The forex landscape looks calm on the surface, as judged by the absence of pronounced movements in either direction across the main pairs. Does it mean that we can lower our guard because a modest move might lack a meaningful implication going on? Far from it! Please accept our invitation to decipher how the pieces of the puzzle fit together.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1501; the next downside target at 1.1240)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 112.32; the initial downside target at 109.82)

- USD/CAD: long (a stop-loss order at 1.3228; the initial upside target at 1.3530)

- USD/CHF: none

- AUD/USD: none

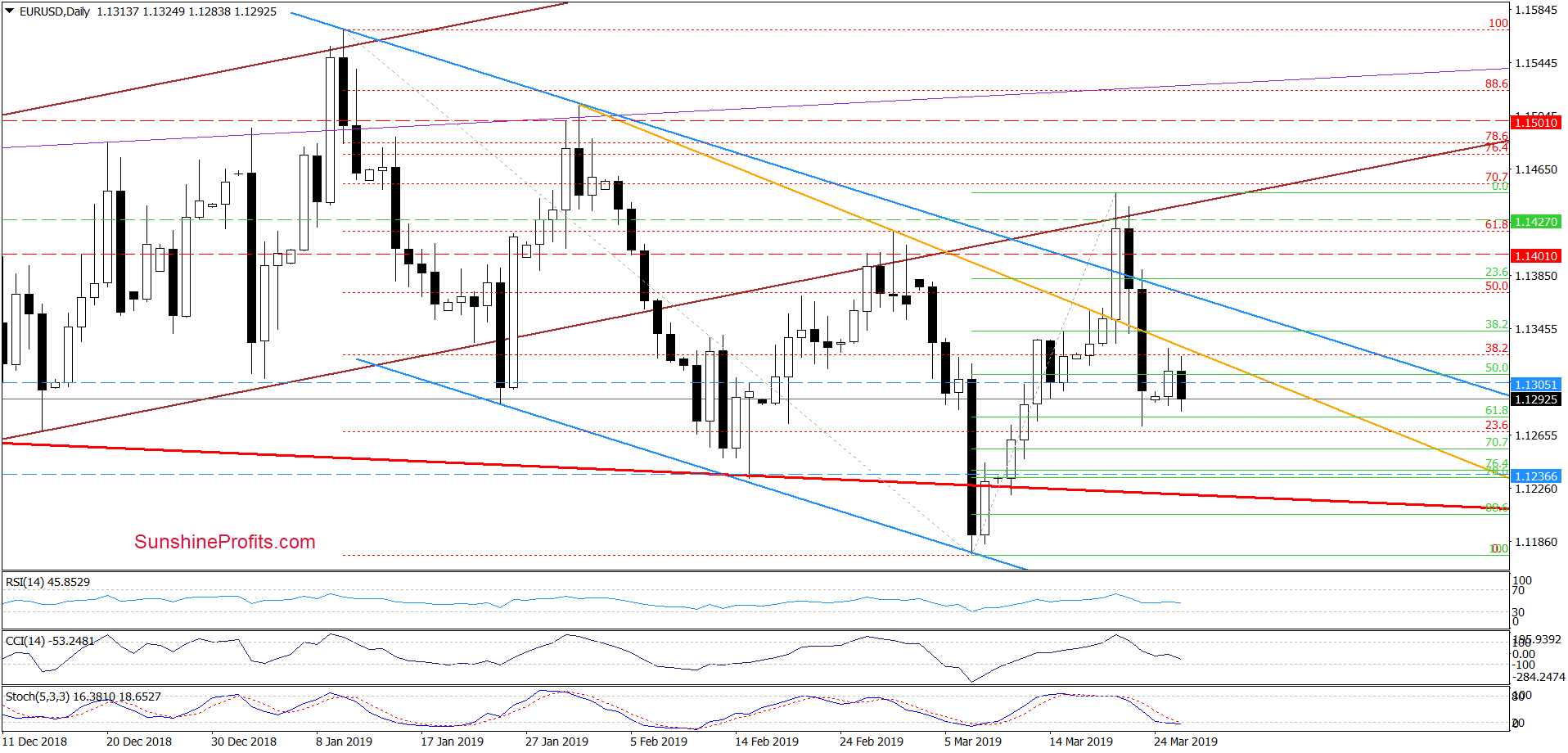

EUR/USD

Yesterday, we wrote:

(…) EUR/USD moved higher earlier today. However, the pair is still trading below the orange resistance line, which suggests that today’s move can be nothing more than a verification of Friday’s breakdown beneath it.

The sell signals from the CCI and Stochastics remain on the cards. Another attempt to move lower is likely still ahead of us. If this is the case, the exchange rate will reverse shortly and extend last week’s decline.

As well today, the exchange rate failed to even move to the orange resistance line, let alone test it. The pullback we’re witnessing today, is in line with our expectations. The pair has already more than erased yesterday’s upswing to trade at around 1.1285 currently. It suggests that we’ll likely see a realization of the bearish scenario about which we wrote on Friday:

(…) “If the situation develops in tune with this assumption, EUR/USD will extend losses and test next Fibonacci retracement or even the lower border of the long-term red declining trend channel (currently at around 1.1232) in the coming week.”

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1501 and the next downside target at 1.1240 are justified from the risk/reward perspective.

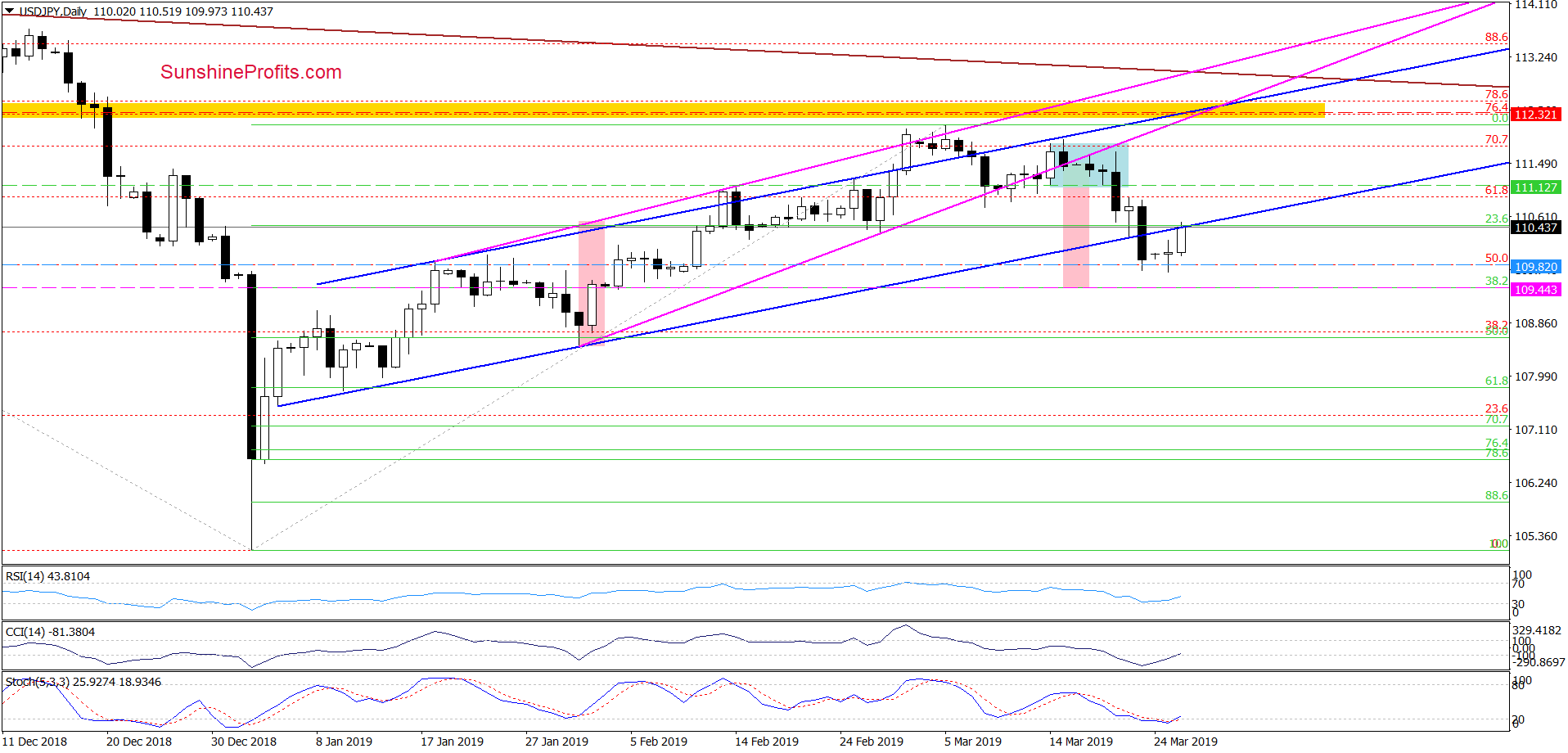

USD/JPY

On Friday, USD/JPY experienced heavy losses which were modestly retraced on Monday after a failed attempt to move still lower. Earlier today, the pair is on an upswing targeting the previously-broken lower border of the rising blue trend channel.

Lacking a daily close back inside the channel, today’s action would only be a verification of last week’s breakdown. Absent such a price action reversion back inside the channel, one more downswing remains likely.

In such a case, how low could the pair go then? Let’s check the quote from our last commentary on this pair for the up-to-date answer:

(…) if the pair closes today’s session under the lower border of the blue rising trend channel. (…) the way to 109.44 (in this area the size of the downward move will be equal to the height of the pink rising edge) will be open.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 112.32 and the initial downside target at 109.82 are justified from the risk/reward perspective.

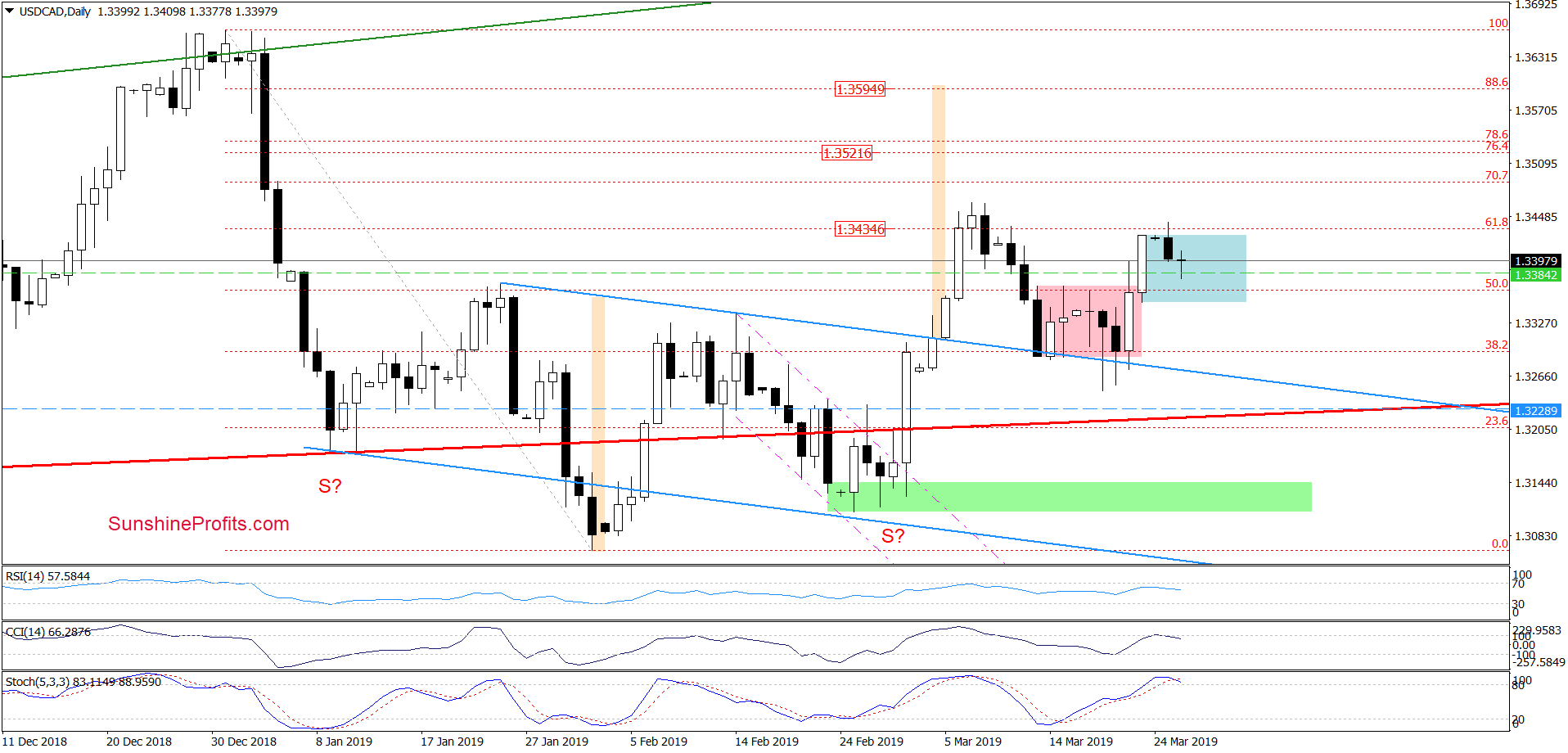

USD/CAD

USD/CAD closed Friday’s session above the pink consolidation. The bulls were however stopped by the 61.8% Fibonacci retracement on Monday and the pair turned lower.

Despite this pullback, the pair moved into another consolidation (marked with blue), which suggests that as long as there is no daily close below the lower line of the blue consolidation, one more upswing remains still likely.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3228 and the initial upside target at 1.3530 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist