Bitcoin Trading Alert originally sent to subscribers on May 19, 2015, 11:28 AM.

In short: short speculative positions, $stop-loss at $247, take-profit at $153.

Bitcoin is just ahead of a possibly important change in the design of the Bitcoin currency, we read on the MIT Technology Review website:

In a test of Bitcoin’s ability to adapt to its own growing popularity, the Bitcoin community is facing a dilemma: how to change Bitcoin’s core software so that the growing volume of transactions doesn’t overwhelm the network. Some fear that the network, as it’s currently designed, could become overwhelmed as early as next year.

(...)

The technical problem, which most agree is solvable, is that Bitcoin’s network now has a fixed capacity for transactions. Before he or she disappeared, Bitcoin’s mysterious creator, Satoshi Nakamoto, limited the size of a “block,” or group of transactions, to one megabyte. (…)

Under the one-megabyte-per-block limit, the network can process only about three transactions per second. If Bitcoin becomes a mainstream payment system, or even a platform for all kinds of other online business besides payments (…), it’s going to have to process a lot more. Visa, by comparison, says its network can process more than 24,000 transactions per second.

The developers in charge of maintaining Bitcoin’s core software have been aware of this impending problem for a while. Gavin Andresen, who has led work on Bitcoin’s core code since Nakamoto handed him the reins in 2010 (…) got more specific, proposing that the maximum block size be increased to 20 megabytes starting in March 2016, calling this the “simplest possible set of changes that will work.” (…)

This might be a bit technical, but the important part is that Bitcoin developers will have to decide on a change to the network that will have possibly important implications for how the whole system operates. Bitcoin might gain capacity but this could mean that the transactions will become slower. The decision on the size of the “block” is still to be confirmed and implemented so the changes might still be some time from now but it will definitely be interesting to see what kind of impact this will have on the Bitcoin network.

For now, let’s focus on the charts.

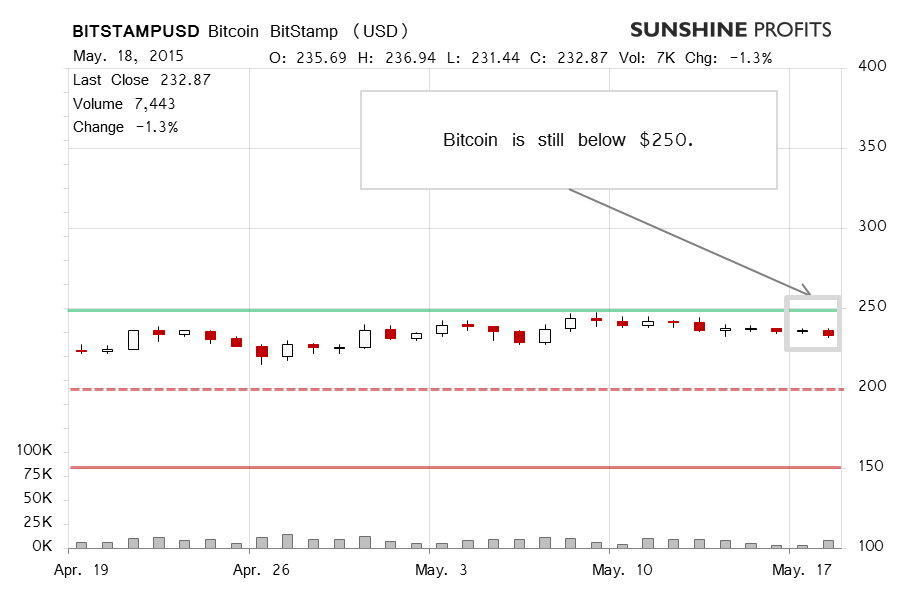

On BitStamp, we saw a move down, not by much but visible nonetheless. The volume was up from the day before. The move was not really very significant on its own but it might hold some clues for traders. If you recall, yesterday we wrote:

(…) Bitcoin stayed below $250 (green line in the charts) and didn’t really show any signs of a violent move up. Does this mean that the perceived boredom is to persist? Not necessarily, and we don’t think that the current situation is boring.

Bitcoin might not be moving almost at all but this doesn’t means that it will continue to do so for much longer. Bitcoin might stay at the current levels but this doesn’t really improve the short-term outlook at all. With Bitcoin below $250 and failing to move up, we might see a stronger move to the downside in the days and weeks to come. This makes the current environment interesting rather than boring, in our opinion, and the situation remains tense.

The situation is still tense but the fact that Bitcoin hasn’t moved higher in some time now and that volume was up on a day of a decline might suggest that a move down might be in the cards, if not now, then in the near future.

On the long-term BTC-e chart, we see that Bitcoin is now below a possible trend line. Couple that with a move down yesterday, and the fact that Bitcoin has been in decline for some time now, and with what we wrote yesterday:

We just saw a first weak confirmation of a possible move down. Is this time to open shorts? We would prefer to wait for Bitcoin to start moving down, which would provide us with more of a confirmation. We don’t rule out a hypothetical short position if Bitcoin fails to move up in the next couple of days, so stay tuned.

The confirmation from yesterday just got stronger, especially since the move below the possible trend line might be now confirmed and the move down yesterday was on higher volume, not necessarily very high but higher than in the last couple of days. It might also be the case that any move up could stop around $250 (green line) while the downside might be more significant since Bitcoin might move to $200 (dashed red line) or even lower. We have stop-loss levels in place to guard the hypothetical position from any move up. Our bet now is on Bitcoin going down.

Summing up, speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, $stop-loss $247, take-profit at $153.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts