Oil Trading Alert originally sent to subscribers on November 10, 2014, 10:41 AM.

Trading position (short-term; our opinion): Long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective.

On Friday, crude oil gained 0.77% as a weaker dollar and concerns over the situation in Ukraine pushed the price higher. As a result, light crude approached the previously-broken barrier of $80. Is this a sign of strength or the last stop before new lows?

On Friday, the Department of Labor reported that the U.S. economy added 214,000 jobs in Oct. Although it was the 49th straight month of positive job growth, Friday’s numbers missed expectations for an increase of 231,000. In a response, the USD Index, which tracks the performance of the greenback against a basket of six major currencies gave up some gains, slipping below 88 and making crude oil a more attractive commodity among investors holding other currencies. Additionally, the U.S. unemployment rate dropped to a fresh six-year low of 5.8%, suggesting that slack in the labor market is diminishing.

On top of that, the Ukrainian military accused Russia of moving 32 tanks and trucks carrying troops across its border, which sparked concerns that a ceasefire between the two countries could end and disrupt the oil’s export from Russia. In these circumstances, the price of light crude climbed to an intraday high of $79.41. Will we see an invalidation of the breakdown under $80 in the coming days?(charts courtesy of http://stockcharts.com).

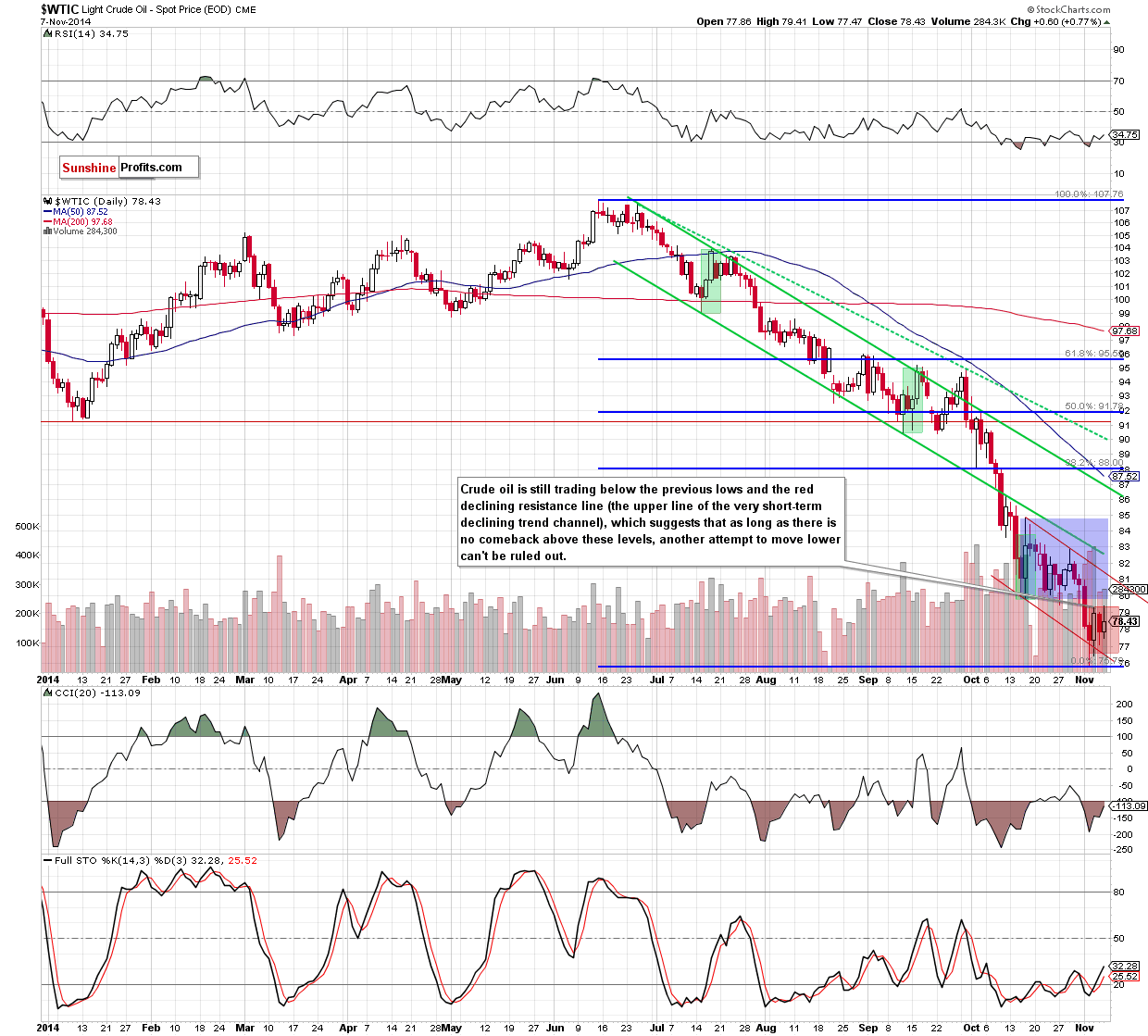

The situation in the medium term hasn’t changed much as crude is still trading in a narrow range between the support zone created by the Aug and Oct 2011 and Jun 2012 lows and the resistance area based on the barrier of $80, the previous lows and the long-term blue resistance line. Therefore, we still think that as long as there is no breakout/breakdown, another sizable upward/downward move is not likely to be seen.

Did the very short-term picture of crude oil change after Friday’s session? Let’s check.

Looking at the daily chart, we see that although crude oil moved little higher on Friday, this one-day increase didn’t change anything as the commodity remains in the consolidation (marked with red) under the previous lows and the barrier of $80. Taking into account buy signals generated by the RSI and Stochastic Oscillator, it seems that we’ll see another attempt to move higher in the coming days. If this is the case, and oil bulls invalidate the breakdown below the above-mentioned resistance area, it will be a strong positive sign, which will trigger an increase to at least $81, where the upper line of the very short-term declining trend channel is. Nevertheless, we should keep in mind that as long as light crude is trading under this resistance zone and the long-term resistance line, another attempt to move lower can’t be ruled out.

Summing up, although crude oil moved little higher, the overall situation in the commodity hasn’t changed much as it is still trading in a narrow range under the solid resistance zone, which could trigger another downswing in the coming week. Nevertheless, taking into account the fact that the space for further declines seems limited, we suggest opening long positions when crude oil drops to $75.82 with a stop-loss order at $73.47.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a buy limit order at $75.82 and a stop-loss at $73.47 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts