What a busy week. We've had Iran tensions running high and China has also added its two cents to the toughening trade atmosphere. The king dollar tends to do well in such an environment. Indeed, the euro bears have broken through support like a hot knife through butter and the momentum looks to be building. Do they have sufficient power to add to the euro's bearish outlook even more? Which target areas are they looking at? What about the other pairs?

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a new stop-loss order at 1.1229; the initial downside target at 1.1147)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3545; the initial downside target at 1.3363)

- USD/CHF: none

- AUD/USD: none

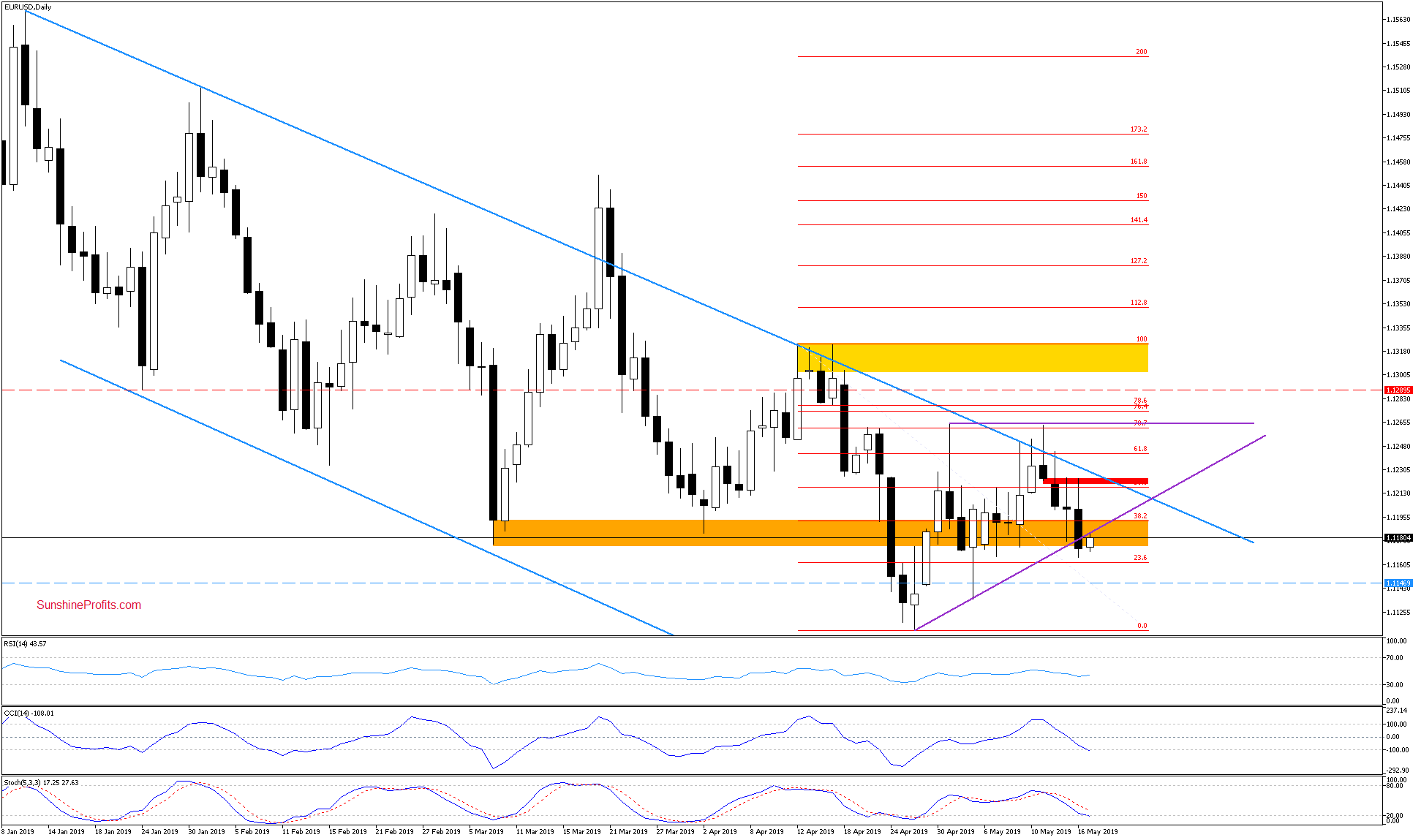

EUR/USD

Early in yesterday's session, the bulls took EUR/USD higher, right to the red gap. This nearest resistance had predictably stopped them and a downward price reversal followed. It took EUR/USD just below the rising purple support line. The pair has closed the day below it, which is a bearish development.

Earlier today, we have seen a modest attempt to retrace some of yesterday's losses. It had fizzled out already and the pair changes hands at around 1.1170 as we speak. In conclusion, this certainly looks like a verification of yesterday's breakdown.

Additionally, the sell signals generated by the daily indicators remain on the cards. This also suggests that another move down is just around the corner. Should we see such price action, the way to our initial downside target would be open.

Let´s take a look at the weekly chart now. It´s notable that EUR/USD slipped below the previously-broken lower border of the red declining trend channel. Should the pair close today's session anywhere below 1.1180 (as shown on the chart below), we'll see an invalidation of the last week's breakout above this support. This would strengthen the bearish case further.

Trading position (short-term; our opinion): Profitable short positions with a new stop-loss order at 1.1229 (reflecting the outlook, it serves to secure the position) and the initial downside target at 1.1147 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

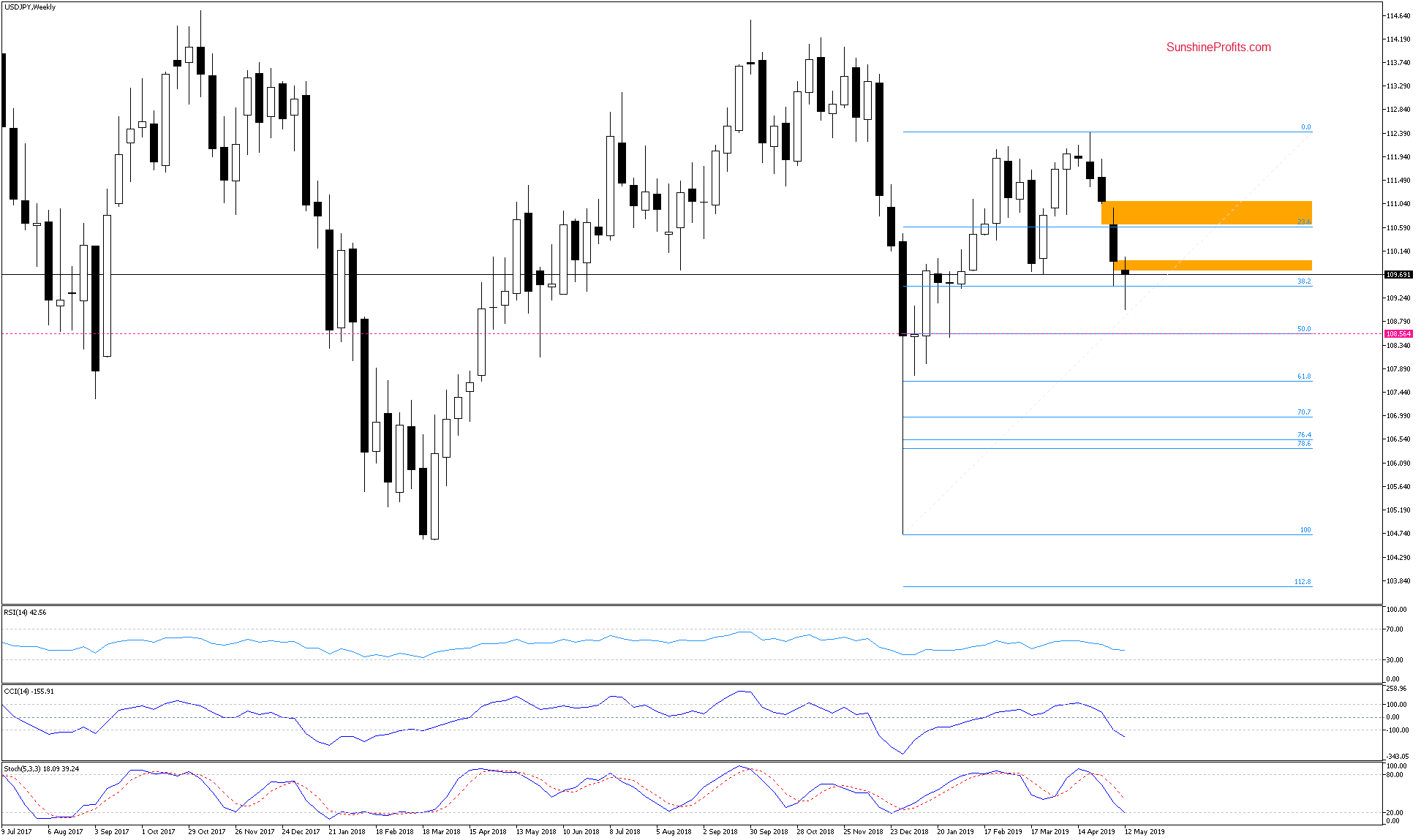

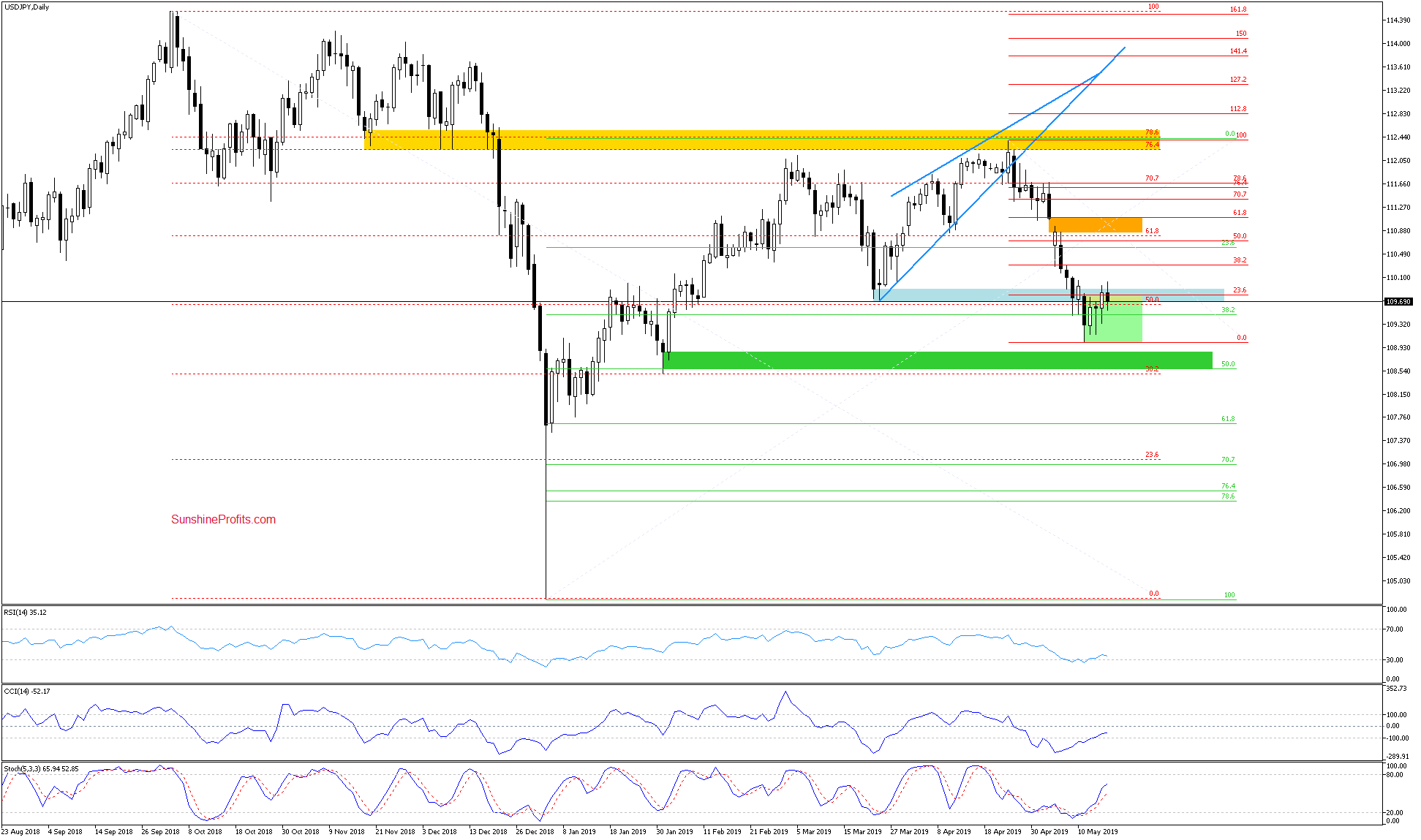

USD/JPY

Let's start with the weekly perspective. The lower orange gap remains open and the sell signals by the weekly indicators remain in place. It suggests that as long as this week doesn't bring a close higher than last week (that is, above 109.95), lower values of USD/JPY remain probable.

The daily perspective reveals that the bulls took the rate above the upper border of the green consolidation and the previously-broken late-March lows yesterday. This bullish event encouraged the sellers to act earlier today and the pair trades at around 109.65 currently.

Should we see today's session close inside the consolidation and the pair invalidating yesterday's breakout, the way to the lower border of the formation could be open.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

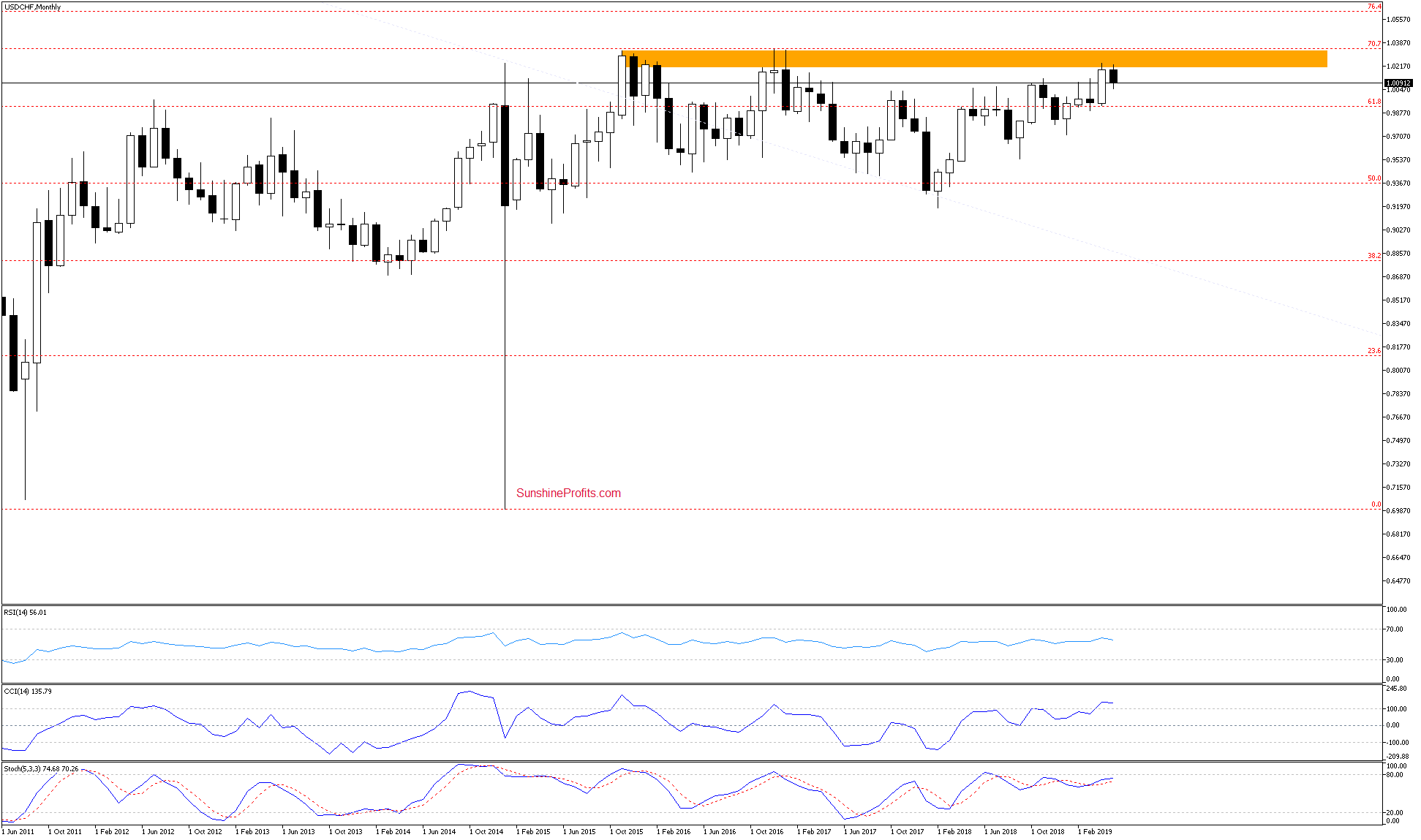

USD/CHF

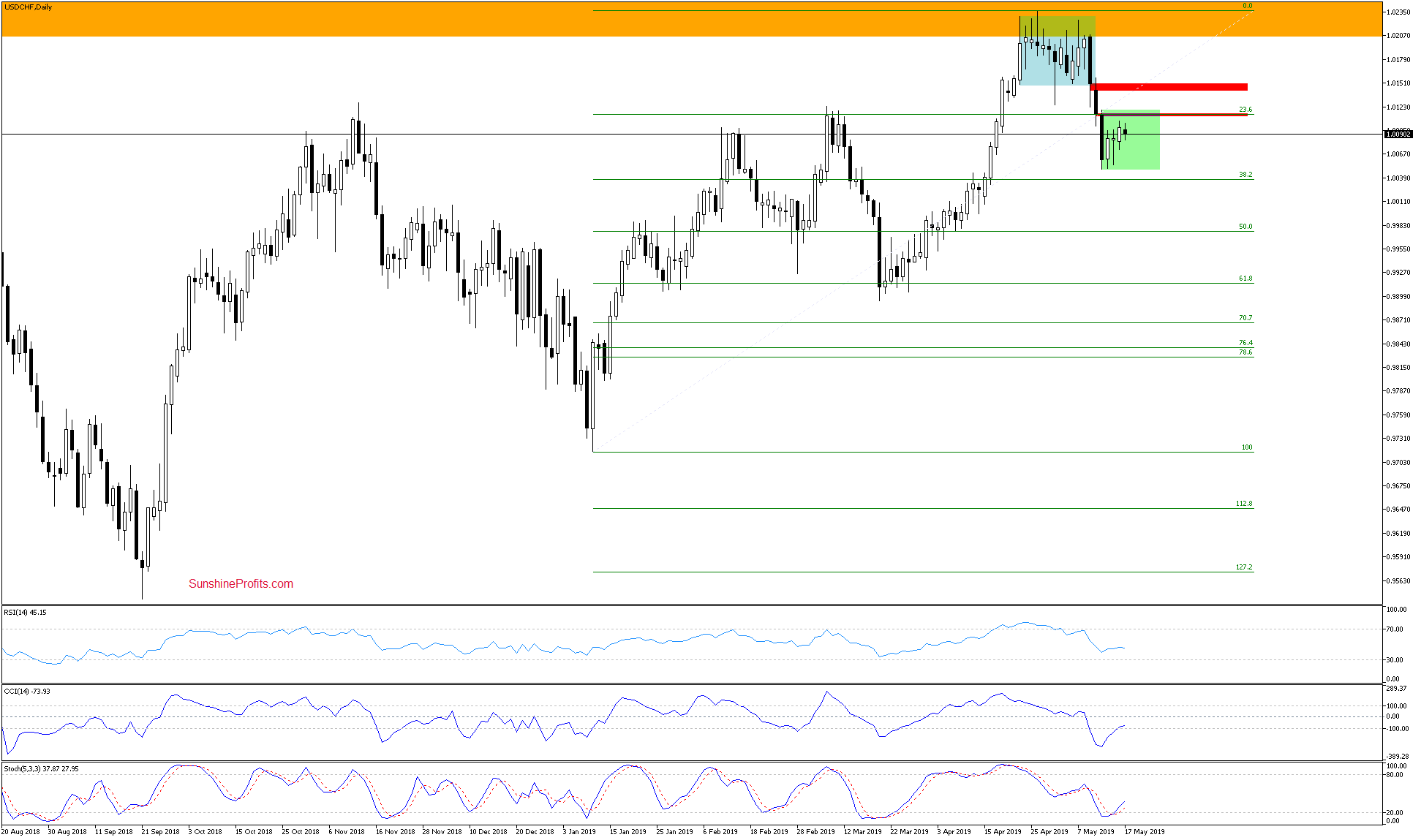

We'll start again with the long-term chart. This time, it'll be the monthly chart. It's apparent that the major long-term orange resistance zone continues to keep gains in check.

USD/CHF bounced off this week's lows and temporarily rose to above 1.0100. However, the proximity to the upper line of the green consolidation (created by the Monday's peak) and the lower red gap (overlaying the 23.6% Fibonacci retracement) encouraged the bears to act earlier today.

While the buy signals generated by the daily indicators suggest further improvement, we think that as long as there is no daily close above the mentioned gap, another move to the downside remains likely. How low could the pair go?

If USD/CHF extends losses from here, we could see a drop to the lower border of the green consolidation that marks recent lows. Even a test of the 38.2% Fibonacci retracement isn't out of the question in the coming week.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the euro bulls' response has indeed stalled and the bearish momentum is increasing. Our short position remains profitable and justified. Despite the USD/CAD upswing, our profitable short position remains justified. It's due to the strong combination of resistances ahead that the bulls have been having trouble overcoming recently. AUD/USD bulls haven't shown any strength yesterday or earlier today, which means that a long position isn't justified. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist