This essay is based on the Premium Update posted on November 12th, 2010. Visit our archives for more gold articles.

The biggest point of discussion over the past few days has been the relative strong performance of the US Dollar and its impact on precious metals. Precious metals continue to be negatively correlated with the USD Index, although to a lesser extent. Gold, silver and mining stocks have held much of their recent gains even as the dollar rallied. It appears that metals have been moving in tune with the general stock market more so than the dollar and it seems that when watching stocks has become more important recently for precious metals investors. A rally is likely in the coming months and a stronger correlation could be seen in the days ahead.

The USD Index which surprisingly has rallied recently will likely reach a local top fairly soon. Stocks appear likely to continue their rally although this may slow or pause for a time in the week ahead. The implications for gold, silver, and mining stocks are a similar pause followed by a big rally. Their recent show of strength bodes well for a bullish outlook for the medium term.

The most important target level discussed this week is the $1,600 level for gold. Confirmation of a breakout is needed first and then strong rally will likely follow. A local bottom will likely be seen soon and investors should wait before adding to speculative positions

Gold at the Crossroads - Long-Term Bullish but Short-Term cautious

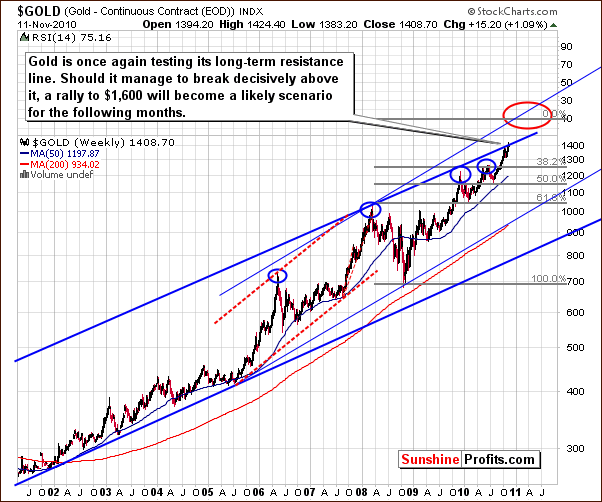

At first glance, gold seems to be heading up with no limit in sight but a closer inspection of recent moves shows that no breakout has been seen yet. Gold's price has moved slightly above the upper border of the long-term trading channel created by the recent bull market but the move has not been confirmed. Several days of trading above this level would be needed for confirmation of such a breakout.

Additionally, this can at times be an imprecise chart and some misrepresentations can occur when working with very long-term data. Zooming in more closely, we can see that gold has actually touched the trading channel and then moved lower but it is clear that no breakout has been seen - yet.

The target level for gold's next rally has been moved up to $1,600 using the Phi factor of 1.618 to obtain this estimate. Once a breakout is seen, a big rally is quite likely. It is important to note here that this may not be immediate or even soon as it could actually take several weeks or more to develop. If the breakout is seen, a move to the long side will likely be best and if gold corrects, speculative positions could then be taken at more attractive lower price levels. Either way, exciting times seem to be on the horizon for gold traders and speculators alike.

Gold in a Consolidation Phase?

From a non-USD perspective, the signals are long-term bullish but short-term cautious. The patterns for several years have been somewhat predictable as a period of very strong rally is regularly followed by a lengthy period of consolidation or sideways movement. This was seen from late in 2008 to the middle of 2009 and again late last year through our present point in 2010. Perhaps both of the upper borders in our chart could be reached in the near future but this is not at all a certainty at this point, merely a possibility.

A small consolidation from a non-USD perspective may correspond to a similar trend on the USD side. The rally, which will likely follow could last for several months, thus making any small price decline which was missed insignificant. Of course, as is normally the case, not enough details are currently available to state this as anything more than a possibility at this time. It does seems worthy of discussion, however, as the upside could be quite profitable for those whose timing is accurate.

Possible Pause in Mining Stocks'Rally

The GDX:SPY ratio measures mining stocks outperformance relative to the general stock market. For the short-term, bearish signs have been seen. High volume levels accompany local tops and a recent spike in volume indicates we may were at that point. Consequently, the decline that we've seen since that time, was not something unexpected and at this point is no proof that the rally is completely over. The pause may take a few weeks, but we will leave the details to our Subscribers.

Summing up, mining stocks are truly at a critical point. It appears they have indeed broken out to new highs. However, before stating that we expect a continuation of a rally, we feel that the mining stocks need to take a breather. This consolidation will likely ensure strength for the major tops yet to come. Target levels for this next move will be set and published once breakouts have been verified.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

This week, our Premium Update comes with 22 charts, which allow us to visually illustrate our discussion points. Our 5 gold-, 4 silver- and 3 mining stock charts are accompanied this week by additional charts related to the USD Index (2 charts) and stocks (4 charts) as well as the unveiling of our NEW Correlation Matrix. Additionally, we provide 3 charts dedicated to our unique indicators, which have flashed signals recently.

As the impact of the Feds recent QE2 move continues to take shape, market actions, we expect to see more surprises and opportunities to profit if positioned properly. We provide the likely targets (short and long-term) for the gold and silver. Once again, we will continue to sort it all out for our Subscribers and emphasize what to watch for and what to expect in the days, weeks, and months ahead.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.