The euro bulls are joined by the commodity currencies' bulls in attempting yet another comeback today. How far can their efforts take them? By all reckoning, the USD has just scored a good week. Will the USD bulls be able to overcome their opponents? Let's take a look at both sides of the coin. Oh, lest we forget - get ready for a potentially wild ride due to the unprecedented 10-day Golden Week holiday in Japan. The details follow...

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (20% of already existing positions) (a new stop-loss order at 1.1219 and the next downside target at 1.1075))

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (50% of already existing positions) (a new stop-loss order at 0.7070; the next downside target at 0.6960)).

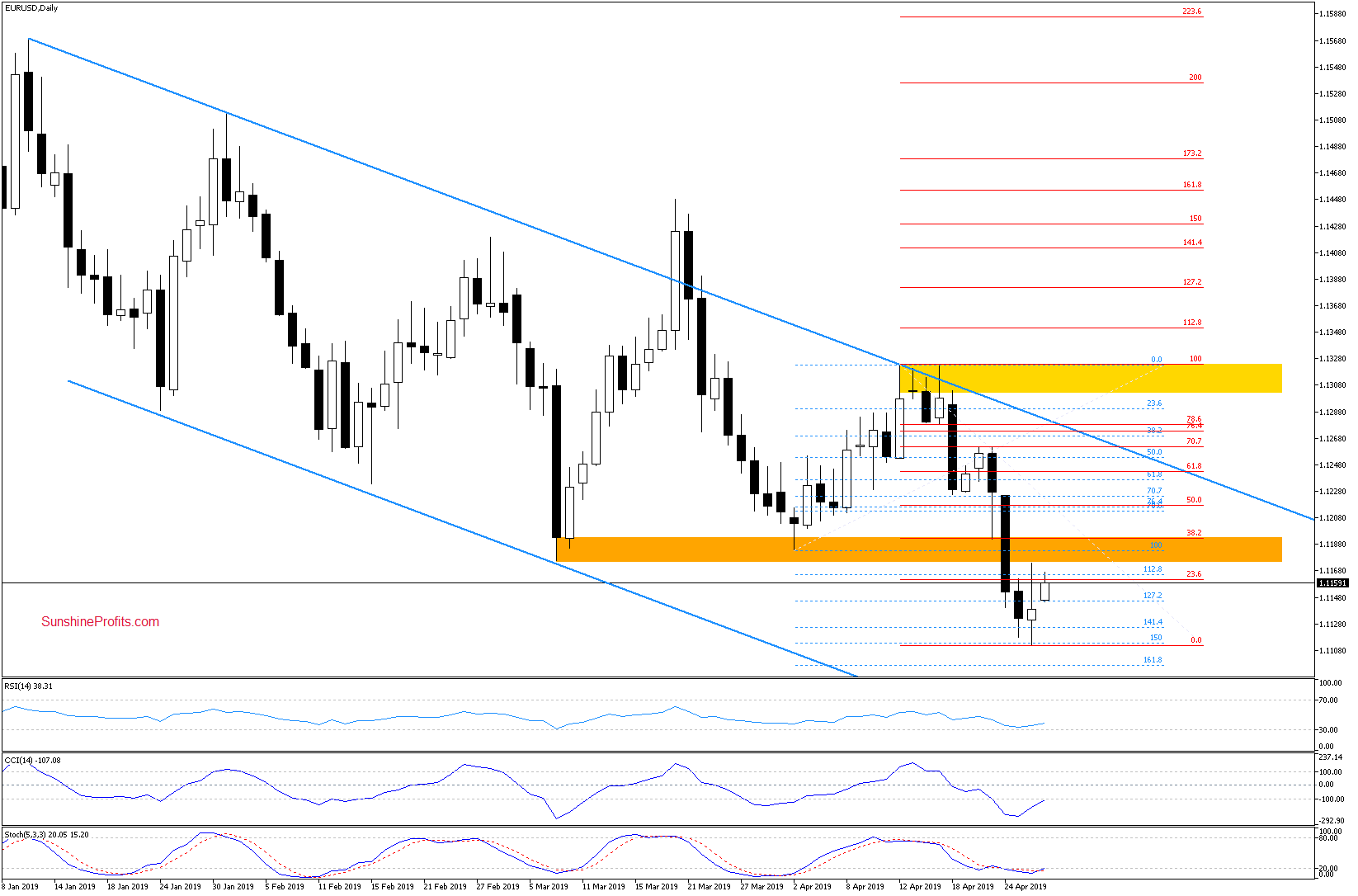

EUR/USD

Both the monthly and weekly perspective show that the overall situation hasn't changed much. EUR/USD is still trading above the very long-term green support line on both charts.

Let's take a look at the daily chart. What can we see?

Initially on Friday, EUR/USD extended losses only to attempt a rebound and close the day almost unchanged. That rebound attempt has approached the previously-broken orange support zone.

Such a reversal from the attempted upswing looks like verification of the preceding breakdown. Earlier today, the bulls tried again to push the rate higher but appear to have run out of steam as the pair changes hands at around 1.1160 currently. That is not only below Friday's high but also below that orange support-turned-resistance zone.

Therefore, as long as the breakdown below the orange zone isn't invalidated, one more attempt to move lower remains likely.

Trading position (short-term; our opinion): 20% of profitable short positions with a stop-loss order at 1.1219 and the next downside target at 1.1075 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

Although the bears have pushed GBP/USD lower in the previous week, three factors came to the bulls' rescue. These were the green support zone (marking the gap between the February 15 closing price and the February 18 opening price), the lower border of the red declining wedge and the 50% Fibonacci retracement.

Friday's price recovery followed. It has marked the invalidation of the earlier tiny breakdown below the lower border of the red declining wedge. This is a positive event for the bulls. Additionally, the CCI and Stochastic Oscillator have generated buy signals.

How high can the bulls aim? It's our opinion that if they manage to take the pair higher, their first upside target would be the upper border of the red declining wedge (at around 1.3007 currently).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

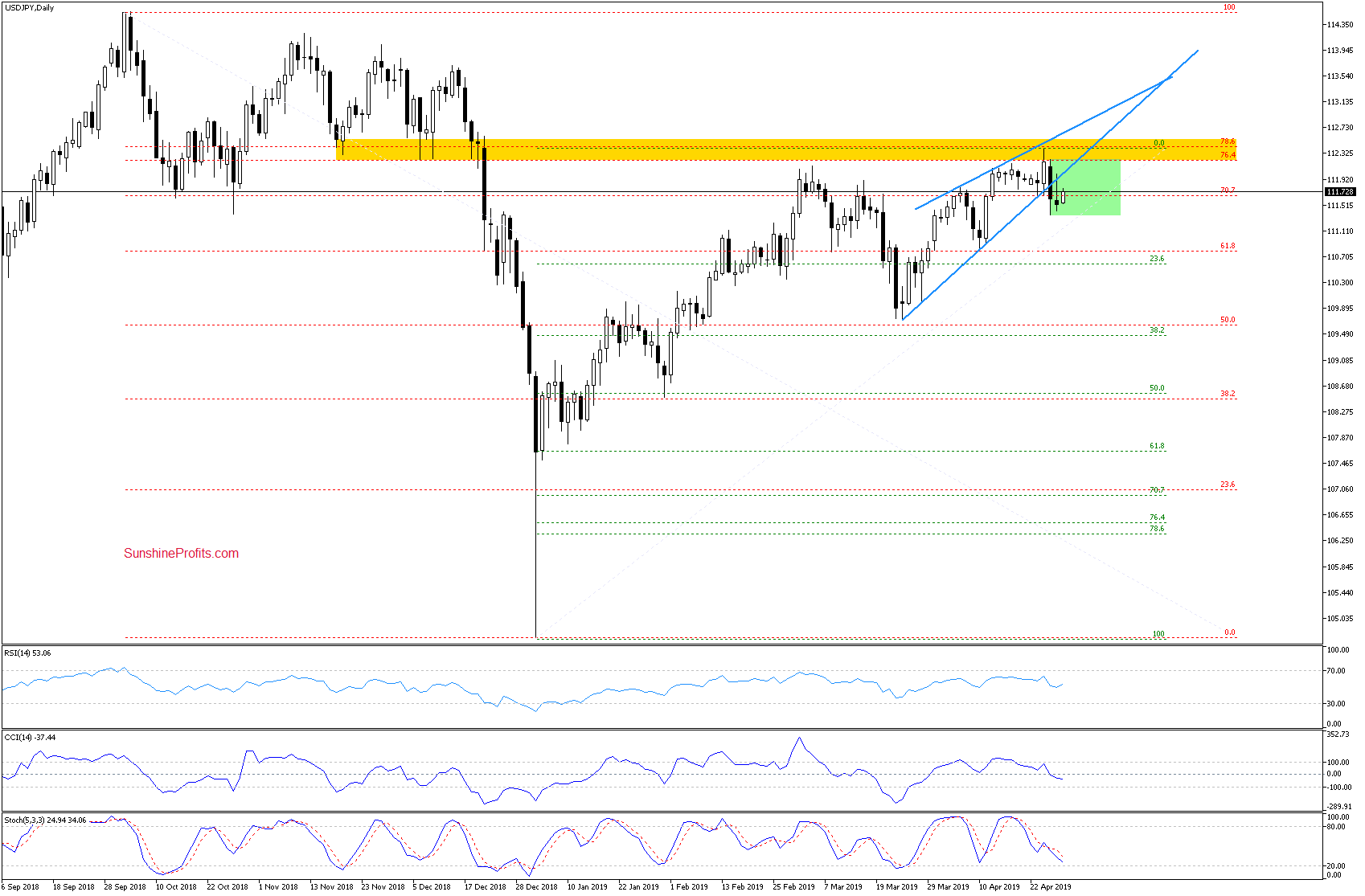

USD/JPY

USD/JPY broke below the lower border of the blue rising wedge on Thursday. The breakdown below this blue support line based on the previous lows is a bearish sign. On Friday, the pair has verified the breakdown and went on to give up most of its gains to finish the week only slightly above Thursday's lows.

Earlier today, the bulls have attempted another upswing that brought modest gains so far (currently trading at around 111.85). The technical picture hasn't changed much as the pair is still trading both inside the green consolidation and below the lower border of the previously-broken blue rising wedge.

Connecting the dots, as long as there's no breakdown below the lower border of the green consolidation, lower values of the exchange rate are questionable and short-lived moves in both directions wouldn't surprise us.

This is especially the case since Japan celebrates an extended spring holiday right now, the so-called Golden Week (April 27 - May 6). With the markets closed for the longest streak since the end of World War II, we can expect low liquidity coupled with potentially extreme market moves across all the markets during Asian trading hours. Recent examples of such 'flash crashes' include:

- 3rd January 2019 - JPY crosses +10%

- 7th October 2016 - GBP crosses -10%

In practice, this means wider spreads and slower-moving markets that are prone to occasional, extremely fast-moving candles bringing violent moves in either direction. You've been forewarned!

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

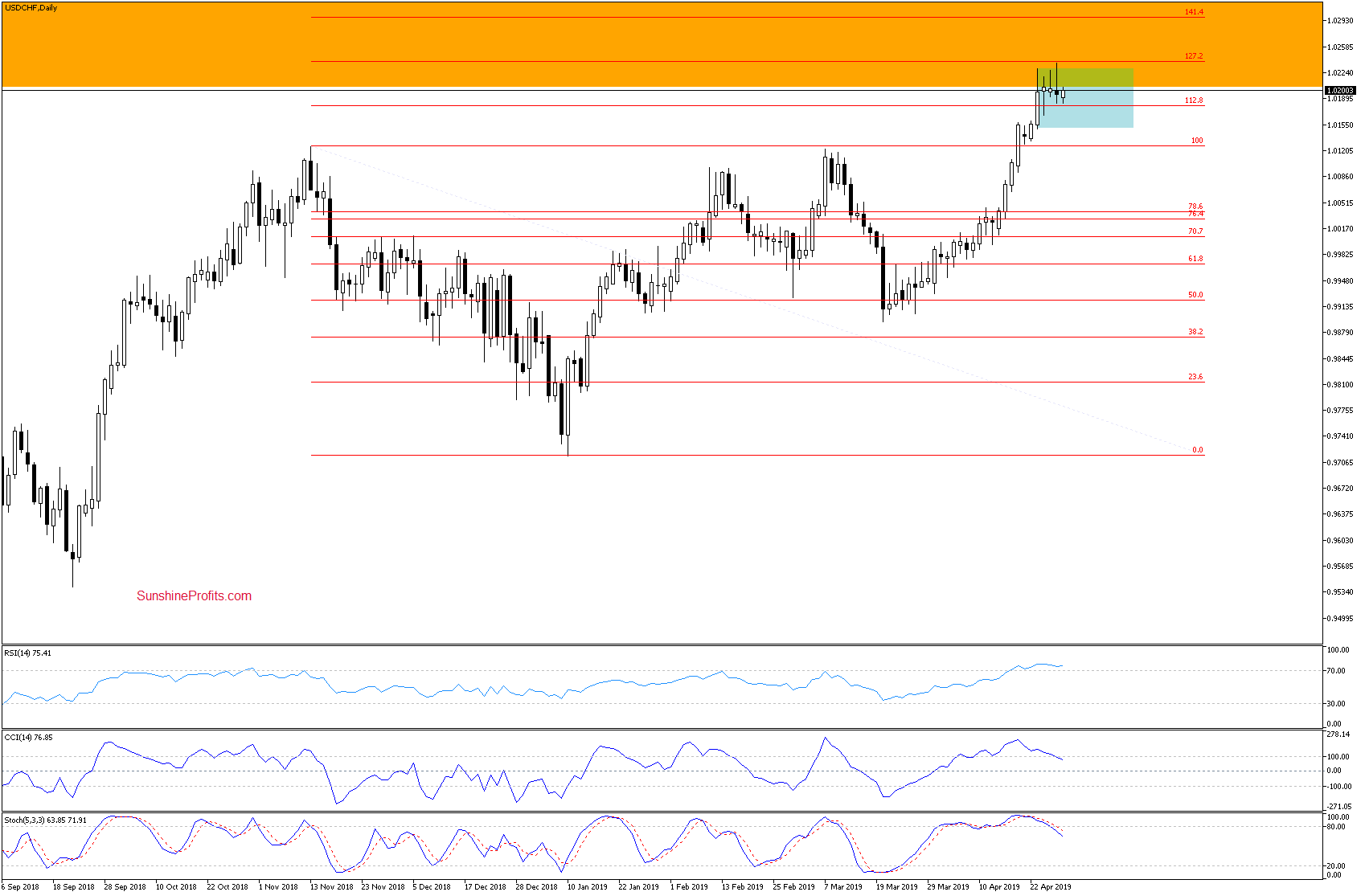

USD/CHF

Let's combine the monthly and daily perspective. Although USD/CHF hit a fresh peak on Friday, the bulls have met their resistance and didn't manage to take the pair any higher before the closing bell. To the contrary, the rate reversed lower and the result is seen as an invalidation of the earlier tiny breakout above the upper border of the blue consolidation on the daily chart.

This is a bearish sign. Combined with the orange resistance zone, the proximity to the 127.2% Fibonacci retracement and the sell signals generated by the daily indicators, it increases the probability of further deterioration this week.

Should we see a breakdown below the blue consolidation, we'll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Summing up the Alert, earlier today, we've seen a corrective upswing in both EUR/USD and AUD/USD. In the case of AU/USD, it has already fizzled out and EUR/USD has also given up most of its gains. Today's price action therefore looks like another attempt at verification of their both preceding breakdowns. Therefore, both short positions (the remainders thereof) remain justified from the risk-reward point of view. There're no other opportunities worth acting upon in the currencies right now. As always, we'll keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist