Oil Trading Alert originally sent to subscribers on January 12, 2015, 9:36 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 1.45% as worries over a glut in global supplies continued to weigh on the price. In these circumstances, light crude approached the recent low, finishing the day slightly above $48. Will April’s 2009 lows pause oil bears for longer?

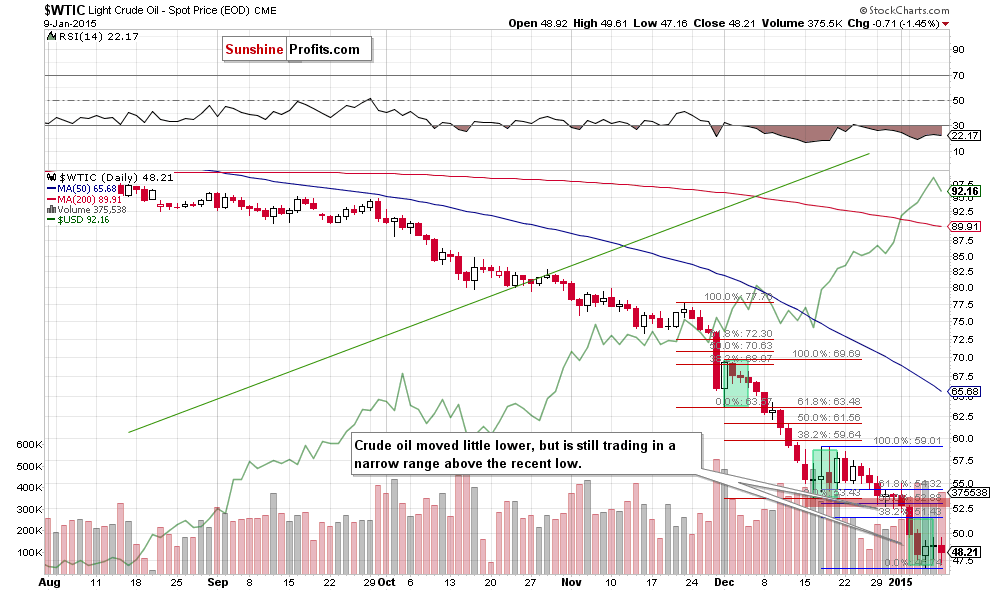

After the market’s open crude oil moved higher supported by data from the Labor Department, which showed that the U.S. economy added 252,000 jobs in December, beating expectations for a 240,000 increase. Despite these numbers, the data also showed that hourly wages declined and more Americans dropped out of the labor market, suggesting the economy may not be as healthy as previously seemed. This news, in combination with ongoing worries over a glut in global supplies, encouraged oil bears to act, which pushed the commodity to an intraday low of $47.16. Despite this drop, light crude rebounded slightly as data showing a sharp drop in U.S. oil drilling rigs supported the price. As a reminder, oil services firm Baker Hughes reported that the number of rigs drilling for oil in the United States fell by 61 last week, which was the largest drop in 24 years. Will this drop support a comeback above the barrier of $50 in the coming week? (charts courtesy of http://stockcharts.com).

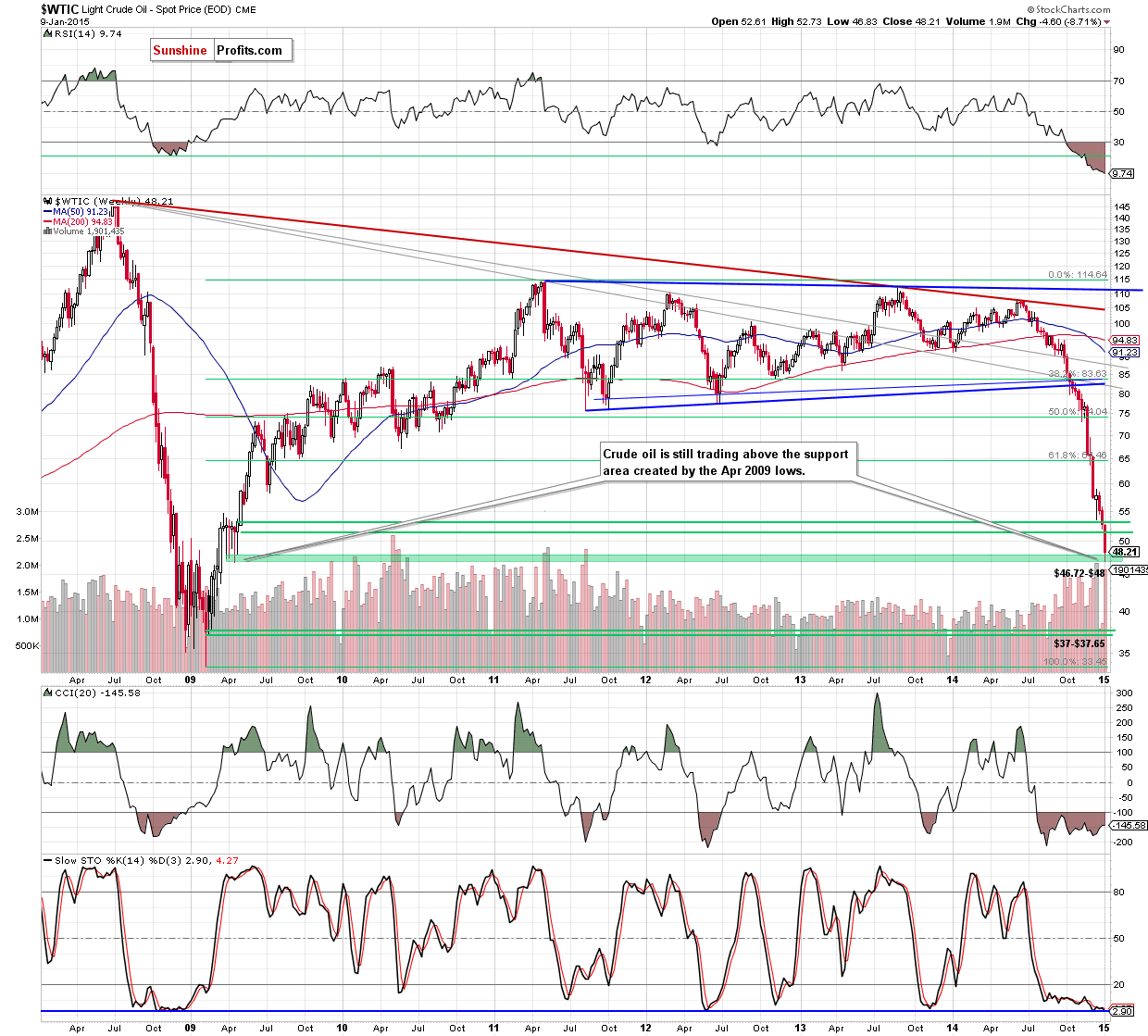

As you see on the charts, although crude oil moved little higher after the market’s open, the commodity reversed and declined, approaching the 2015 low and the green support zone based on the Apr 2009 lows. Taking this fact into account, we believe that our last commentary is up-to-date:

(…) we think that as long as there is no bigger upswing (bigger than $5.85, which won’t be followed by a fresh multi-year low) and a successful breakout above the 38.2% Fibonacci retracement (based on the Dec-Jan decline), a sizable upward move is not likely to be seen and another test of the lower border of the support zone (at $46.72) can’t be ruled out.

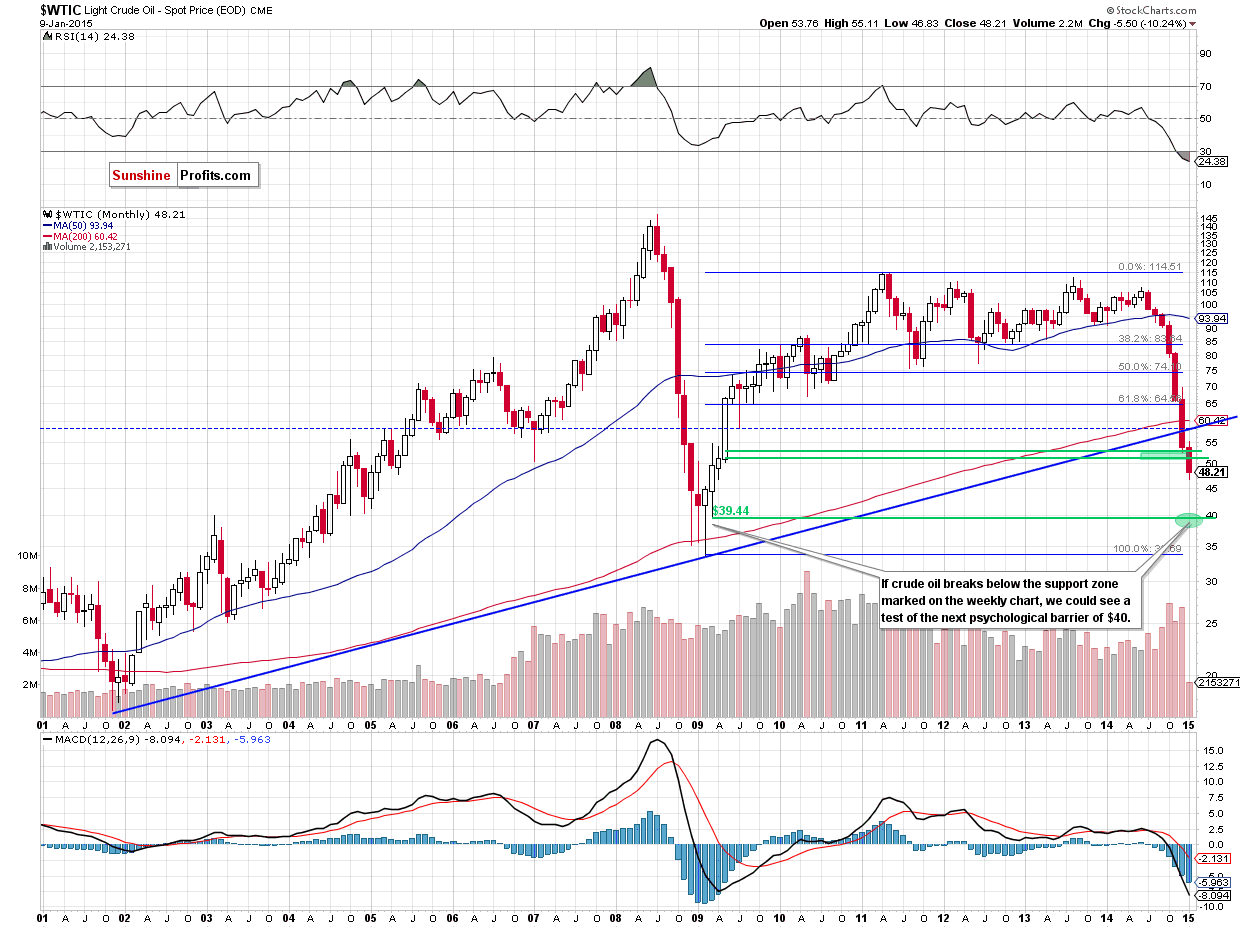

(…) what could happen if light crude drops below this support. (…) if crude oil extends losses, we could see a test of the strength of the next psychologically important barier of $40 in the coming month (this area is supported by the Mar 2009 low of $39.44).

Summing up, crude oil moved little lower, approaching the 2015 low and the green support zone (marked on the weekly chart), which suggests that oil bears could test the strength of the support level at $46.72 in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. However, if we see an invalidation of the breakdown below the level of $50, we’ll consider opening long positions. We will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts