Oil Trading Alert originally sent to subscribers on October 29, 2014, 11:13 AM.

Trading position (short-term; our opinion): No positions.

On Tuesday, crude oil gained 1.13% as weaker U.S. dollar supported the price. In this way, the commodity bounced off a multi-month low and closed the day above $81. Did this upswing changed the very short-term outlook?

Yesterday, the Commerce Department showed that durable goods orders fell 1.3% in the previous month, disappointing expectations for a 0.5% increase. Core durable goods orders (without volatile transportation items) dropped 0.2% in September, which was the largest decline in eight months. On top of that, orders for core capital goods fell by 1.7% last month, worse than expectations for a 0.6% increase, while shipments of core capital goods declined 0.2% in the previous month, missing forecasts for a 0.7% gain. Thanks to these bearish numbers, the U.S. dollar declined against major currencies, making crude oil more attractive on dollar-denominated exchanges.

Despite this disappointing data, later in the day, the Conference Board showed that its consumer confidence index increased to 94.5 in October (from 89.0 in the previous month), which fueled hopes that stronger economy will consume more fuel and energy. As a result, light cude extended gains, hitting an intraday high of $81.66. Will we see further rally? (charts courtesy of http://stockcharts.com).

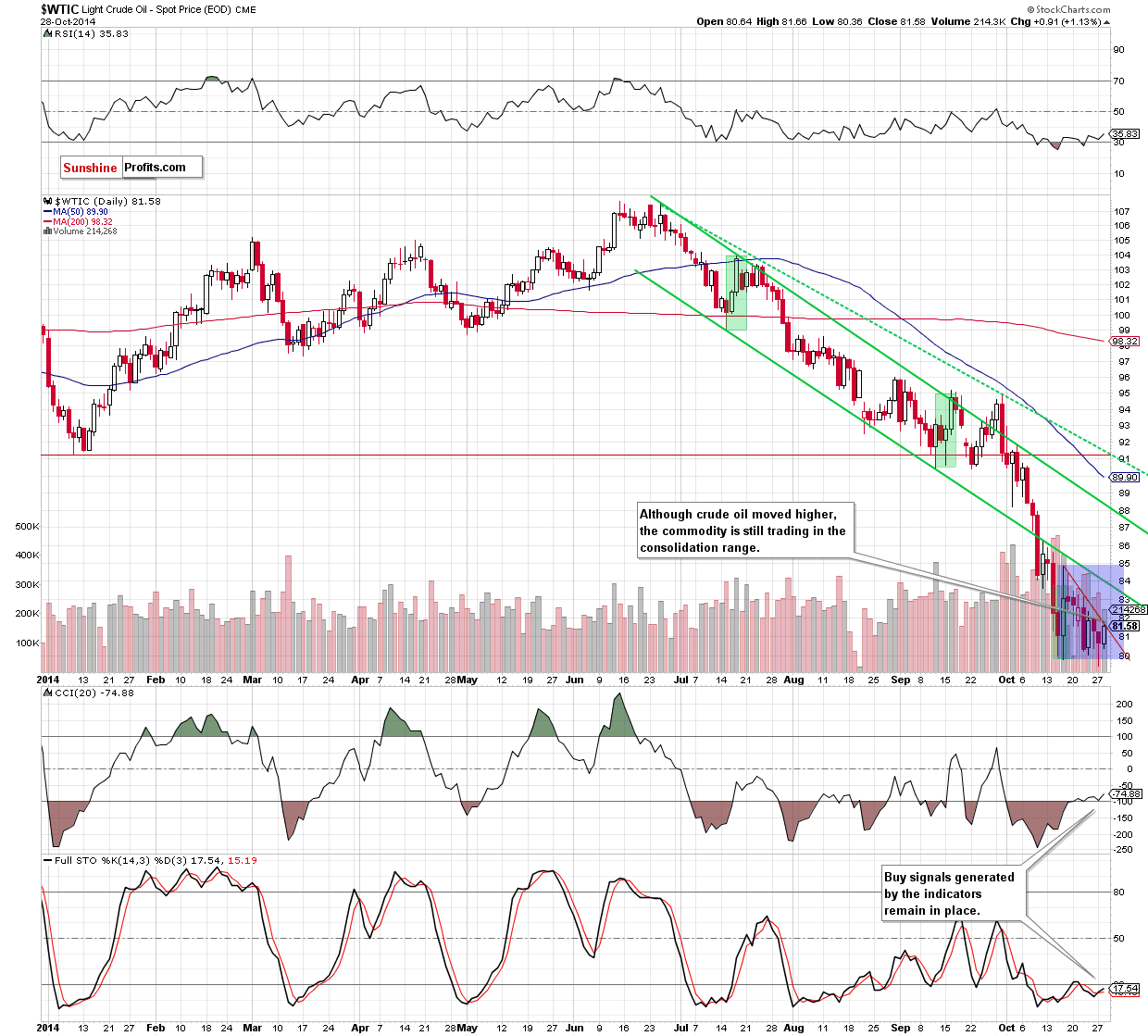

As you see on the above chart, an invalidation of the breakdown below the lower border of the consolidation (and the key support level of $80) encouraged oil bulls to act and resulted in an increase to the very short-term resistance line based on the recent highs. Taking into account buy signals generated by the indicators, it seems that we’ll see further improvement. If this is the case, the initial upside target will be around $83.60, where the lower border of the declining trend channel and the lower long-term grey resistance line are. If oil bulls manage to push light crude above it, a sizable (and profitable) upward move will be more likely. Until this time, another attempt to move lower can’t be ruled out (please keep in mind that the next downside target for oil bears would be around $77.28, where the Jun 2012 low is).

Did yesterday’s upswing affected the medium-term picture? Let’s take a look at the weekly chart and find out.

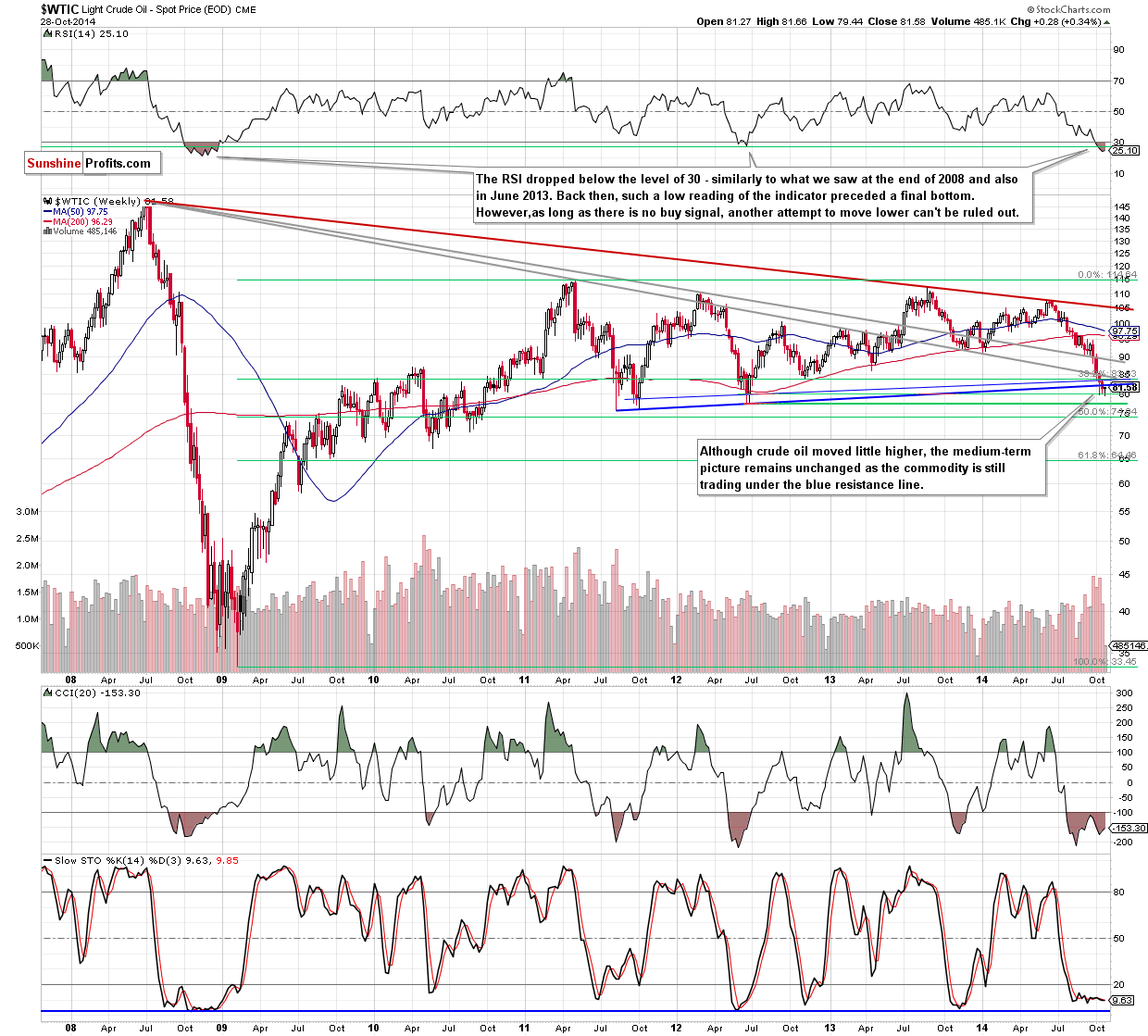

From this perspective, we see that although crude oil rebounded slightly, the situation in the medium-term hasn’t changed much as the commodity is still trading under the first long-term resistance line (marked with blue). In our opinion, as long as oil bulls do not invalidate the breakdown below this line, another sizable upward move is questionable.

Summing up, although crude oil rebounded slightly, the commodity is still trading under the solid resistance zone (created by the medium- and long-term resistance lines), which could pause or stop further rally - similarly to what we saw earlier this month. In our opinion, a sizable (and profitable) upward move will be more likely after a breakout above this area. Until this time, another attempt to move lower can’t be ruled out. Therefore, staying on the sidelines and waiting for the confirmation that the final bottom is in is the best choice at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts