After the ECB monetary decisions and insight into the Fed thinking, the dust is settling. Pointing out in a certain direction. And that favors a pretty fast reaction on our part. Without further ado, let's share with you the sensible insights and a fitting response.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none (we decided to close positions and take profits off the table)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

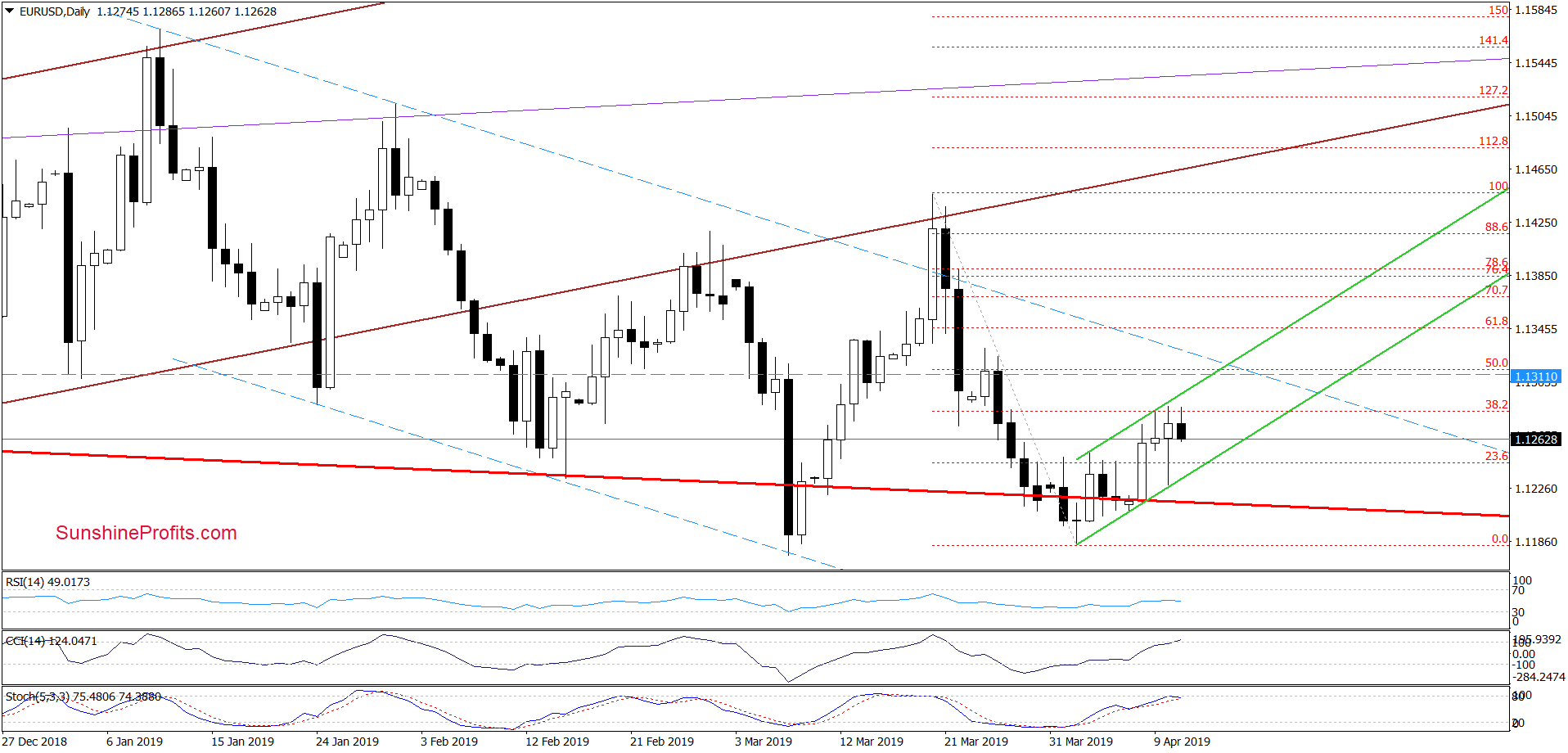

EUR/USD

EUR/USD had quite an eventful session yesterday. After touching the lower border of the green rising trend channel, the pair has bounced higher but the bulls didn't close the day near the daily highs. They haven't made it even above the 38.2% Fibonacci retracement.

Earlier today, their attempt to move higher fizzled out. It increases the odds of another decline. Looking at the current position of the daily indicators, this move could actually be bigger than yesterday's downswing. Therefore it's our opinion that closing long positions and taking profits off the table is justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

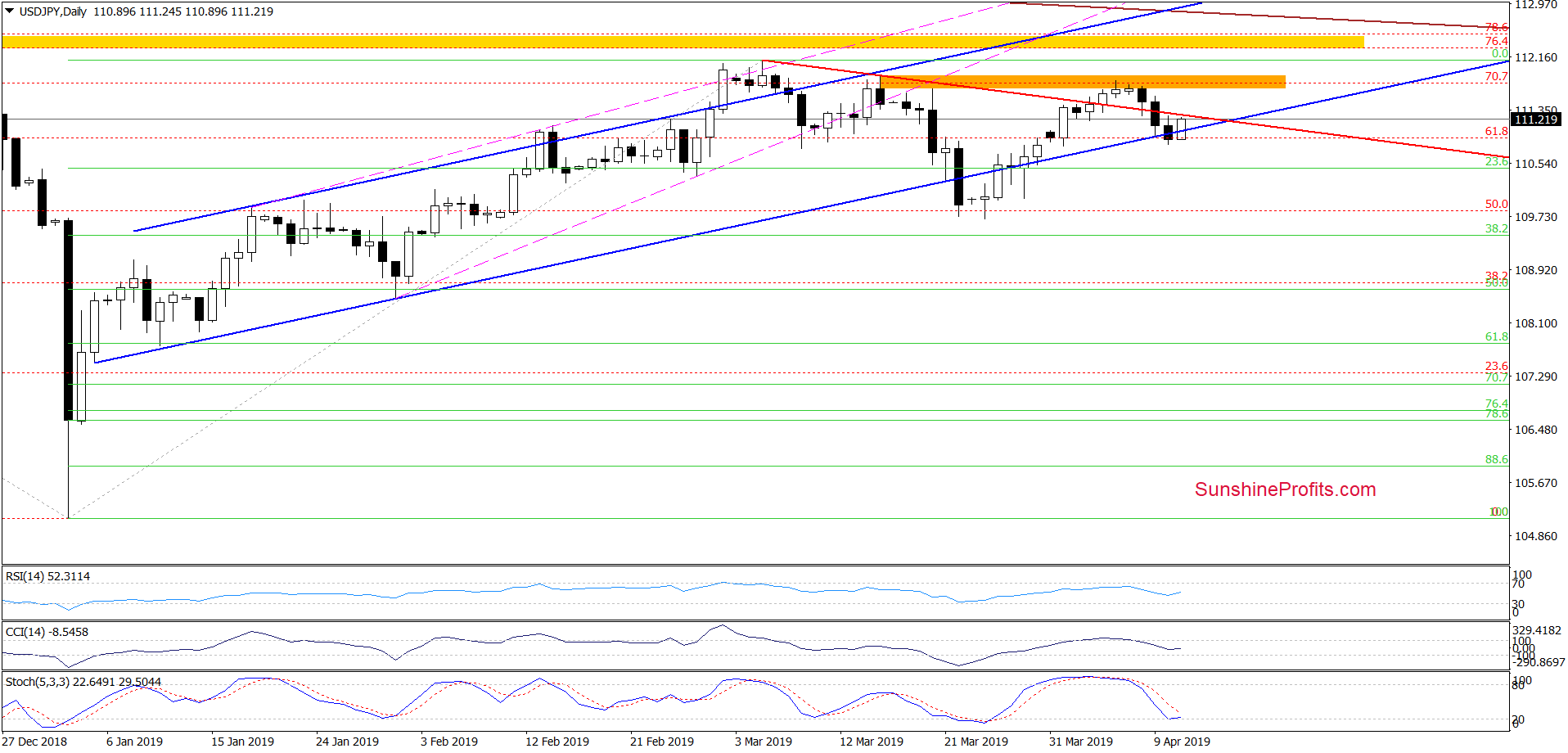

USD/JPY

Although USD/JPY closed yesterday's session below the lower border of the rising blue trend channel, the bulls' response didn't take long. Taking control earlier today, they've pushed the pair back above the lower border. This invalidated the earlier breakdown below the rising blue trend channel.

This is a bullish development and suggests further improvement. However, such price action will be more credible only if the exchange rate breaks above the red declining resistance line on a closing basis first. If that happens, the next target for the bulls would be the orange resistance zone, which stopped the buyers in the previous week

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

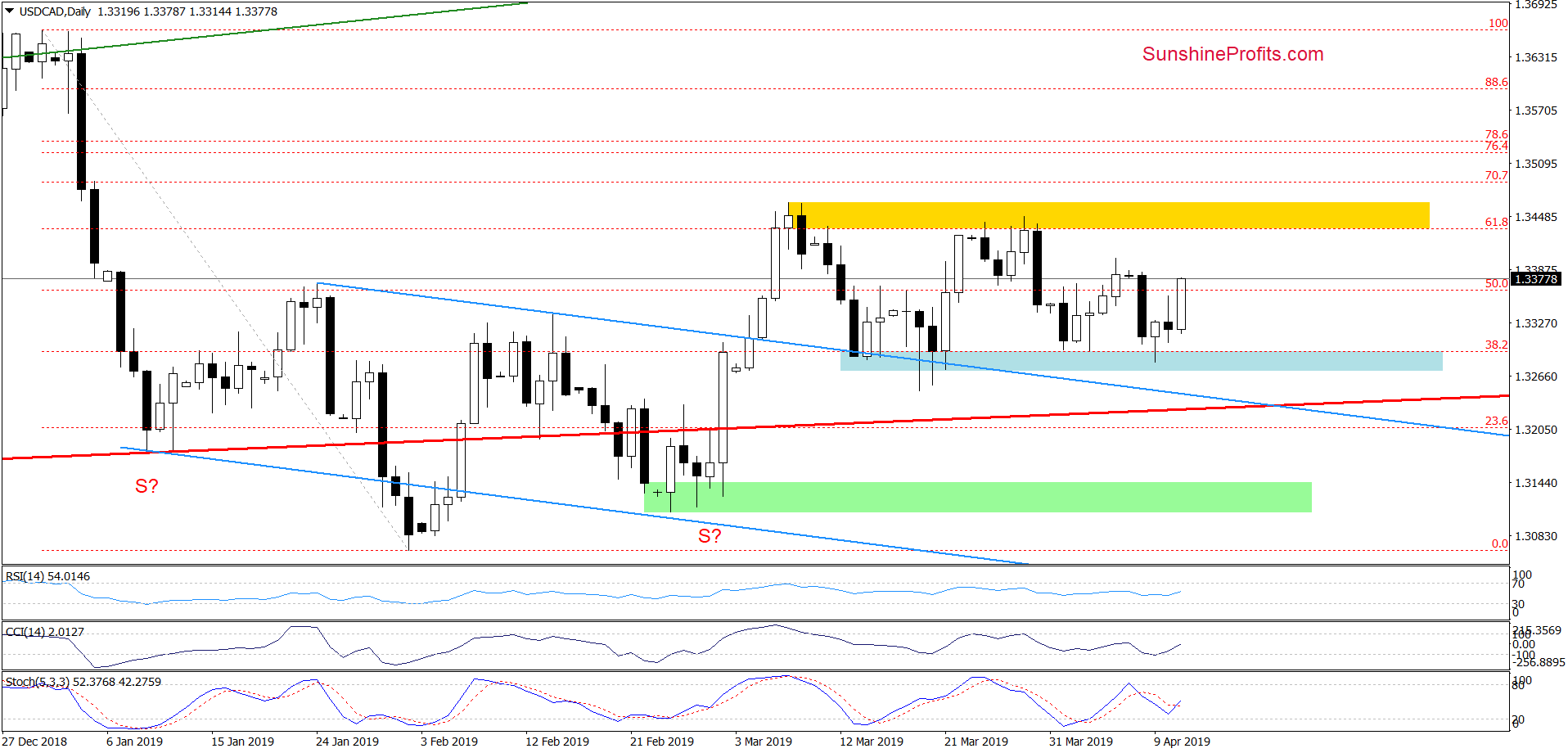

USD/CAD

USD/CAD bounced off the blue support zone once again. CCI and the Stochastic Oscillator generated their buy signals, which suggests that we'll see a test of the yellow resistance zone in the coming day(s).

As long as there is no breakout above it, higher values of the exchange rate are not likely to be seen. Continuation of short-lived moves in both directions wouldn't surprise us in the least.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, closing the long euro position is the sensible thing to do right now. Both the charts and capital accumulation point of view favor that. There're no opportunities worth acting on in the other currency pairs right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist