A new day, a new opportunity to cash some nice profits. It's hard to choose where to look first - our situation is that favorable. Time to examine the charts, and decide where to lock in some profits, and where to let them run. Let's dive in to the details. They are rich indeed.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (fresh stop-loss order at 1.1283; the next downside target at 1.1174)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.6991; the next downside target at 0.6898)

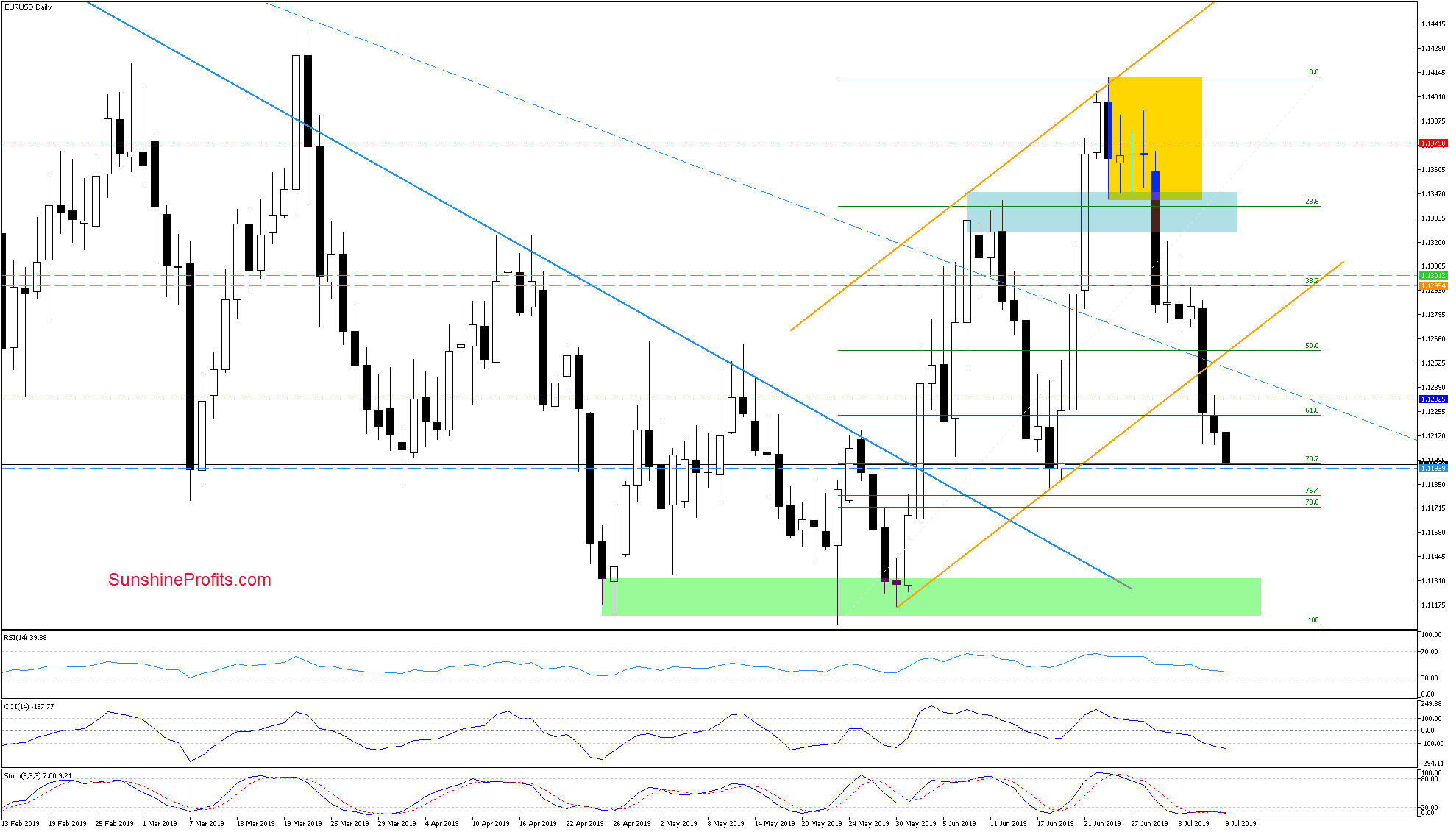

EUR/USD

EUR/USD extended losses earlier today and reached our next downside target. Coupled with the proximity to the support area created by the 76.4%, 78.6% Fibonacci retracements and the mid-June lows, closing 50% of the profitable short positions and taking profits off the table is a sound idea.

We're leaving the other half of the profitable positions on, with a fresh stop-loss order and a next downside target. All details below.

Trading position (short-term; our opinion): Profitable short positions with a fresh stop-loss order at 1.1283 (we're moving it below our entry level to protect more of the earlier gains) and the next downside target at 1.1174 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

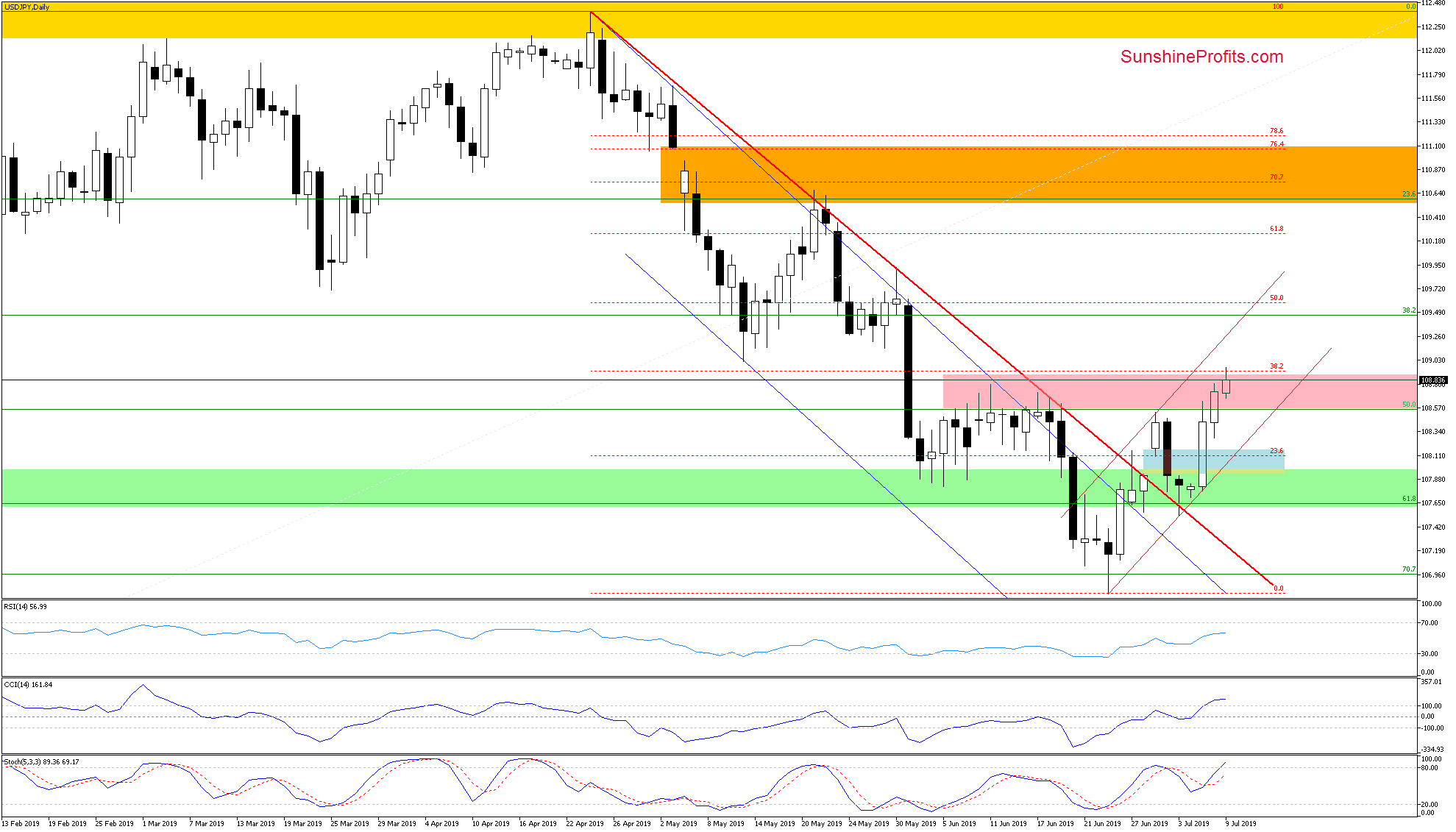

USD/JPY

The exchange rate extended gains and climbed to the pink resistance zone reinforced with the 38.2% Fibonacci retracement. Earlier today, the bulls have tested the retracement but gave up some of their gains, thus invalidating the earlier tiny intraday breakout.

However, the daily indicators haven't flashed any sell signals. That means that one more attempt to move higher targeting a test of the upper border of the brown rising trend channel remains likely.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

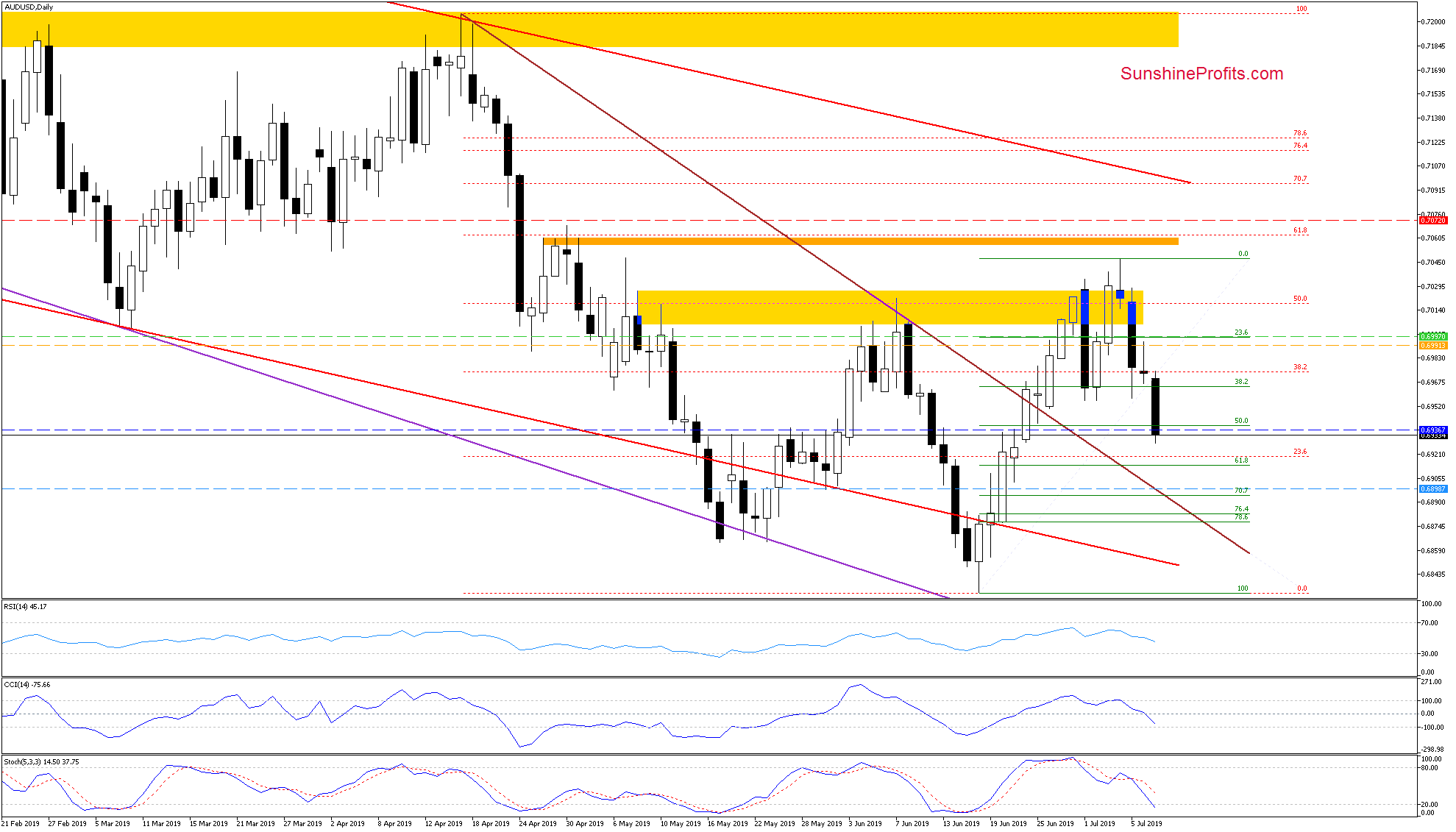

AUD/USD

Earlier today, AUD/USD has falled below our initial downside target, making our already profitable short position even more so. The pair has declined below both last week's lows and the 50% Fibonacci retracement, opening the way to even lower values.

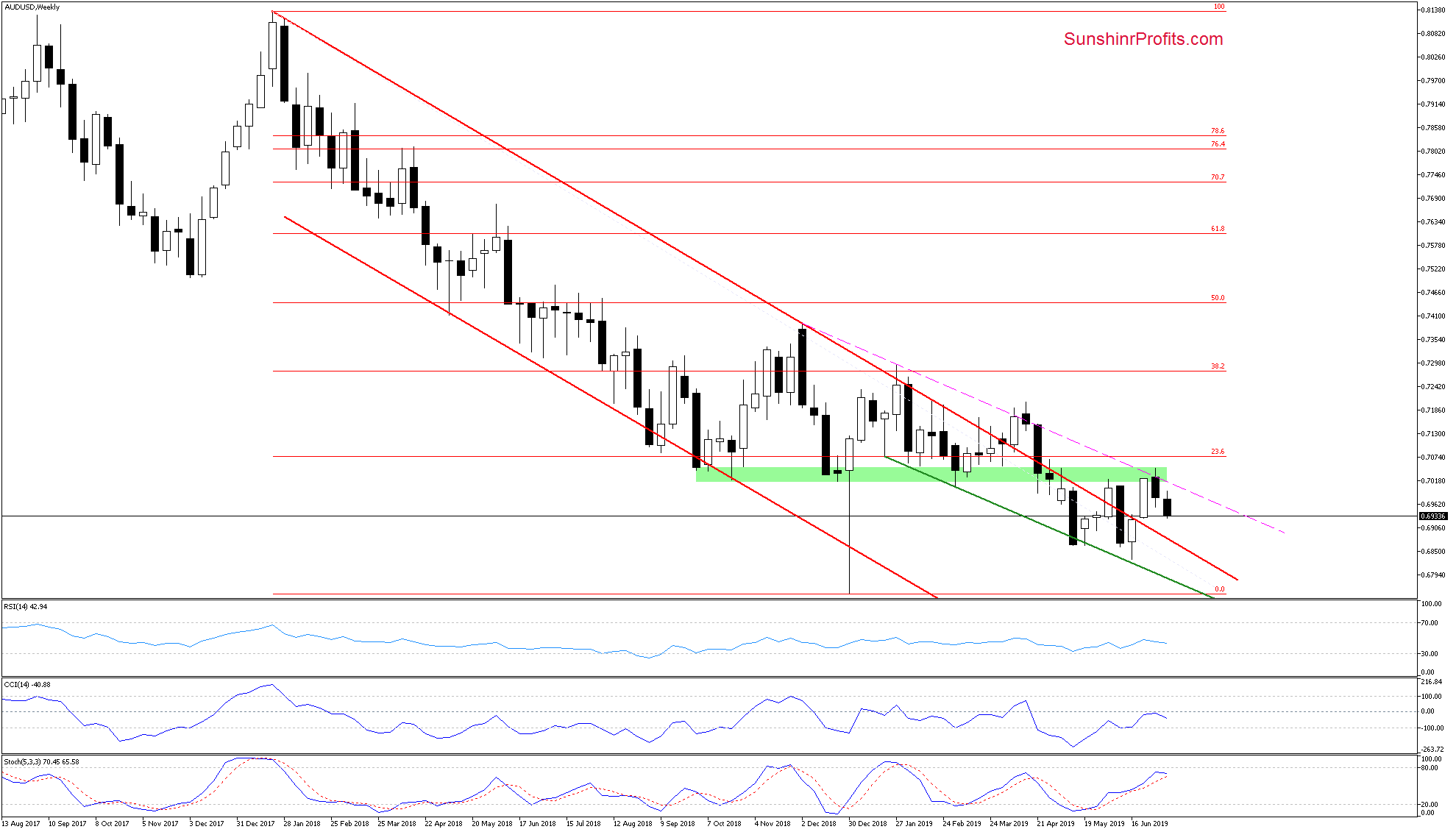

Let's check again how the bearish outlook goes with the weekly chart. That's something we have covered yesterday:

(...) the pair retested the previously-broken pink dashed resistance line. This is similar to what we saw in mid-April, and suggests that further deterioration is very likely. After all, that would be exactly what we have seen back in April.

Connecting the dots, even lower values of the exchange rate are likely still ahead of us. Therefore, we have moved our downside target to 0.6899 and also updated the stop-loss order. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.6991 and the next downside target at 0.6898 (just below our entry level to protect capital) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, the EUR/USD has reached levels where several supports are located, warranting closing 50% of our profitable short positions while adjusting the trade parameters of the remaining half. Cashing in some profits is justified from the portfolio point of view, providing better stability of returns over time. As AUD/USD keeps pushing lower, we're giving our open profits more room to grow as our initial downside target has been reached, and both the short- and medium-term outlook favor another downswing. USD/CHF hasn't yet brought us yet enough evidence of the bulls losing their grip - opening a short positions isn't justified now. Apart from these, there're no other opportunities worth acting upon in the currencies. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist