This essay is based on the Premium Update posted on March 19th, 2010. Visit our archives for more gold articles.

In the March 12-th commentary we've discussed the influence that China might have on the precious metals market and since the feedback was very positive, we decided to provide you with a follow-up.

April 15th is the date to watch. That's when the U.S. Treasury Department is mandated by law to issue a report identifying nations that "manipulate the rate of exchange between their currency and the United States dollar for purposes of ...gaining unfair competitive advantage in international trade."

Does China come to mind?

Already the decibel level in Washington is rising and President Barack Obama isfaced with growing congressional pressure to get tough with China over its currency practices, something he had promised to do during his presidential campaign. The impact of China's currency manipulation on the U.S. economy cannot be overstated, said 130 lawmakers in a letter to U.S. Secretary Timothy Geithner.

"Maintaining its currency at a devalued exchange rate provides a subsidy to Chinese companies and unfairly disadvantages foreign competitors," they wrote. A Treasury Department report labeling China as a "Currency Manipulator" technically would not result in any U.S. actions against China. But invoking the rarely used act-no country has been named since 1994-would likely infuriate Beijing and give Congress new ammunition to pressure for action.

Many economists estimate China's currency is undervalued by 25 to 40 percent, giving it a huge trade advantage by effectively subsidizing its exports making them artificially competitive. Many U.S. lawmakers blame the lost manufacturing jobs and the huge U.S. trade deficit on this. In essence, China gets a huge trade advantage. An undervalued Chinese currency means that Chinese products are cheaper for U.S. consumers, and American products cost more in the Chinese market.

Some go so far as to say the undervaluation of the renminbi has become a significant drag not just on the American economy, but also on global economic recovery.

The New York Times minced no words in a strong editorial last Wednesday.

"China's decision to base its economic growth on exporting deliberately undervalued goods is threatening economies around the world. It is fueling huge trade deficits in the United States and Europe. Even worse, it is crowding out exports from other developing countries, threatening their hopes of recovery."

This issue is nothing new. There have been complaints that China was manipulating its currency by selling renminbi and buying foreign currencies for at least the past seven years. Since 2003, China's central bank has been purchasing huge amounts of dollars to keep the value of its currency artificially low against the dollar. China eased off somewhat in 2005, allowing its currency to appreciate slowly from 8.25 renminbi to the dollar, to about 6.83 renminbi by 2008. As the global recession hit, China made moves to protect its exports. Since then the renminbi has remained at about 6.83.

Today, China is adding more than $30 billion a month to its $2.4 trillion hoard of reserves. The International Monetary Fund expects China to have a 2010 current surplus of more than $450 billion.

In the last report, issued in October, the Treasury Department said it had "serious concerns" about a lack of flexibility in the value of China's currency against other currencies, but didn't go so far as to label China as a "currency manipulator." If China had been thus designated, it would have triggered negotiations between the two countries and could have lead to economic sanctions if the U.S. took a case before the World Trade Organization.

According to Nobel Prize winning economist Paul Krugman, most of the world's large economies are stuck in a liquidity trap as they are unable to jumpstart a recovery by cutting interest rates because the rates are already near zero.

"China, by engineering an unwarranted trade surplus, is in effect imposing an anti-stimulus on these economies, which they can't offset," wrote Krugman in a recent New York Times column.

So far China seems nonplused by criticism and is behaving with new assertiveness. It is in no mood for lectures from Washington. After all, it is the world's only major economy still growing strongly, and it is the U.S.'s largest creditor. It makes no secret of its disdain for U.S. economic management.

In his annual press conference this Sunday Chinese Premier Wen Jiabao aimed sharp words at Washington, ceding little ground on China's currency policy.

"First of all, I do not think the renminbi is undervalued," Mr. Wen said "We are opposed to countries pointing fingers at each other or taking strong measures to force other countries to appreciate their currencies. To do this is not beneficial to reform of the renminbi exchange-rate regime."

He accused unnamed competitors (read U.S.A.) of trying to bail out their own slumping economies by hamstringing the Chinese juggernaut.

"I understand some economies want to increase their exports," he said, "but what I don't understand is the practice of depreciating one's own currency and attempting to force other countries to appreciate their own currencies, just for the purpose of increasing their own exports."

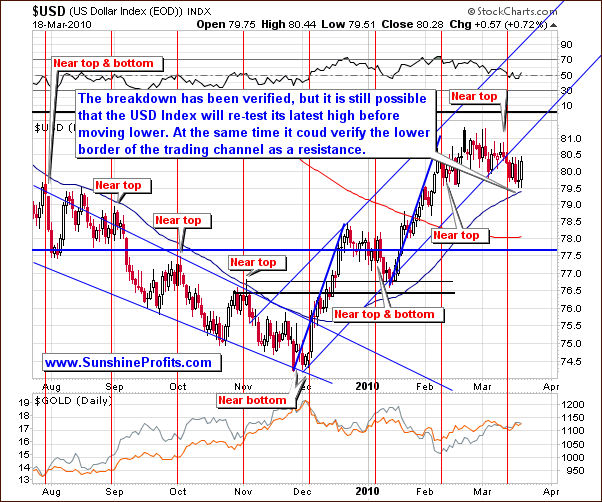

Some ask what would happen if the Chinese took their dollar holdings, equal to around 10% of US GDP, and switched them into other currencies. The USD would plunge - but that is not in China's interest, because this means that China would be selling part of its holdings at much lower prices. Therefore, it might be in China's best interest to see the USD decline in a stable manner instead of one last drop. Let's take a look on the long-term USD chart (charts courtesy of http://stockcharts.com) for details regarding the current situation, as we've seen particularly interesting patterns last week.

We saw the USD index break below the up trending channel line. This move was confirmed with 3 consecutive closes below the lower channel trend line, so the next significant move in the index is likely to be down. The USD index still is having a low correlation with the precious metals sector, which means that either action doesn't necessarily influence value of PMs.

However, what we did see recently is the relatively high (and negative) correlation between the general stock market and the USD Index. Should the latter find some temporary support at its 50-day moving average and move higher, perhaps to re-test its recent high, we could see the USD Index move higher along with lower values of gold.

Let's take a look on the short-term chart for more details.

Since the RSI remains pretty much in the middle of its trading range indicating that next move could be in either direction. Still, the USD Index moved higher, and at the same time it tested its previous high along with the recently broken lower border of the previous trading channel. Both levels managed to prevent the USD Index from rising further, which means that USD Index is likely to move lower from here.

Summing up,there is still a low correlation between PM stocks and the USD Index in the short-term, but it seems that we might see it become visibly negative once again. With a mixed RSI signal and confirmation of the downward breakout the most likely short-term action is climbing to recent highs and then resuming the lower channel breakout, which would serve as a positive factor in the medium-term for the PM sector. As always, should the situation change, we will send out a Market Alert to our Subscribers.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

The biggest story this week was that the general stock market managed to move above the the January 2010 high. The breakout was not confirmed yet by all signals, so we take a closer look on each of them end let you know what we believe is likely to take place next - and most of all - how it's likely to influence the value of gold, silver and PM stocks.

The second biggest story this week was the move lower in the USD Index, which closed above its previous trading channel for more than three consecutive days. Again, this week's Premium Update includes our comments on how it might influence portfolios of PM Investors and Speculators.

This Update is an extensive follow-up on the Market Alert that we've sent on Wednesday, and it features 4 charts dedicated to the general stock market (including the Dow Jones Transportation Average), 2 charts of the USD Index, 2 gold charts, 4 silver charts (including two very-long-term charts providing targets for the coming decline), and 2 charts dedicated to PM stocks. Moreover, we've analyzed charts of the Gold Miners Bullish Percent Index, and Platinum - both of them provide us with important signals. Additionally, we feature the Trix indicator that used to provide major buy signals and comment on what it tells us today. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.