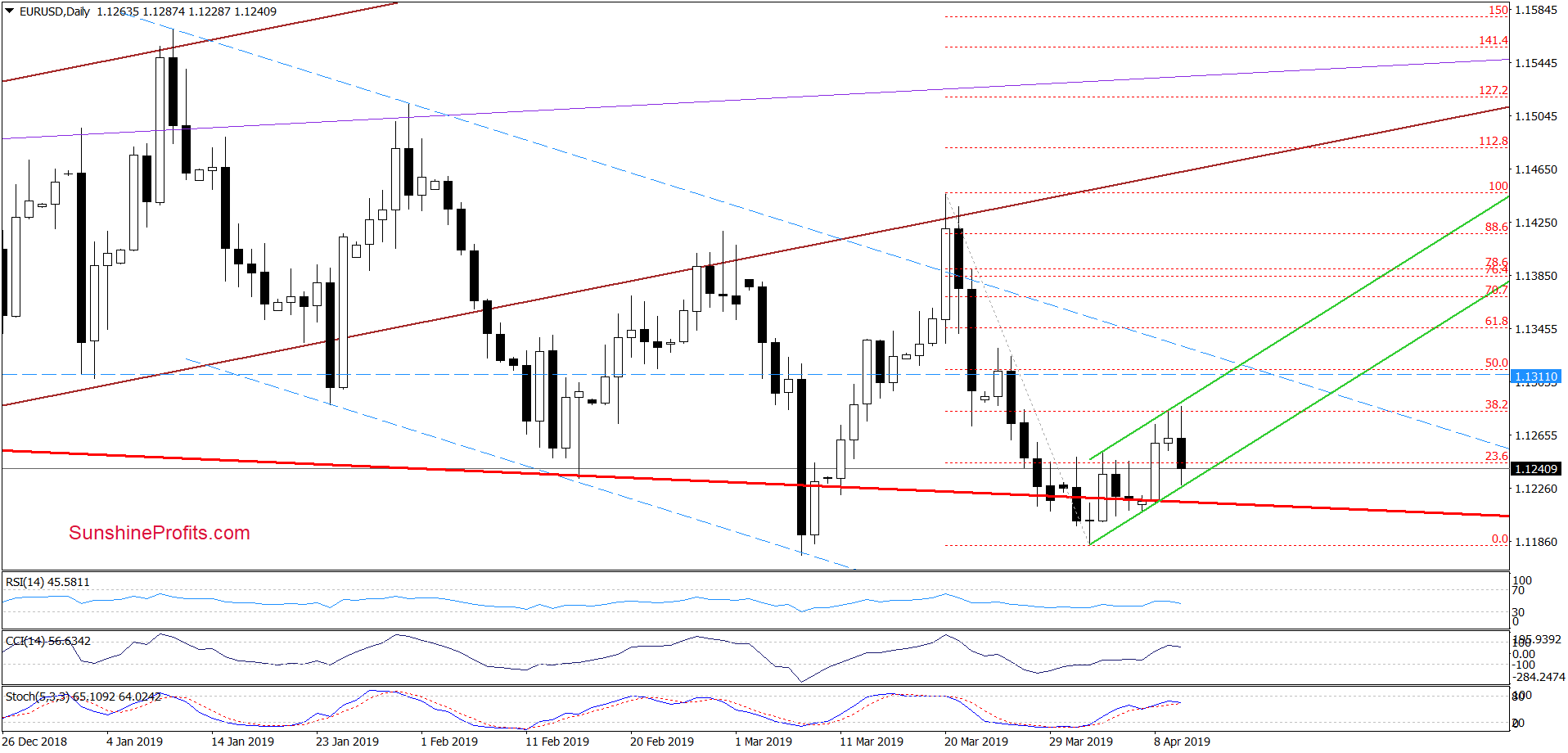

EUR/USD

Yesterday and also today, we’ve seen an attempt to break above the upper border of the short-term rising green trend channel. In both instances, the attempt failed and we’re seeing some follow-through selling in recent hours. The euro changes hands at around 1.1245 currently.

However, the lower border of the rising green trend channel was all where the bears managed to take the exchange rate. There was no breakdown below it. Despite the daily indicators showing quite high readings, they do not flash any sell signals at the moment. Offering support, there’s also the lower border of the declining red trend channel.

These factors provide comfort for the bulls and a rebound in the following hours or day(s) remains likely.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.1099 and the initial upside target at 1.1311 are justified from the risk/reward perspective.

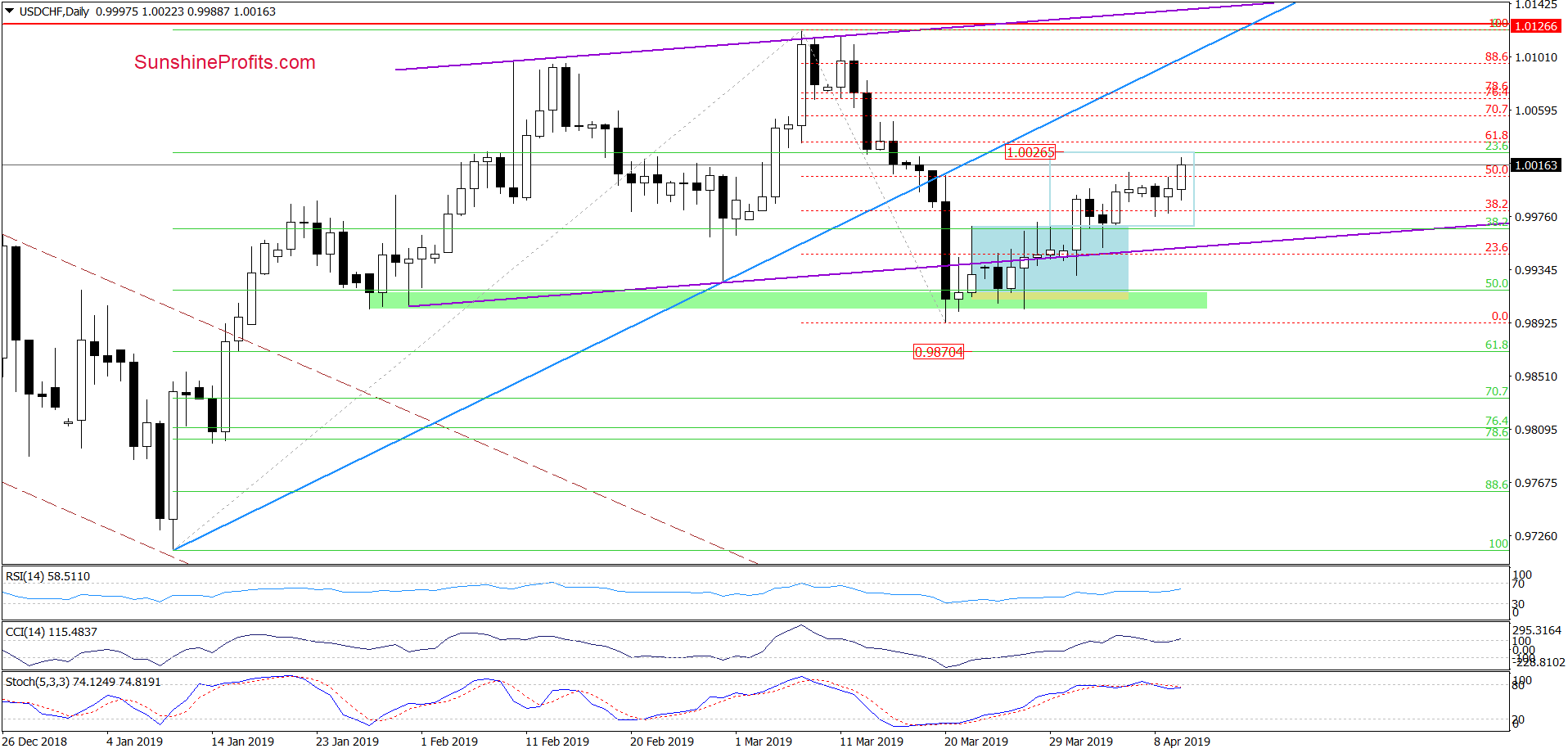

USD/CHF

Earlier today, USD/CHF extended recent gains. The daily indicators haven’t issued any sell signals. This means that our words dating back to April 2 remain up-to-date:

(...) If the pair extends gains from here, the first upside target would be around 1.0026, where the size of the upward move would correspond to the height of the blue consolidation.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

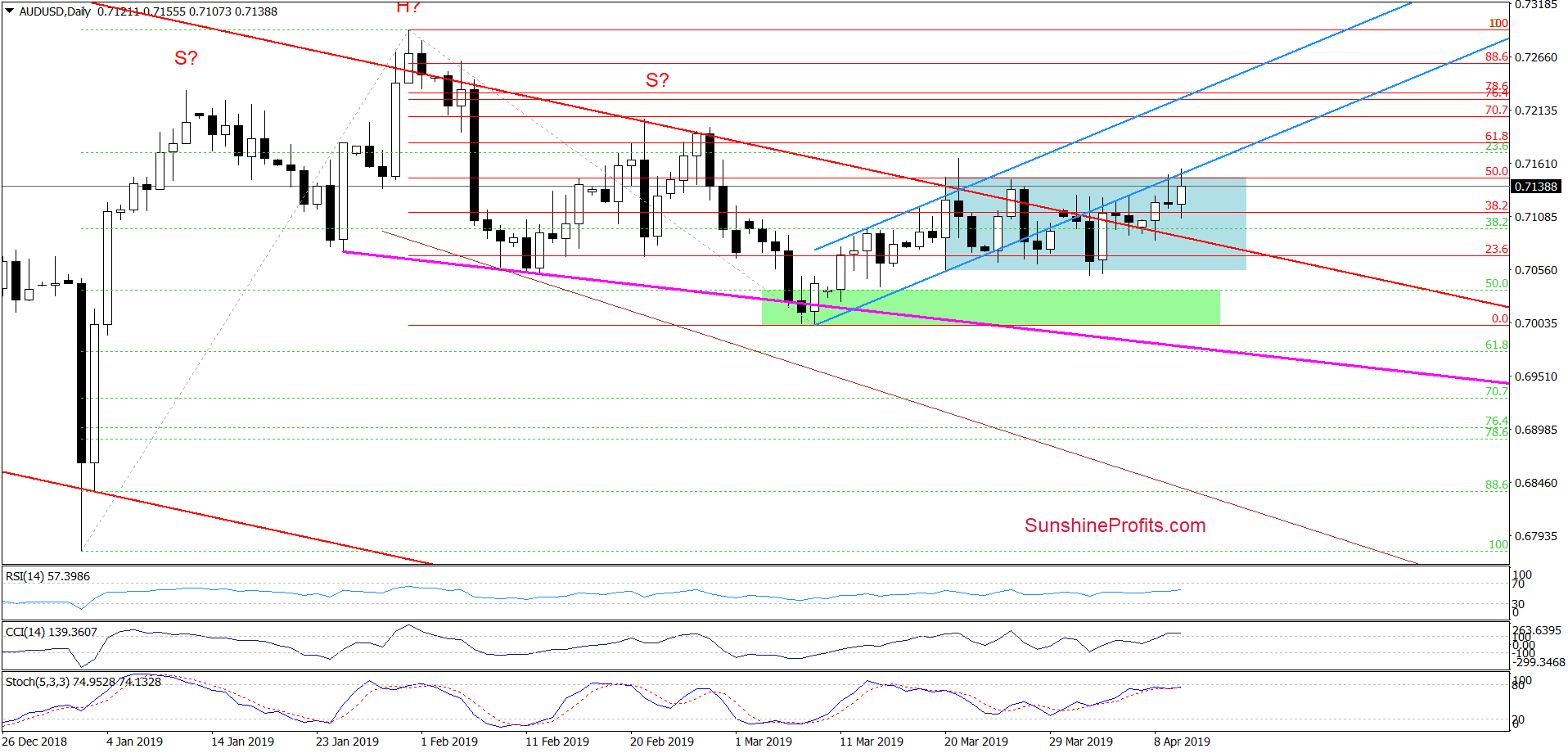

AUD/USD

On Monday, the pair has broken above the upper border of the red declining trend channel. This triggered a test of the lower border of the rising blue trend channel that sits next to the 50% Fibonacci retracement.

However, the pair is still trading inside the blue consolidation and hasn’t managed to escape it either today so far. We think that no tradable move will emerge unless we see a breakout above the upper border of the consolidation or a breakdown below it first.

Until then, short-lived moves in both directions would not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the long euro position continues to be justified. There’re no opportunities worth acting on in the other currency pairs right now. This may change in the Japanese yen, though. As always, we’ll keep you – our subscribers – informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist