This year clearly showed that the yellow metal’s price depends not only on central bank’s policies, but also on geopolitical factors. Traditionally, geopolitical problems are positively correlated with the price of gold. Gold has been safe haven during any kind of turmoil for five thousand years. But there are some caveats to be aware of.

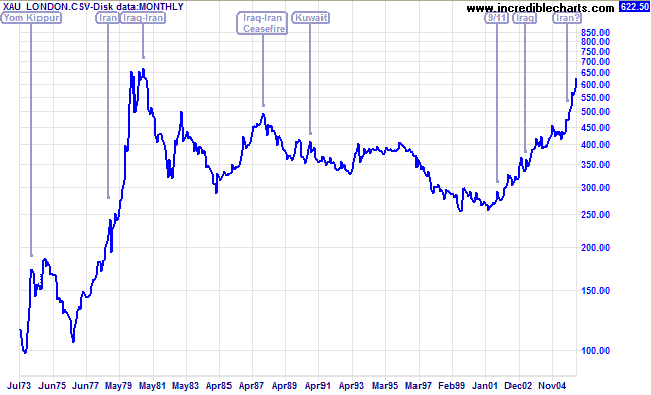

Many historical examples suggest that the price of gold rises before military actions rather than during them. Gold gains due to threat of war or the rise in global uncertainty. But not all military actions increase uncertainty; some of them clearly decrease it. For example, Operation Desert Storm during the Gulf War in 1991 reduced political risks in the Middle East. Similarly, not all crises affect the gold market. For example, gold would probably respond to the potential conflict between Pakistan and India (strongly gold-oriented countries) or to turmoil in South Africa (one of the main gold’s producers), but it did not significantly respond to the Falklands War (where the heck are Falklands?!).

Graph no. 5: Gold price during some military conflicts

Source: incrediblecharts.com

Second, it seems that this traditional correlation between geopolitical risk and rising prices of gold is weaker than in the past. Taking into account the number and potential economic importance of current geopolitical risks gold should have sky rocketed. However, it did not. Instead, it is traded horizontally in the 8% range corridor since April. Why is that? One part of the story is that gold has probably gotten ahead of itself during the previous 10 years of rallying and had to correct these gains in the following years. Another explanation could be even simpler: greater geopolitical risk is the new norm. Gaza has faced geopolitical problems for 40 years now. It does not mean that investors do not pay attention to them, but rather that they already take them into account. Investors are also more capable of gathering relevant information, assessing the risks and protecting themselves accordingly. Gold can be regarded as the insurance policy, but it is not the only player in town.

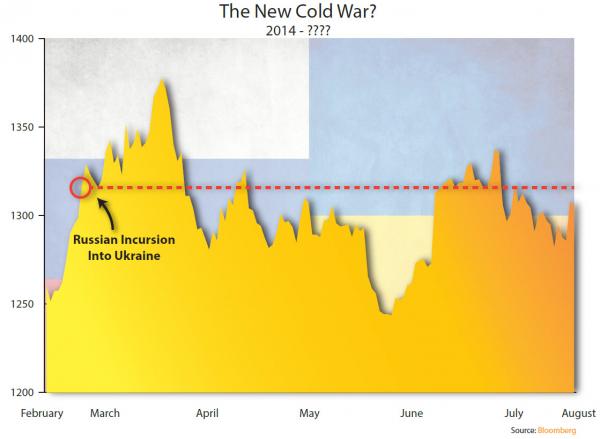

Additionally, investors consider many geopolitical incidents as short-term risks. This can explain why the price of gold often spikes at the beginning of a new crisis, but after a while falls again, sometimes to the pre-crisis level.

However, we should not lose sight of central banks’ actions. The accommodative monetary policies and the record low interest rates increase the risk taking and cap price of gold. Investors are more prone to take or accept higher risks if they expect to be protected by the central banks or governments always being ready to develop bailouts.

The bottom line is that the only generalization is that there is no generalization. It means that gold does not necessarily gains during crises, because its behavior depends on many factors including the economic context of the particular situation. For example, the need for cash can be greater than the demand for a safe haven, as it was probably in the case of the Libyan civil war and the Japanese earthquake in 2011. Therefore, although we consider gold as long-term insurance against future political tensions (among many other things), we do not advise automatically buying gold because of the rise of the geopolitical risks. These issues are very complex and it is extremely difficult to correctly predict the future courses of action and their impact on the gold market. Investors should be aware that not all conflicts affect the price of gold (positively) and even when they do, crises often do not escalate further, so investors risk purchasing gold at unfortunate times, after the momentum has passed. In many historical cases after the initial spike, the price of gold quickly returned to the pre-crisis level (Graphs 1 and 2).

Long-term investors should not make a decision based only on geopolitical events, which often strengthen gold support only in the short-term, but always look at the fundamentals. The latest report of World Gold Council for Q2 2014 shows that demand (even demand for physical bullion) for gold actually decreased (about 125 tonnes compared to Q1 2014 and 16 tonnes compared to Q2 2013), despite the geopolitical concerns.

Hence, the importance of the geopolitical concerns (a.k.a. current events) is often overstated. Unless investors believe that the world is on the edge of the next Cold War, or even the Third World War, or live in the region affected by the conflict, they should be guided by the fundamentals and not by the geopolitical concerns that are popular in the media at a given point in time. Crises should be regarded rather as possible bonus or premium factors contributing to the rise in the price of gold.

Graph no. 6: Gold price since Russian incursion into Ukraine

Source: zerohedge.com

Long-term trends are shaped by fundamentals while shorter-term trends can be attributed to investors’ and traders’ emotions – the impact of geopolitical concerns can trigger some moves, but their impact seems to average out over the long run.

Stay updated on the latest developments in the gold market by joining our gold newsletter. It’s free and you can unsubscribe in just a few clicks.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor