Oil Trading Alert originally sent to subscribers on August 6, 2014, 8:16 AM.

Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 0.83% as worries over plentiful supplies outweighed fears that violence in Iraq, Libya and Ukraine could disrupt production. As a result, light crude declined to its level since February, testing the strength of the nearest support zone. Will it withstand the selling pressure?

Yesterday, the price of crude oil slipped to a fresh six-month low ahead of weekly inventory data, which is expected to show that U.S. oil supplies shrank but product stockpiles grew last week. Although supplies typically drop at this time of year as refineries run at high rates before entering seasonal maintenance in the fall, the busy summer-driving season is coming to an end on Labor Day, and product markets are already well-supplied. Therefore, it seems that oil investors are less concerned about a large supply interruption.

Another bearish factor that affected the price was the U.S. dollar (a strong greenback makes oil more expensive to buyers using foreign currencies), which strengthened after the Institute of Supply Management reported that its non-manufacturing PMI increased to a three-year high of 58.7 in July from a reading of 56.0 in June, beating analysts’ expectations of a 56.3 reading.

Are there any technical factors that could drive crude oil higher or lower in the near future? Let’s check the charts and find out (charts courtesy of http://stockcharts.com).

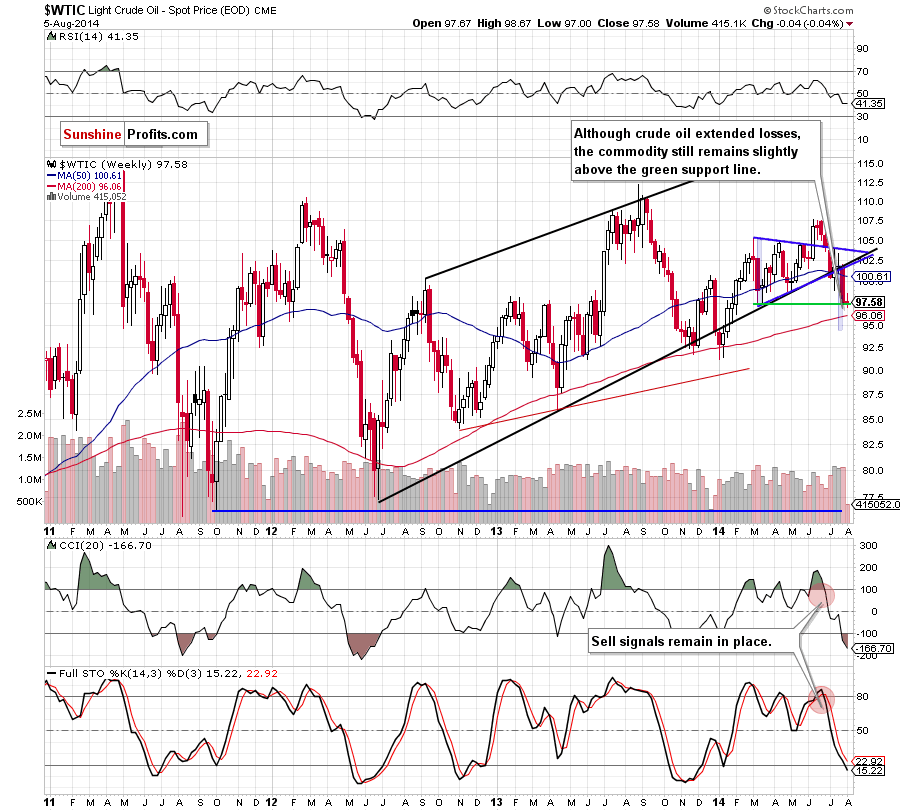

From this perspective, we see that crude oil re-tested the strength of the support level (marked with green) based on the March low. As you see, although there was another drop below it, the commodity moved up and still remains above the green support line. If this support level holds, we’ll see a rebound from here in the coming week and the initial upside target will be around $98.74, where the April low is. If it’s broken, the next resistance would be the June low (at $99) or even the previously-broken psychological barrier of $100. Nevertheless, we should keep in mind that sell signals remain in place (despite the fact that the CCI and Stochastic Oscillator are oversold), which suggests that even if we’ll see a short-term improvement, the commodity may test the strength of the 200-week moving average (currently at $96.06) – similarly to what we saw several times in the past (for example in April, November 2013 and also at the beginning of the year).

Can we infer something more from the very short-term chart? Let’s check.

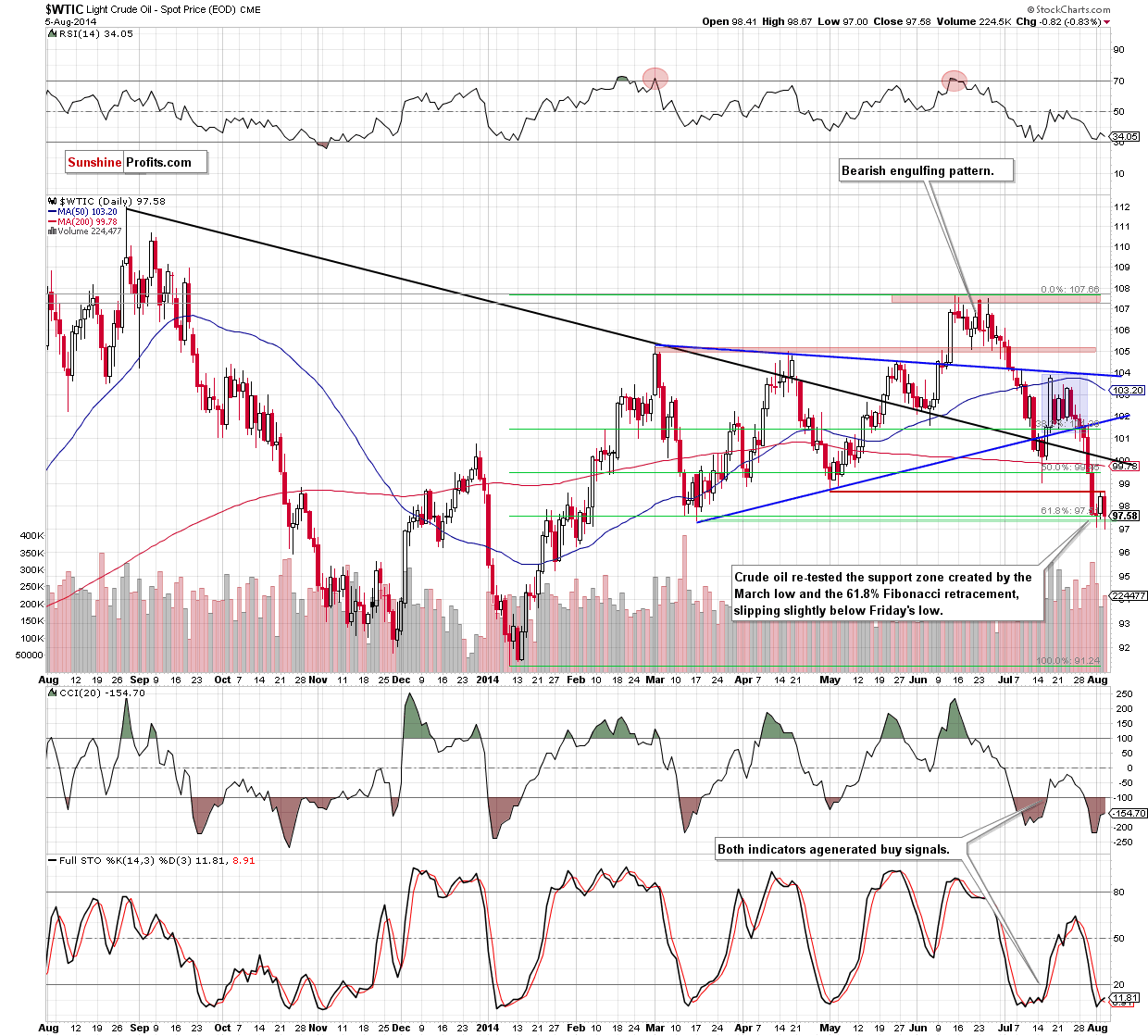

Quoting our last Oil Trading Alert:

(…) crude oil reached its initial upside target. (…) if the nearest resistance holds, the commodity will reverse and test the strength of the green support zone once again. In this case, it could turn out that yesterday’s upswing was nothing more than a verification of the breakdown below the May low, which would be a bearish signal that could trigger further declines.

Yesterday, we saw a realization of the above-mentioned scenario as crude oil slipped below Friday’s low. Although such drop is another bearish sign, this deterioration was only temporarily and the commodity closed the day above the green support zone. At this point, you’re probably wondering what’s next? Unfortunately, the answer to this question is not clear. On one hand, if the support zone withstand another oil bears’ attack, it seems to us that that we’ll see one more try to break above the May low, which still serves as the nearest resistance. On the other hand, if crude oil declines below the recent lows, closing the day below them, we may see a drop to the next downside target around $94.76-$95.21, where the strong support zone (created by the 76.4% and 78.6% Fibonacci retracements based on the entire 2014 rally and the Jan. 27 bottom) is.

Summing up, although crude oil hit a fresh multi-month low, the overall situation hasn’t changed much as the commodity erased some losses and closed the day above the green support zone. Therefore, we think that it’s worth to stay on the sidelines waiting for another profitable buying or selling opportunity as long as we won’t receive more valuable clues about future moves.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts