After Friday's bloodbath thanks to the U.S. retail figures, we have a wildcard for today too. The ECB President Mario Draghi speaks. A careful chart examination calls for adjusting both our profitable positions with immediate effect. No one gets poor by cashing in nice profits, do they? Think capital preservation and appreciation long-term. This is what wins championships as opposed to matches. Where did that come from? You're right - offense wins matches while defense wins championships.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: 50% of existing profitable short positions with a fresh stop-loss order at 1.1286 and the new downside target at 1.1166

- GBP/USD: short (a new stop-loss order at 1.2643; the next downside target at 1.2488)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7041; the exit downside target at 0.6887)

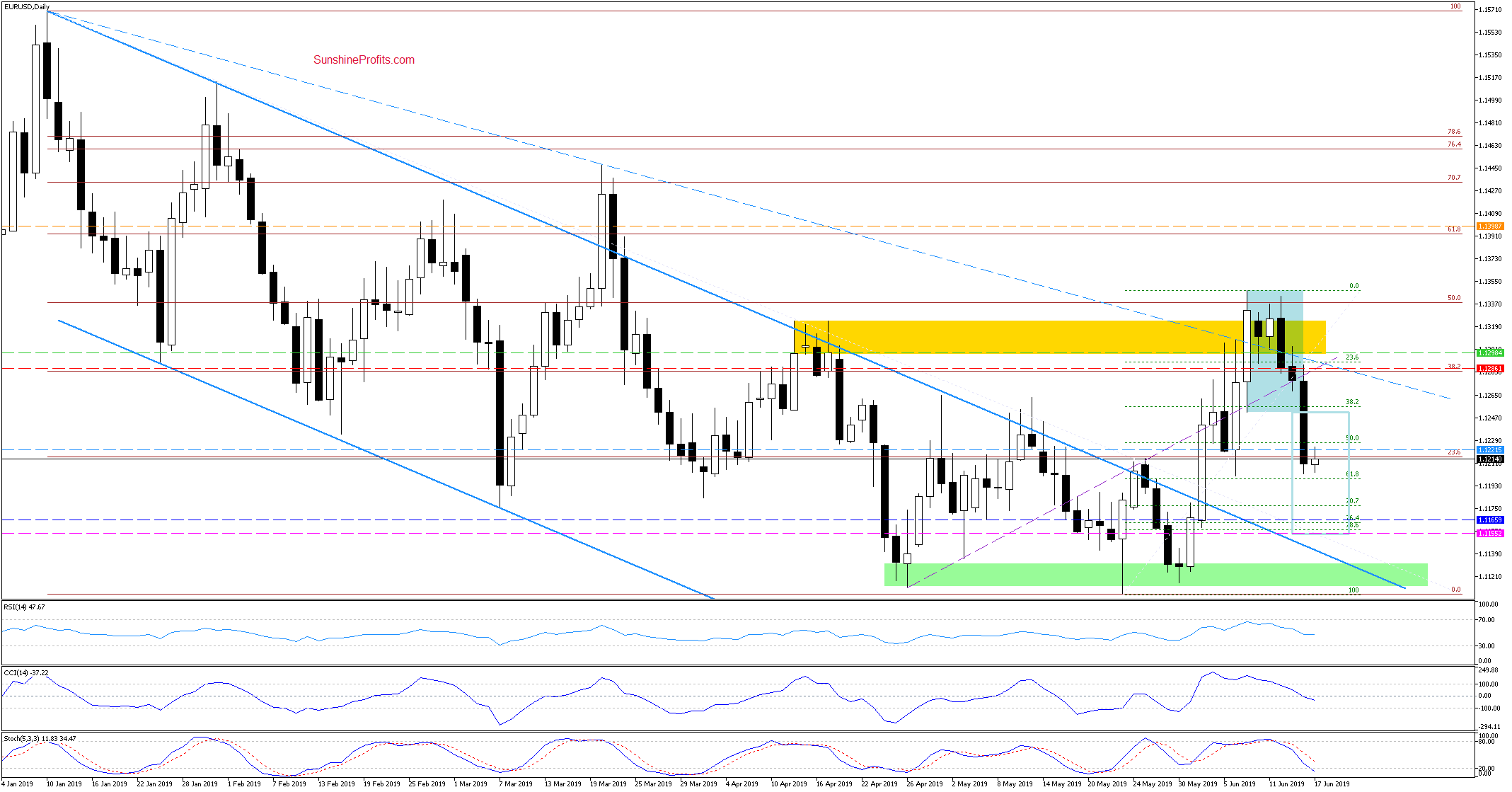

EUR/USD

On Friday, we wrote:

(...) Any moves higher have been soundly rejected however, and the proximity to the upper border has kept bullish spirits at bay.

(...) Coupled with the sell signals of all daily indicators, the probability of a larger upcoming move to the downside remains high and the profitable short position is therefore justified.

EUR/USD has moved sharply lower on Friday, making our short position even more profitable. The pair not only cut through the lower border of the blue consolidation, but also slipped below our initial downside target and approached the 61.8% Fibonacci retracement and the bottom of the early-June correction.

Both these supports encouraged the buyers to act earlier today, however the exchange rate still trades below the blue consolidation, and the sell signals of the daily indicators remain on the cards. This speaks for another move to the downside being just around the corner.

Nevertheless, taking into account today's ECB President Draghi speech and the proximity to the above-mentioned supports, we 're closing 50% of our short positions and taking profits off the table. We're carrying on with the remaining 50% of our positions with a fresh stop-loss order and the new downside target. All details below.

Trading position (short-term; our opinion): 50% of existing profitable short positions with a fresh stop-loss order at 1.1286 (it's below our entry level, which protects some profits in the remaining part of short position should this level be reached) and the new downside target at 1.1166 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

GBP/USD has moved sharply lower on Friday, and the pair broke back below the lower border of the declining red trend channel. Besides, the pair also broke below the green support zone and our initial downside target, making our short positions more profitable.

Earlier today, the exchange rate rebounded a bit, but it's still trading below the green support zone and the lower border of the declining red trend channel. Coupled with the sell signals of the daily indicators, it increases the likelihood of another move to the downside.

Nevertheless, taking into account the above-mentioned ECB President Draghi speech, we decided to protect some of our gains and move the stop-loss order below our entry level. Additionally, we're also moving our downside target lower. All details below.

Trading position (short-term; our opinion): Profitable short positions with a new stop-loss order at 1.2643 and the next downside target at 1.2488 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

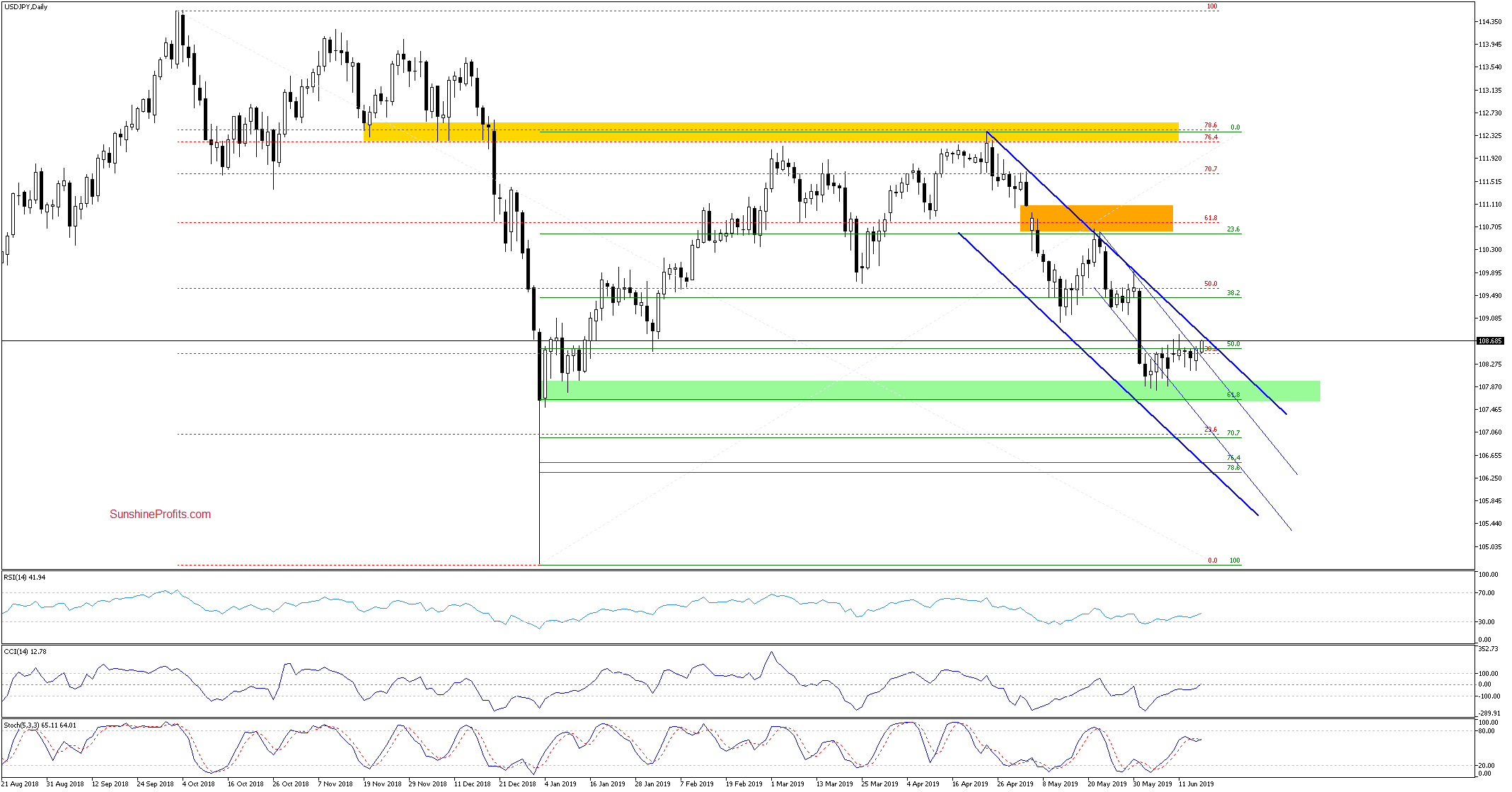

USD/JPY

We wrote these words on Thursday:

(...) The pair is still trading in a narrow range inside the thin declining blue trend channel. The rebound from the green support zone remains on. (...) One more move to the upside and a test of the upper border of the declining thin blue trend channel, or even a climb to the upper border of the thick declining blue trend channel can't be ruled out in the coming days.

USD/JPY has moved higher earlier today and the Stochastics Oscillator starts looking extended, however no new position is warranted. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Summing up the Alert, EUR/USD did truly slide on Friday and the same can be said about GBP/USD. Due to the proximity of important supports and ECB President Draghi's upcoming speech, closing 50% of the EUR/USD short position is warranted. Also adjusting the trade parameters of GBP/USD is wise in light of the above. There're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist