Stock Trading Alert originally sent to subscribers on January 29, 2014, 7:01 AM.

Our intraday outlook is neutral, and our short-term outlook remains neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

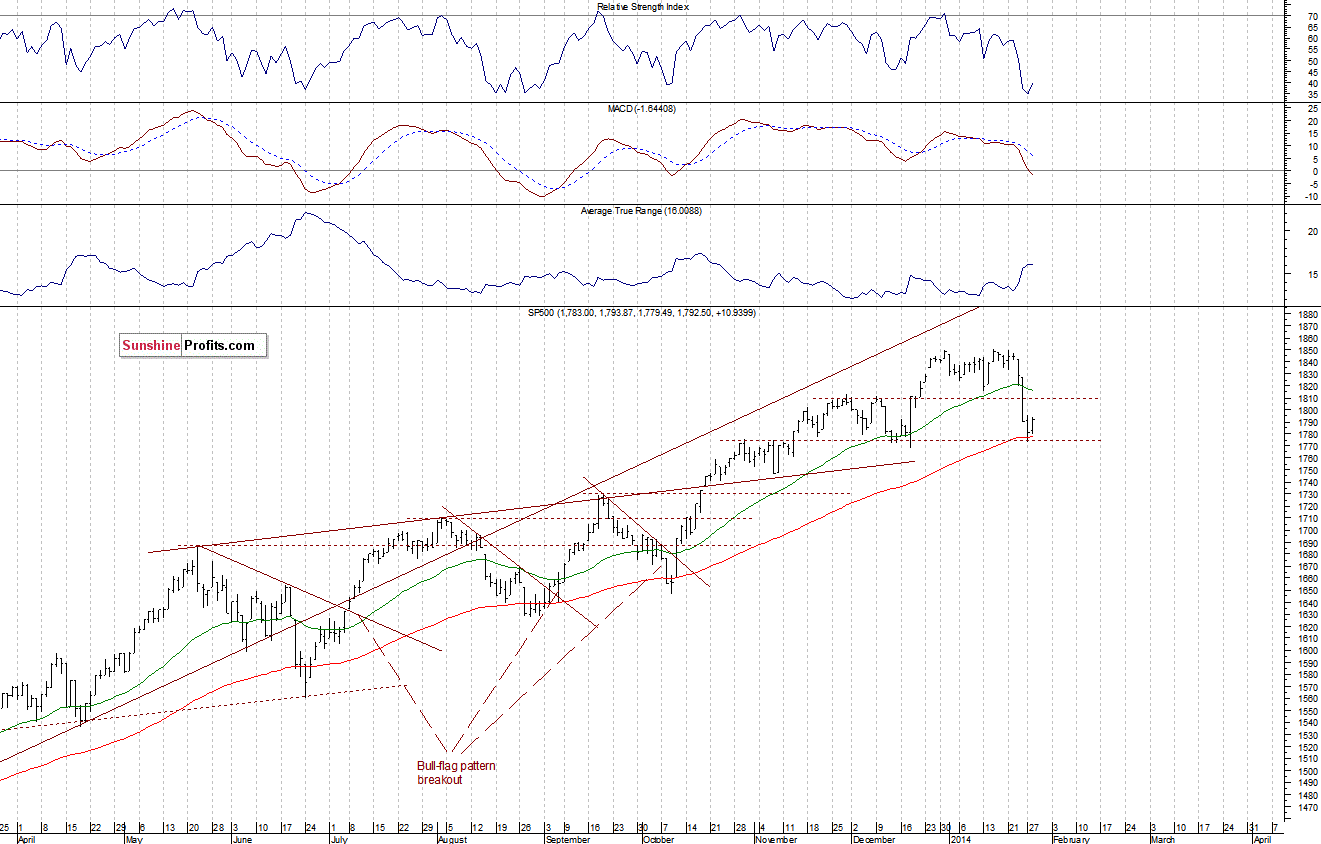

The main U.S. stock market indexes were mixed between -0.1% and +0.6% yesterday, as investors continued to hesitate following recent selloff. The S&P 500 index remained below the level of 1,800, so it looks like a flat correction within downtrend. The nearest important resistance is at 1,800-1,810, marked by the previous support. On the other hand, the support is at around 1,775, marked by November-December local lows, as we can see on the daily chart:

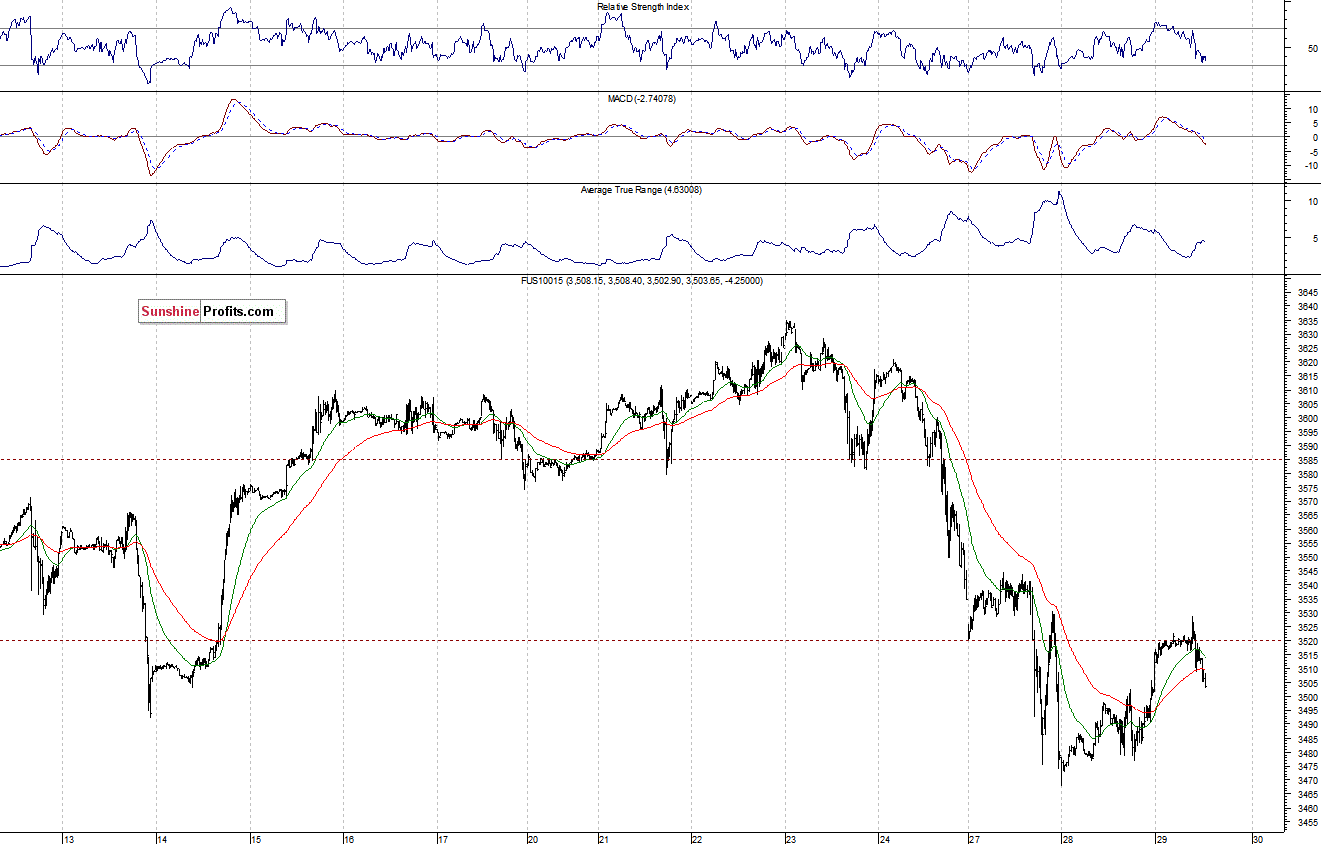

Expectations before the opening of today’s session are slightly negative, with index futures currently down 0.1-0.2%. The European stock market indexes have been mixed so far. Investors will now wait for the FOMC Rate Decision at 2:00 p.m. The S&P 500 futures contract (CFD) bounced off the 1,770-1,780 area, however, it remained below the resistance of 1,800. For now it looks like an upward correction of the recent move down, as the 15-minute chart shows:

The technology stocks Nasdaq 100 futures contract (CFD) analogously bounced off its support at around 3,470-3,480, reaching the nearest resistance at 3,520-3,530. There are no confirmed downtrend reversal signals so far:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts