Euro bulls are facing formidable obstacles ahead. How strong will they be in overcoming them? With the Japanese yen however, the bears look set to take the reins seriously, having cleared an important obstacle to do so. Which one and how far across the currencies universe could such action spill? Are the Canadian dollar bulls safe, many of you are interested to know. Enough speaking in riddles, it’s time for a clear-cut analysis instead.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 112.32; the initial downside target at 109.82)

- USD/CAD:long (a stop-loss order at 1.3247; the initial upside target at 1.3530)

- USD/CHF: none

- AUD/USD: none

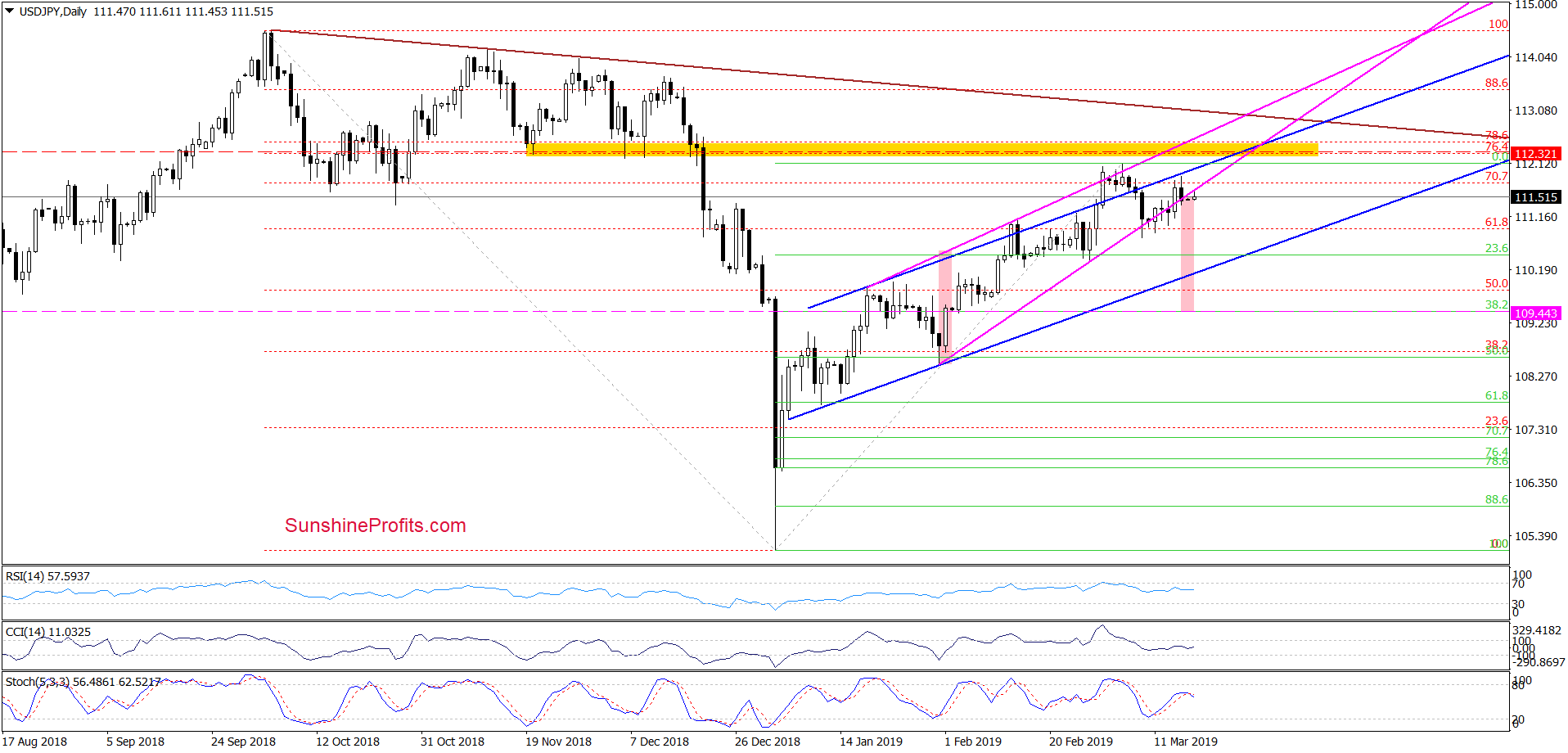

EUR/USD

After not overcoming the upper line of the blue consolidation on Friday, EUR/USD broke above it earlier today to trade at around 1.1355 at the moment of writing these words. It suggests that we’ll see a test of the orange declining resistance line or even the strong resistance area marked with the red ellipse in the coming days. Why do we say a strong resistance area? It’s because it was created by the 76.4%, 78.6% Fibonacci retracements based on the March downward move and the 50% Fibonacci retracement based on the entire January-March declines.

The CCI approached its overbought area and there is a bearish divergence between the indicator and the exchange rate. Also on the horizon, the Stochastic Oscillator flattened as it climbed above 80, which suggests that the space for further increases may be limited and reversal later this week should not surprise us in the least.

Should we see currency bulls hesitating and weak in the above mentioned strong resistance area, we’ll consider reopening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

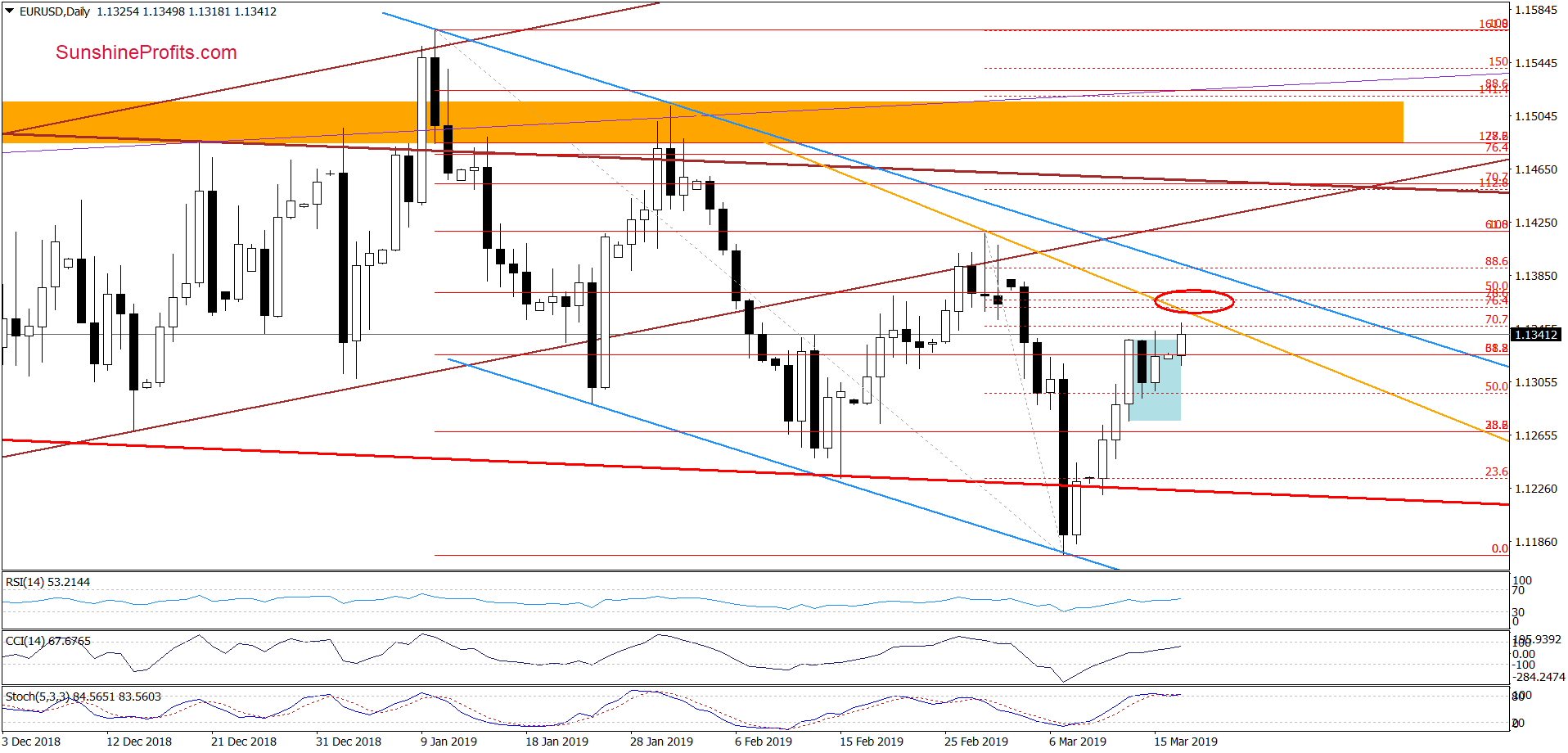

USD/JPY

We wrote the following on Thursday:

(…) USD/JPY moved higher earlier today and climbed back above the previously broken lower border of the pink rising wedge, invalidating yesterday’s breakdown. The bulls are fighting hard to keep the price action still inside the pink rising wedge.

Nevertheless, as long as the pair remains below the upper border of the formation, the recent peaks and the yellow resistance zone, another attempt to move lower is still likely and the short position justified by the risk-reward ratio.

On Friday, the upper line of the blue rising trend channel encouraged the sellers to act. The pair reversed lower, slipped slightly below the pink rising wedge line and closed the day below it. Earlier today, the bulls tried to push the exchange rate higher, but look to have failed after touching the lower border of the pink rising wedge, which suggests that today’s upswing probably is just a verification of Friday’s breakdown below it.

If this is indeed the case, the pair looks bound to extend losses from here and we’re likely to see a test of the lower border of the blue rising trend channel, or even a drop to the 38.2% Fibonacci retracement based on the entire January-March upward move (a drop to around 109.44). The latter move would correspond to what would be the price target based on the size of the wedge as marked by two vertical pink rectangles for your convenience.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 112.32 and the initial downside target at 109.82 are justified from the risk/reward perspective.

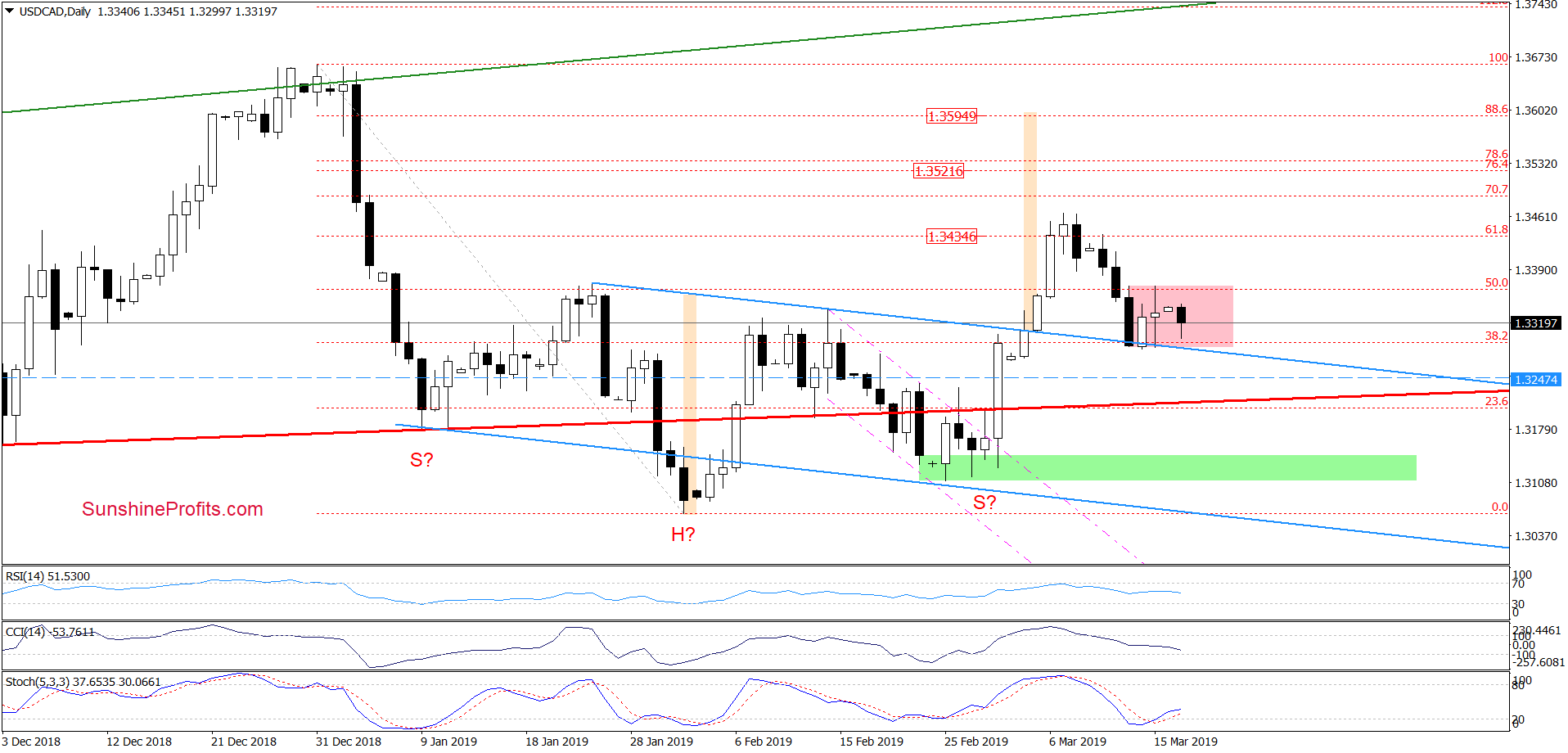

USD/CAD

On Thursday, USD/CAD bounced off the upper border of the blue declining trend channel. It surely looks like a verification of the breakout above the blue declining trend channel. Friday didn’t bring any convincing moves up or down and earlier today, the pair has slightly declined so far.

However, the overall situation remains almost unchanged as the exchange rate is still trading inside the pink consolidation between Wednesday’s high and low. This makes the very short-term picture a bit unclear, so we have to look for clues elsewhere.

The buy signal generated by the Stochastic Oscillator suggests that another attempt to move higher may be just around the corner. If the pair breaks above the upper line of the pink consolidation, the way higher and targeting March peaks looks to be then open.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.3247 and the initial upside target at 1.3530 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist