Tuesday looks to be marching in lockstep with Monday’s action in the foreign exchange universe. That means not much happening at first sight. As they say, time to go long, time to go short, and time to go fishing? Not so fast! Even a relative breather provides a welcome opportunity to reexamine the case for a trade (or against it) and adjust the parameters accordingly. Been there, done that. Here we go.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1099; the initial upside target at 1.1311)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

Yesterday, we wrote the following:

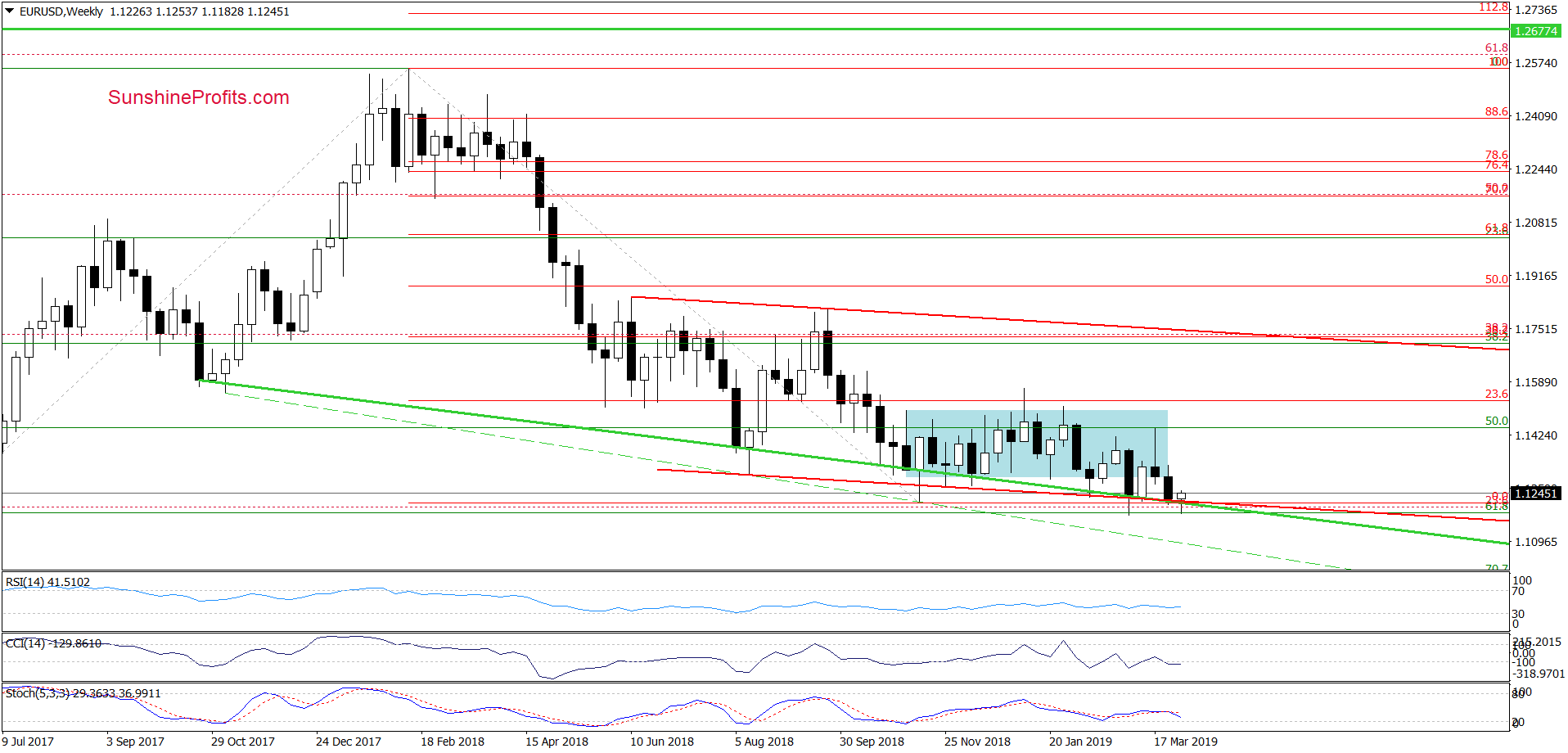

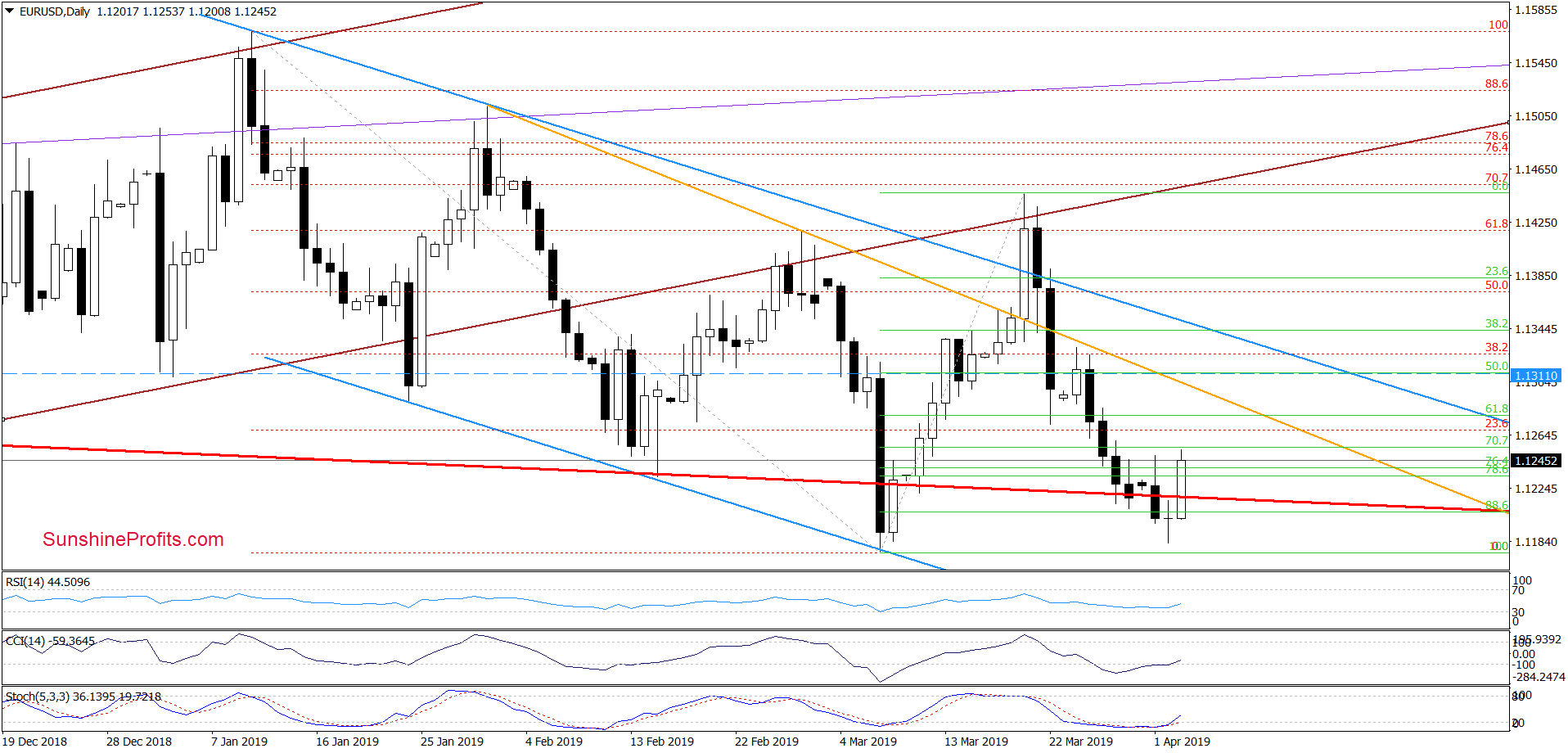

(…) EUR/USD (…) finished the day below the lower border of the red declining trend channel and the long-term green support line (…)

This is a negative development but taking into account just how close March lows are and also the current position of the daily indicators (bullish divergences forming between both the CCI and the Stochastic Oscillator, and the exchange rate itself), we think that reversal is most likely around the corner.

Additionally, we have seen similar price action almost a month ago. It suggests that as long as there is no weekly close below the green support line on the weekly chart, another rebound and an invalidation of the small breakdown below it remains very likely.

The situation developed in line with our observations. Earlier today, EUR/USD has moved quite sharply higher. In the process, it invalidated the above-mentioned breakdowns.

This is a bullish development, which suggests further improvement. Especially, when we factor in the buy signal generated by the daily CCI and the daily Stochastic Oscillator.

Should the pair close the day at least at current levels (the pair trades at around 1.1245 as we speak), the bulls will get additional reason to act. That reason will be the morning star candlestick pattern. This is a three-day reversal pattern marked by a large red candle, followed by a small-body bullish or bearish candle, and finally a large white candle.

Connecting the dots, the technical picture favors further growth in the pair. Our upside targets remain on.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.1099 and the initial upside target at 1.1311 are justified from the risk/reward perspective.

USD/JPY

Quoting our last commentary on this currency pair:

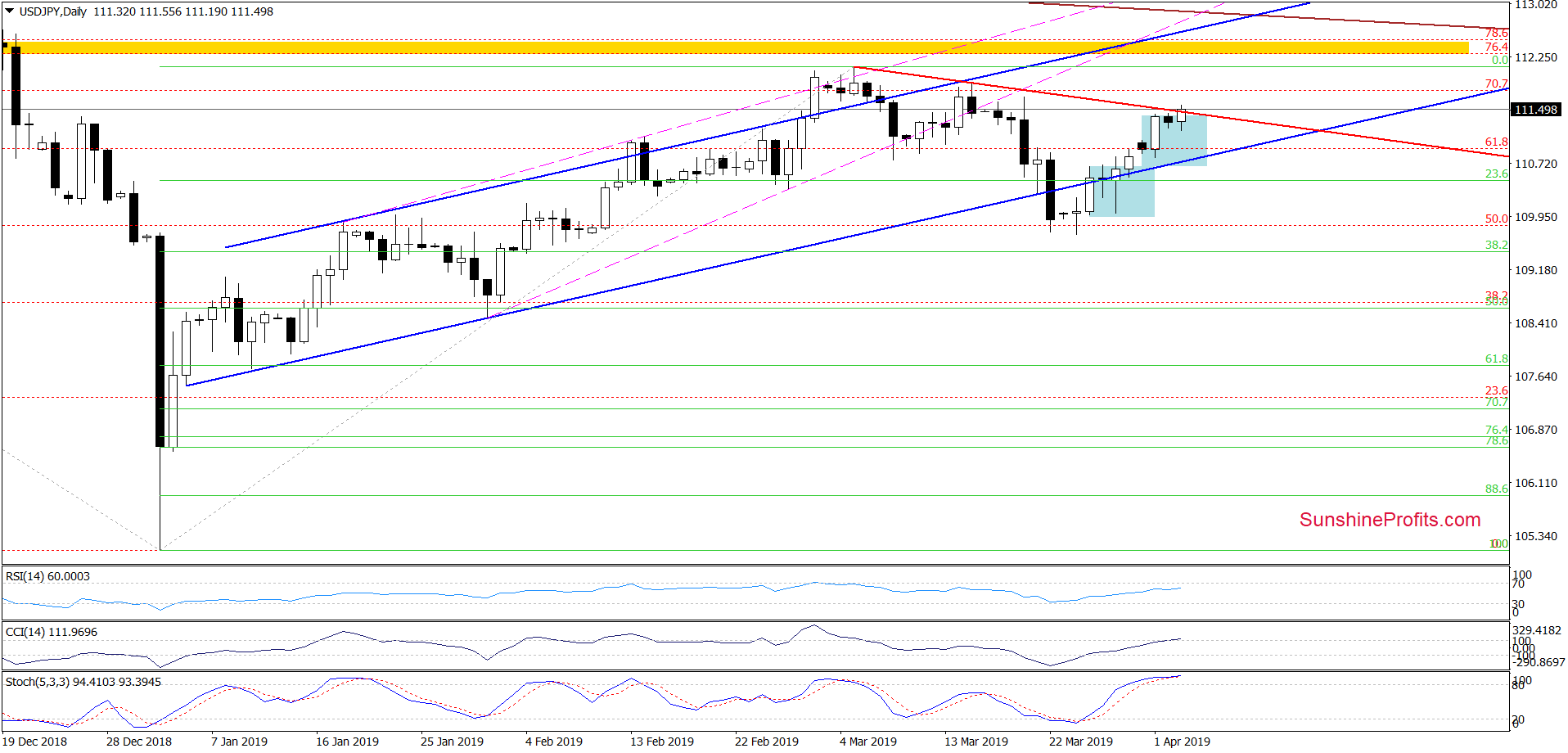

(...) the pair invalidated a small breakdown below the lower border of the blue rising trend channel. Coupled with the lack of sell signals by the daily indicators, it suggests that USD/JPY will likely extend gains from current levels and test the red declining resistance line based on previous highs in the coming week.

USD/JPY indeed moved higher as we had expected. It has also reached the red declining resistance line.

Earlier today, we have noticed a tiny intraday breakout above the red line but the day is still young. As long as there is no daily close above this resistance, higher values of the exchange rate are questionable. Nevertheless, if the bulls manage to close today’s session above 111.44 (the red declining resistance line), the way to the mid-March highs would be open.

Please keep in mind however, that the CCI and the Stochastic Oscillator moved to their overbought levels, which can translate into a reversal in the coming days. Should we see such price action accompanied by signs of bulls’ weakness, we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

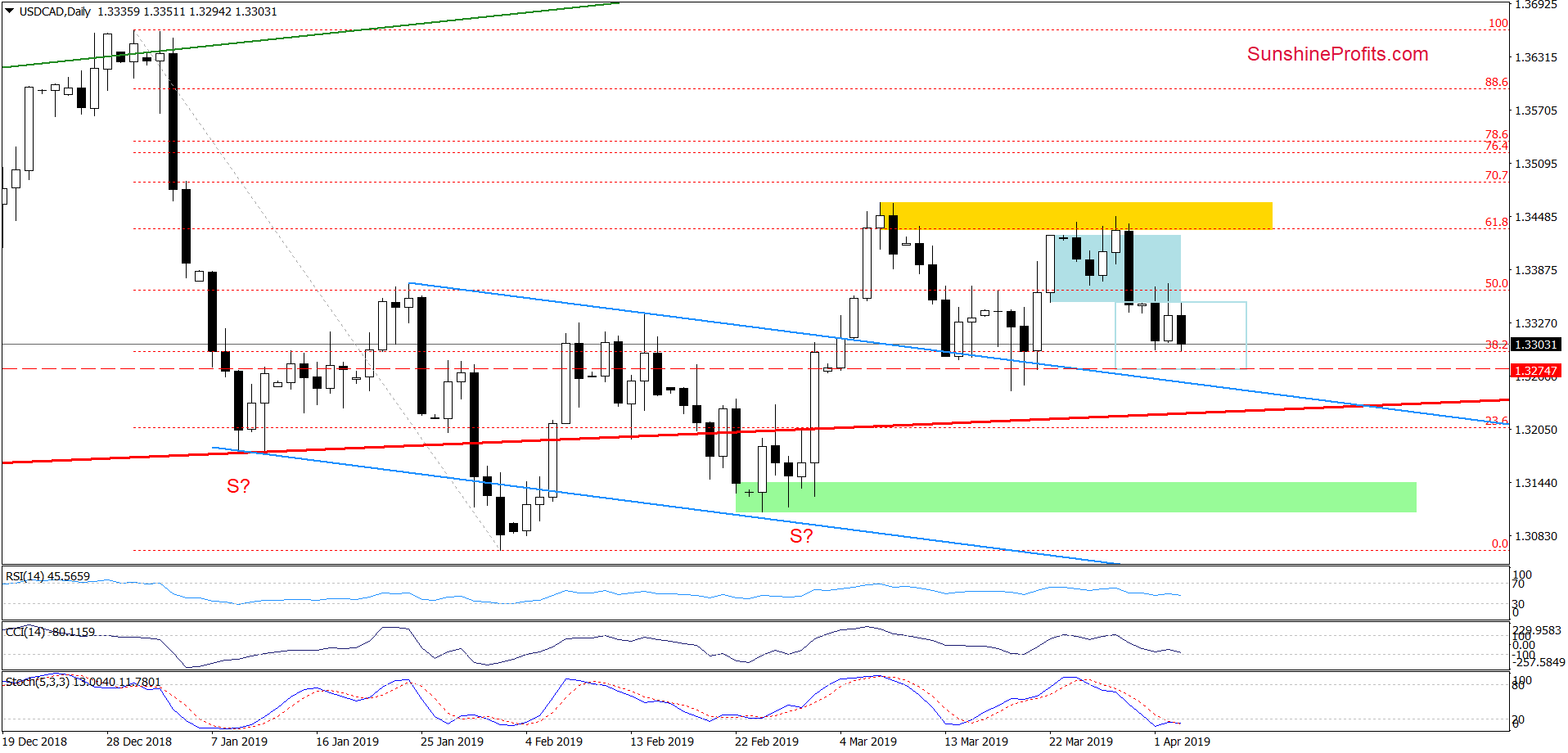

On Monday, USD/CAD closed the day below the lower border of the blue consolidation. Yesterday’s bullish action erased almost entirely Monday’s decline. It tested the lower border of the formation, but didn’t manage to come back inside.

Therefore it’s our opinion that this upswing was nothing more than a verification of Monday’s breakdown. This fits in well with the heavy selling we are seeing today.

The pair is slipping below this week’s low, which suggests that we can see a realization of our Monday’s bearish scenario in a very near future:

(…) the sellers took the exchange rate even lower. Taken together with the sell signals generated by the daily indicators, it increases the probability of further deterioration in the coming days.

If this is indeed the case and USD/CAD declines from current levels, we’ll likely see a drop to around 1.3275. There, the size of the downward move would correspond to the height of the preceding consolidation. However, if this area is broken, the sellers could also retest the strength of the previously-broken upper border of the blue declining trend channel.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist