The euro bulls are on the move after having bested an important technical obstacle yesterday. Having been ready for this turn of events, where does it leave the pair next? Looking at the fresh charts, we have quite a lot to tell you about the Japanese yen and Canadian dollar, too. Let’s get right into the juicy details.

In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1099; the initial upside target at 1.1311)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

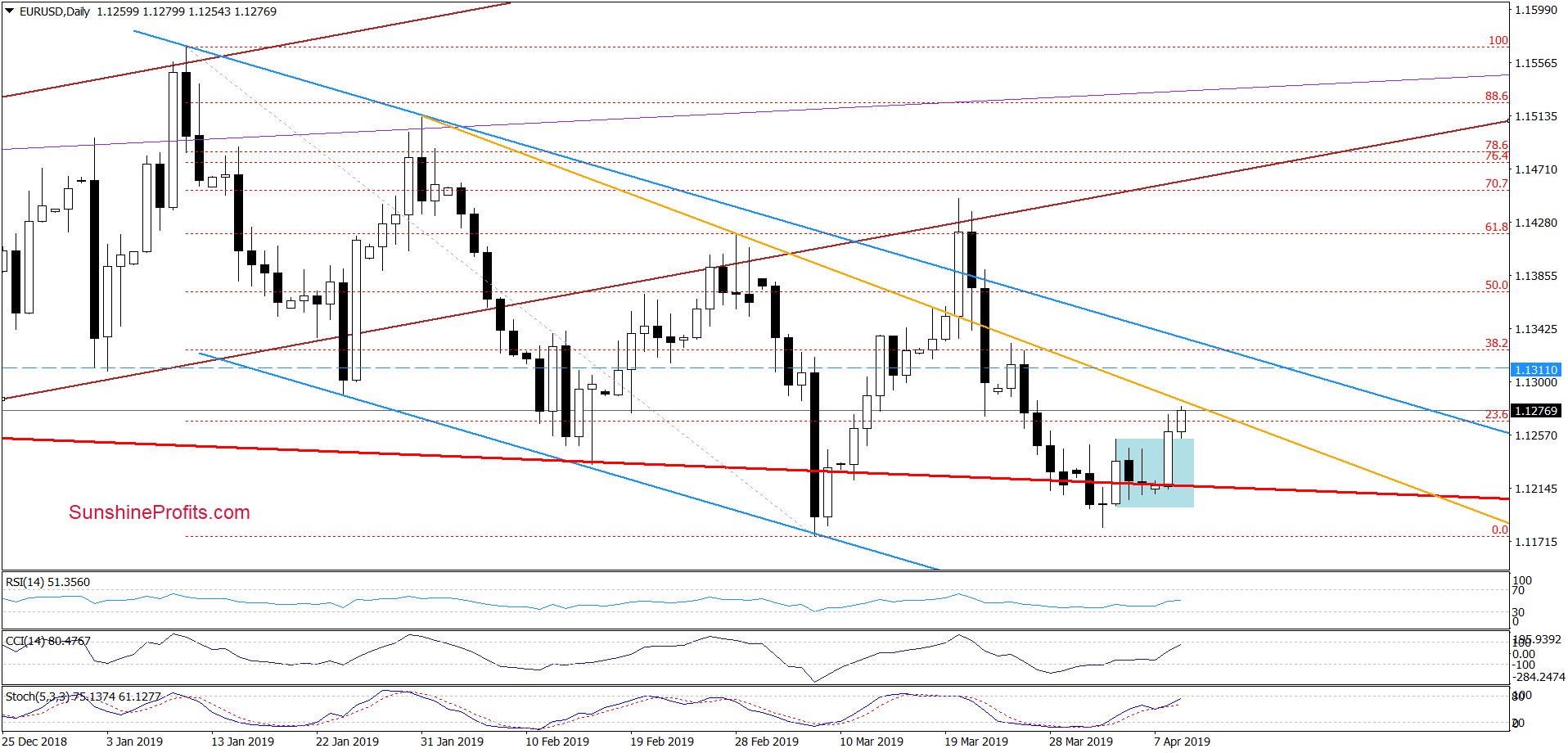

EUR/USD

We have written these words yesterday:

(…) Earlier today, the lower line of the red declining trend channel triggered a rebound and the exchange rate trades currently at around 1.1270. This means it’s attempting an intraday breakout above the blue consolidation.

Indeed, EUR/USD closed yesterday’s session above the blue consolidation. Today, we’re seeing follow-through buying.

Taking this positive event into account, we believe that higher values of the exchange rate are just around the corner.

Discussing the targets, we noted on Friday:

(…) How high can the bulls set their sights? The first upside target would be the declining orange resistance line.

Let’s expand that and look at the daily indicators right now. They’re on buy signals with no warning signs ahead, still having room to go. Therefore, the next logical target after the declining orange resistance line is the upper border of the declining trend channel.

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.1099 and the initial upside target at 1.1311 are justified from the risk/reward perspective.

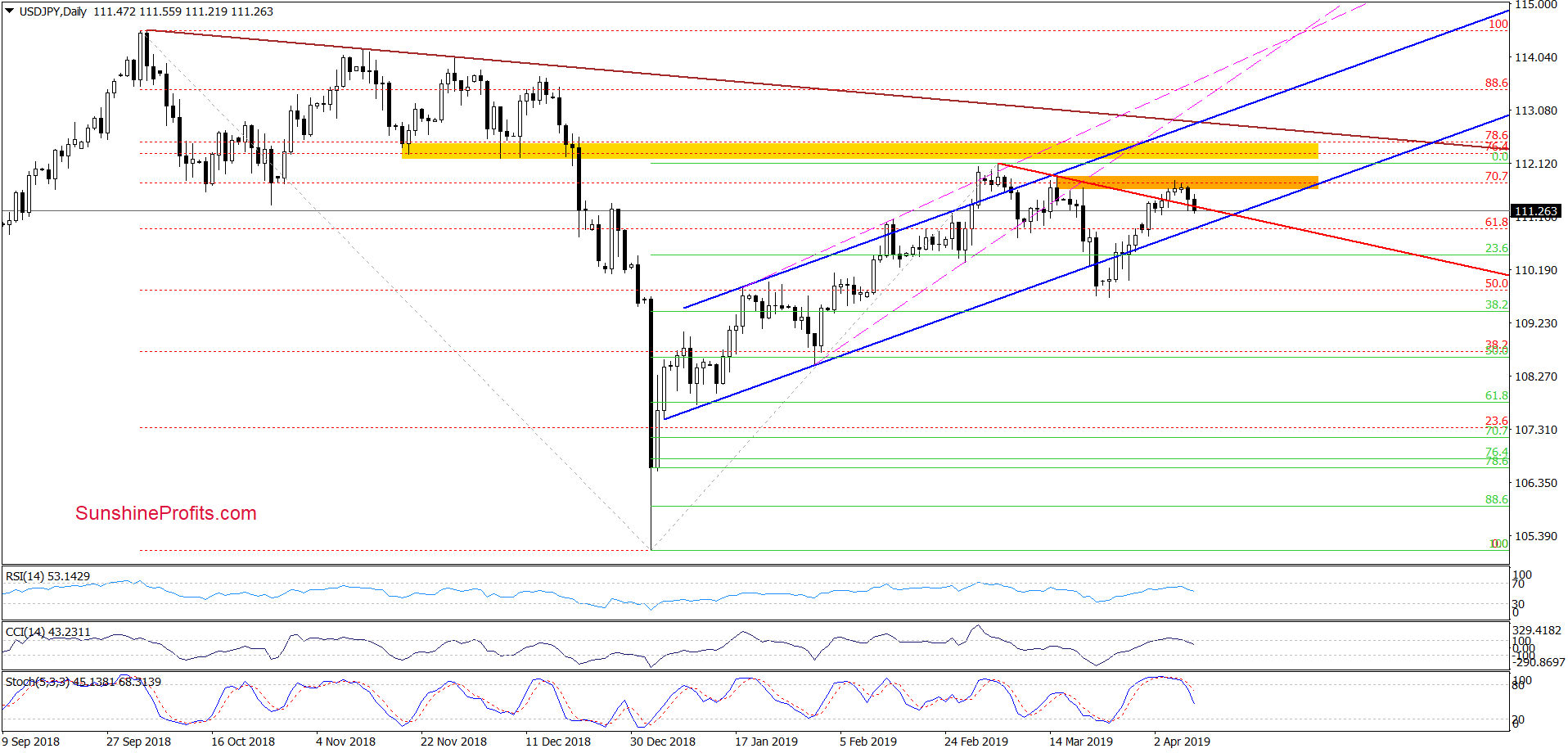

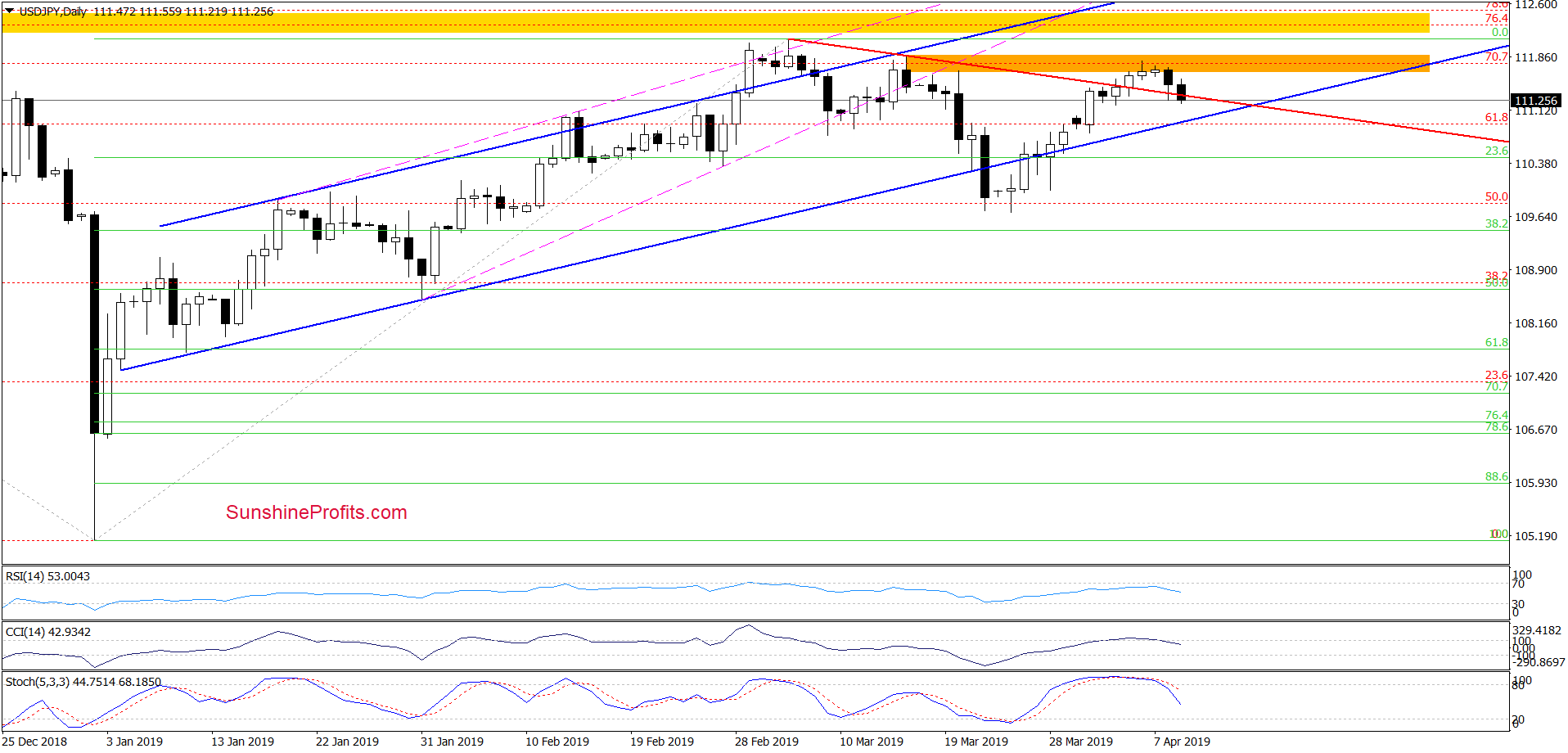

USD/JPY

Let’s take a look at two daily charts: they differ in their starting point only. One of the most prominent features is the orange resistance zone based on previous local peaks. It had stopped the buyers yesterday and USD/JPY pulled down next.

Earlier today, the sellers attacked once again, taking the pair below the previously-broken red declining resistance-turned-support line.

This is encouraging for the bears, especially if they manage to close the day below this line. Take note of the sell signals generated by the daily indicators. They increase the likelihood of further deterioration in the coming day(s).

If this is indeed the case, the first downside target would be the lower border of the blue rising trend channel.

If it is broken, the way south testing even the March lows would open. Should we see weakness of the bulls, we’ll likely open short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

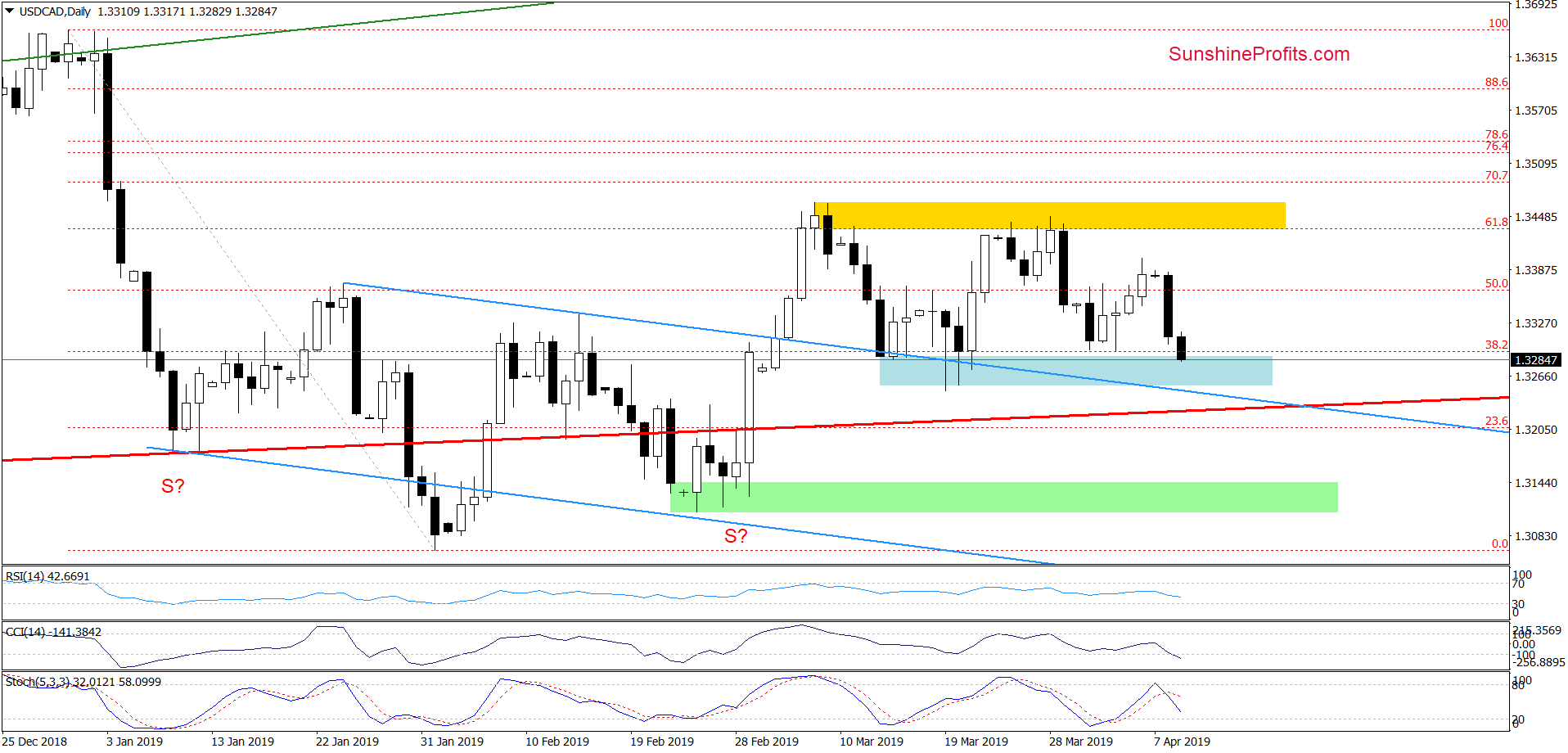

USD/CAD

Although the bulls went from strength to strength last week, they didn’t manage to take USD/CAD even up to the yellow resistance zone. This weakness encouraged the bears to show up in full force yesterday. Earlier today, they have managed to press the exchange rate even lower.

Now, with the blue support zone back in play, where next for the pair? The chart suggests a test of the previously-broken upper border of the blue declining trend channel in the coming days.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist