The euro bulls are having a bad week. But the bears haven't made much progress today either. Which way does the wind blow in today's thin holiday trading (German markets are closed)? A sizable move is coming and the odds are we're positioned correctly in expectation of that. Time to examine the opportunities in other pairs too. Here we go.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1228; the initial downside target at 1.1120)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3545; the initial downside target at 1.3360)

- USD/CHF: none

- AUD/USD: none

EUR/USD

EUR/USD has extended losses yesterday, which took the pair to its previous lows. Earlier today, the downswing has lost momentum and we saw a small rebound instead. The rate is trading close to unchanged on the day, at around 1.1135. Taking into account the sell signals of the daily indicators, one more attempt to move lower and test the recent lows looks to be still ahead of us.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1228 and the initial downside target at 1.1120 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

USD/JPY reversed higher yesterday and this encouraged the buyers to build on previous gains also earlier today. The pair has reached the declining red resistance line - suggesting that higher values of USD/JPY will be more likely and reliable only if we see a successful breakout above it.

As the daily indicators favor a bullish resolution, it's a good idea to discuss the targets of the upside move. The first one will be the resistance area created by both nearest Fibonacci retracements (the 38.2% and the 50% ones), followed by the red gap.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

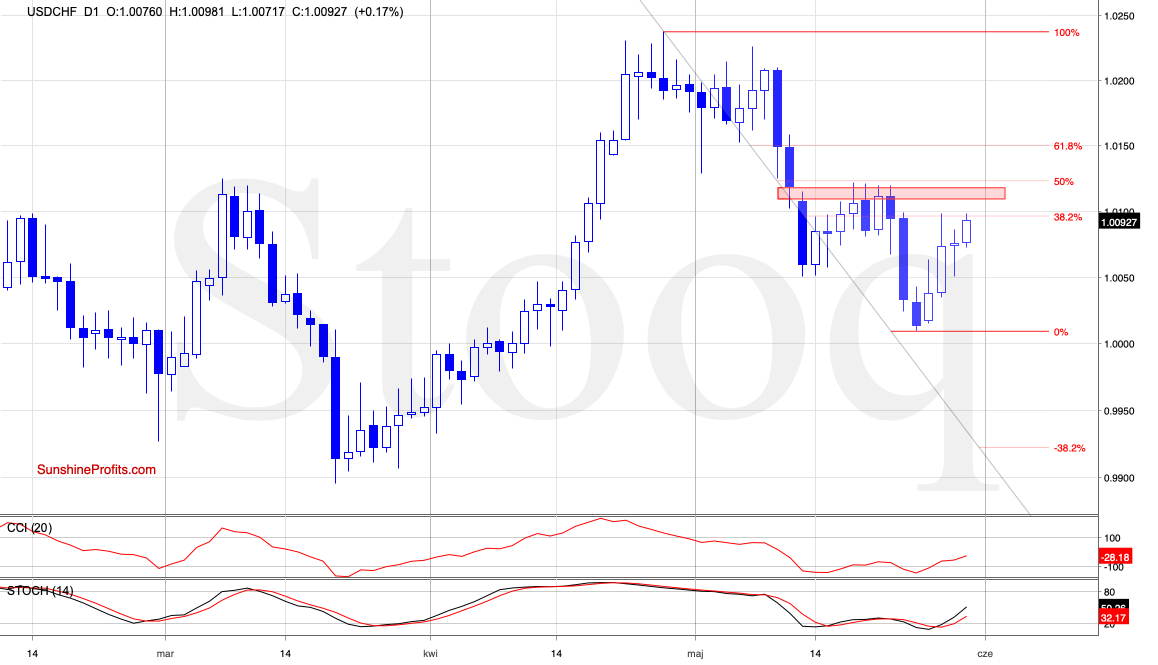

USD/CHF

USD/CHF didn't continue higher as was the case earlier this week, and pulled back yesterday instead. The bulls have attempted to go higher earlier today, but gave up most of their gains as the pair trades at around 1.0080 currently.

The daily indicators are however positioned in a bullish way. They suggest that we're likely to see another test of the red gap and the late May highs in the near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, EUR/USD has had a down session yesterday that erased the remainder of last week's upswing. The daily indicators continue to favor one more downswing, targeting the green support zone initially. USD/CAD has again tested the strong combination of resistances that have sent it lower many times earlier already. Our short position remains justified, the pair has already given up almost all of its yesterday's gains, and there hasn't been any breakout, let alone a verified one above those resistances. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist