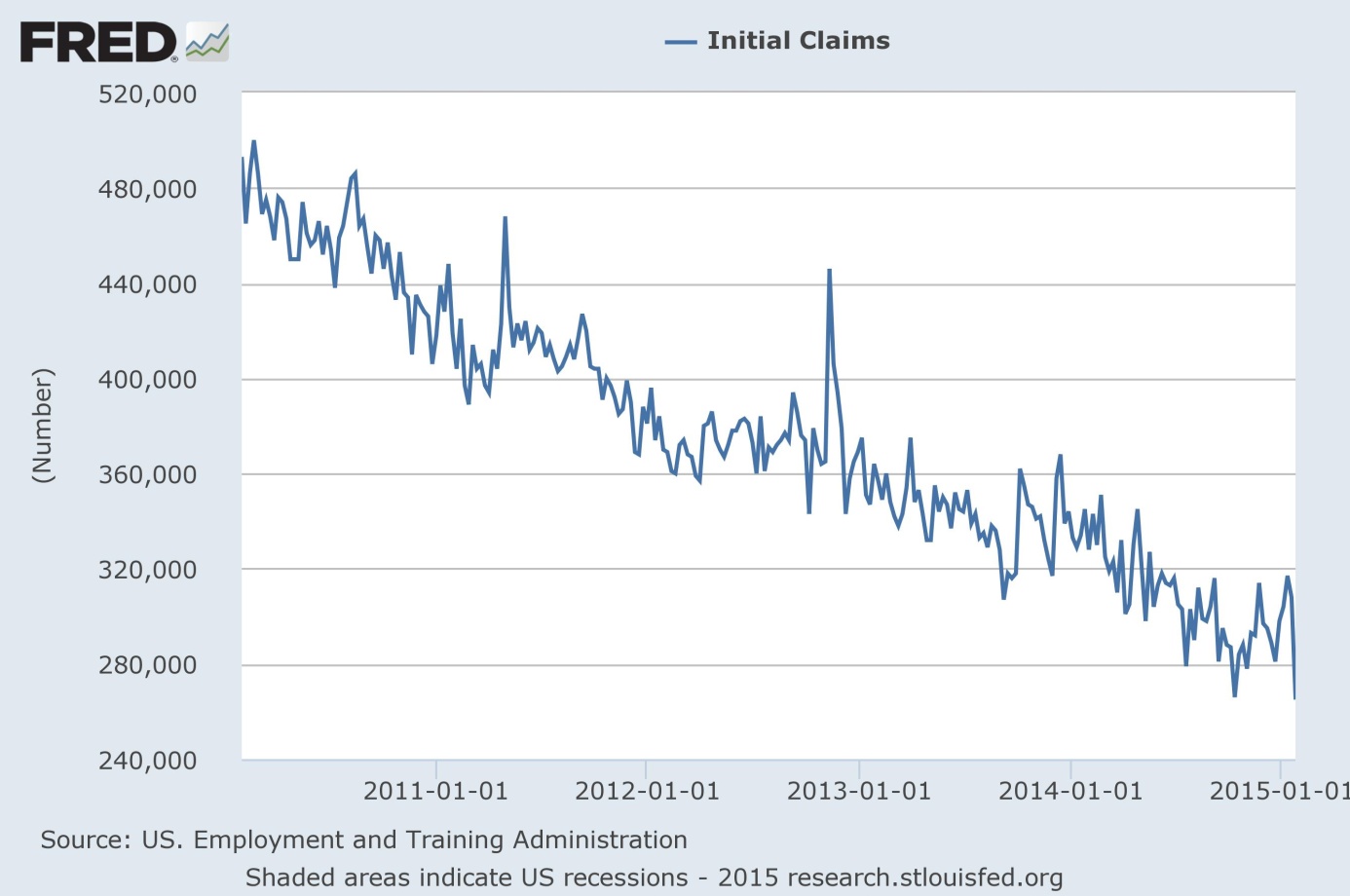

The U.S. weekly jobless claims dropped from 308,000 to 265,000, the lowest level since April 2000, according to the yesterday’s Labor Department statement (Graph 1). This labor market data seems to indicate that Fed was right on Wednesday. This could be negative news for gold prices, because a strong labor market would imply the interest rate hike is more probable.

Graph 1: Number of people filing for unemployment benefits

However, the reality is more complex. First, last week included the Martin Luther King Jr. Day, a federal holiday, which shortened the reporting week.

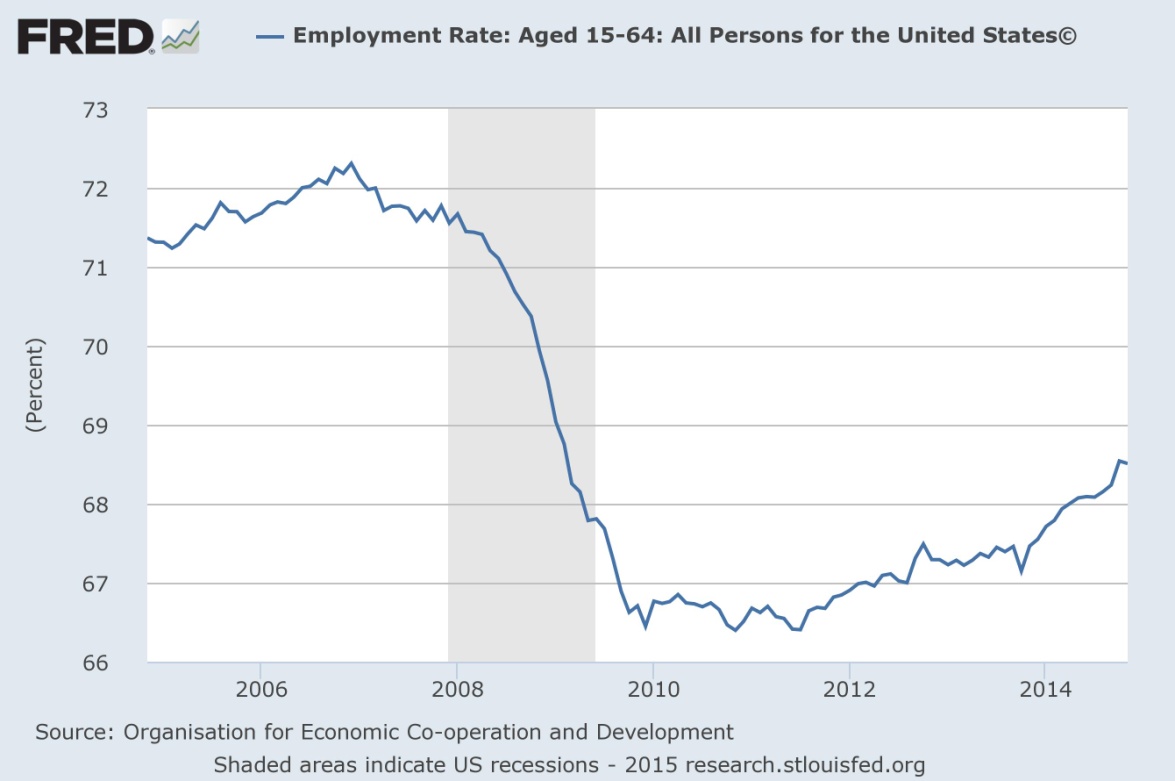

Second, and more fundamental, the labor market is far from full recovery. You can notice it looking from a proper perspective. You can discover, for example, that employment in the working-age population is still a few percentage points lower than before the 2008 financial crisis (Graph 2). The situation is much worse, because people work only part time much more often than in the past.

Graph 2: Employment rate for the working-age population.

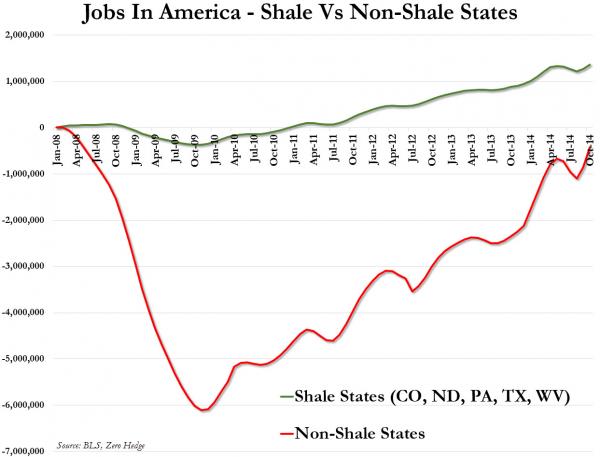

Third, and the most important, even these official and flawed indicators are going to get worse. Why? Just look at Graph 3. Since the beginning of 2008 shale oil states have added 1.36 million jobs, while non-shale states have lost 424,000 jobs. It means that all those “strong” job gains the Fed was talking about have been in just 5 shale states. The sad truth is, thus, that with further problems in the energy sector we will rather see job losses. Actually, the layoffs have already begun in some states, such as North Dakota and Texas. Undoubtedly, cheap oil can also add some jobs, for example, in the logistics and transportation industry; however we are skeptical about the overall balance. Therefore, gold investors should not pay too much attention to partial and raw data, and always try to have the whole picture in mind. The labor market is not as strong as it is commonly believed, so the Fed may loosen its policy at any time.

Graph 3: Jobs created or lost in the United States – shale versus non-shale states.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Gold Trading Alerts

Gold Market Overview

This articles is exclusive to Sunshine Profits; please do not copy it (you are free to link to it, though).

Back