In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0954; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the exit target at 1.3019)

- USD/JPY: short (a stop-loss order at 110.03; the initial downside target at 107.14)

- USD/CAD: none (in other words, our exit target was reached and the earlier long positions were profitably closed)

- USD/CHF: short (a stop-loss order at 1.0001; the initial downside target at 0.9849)

- AUD/USD: none

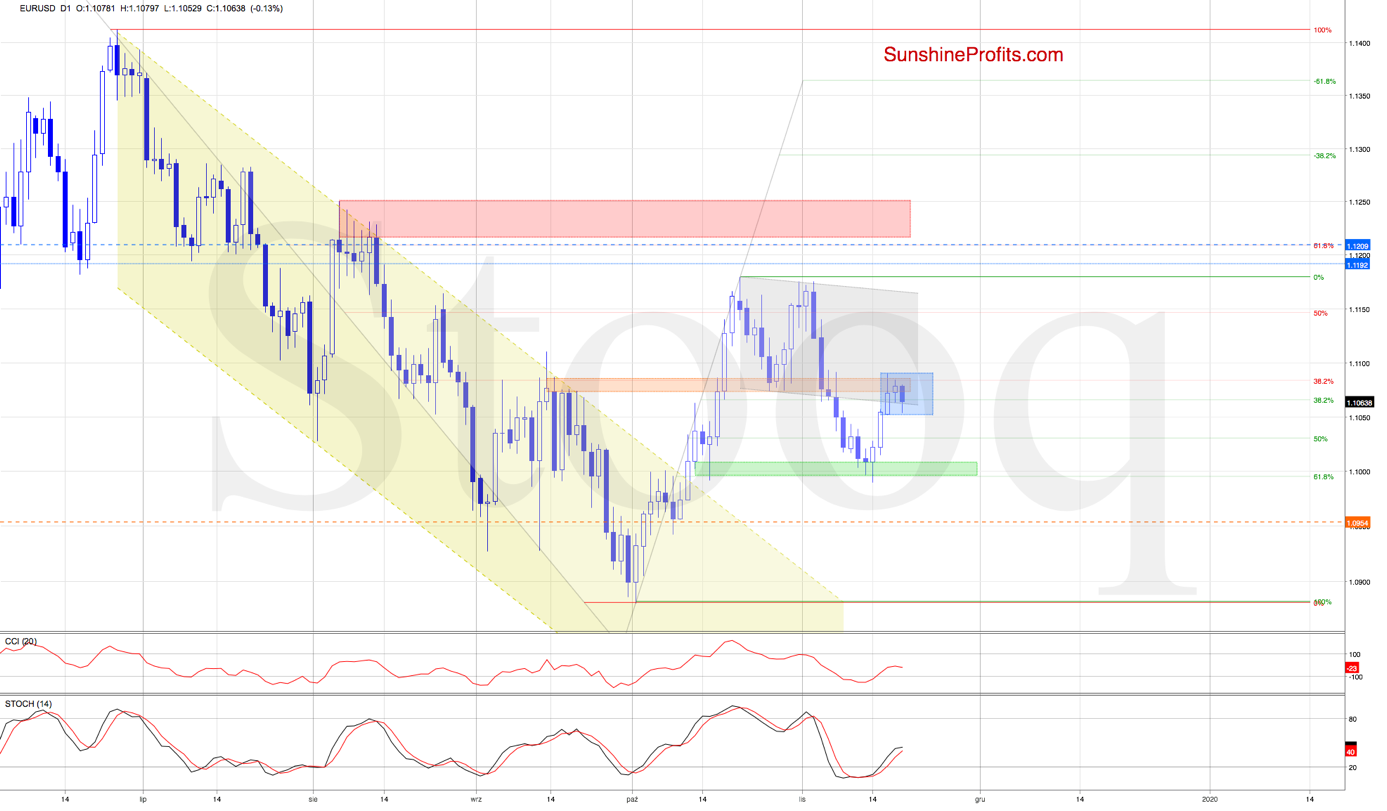

EUR/USD

EUR/USD pulled back a bit earlier today, but the lower border of the very short-term blue consolidation withstood the selling pressure and the pair rebounded.

The daily indicators' buy signals remain on the cards, and they support further improvement in the very near future.

Should the bulls move higher from current levels and break above the Nov 6 and Nov 7 peaks, the way to the upper border of the grey trend channel (or even the recent peaks) may be open.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0954 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

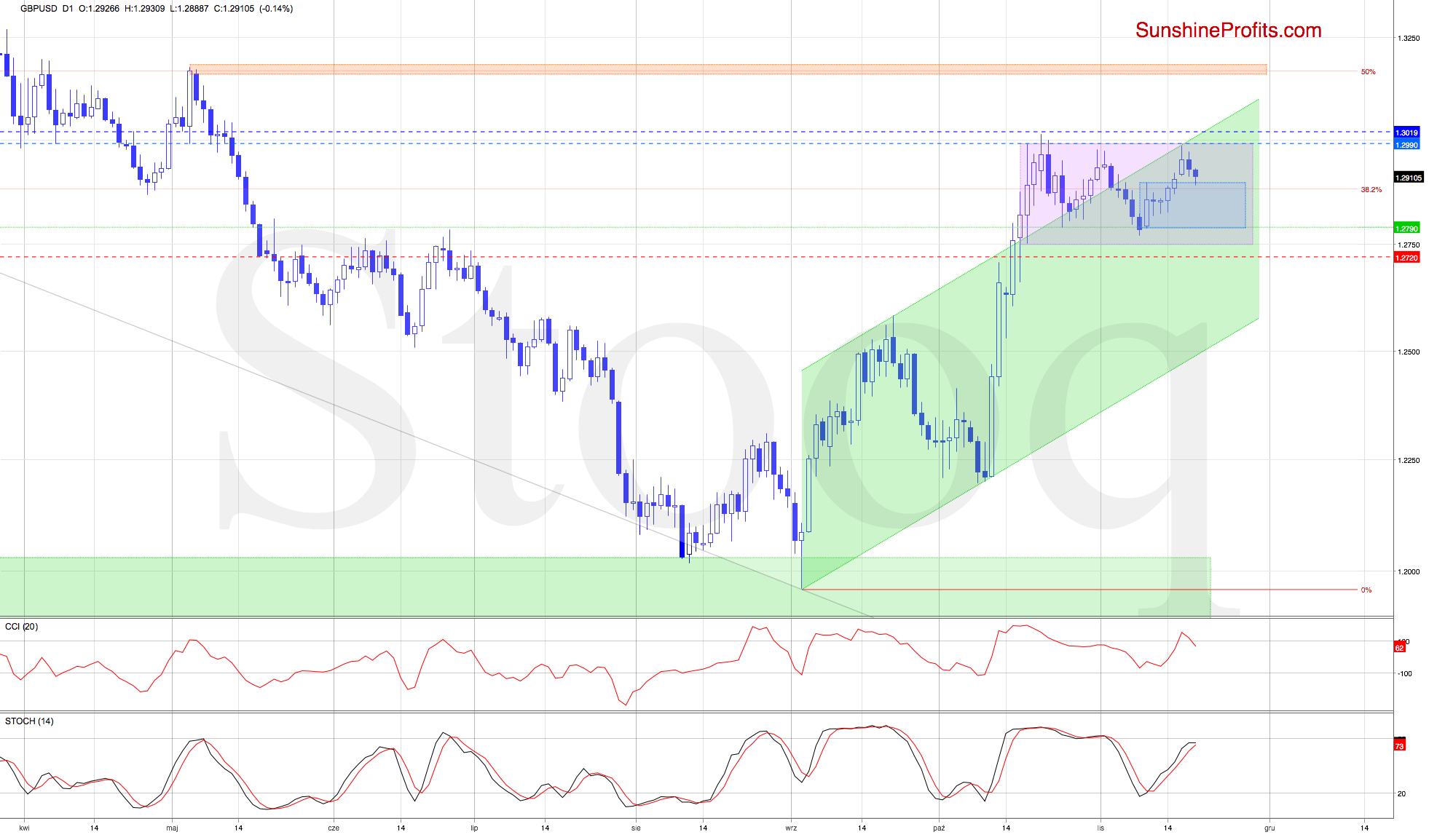

GBP/USD

GBP/USD approached both the upper border of the purple consolidation and the upper border of the green rising trend channel recently. Both resistances encouraged the sellers to act, and the pair pulled back.

It went on to test the previously broken upper border of the very short-term blue consolidation. Such price action appears to be nothing more than verification of the earlier breakout and suggests that another attempt to move higher may be just around the corner. This is especially so when we look at the still open gap created earlier in the week.

As long as the bulls find support there, higher values of GBP/USD remain likely. Should it be the case and the exchange rate moves higher from here, we'll likely see a retest of both the upper border of the purple consolidation and the upper border of the rising green trend channel in the very near future.

Nevertheless, taking into account the deteriorating position of the daily indicators, we decided to place the exit order at 1.3019, in the proximity of the upper border of the rising green trend channel

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.2720 and the exit target at 1.3019 are justified from the risk/reward perspective.

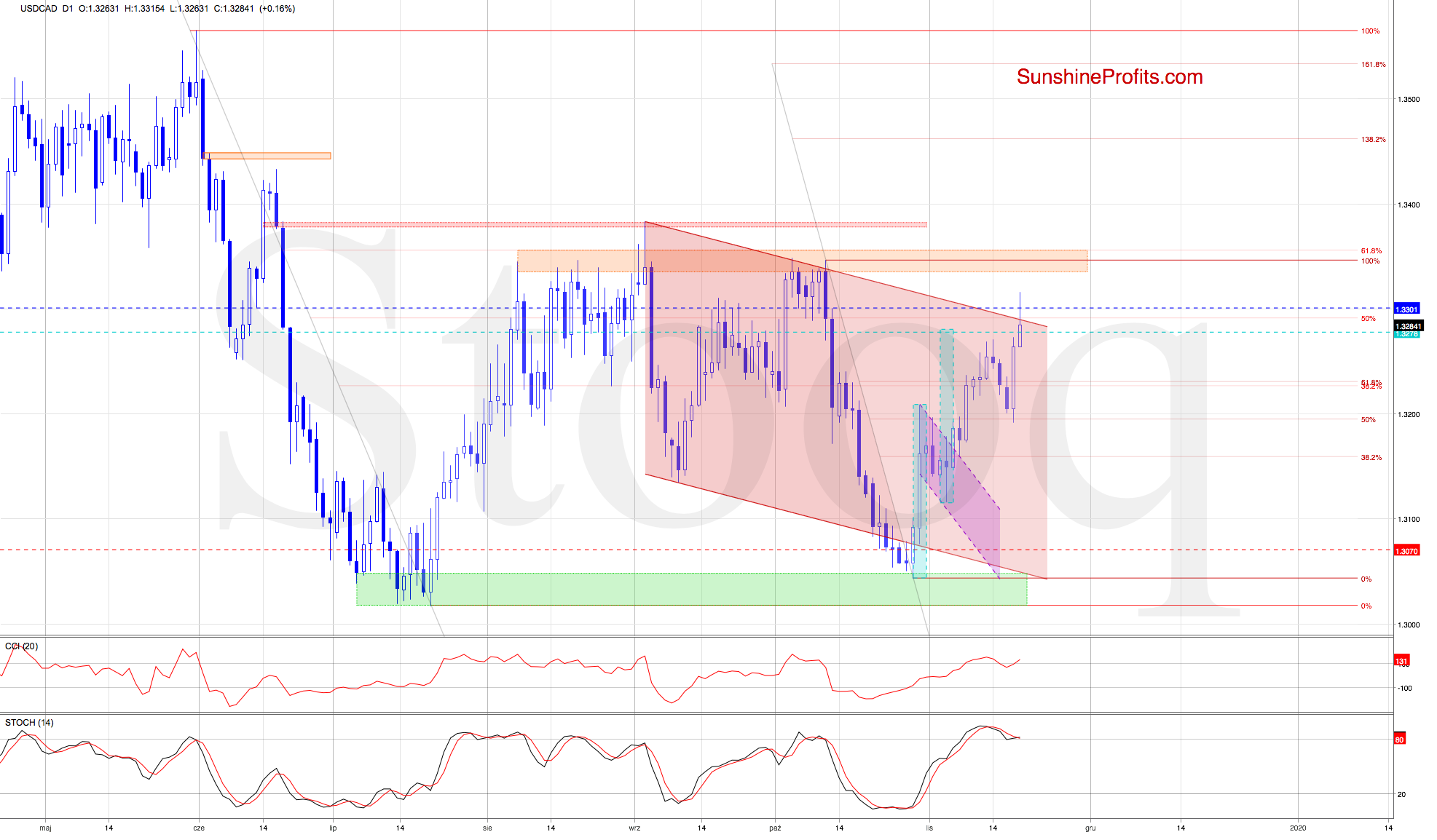

USD/CAD

USD/CAD just shot higher, and the bulls are attempting to add to yesterday's strong gains. Yet it seems they're having trouble keeping today's momentum. Is it merely an intraday consolidation, or will the bears show up shortly?

In our last commentary on this currency pair, we wrote:

(...) When October gave way to November, USD/CAD moved sharply higher, up to the 50% Fibonacci retracement. Then, it pulled back, sliding inside the declining purple trend channel, reversing and continuing even higher. This is what a flag pattern looks like: it's a consolidation within the pre-existing trend. In a flag, prices are reluctant to move much lower, and the correction tends to wear you off rather in time. And patience was exactly what we needed back then in USD/CAD.

Should it be the case and we're again looking at a flag, we'll likely see further improvement and a fresh November peak hit in the coming week.

Take a look slightly above the recent highs. The size of the upward move would correspond there to the height of the mentioned formation (marked with the turquoise rectangles for your convenience).

Connecting the dots, we lowered our upside target a little, and changed it to the exit target to make sure that our long position will be closed with a satisfactory profit without the risk of a sudden reversal when other bulls start cashing their profits.

The cautious approach is also supported by overextended levels of daily indicators. The Stochastic Oscillator even generated its sales signal, which underscores the risk of reversal in the very near future.

The situation developed in tune with the above, and USD/CAD not only reached our exit target to close our long positions with profit, but also managed to break above the upper border of the declining red trend channel.

The bulls however didn't manage to hold gained ground, and the pair pulled back earlier today. Coupling this fact with the current position of the daily indicators, a reversal may be just around the corner. It'll be more likely and reliable only if the pair closes today or one of the following sessions below the upper border of the red channel, invalidating the earlier breakout in terms of daily closing prices.

Should we see such price action, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist