The start of the trading week finds us in great shape and ready to take advantage of the juicy opportunities we're presented with. It's a strong lineup indeed. It's a rare day when we open three new positions - and their prospects look great from the get-go! Without further fanfare, learn about our three opportunities that are too mouth-salivating to miss.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1398; the initial downside target at 1.1221)

- GBP/USD: short (a stop-loss order at 1.2824; the initial downside target at 1.2602)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7041; the initial downside target at 0.6910)

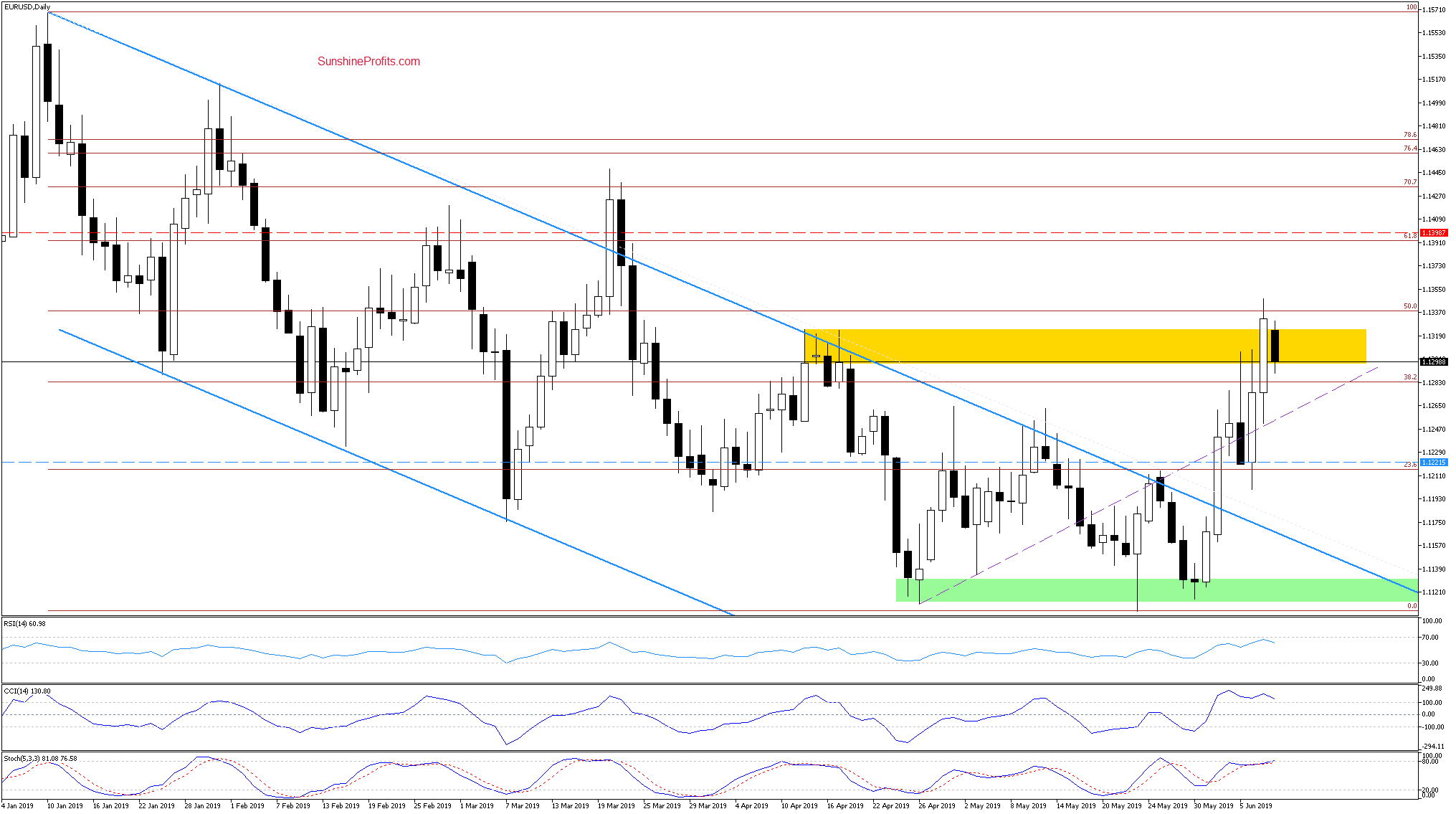

EUR/USD

After a decent upswing in the previous week, EUR/USD has had trouble overcoming the 50% Fibonacci retracement on Friday. While it still finished the day above the yellow resistance zone (that's above the mid-April highs), it gave up some of its gains before the day was over.

Earlier today, the exchange rate has deteriorated and the earlier breakout above the yellow resistance zone was invalidated. The pair changes hands currently at around 1.1305.

The daily indicators look extended and appear readying to issue their sell signals shortly. This is also playing into the hands of the bears.

Connecting the dots, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1398 and the initial downside target at 1.1221 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

After the pronounced downswing of recent weeks, GBP/USD has rebounded from the green support zone that marks early 2019 closing lows. The bulls took the pair back inside the declining red trend channel a few days ago.

They didn't have much success keeping it there, however. Earlier today, we have witnessed a sharp move to the downside with the rate piercing the lower border of the declining red trend channel again.

Let's take a look at the position of the daily indicators. We see that the CCI and Stochastics have generated their respective sell signals, supporting the bearish take on things.

Connecting the dots, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.2824 and the initial downside target at 1.2602 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

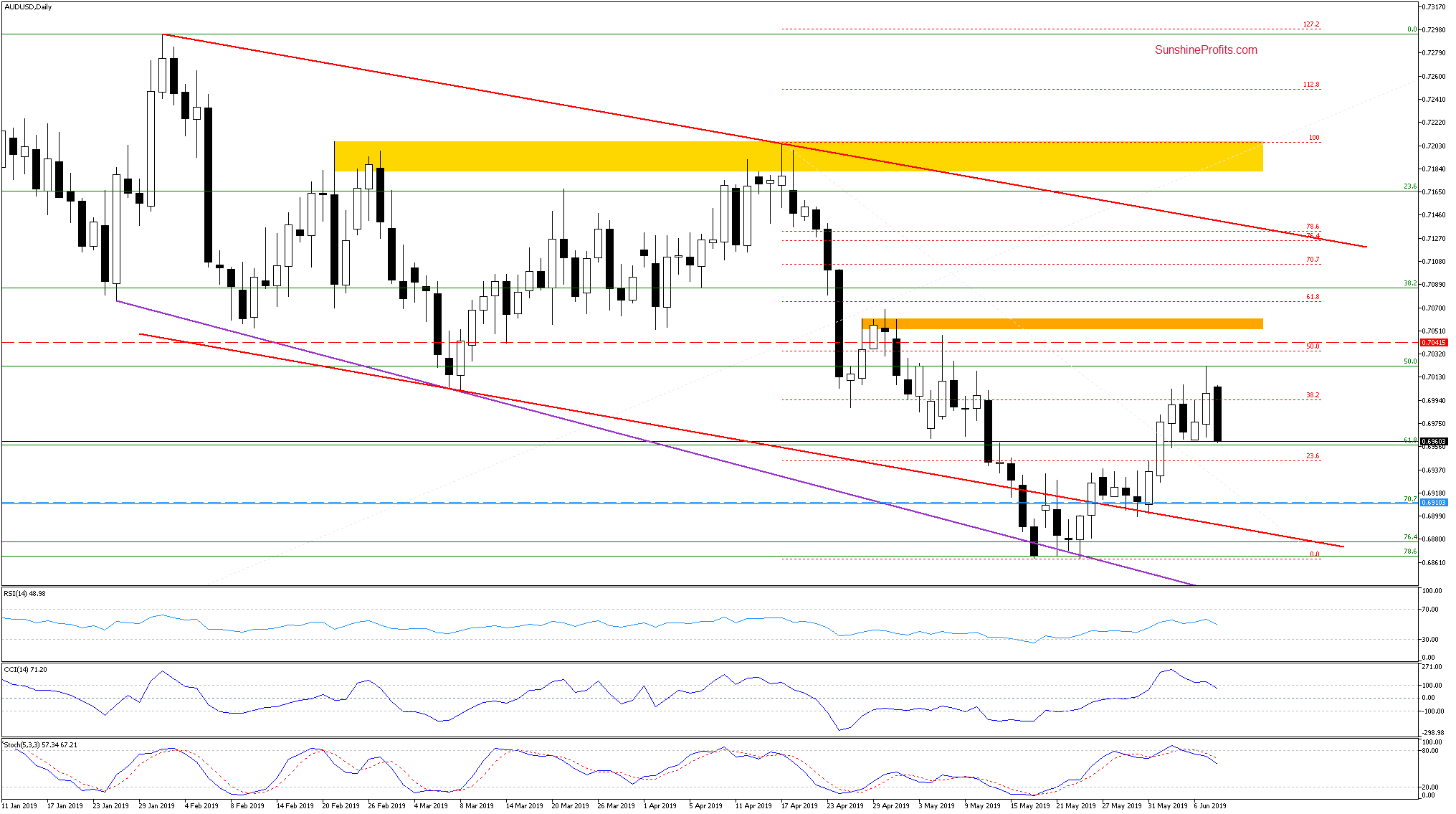

AUD/USD

Another pair, another trouble for the bulls. Here in AUD/USD, they have had issues with the 38.2% Fibonacci retracement in the previous week. Earlier today, we have seen a sharp move to the downside which has invalidated Friday's modest breakout above this 38.2% Fibonacci retracement.

Let's take a look at the daily indicators for more clues. The Stochastic Oscillator's sell signal is being joined by the CCI's sell signal as we speak. One more factor supporting the bears.

Connecting the dots, opening short positions is justified from the risk/reward perspective. All details below.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 0.7041 and the initial downside target at 0.6910 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up the Alert, we have seen three cases of bullish momentum exhaustion, coupled with a reversal to the downside. This action in EUR/USD, GBP/USD and AUD/USD speaks in favor of opening short positions in each of these pairs. Their charts support a bearish outcome as a breakout attempt in each of these pairs has fizzled out and the bears pounded upon these opportunities with a vengeance earlier today. The momentum they demonstrated bodes well for seeing even lower rates ahead in each of the above pairs.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist