Bitcoin Trading Alert originally sent to subscribers on December 23, 2014, 7:24 AM.

In short: no speculative positions.

We’ve read an interesting article on Quartz about the possibility that the “gold rush” of Bitcoin miners has effectively come to an end:

(…) one area of the bitcoin economy is maturing much faster than the others, to the point where profits are increasingly harder to come by and consolidation and diversification are already happening: the mining of bitcoins. For years, bitcoins were mined largely by a far-flung network of desktop hobbyists. But increasingly, a smaller group of companies building large data centers set up for the sole task of mining new bitcoins.

(...)

Perhaps the biggest squeeze on smaller miners has been the drop in the price of bitcoins. After surging from $99 to $1,147 late last year, bitcoin has fallen back to $344 this week, a decline of 70% from the peak. One big reason for the decline is thought to be the race itself to mine bitcoins: As miners sold their bitcoin rewards to finance new equipment, those coins added to the overall supply in the market.

(...)

There’s an adage that people make more money in gold rushes by selling pickaxes than by mining for gold. In the world of bitcoin, it seems, you make money by doing both. And, increasingly, by acquiring other companies that are doing the same.

It seems that various aspects of the Bitcoin economy are developing very much in the way one would expect a market for a new product or service to evolve. After a period of initial competition, specialization and consolidation emerge, economies of scale kick in and the market is dominated by a rather limited number of players. With the ubiquity of the Internet, this all gets a twist in that some of the dominant players are actually pools of resources of smaller entities (in this case: pools of smaller miners are big players).

The really interesting aspect of all this for Bitcoin investors is the effect mining might have on the price. Generally, a steady inflow of Bitcoins into the market delivered by miners immediately selling their spoils might be a drag on the price. The extent to which this kind of Bitcoin supply actually affects the market mechanism is not crystal clear. Simply put, the price is an effect of demand and supply so in determining the drivers in the Bitcoin market we have to look at both.

For now, let’s take a look at the charts.

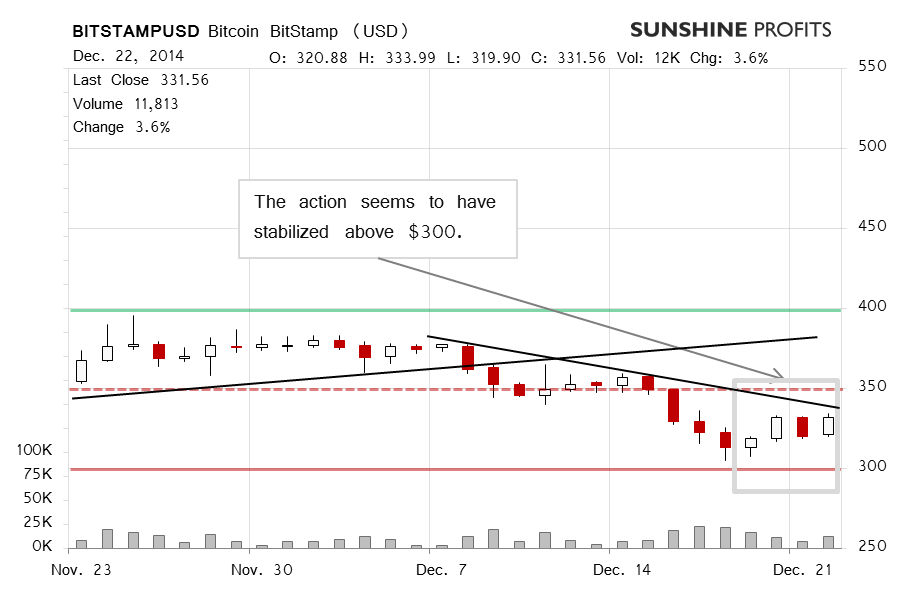

On BitStamp, we saw yet another day of appreciation yesterday. The move up was also on volume higher than on the day before. Does this mean that the short-term picture is now bullish? Not necessarily. Yesterday, we wrote:

Usually a mixture of upswings on stronger and declines on weaker volume might be a bullish indication. This could be supported by the fact that the volume today is already higher than yesterday and today has been a day of appreciation (this is written after 10:30 a.m. ET).

On the other hand, the recent moves haven’t really represented a comeback to a possible declining trend line. This could, in turn, suggest that the short-term picture is still bearish. The situation is slightly cloudy.

Yesterday’s move up continued after our alert was published but today there’s been some depreciation (this is written around 6:30 a.m. ET). The “problem” with this depreciation is that it has mostly been on relatively low volume, possibly lower than in the last couple of days. This could normally, in combination with the appreciation in the last couple of days suggest a move higher.

This time, however, we’re still under the possible recent declining trend line. This might mean that even though there have been some bullish implications, the situation could actually remain bearish unless we see a more decisive move in the direction of $350 (dashed red line in the chart).

On the long-term BTC-e chart, Bitcoin is at a possible recent trend line. Yesterday, our comment was:

The appreciation has become more visible (…) but it doesn’t seem definite in any sense. Bitcoin might still be at declining trend line and this could suggest that a move up could be viewed as a bullish signal if sustained. On the other hand, a move down below $300 (solid red line in the chart) could be the first in a series of more significant declines, possibly to $275. The fact that we saw days of appreciation and depreciation one after and they all were not very weak might suggest that the next move could be the beginning of a more significant swing. The fact that we haven’t really seen decisive appreciation in the last couple of days hints at the possibility of that move being to the downside and this is our best bet at the moment but we don’t think that any hypothetical positions should be open now as a lot can change in the next couple of days.

In short, not much has changed since yesterday. The weak depreciation today and a possible decrease in volume fits in with the scenario we described yesterday. If we see a more decisive move above the possible recent trend line and possibly above $350, the situation might turn to bullish, in our opinion. Otherwise, we the picture might remain bearish. If you take a look at the developments since the beginning of December, you’ll notice that in spite of periods of appreciation, the most significant moves in terms of volume have been to the downside. We think that if we don’t see a more pronounced move up soon, declines might follow in line with the possible recent trend.

On an administrative note, due to personal holiday plans, there will be no Bitcoin Trading Alert from Dec. 24 through Dec. 26, 2014. This means that the first alert after that break will be posted on Dec. 29, 2014 (Monday).

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts