A new week, a new month, and even a new quarter. What a good opportunity to present you with a long-term check on the most appealing currency pairs. Not that we haven’t had been doing so pretty regularly behind the scenes already but now we have a good excuse to share with you. Especially that it’s actionable and makes us act on a new promising opportunity. Yes, today’s promising opportunity.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1158; the initial upside target at 1.1311)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

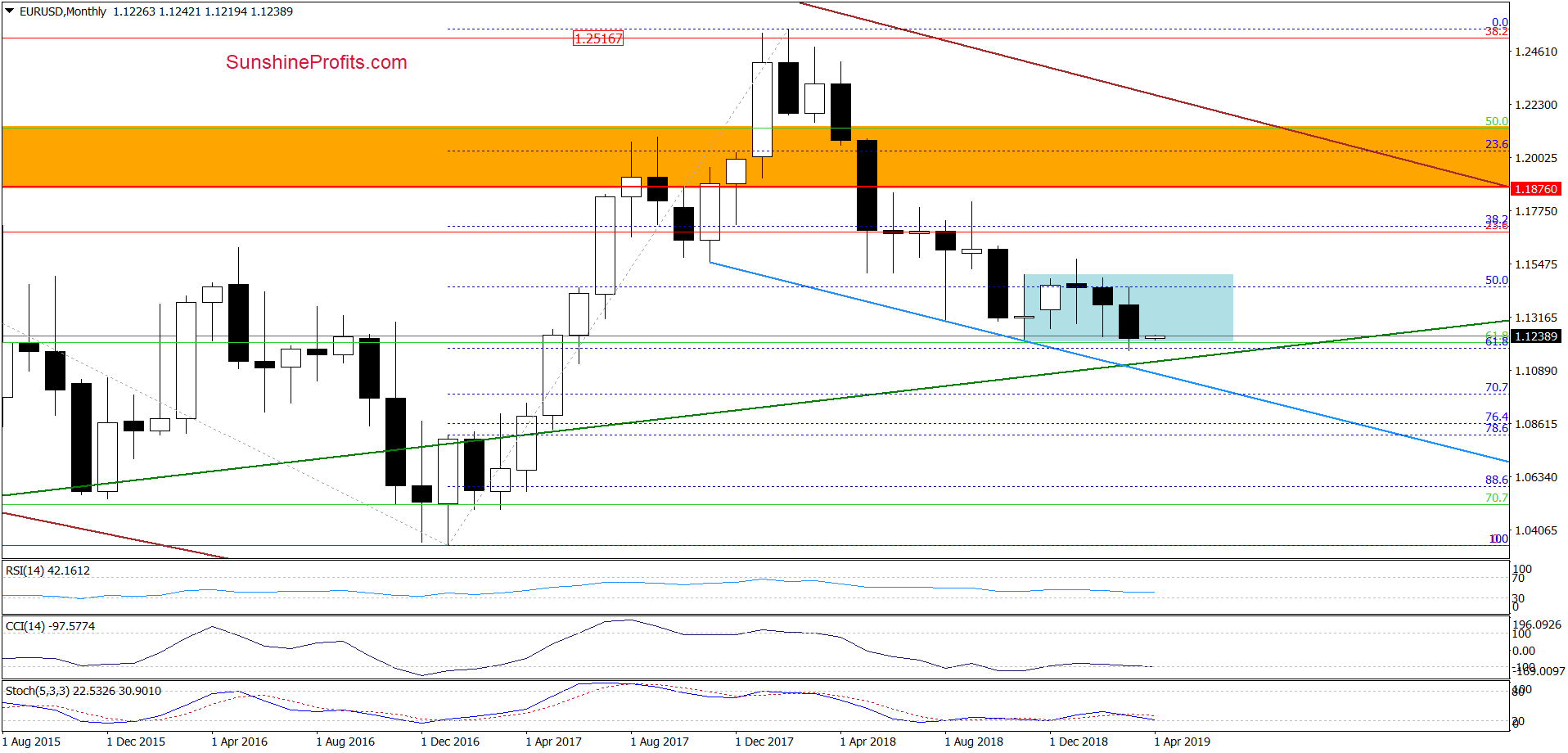

From the monthly perspective, we see that although EUR/USD slipped below the lower line of the blue consolidation, this deterioration was very temporary. The exchange rate came right back into consolidation, invalidating the earlier tiny breakdown.

This is a positive event for the bulls. Combined with the current position of the indicators, this can translate into further follow-up in the coming month.

This assumption is also reinforced by the medium-term picture. Let’s take a look at the weekly chart below:

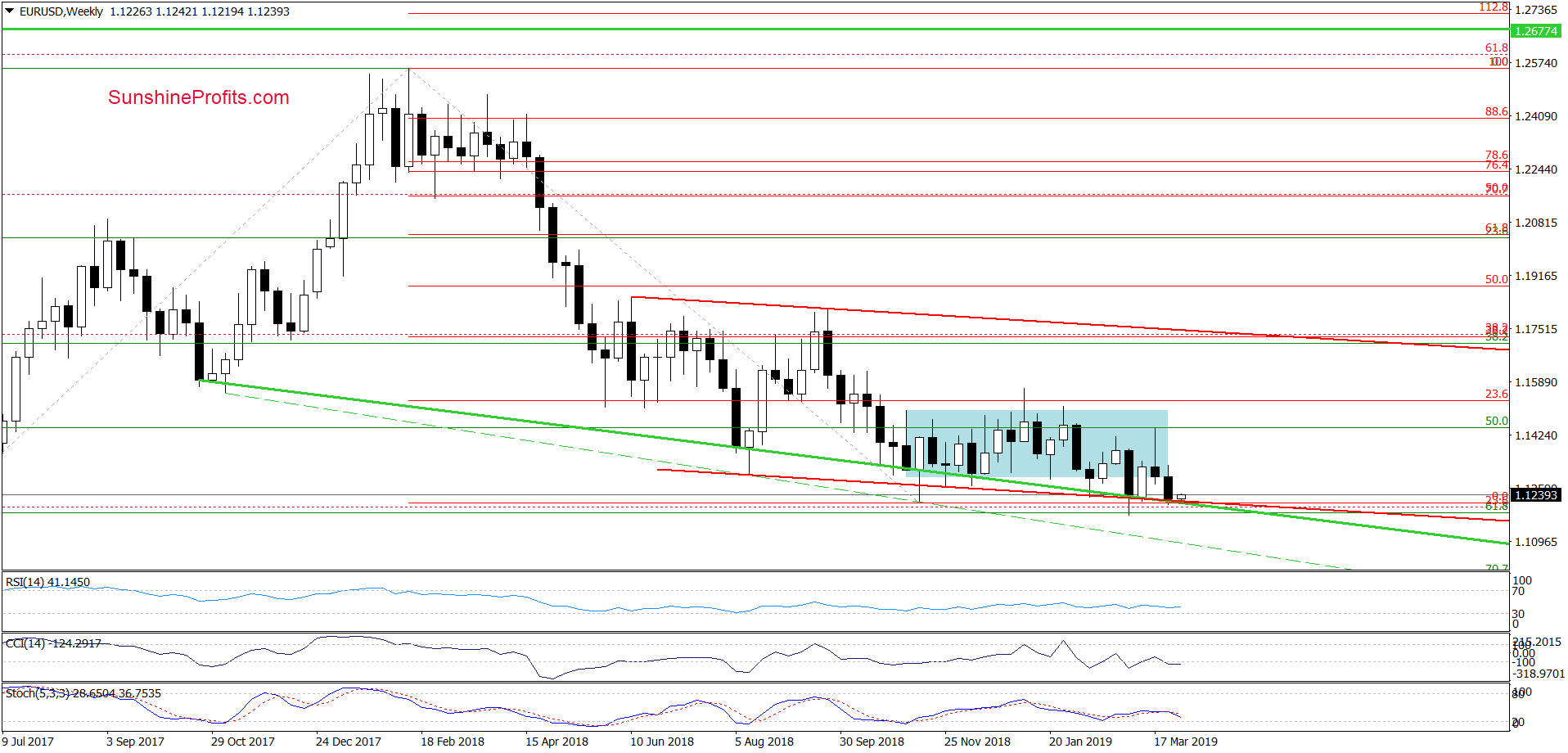

We see that the combination of the lower border of the red declining trend channel and the long-term green support line stopped the sellers once again. Again, this is increasing the likelihood of a rebound from current levels.

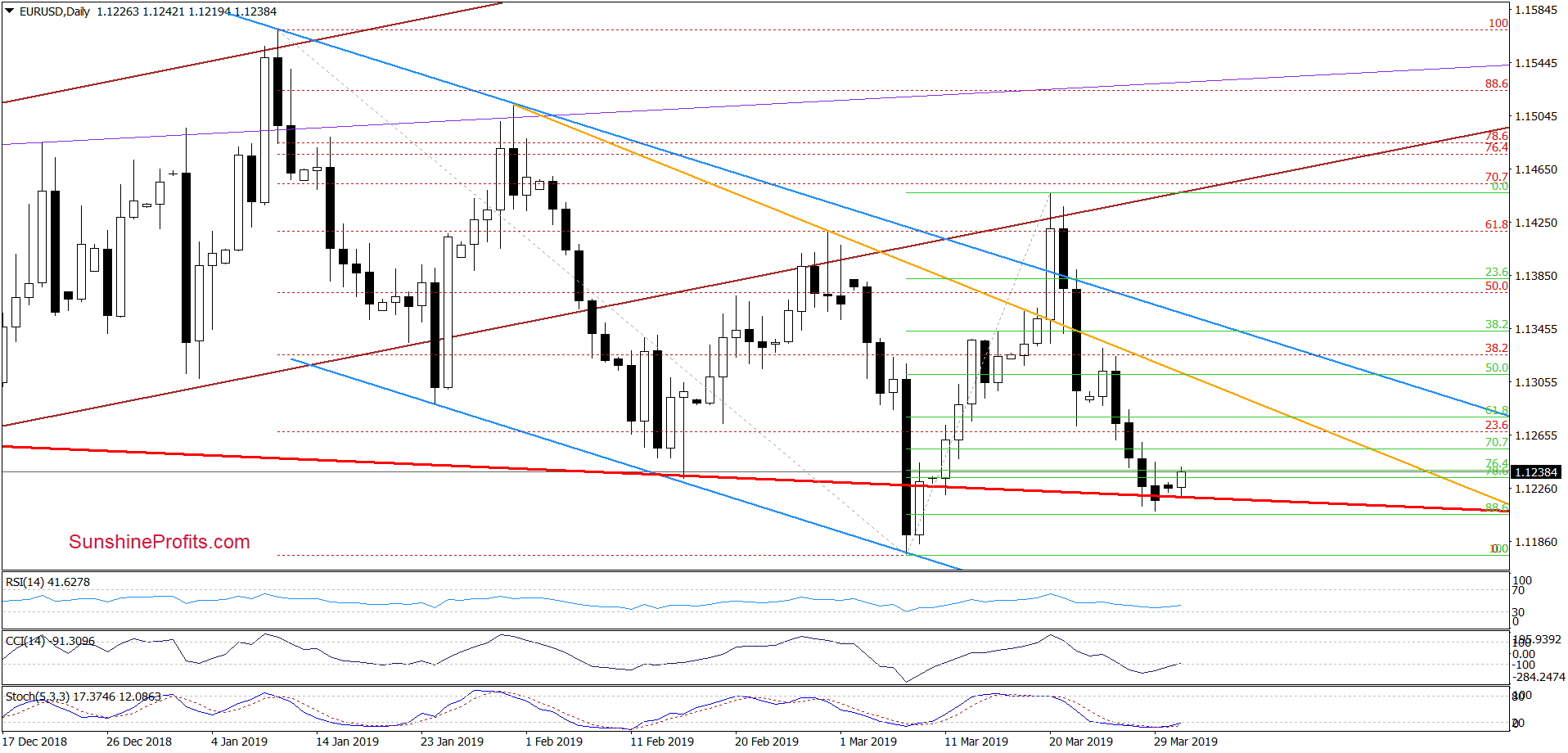

Finally, looking at the daily chart, we see that although EUR/USD closed Friday’s session slightly below the lower border of the red declining trend channel, the bulls took the pair higher earlier today. The pair is trading at around 1.1235 as we speak, invalidating the earlier breakdown.

On top of that, the CCI and Stochastics generated their buy signals, giving the buyers yet another reason to act. Taking all the above intò account, we think that opening long positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.1158 and the initial upside target at 1.1311 are justified from the risk/reward perspective.

USD/JPY

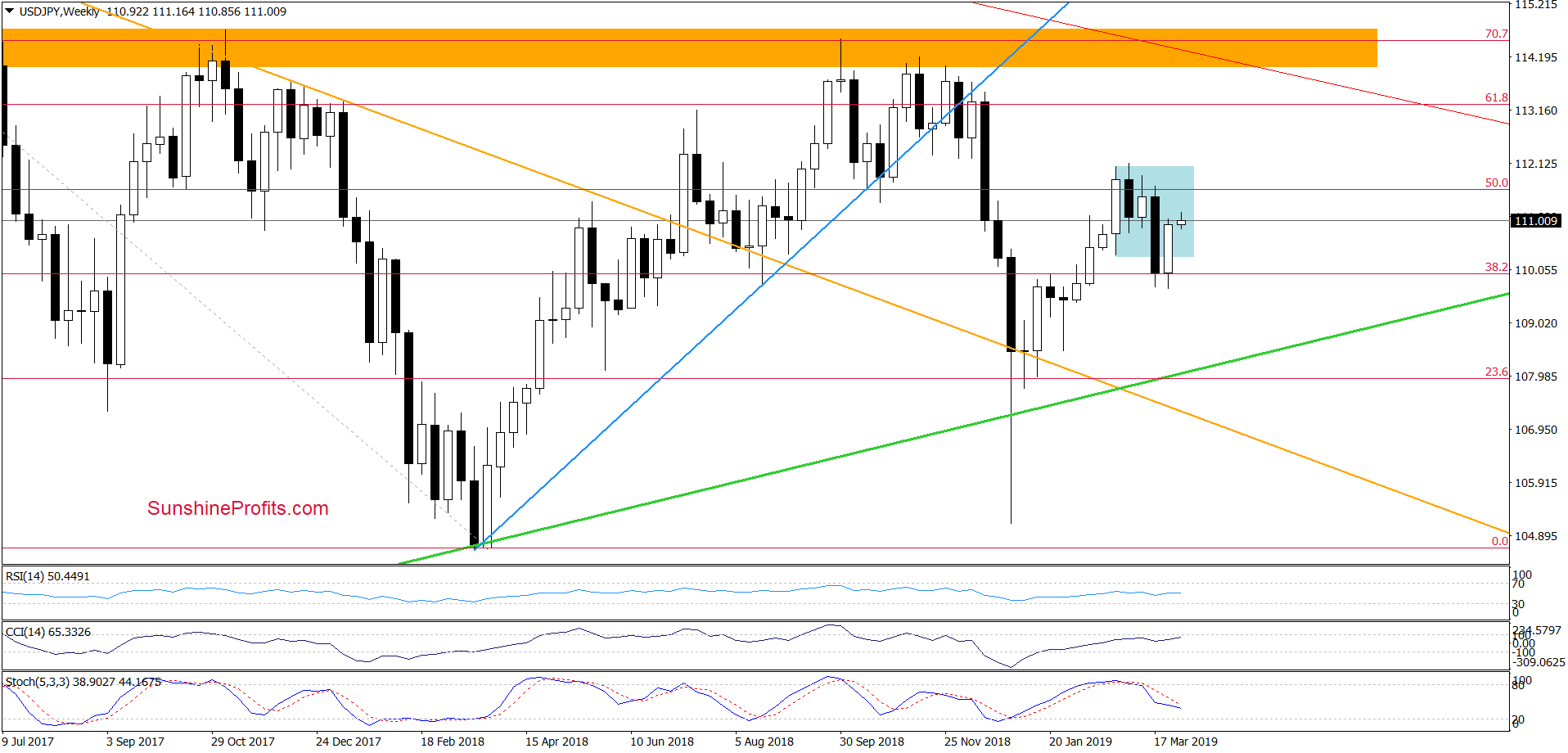

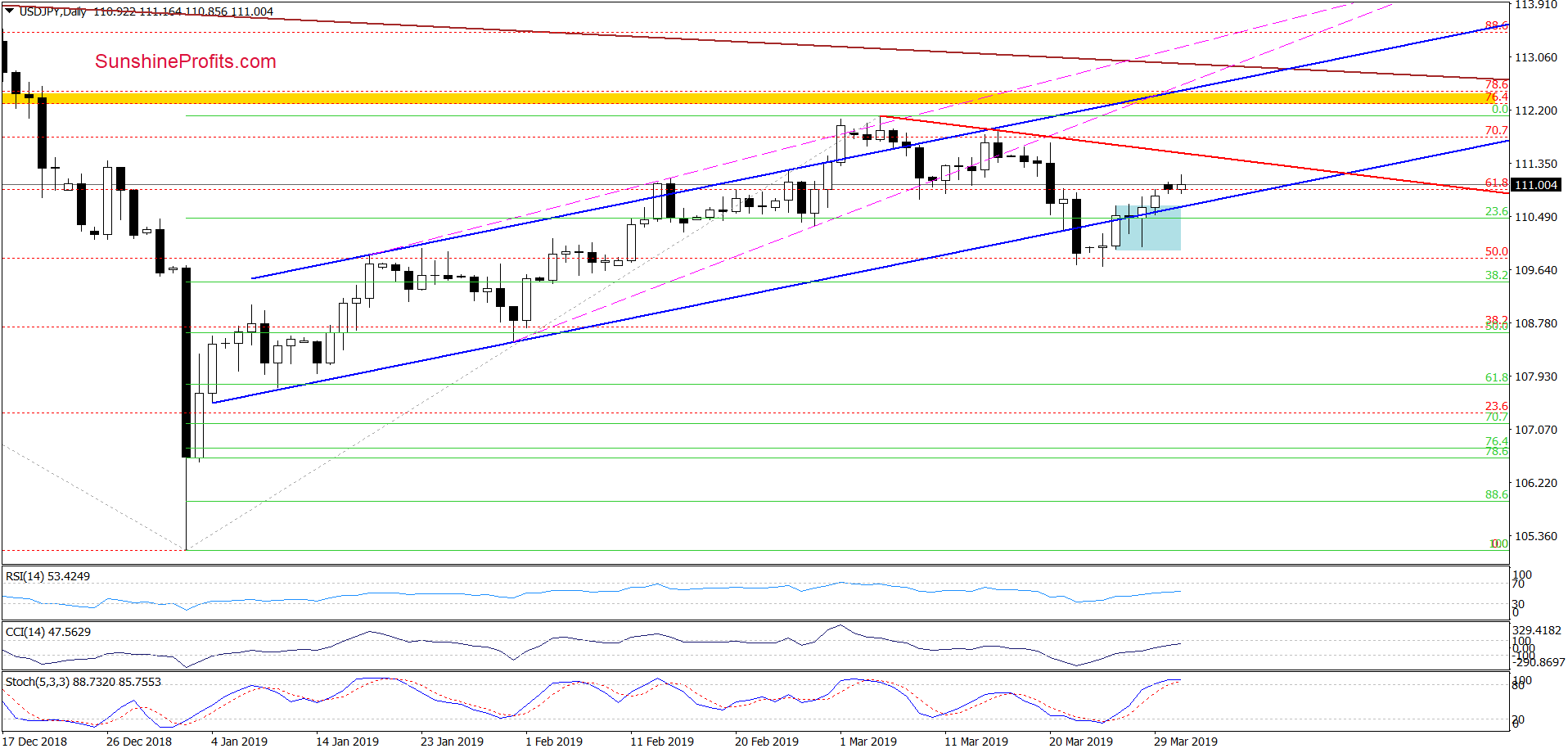

Let’s start again with the weekly perspective. Last week, USD/JPY rose and came back into the blue consolidation. This means an invalidation of the earlier breakdown below the lower line of the formation, which is a positive sign for the bulls.

On the daily chart, the pair invalidated a small breakdown below the lower border of the blue rising trend channel. Coupled with the lack of sell signals by the daily indicators, it suggests that USD/JPY will likely extend gains from current levels and test the red declining resistance line based on previous highs in the coming week. Even a test of the early March peaks as marked by the uppermost horizontal green line is not out of the question.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

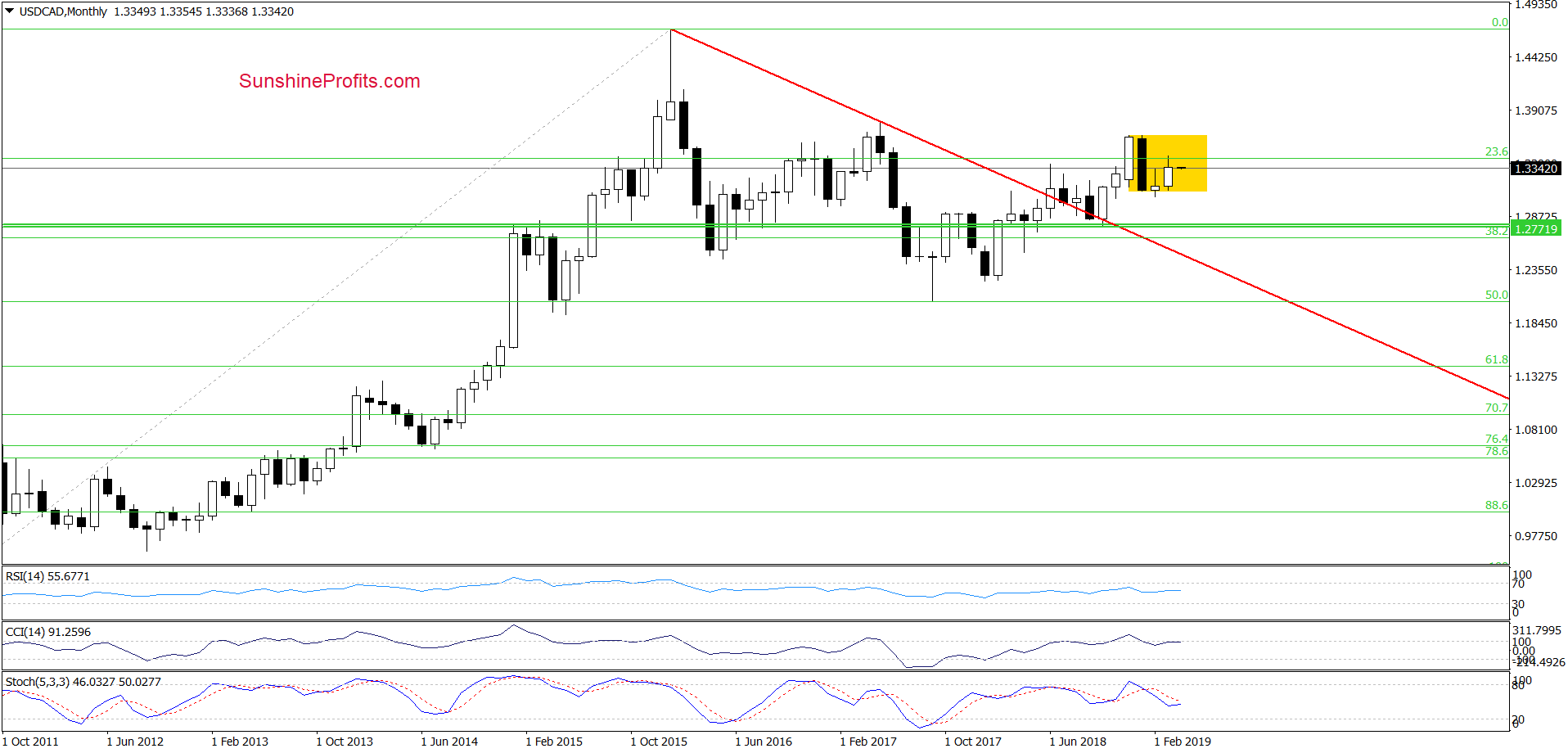

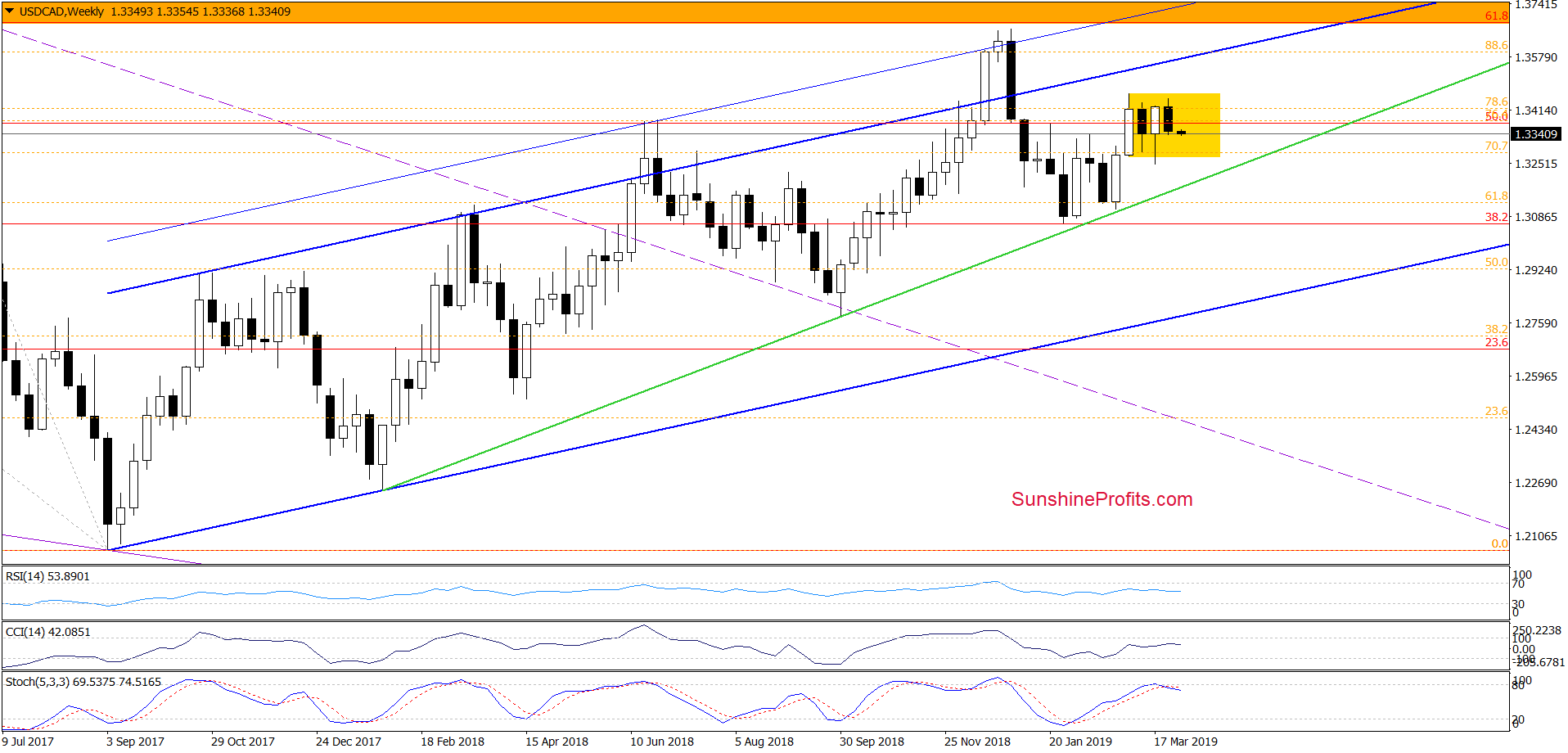

Both on the monthly and weekly chart, we see that USD/CAD is trading in a narrow range. It means that as long as there is no breakout above the upper border or a breakdown below the lower border of the yellow consolidation, another bigger and lasting move is not likely to be seen.

Examination of the position of the both the monthly and weekly indicators however suggests that lower values of the exchange rate are more probable. Does the short-term concur?

Before we answer this question, let’s recall the quote from our last commentary on this currency pair:

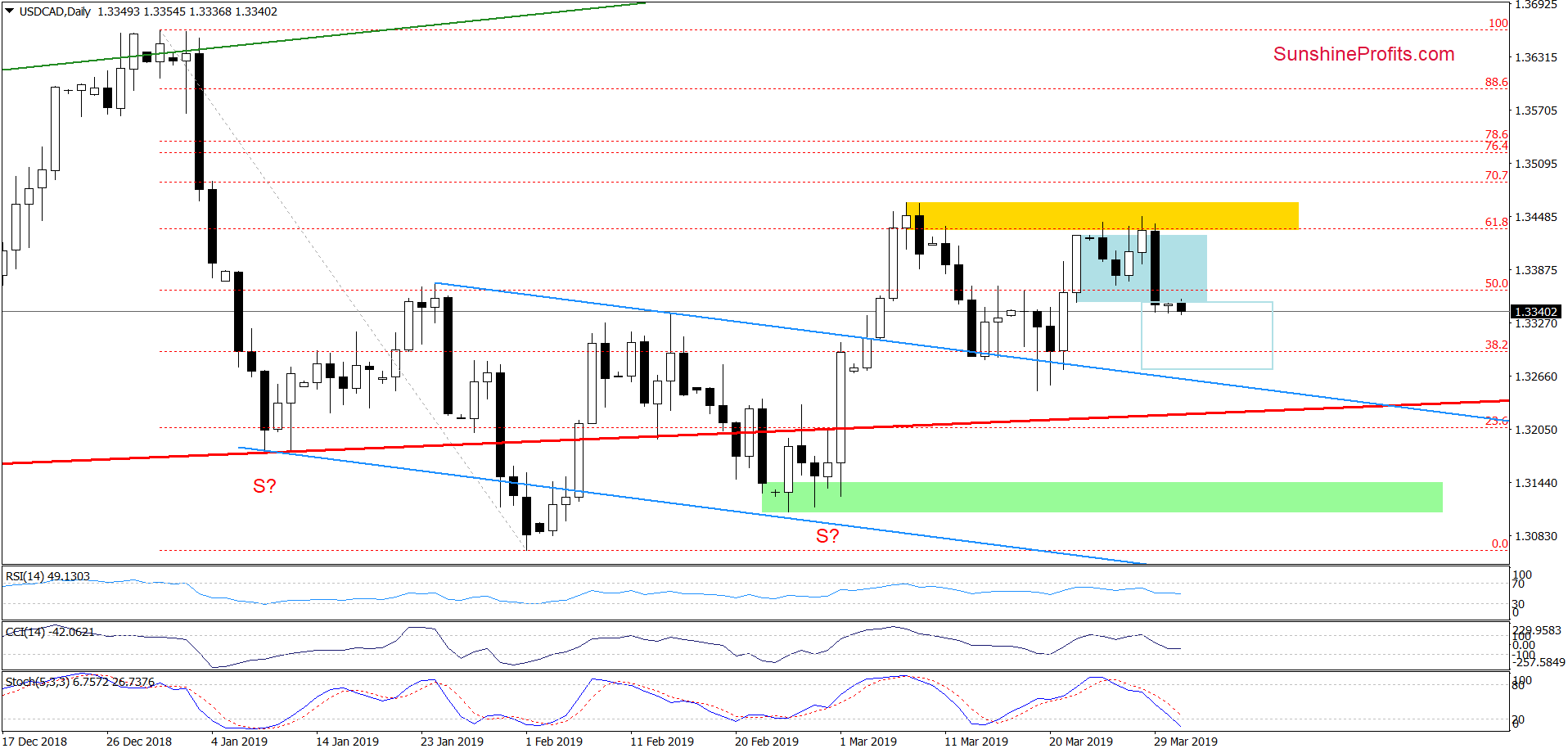

(..) the yellow resistance zone (created by the above-mentioned Fibonacci retracement and the early-March peaks) continues to keep further increases in check. Today’s attempt to go north has mostly failed so far and the pair has come back into the blue consolidation.

Additionally, the sell signals generated by the CCI and the Stochastic Oscillator remain on the cards, increasing the likelihood of another reversal potentially just around the corner. And such a reversal may very well be bigger than the one experienced at the start of the week.

Therefore, taking into account bulls’ weakness in recent days and the position of the indicators, we decided to close our long positions and to sensibly take profits off the table...

The cautious approach was warranted as the situation developed in tune with our assumptions. USD/CAD plunged on Friday and the pair slipped below the lower border of the blue consolidation to close the week below it. This is a bearish development.

Earlier today, the sellers took the exchange rate even lower. Taken together with the sell signals generated by the daily indicators, it increases the probability of further deterioration in the coming days.

If this is indeed the case and USD/CAD declines from current levels, we’ll likely see a drop to around 1.3275. There, the size of the downward move would correspond to the height of the preceding consolidation. However, if this area is broken, the sellers could also retest the strength of the previously-broken upper border of the blue declining trend channel.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist