In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.0983; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 109.66; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the initial upside target at 1.3300)

- USD/CHF: none

- AUD/USD: none

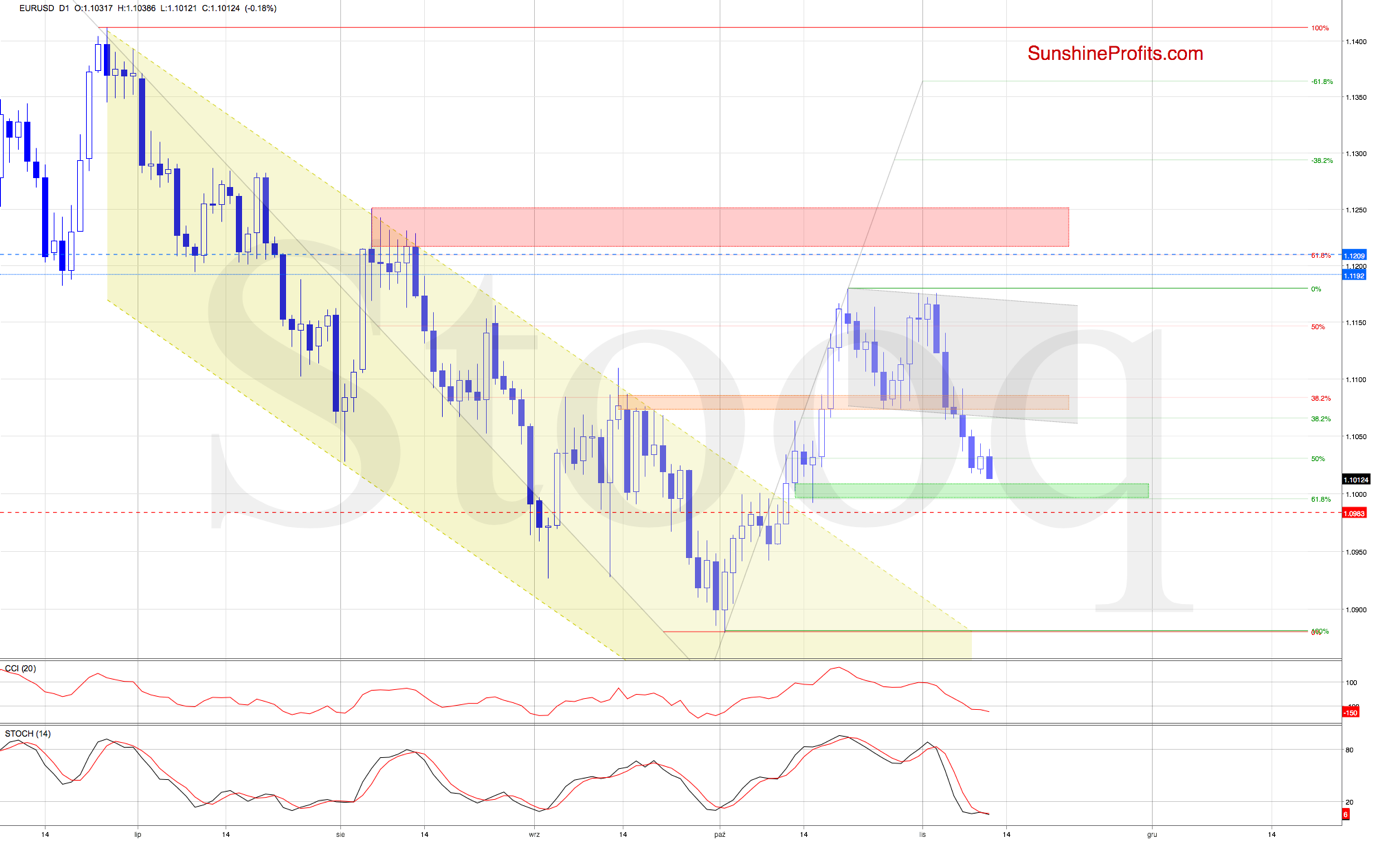

EUR/USD

In recent sessions, EUR/USD broke down below the 50% Fibonacci retracement. This has opened the way to the green support zone based on the mid-October lows and the 61.8% Fibonacci retracement.

As both the CCI and the Stochastic Oscillator dropped to their oversold areas, it suggests that reversal may be just around the corner. Could tonight's Trump speech be the catalyst?

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.0983 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

USD/CHF

Our Thursday's analysis covered USD/CHF at the moment of its bumping into the upper border of the declining red trend channel. The pair went on to break above this resistance, yet plunged yesterday. Similarly to the end of last week, can the bulls deliver yet another surprise shortly?

USD/CHF has risen recently, all the way up to the upper border of the rising green trend channel. But its proximity encouraged the sellers to act.

As the pair moved sharply lower, its earlier breakouts above both the 61.8% and the 50% Fibonacci retracements have been invalidated.

The bulls didn't give up however, pushing the pair higher earlier today. Can they succeed in their efforts?

Looking at the current extended position of the daily indicators, and the upper border of the rising green trend channel, it seems that reversal and lower values of the exchange rate are just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

AUD/USD

AUD/USD recently broke down below the lower border of the blue consolidation, which has triggered the sharp Friday's move to the downside. Earlier this week, the exchange rate extended losses, suggesting high likelihood of a test of the rising green support line (based on the previous lows) and the 38.2% Fibonacci retracement in the very near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist