Many of the leading pairs look to be in search of a firm direction. Some of them seem to need more time to commit to their odds-favored moves, while others already continue moving along nicely. This captures some of the open positions essence we're in right now. The charts remain in the driving seat and it's the skill and experience of reading them that gives edge to one's trading. Let's dive in to the details without having to rely on the above-mentioned (superficial yet deep) essence only. You know - the devil, as always, is in the details.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1398; the initial downside target at 1.1221)

- GBP/USD: short (a stop-loss order at 1.2824; the initial downside target at 1.2602)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7041; the initial downside target at 0.6910)

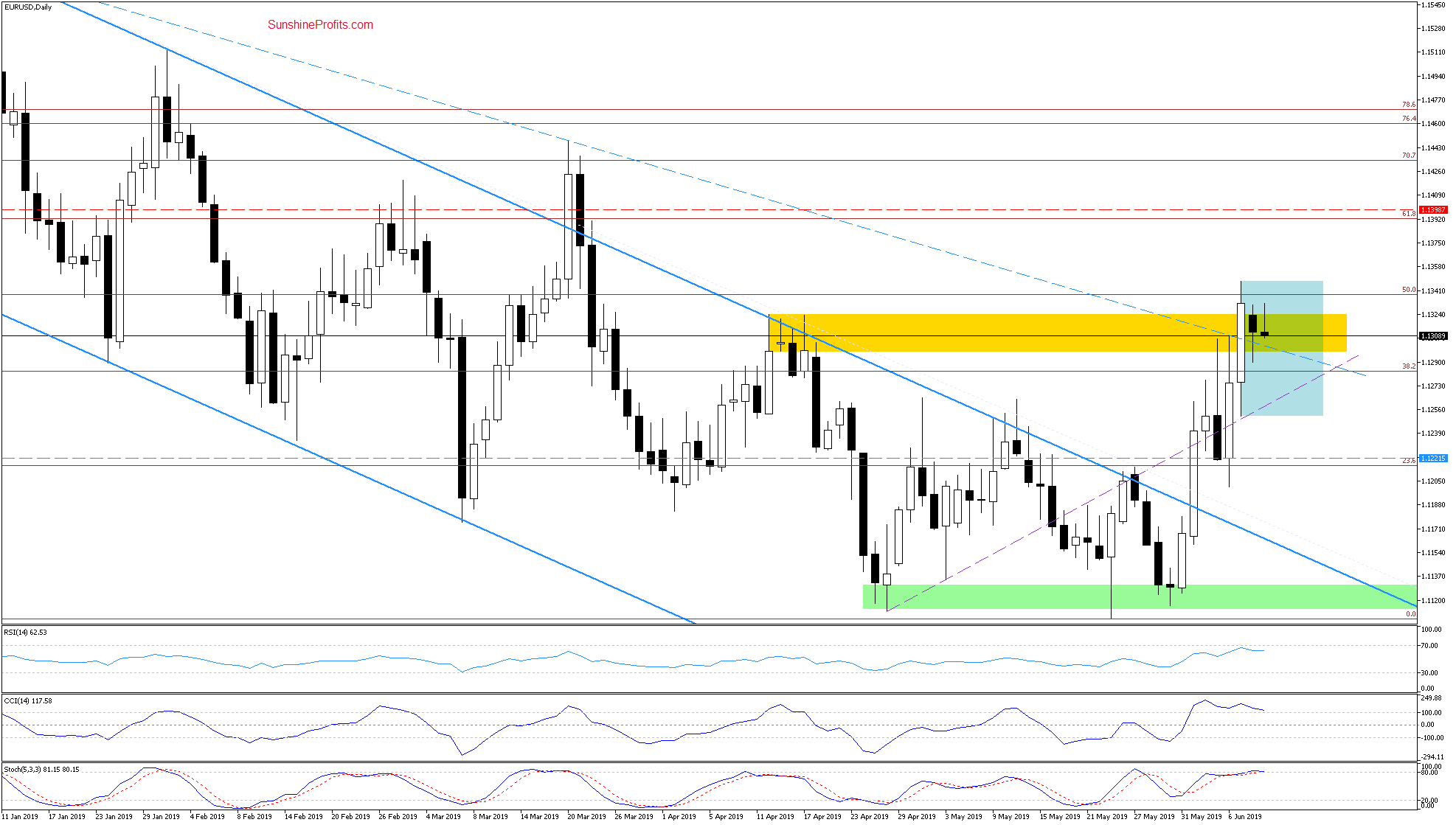

EUR/USD

Confirming our latest analysis, the bulls have had difficulty overcoming the yellow resistance zone also yesterday. The rate is still trading below the 50% Fibonacci retracement.

The daily indicators continue looking extended. They appear to be on the verge of issuing their sell signals shortly. This strengthens the bearish case for EUR/USD.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1398 and the initial downside target at 1.1221 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

Last week, USD/JPY dropped to the green support zone. The bearish onslaught didn't get any farther and a rebound followed. The pair has moved above the lower border of the declining thin blue trend channel (that's within the larger declining blue trend channel), invalidating the earlier breakdown beneath it in the process.

This is certainly a positive event for the bulls. Follow-through buying pressure suggests a test of the upper border of the declining thin blue trend channel (at around 108.94 currently), or even of the upper border of the thick declining blue trend channel (at around 109.27 currently) in the near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

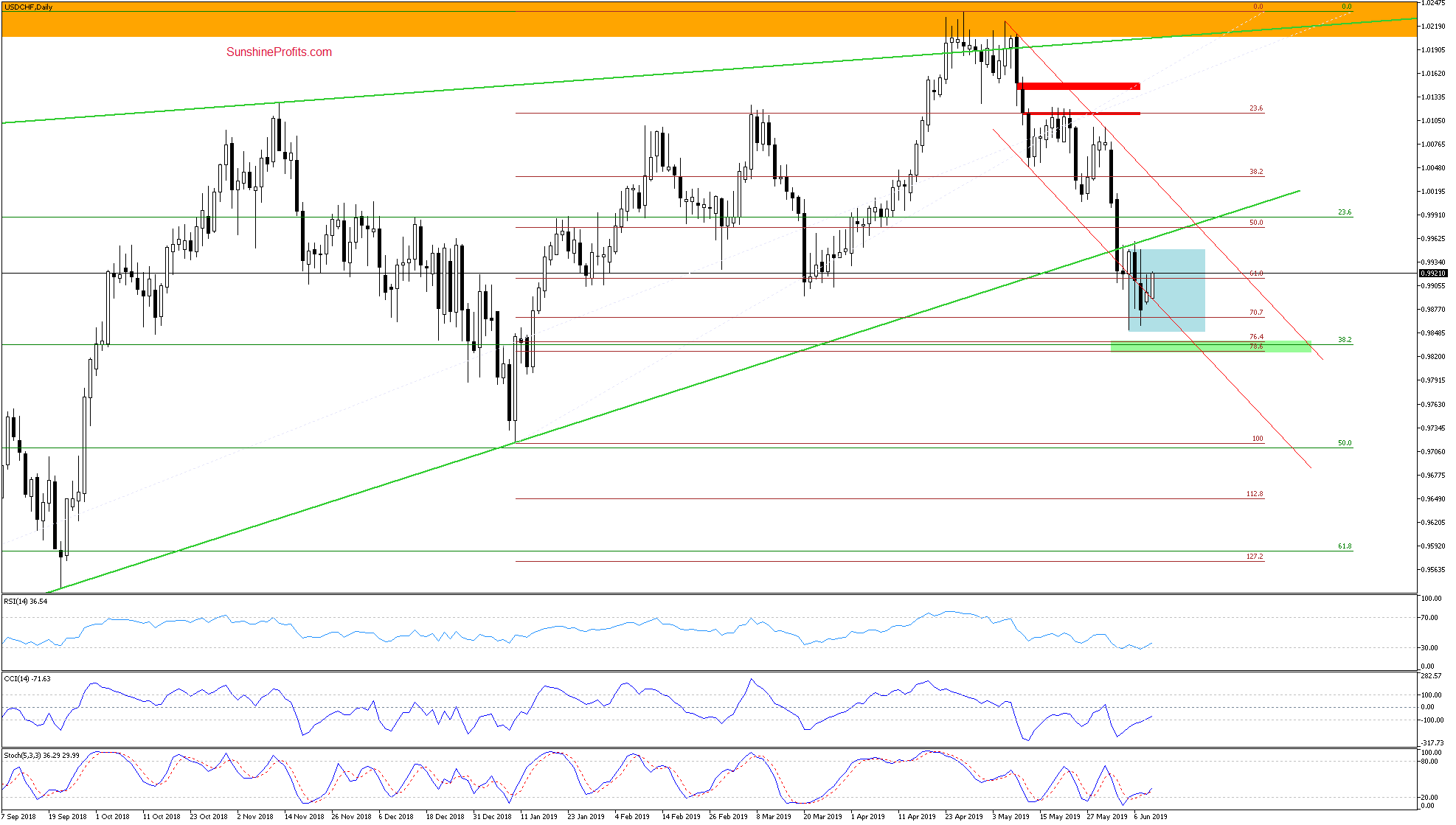

USD/CHF

Both the above daily charts differ only in their starting point. They show USD/CHF having dropped below the lower border of the rising green wedge in the previous week.

However, the 70.7% Fibonacci retracement had stopped the sellers two times in a row already, triggering attempts to go north. Earlier today, the rate moved above the lower border of the declining red trend channel, thereby invalidating the earlier breakdown.

This is a positive development for the bulls and suggests that we're likely to see a test of the previously-broken lower border of the green wedge in the coming days. The first obstacle for the bulls to overcome, is the upper border of the blue consolidation as marked on the latter daily chart.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the bearish outlook for our three open positions (EUR/USD, GBP/USD and AUD/USD) looks to be intact. While the first two pairs need more time to roll over convincingly, AUD/USD is heading south without much in terms of looking back. The momentum demonstrated bodes well for seeing lower values ahead - and in each of the above pairs. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist