Gold & Silver Trading Alert originally sent to subscribers on March 5, 2014, 7:37 AM.

Briefly: In our opinion short speculative positions (half) in silver and mining stocks are justified from the risk/reward perspective. We are closing half of the long-term investment position in gold.

As you know, we had been expecting the tensions in Ukraine to cause a significant rally in gold (not necessarily in the rest of the precious metals sector). Not only wasn’t that the case on Monday – the rally indeed took place, but it was rather average, but gold managed to decline on Tuesday while there was no visible improvement in the situation in Ukraine and on the Crimea peninsula.

Gold is not performing as strongly as it should. That is a major bearish factor. Let’s examine the situation more closely (charts courtesy of http://stockcharts.com.)

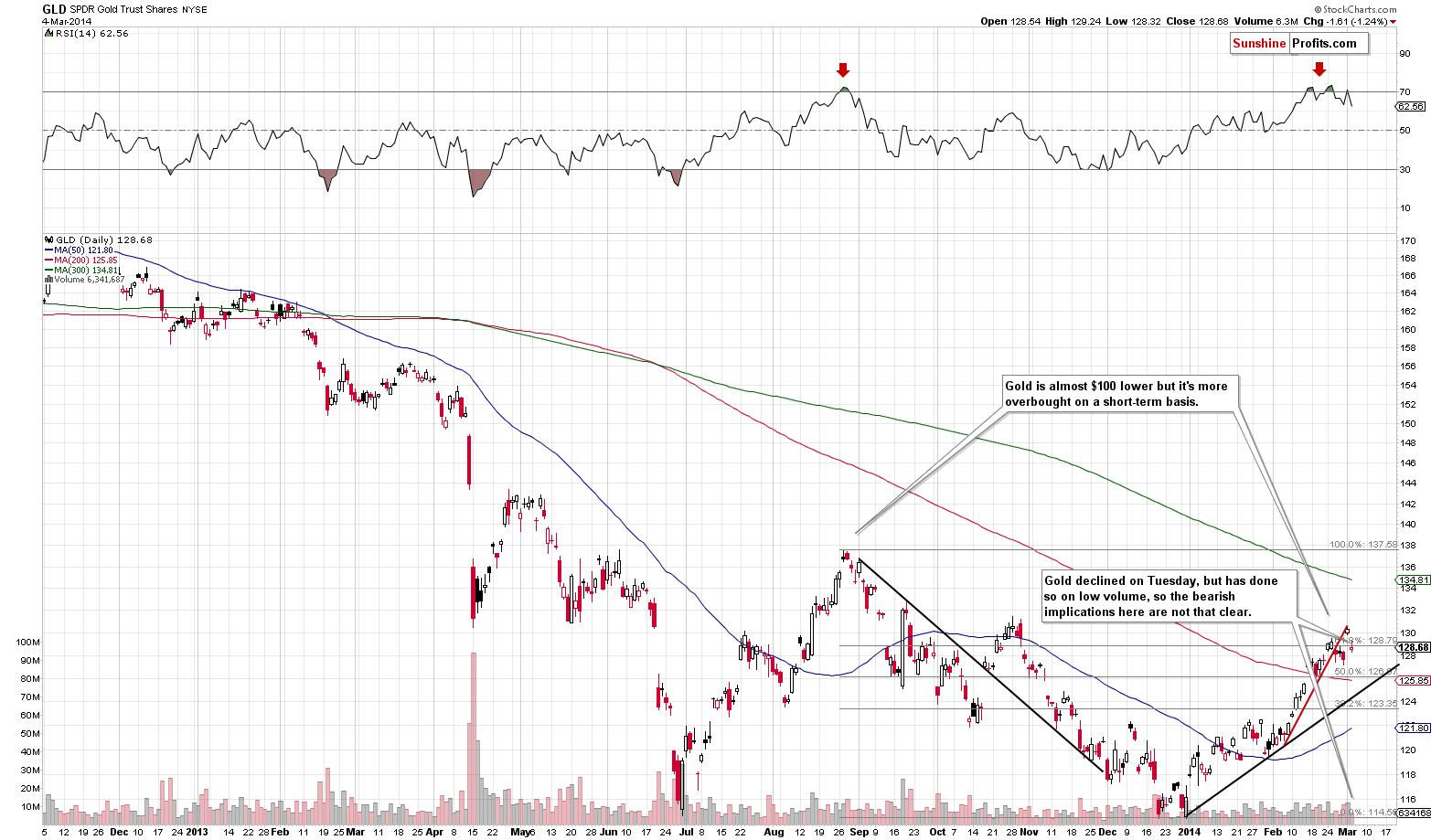

The move above the 61.8% Fibonacci retracement level was invalidated yesterday. The move lower took place on low volume, which doesn’t confirm the rally. However, that’s not the most important thing to focus on – gold’s performance in light of the most recent events is. As mentioned earlier, it didn’t rally. In fact it’s more or less where it was a week ago. The implications are bearish.

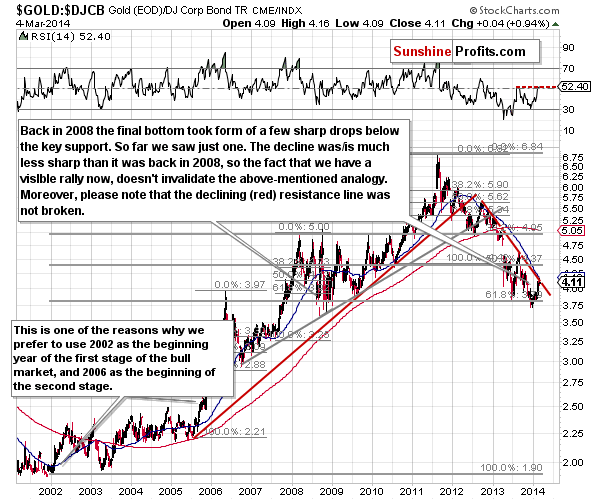

From the gold to bonds perspective, the downtrend simply remains in place. There has been no breakout above the declining resistance line (marked in red), so the precious metals market is still likely to decline once again.

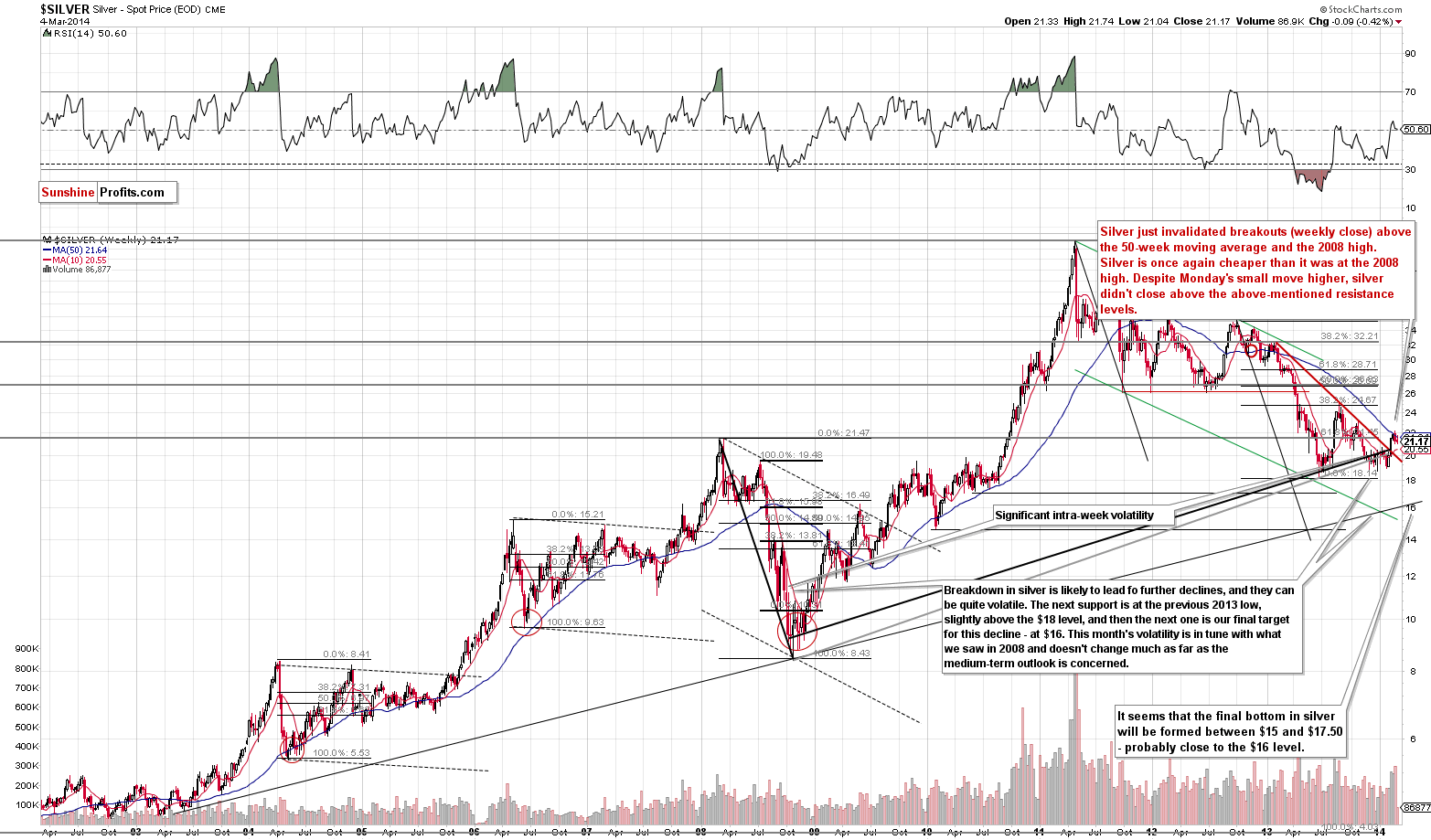

Silver’s performance has been weak, if not very weak. Not only did it not really rally on Monday, but it declined more on Tuesday than it had rallied on Monday and it’s now 0.42% lower than it was last week.

Some might say that the white metal is almost flat, and that is correct, but the point is that it’s almost flat (on the south side of being flat) when the geopolitical tensions are rising significantly. This is a significant underperformance relative to what’s going on in the world.

What we wrote yesterday remains up-to-date:

Meanwhile, silver invalidated the breakout above the 50-week moving average, the 2008 high and the 61.8% retracement level based on the entire bull market. The weekly volume is highest in months, which confirms the significance of the invalidation. Actually, the last time we saw volume that was similar was at the beginning of the previous decline in mid-2013.

Silver is still above the declining red support line, but drawing an analogous line in mid-2013 would also have given us a breakout that turned out to be a fake one.

The situation in silver was bearish based on Friday’s closing prices and it has further deteriorated based on the lack of rally this week despite reasons to make a move higher.

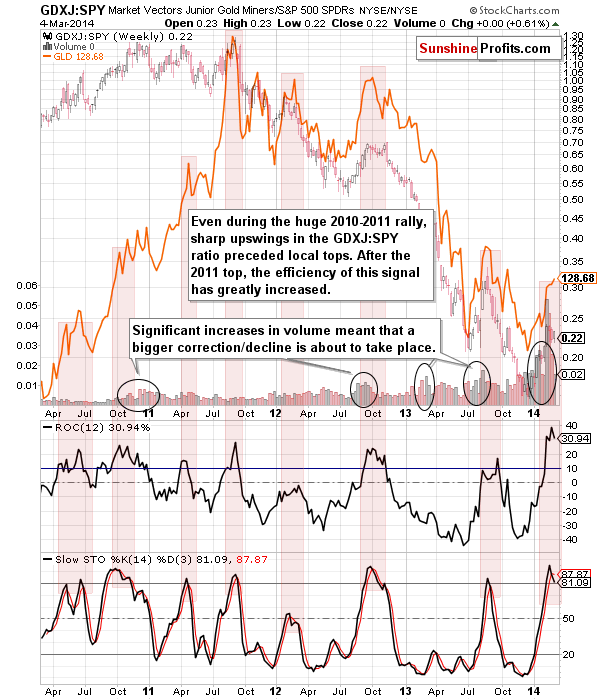

Not too long ago we wrote that the juniors to stocks ratio could indicate local tops in the precious metals market if one looked at it correctly. The things that we were focusing on were spikes in volume (we have seen a major one) and sell signals from the ROC indicator (a decline after being above the 10 level) and the Stochastic indicator. We have seen both recently. Consequently, it seems that the precious metals market will move lower sooner rather than later.

The USD Index moved a bit higher and mining stocks declined, both of which confirm the above bearish indications.

All in all, it doesn’t seem that keeping the full long position in the investment category is justified at this point in our view. Based on this weekend’s events it was likely that gold would move much higher – but its reaction has been very weak. It looks like there will be no rally in gold before a bigger decline. We are keeping half of the funds in gold, though, just in case the next days bring improvement. If not – things will become even more bearish and we will likely adjust the position once again.

We might suggest changing the short-term speculative position and / or the long-term investment one shortly, based on how the markets react and what happens in Ukraine. We will keep you – our subscribers – informed.

To summarize:

Trading capital (our opinion): Short position (half): silver and mining stocks.

Stop-loss details:

- Silver: $22.60

- GDX ETF: $28.9

Long-term capital: Half position in gold, no positions in silver, platinum and mining stocks.

Insurance capital: Full position

Please note that we have started to include the insurance capital on the above list in order to avoid the impression that we suggest being entirely out of the precious metals market. Those of you who have been with us for a long time are well aware of this, but since a lot of new subscribers have joined us recently, we though a quick reminder should be useful.

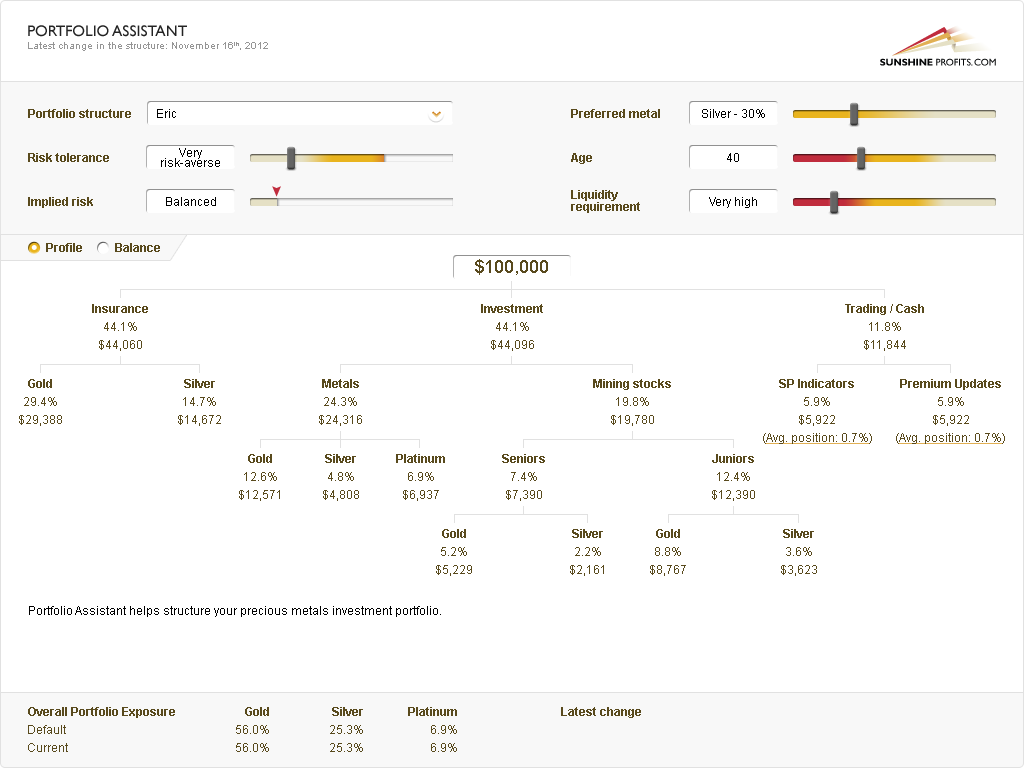

We have suggested being out with one’s long-term investment capital, but being in as far as the insurance capital (physical precious metals holdings) is concerned. You will find details on our thoughts on gold portfolio structuring in the Key Insights section, but in short, it depends on your approach and experience. Below you will find a “portfolio” that we created for Eric – the fictional character that we use to illustrate suggestions (not investment recommendations) for beginning investors. More precisely, this was the portfolio before we suggested moving out of the precious metals market (so, before April 2013).

Now the “investment” category would be 0%, but the insurance remains at 44.1%. Please note that the average size for the trading position (we provide the netted amount in the above points regarding positions / trades) is just 1.4% of the entire capital in this case, so half of the position means using just 0.7% (11.8% is kept in cash / dedicated to trading but only a part of it is used for each trade). The entire portfolio report provides also 2 other fictional characters and their “portfolios”. John being the proxy for an experienced investor is the other extreme (Eric being the beginner). He “has” 17.6% in insurance capital and the average size of his trading position is 31.6% (half of which is 15.8%).

The bottom line is that if you assume that precious metals have much further to go (beyond 2011 highs) like we do, having just some money in the sector might appear as being out – and opening a small speculative short position in addition to it might seem as betting against it. When one looks at it from a “fresh perspective” without any assumptions about the gold bull and reads about shorting, they might get the impression that we suggest being entirely out of the market, which is not the case. Actually, the netted effect of small speculative short positions is simply hedging the insurance capital to a smaller or greater extent. It might be more than that if we suggest doubling the size of the short position, but that’s not the case just yet. Of course the above is not an investment advice and consulting an investment advisor before taking action regarding your portfolio is encouraged.

As always, we'll keep our subscribers updated should our views on the market change.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief.

Gold & Silver Trading Alerts