Bitcoin Trading Alert originally sent to subscribers on July 18, 2014, 12:01 PM.

In short: we still support long speculative positions, stop-loss at $550.

Bitcoin is still perceived by financial professionals as a possible bubble, a poll by Bloomberg has shown:

Bitcoins, which lost 45 percent of their value after skyrocketing to more than $1,100 last year, are poised to tumble further, according to the latest Bloomberg Global Poll of financial professionals.

Fifty-five percent of those surveyed said the virtual currency trades at unsustainable, bubble-like prices, according to the quarterly poll of 562 investors, analysts and traders who are Bloomberg subscribers. Another 14 percent said it’s on the verge of a bubble. Only 6 percent of respondents said a bubble isn’t forming. The remaining 25 percent were unsure.

This definitely shows that the future of Bitcoin is not perceived as clear. And it’s not. What Bitcoin will become is still very uncertain. It might turn out to be a bubble. It doesn’t have to, though. There are numerous possibilities to use the network, so the currency is not an empty promise. It doesn’t have to go down in the future. What is more, if Bitcoin becomes accepted as a payment protocol by the general audience, we might see its value rise sharply. It’s not certain, but this is part of the investment process.

For now, one of the most important parts in the development of Bitcoin is making it safe for the customer to use. Once Bitcoin startups introduce new ideas for Bitcoin security we might as well see the perception of Bitcoin reversed.

There is also one piece of information that doesn’t support the Bitcoin bubble theory. Namely, bubbles are usually formed on widespread enthusiasm about an idea. For instance, the dot-com bubble thrived on the enthusiasm about tech companies. We don’t see this kind of frenzy in the Bitcoin market right now.

Let’s turn to the charts.

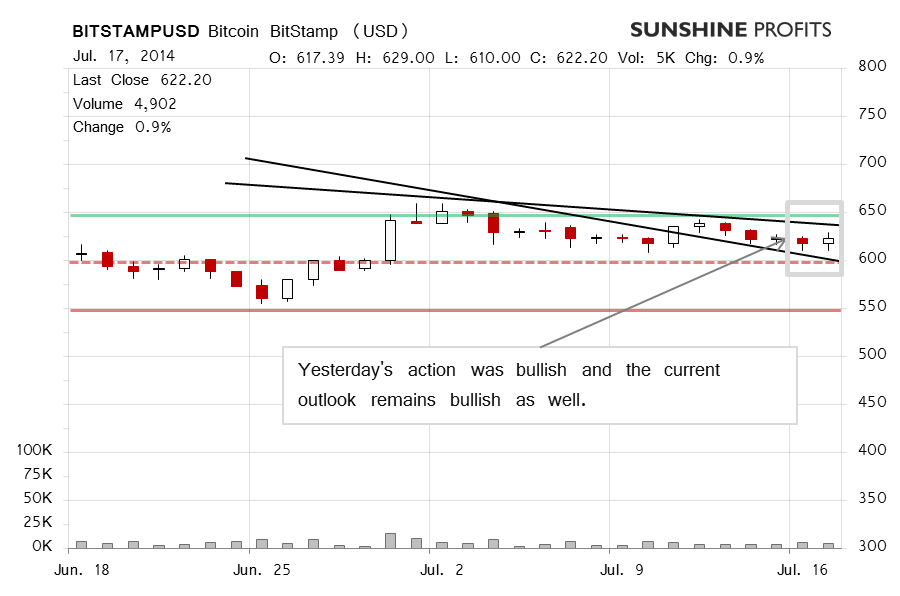

If you recall what we wrote yesterday:

As a matter of fact, Bitcoin has gone up today (this is written after 11:45 a.m. EDT). “Is this bullish enough?” the question might be knocking around hour heads. We’ve asked ourselves the exact same question. Here’s what we think.

This move of appreciation might be first in five days. The slightly more pessimistic take on the market, in which the current trend is established by the declining line ending just below $650 on the above chart, would suggest that we are still below the trend, with a possible attempt at breaking above it.

In other words, the situation might become even more bullish in a matter of days but there also are indications that the move we’ve seen today is not strong enough just yet. The volume levels also don’t support a strong move at this moment.

Caring about your investments as we do, we think that this is not the time to increase one’s positions. On the other hand, the outlook is still bullish enough, in our opinion, to keep the longs.

Bitcoin went up yesterday on BitStamp but has gone down today (this is written before 11:15 a.m. EDT). This confirms the above point of view. The thing you might be wondering about is whether there have been any changes in the market. We certainly do wonder that from one day to another. Let’s address this point.

The move down we’ve seen today hasn’t been significant and the volume remains very low. These are not typical characteristics of a significant move down. Altogether, Bitcoin is still between two hypothetical trend lines (declining black lines on the above chart). The situation remains a bit unclear but the fact that we haven’t seen a significant move down and the recent declines took place on low volume makes us more optimistic than not about the short-term prospects.

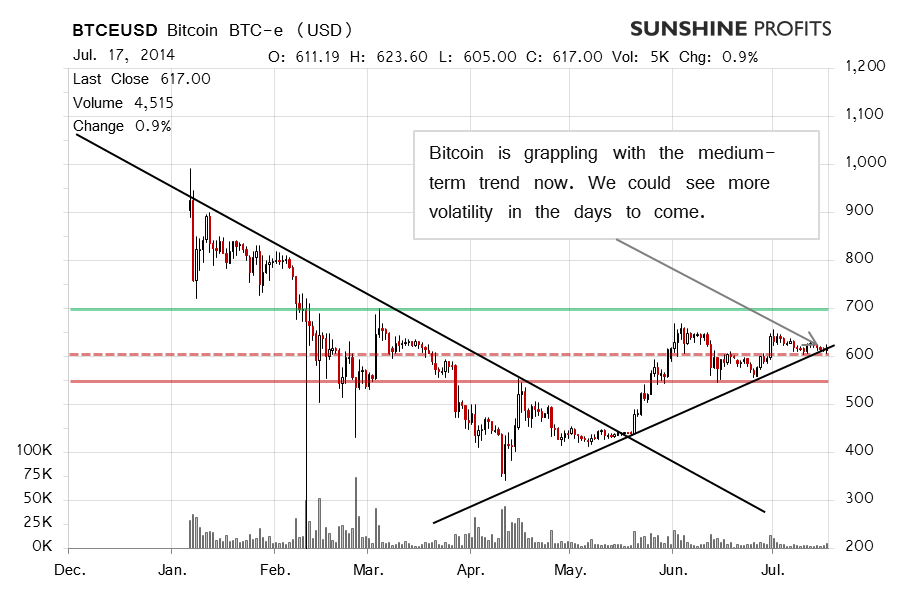

On the BTC-e long-term chart, we haven’t seen too much change. Yesterday’s comments are still valid:

(…) we might see a bounce of the medium-term trend line. This would be a bullish development, but as long as the move is not confirmed by volume, increasing the size of longs might be particularly risky for your capital, and we don’t suggest doing it at this time, as we want to shield your returns from possible moves down.

It turns out that not increasing the size of the long position has been a good idea so far. We didn’t want to take on too much risk with the suggested positions, since we want our suggestions to be well-balance as far as risk/return is concerned. This stems from the fact that we want to provide you with the possibly most accurate analysis.

In the days to come, we might witness Bitcoin move more violently, as the currency is currently testing its medium-term. The fact that the trend hasn’t been broken and that we don’t have any particular bearish indications makes us more bullish than not at this time.

Summing up, in our opinion long speculative positions might be the way to go now.

Trading position (short-term, our opinion): long, stop-loss at $550.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts