The euro has eventually reversed higher yesterday, yet the upswing is being met with renewed selling pressure earlier today. How does such a balance of forces and the immediate outlook influence our open position? An equivalent question also goes to the Australian dollar. So, what trading decisions have we actually just made?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1324; the exit downside target at 1.1219)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7113; the next downside target at 0.6935) ; the downside target at 0.6925)

EUR/USD

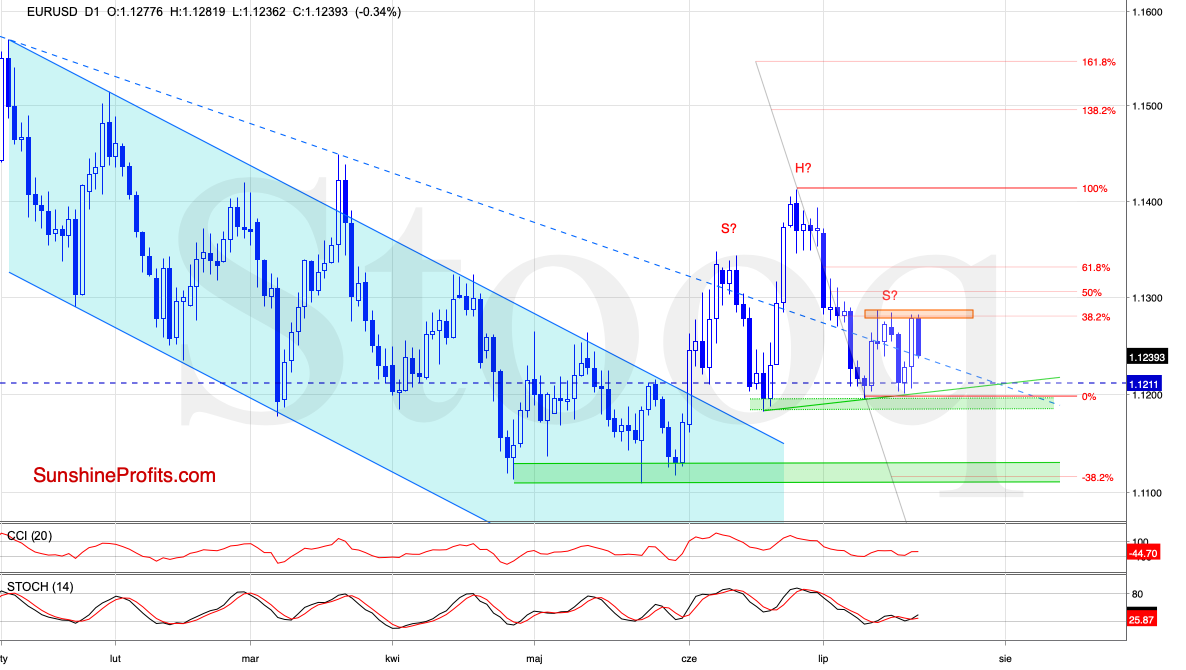

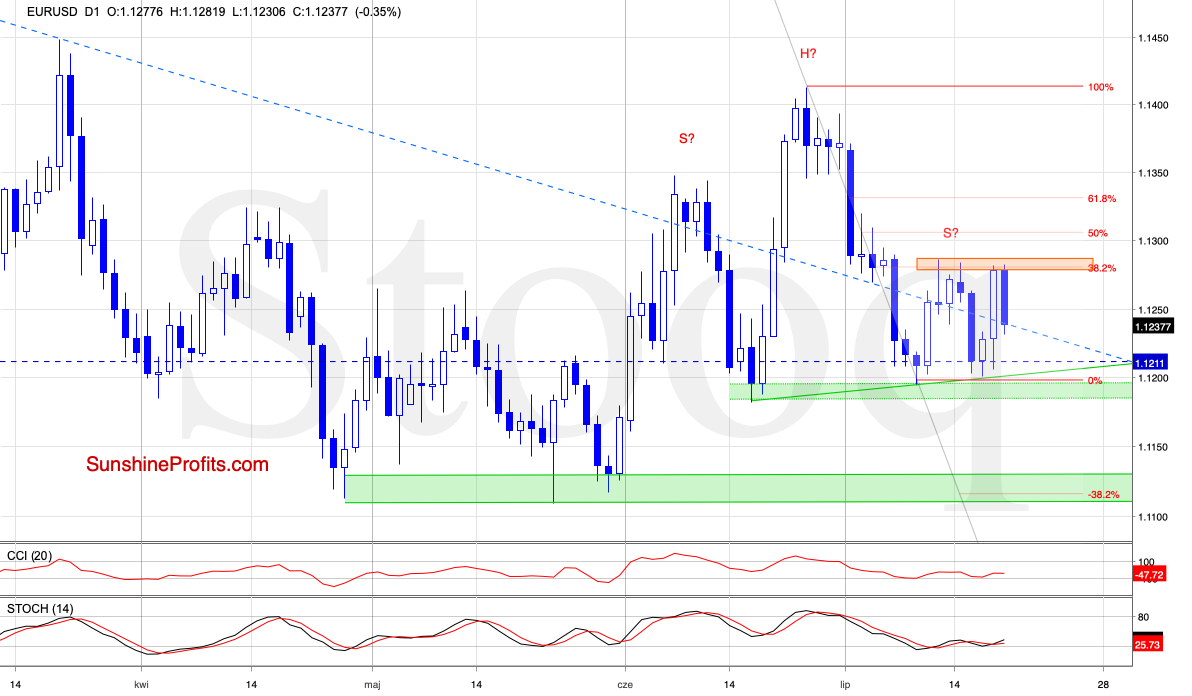

Both the above daily charts of EUR/USD show it has bounced off the green support line. The bulls followed up and took the pair to its major very short-term resistance zone created by the previous peaks and the 38.2% Fibonacci retracement.

Earlier today, this zone stopped the buyers, triggering a sharp move to the downside. The pair has erased much of its yesterday's rebound, suggesting that we'll likely see a retest of the recent lows and the green support line.

Nevertheless, a bigger move south will be more likely and reliable only if we see a breakdown below the first two supports. Therefore, closing short positions and taking profits off the table if the pair drops to our exit target is a sound investment idea from the risk-reward point of view.

However, should we see the buyers' weakness and the above-mentioned breakdown below both supports, we'll consider re-opening short positions.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1324 and the exit downside target at 1.1219 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

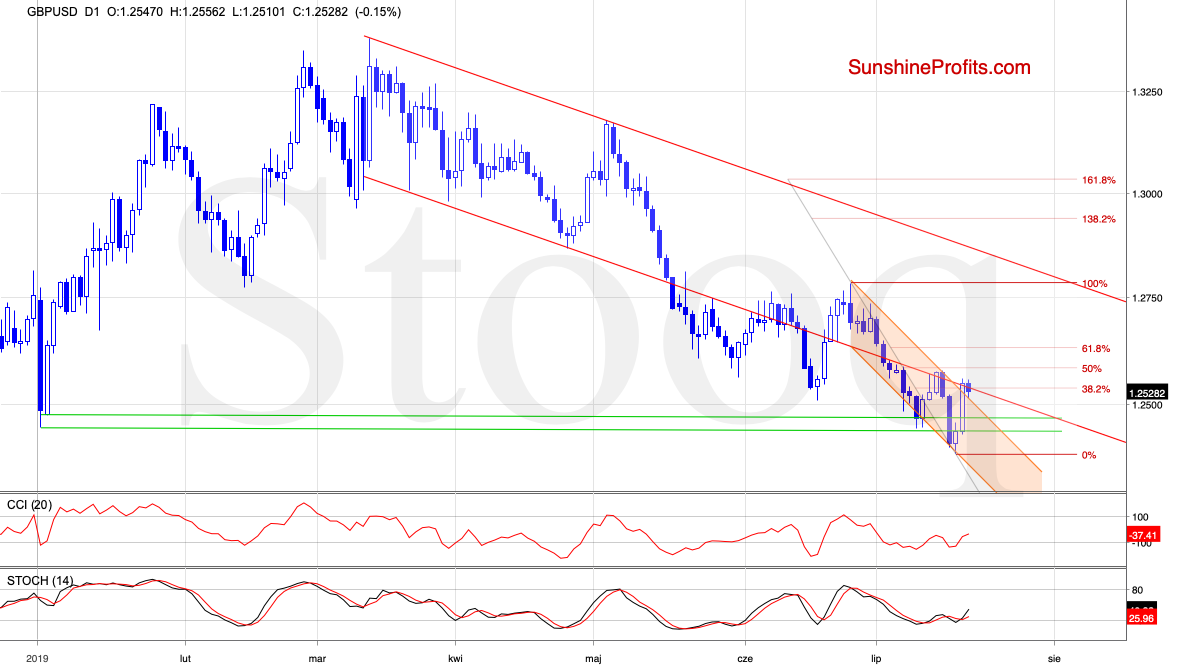

On Tuesday, GBP/USD hit a fresh low on a closing basis, and broke not only below the early-July lows, bit also below the green support zone based on the early-2019 lows. Despite this bearish development, the bulls reversed the exchange rate's course and took the pair higher. This way, the earlier breakdowns below these supports have been invalidated.

The bulls pushed the cable even higher yesterday, testing the previously-broken lower border of the declining red trend channel. Although this is a positive development for the buyers, we have already seen similar price action earlier this month, and the way it resolved to the downside.

Back then, the bulls didn't manage to hold gained ground, and another decline followed. Should the bulls be unable to close the day above this declining lower border, the probability of another bearish resolution increases. The pair would then likely retest the area of both green horizontal support lines, or even visit this week's lows.

Trading position (short-term; our opinion): No positions with are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

AUD/USD moved sharply higher during yesterday's session, and closed the day above both the orange resistance zone and the red rising resistance line that is based on the previous peaks. Despite this improvement, the sellers took the pair lower earlier today, invalidating yesterday's breakouts on an intraday basis.

The daily indicators have reached their overbought readings. The CCI is very overbought, and the Stochastic Oscillator appears ready to flash its sell signal very soon.

Taking both the strength of the bearish turn of events, and the position of the daily indicators into account, reopening the short position is justified from the risk/reward perspective. We're saying reopening the short position because the waiting order might have been narrowly hit yesterday - depending on the data provider. Bottom line, AUD/USD still appears likely to test this week's lows as a minimum in the very near future.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.7113 and the next downside target at 0.6935 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, yesterday's EUR/USD upswing gave way to another move lower earlier today. As the pair is approaching short-term supports that did hold recently, taking the profits off the table should our exit downside target be hit is a justified decision from the risk-reward perspective. AUD/USD upswing appears to be reversing lower, and both the invalidation of recent breakouts and the position of the daily indicators support a downside move. Therefore, reopening the short position is justified. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist