Visit our archives for more gold & silver articles.

All the fundamental factors that have made gold such a stellar investment for the last decade are still intact. Fiat money is still being produced on easy street around the world, which in turn fuels worries about the dwindling purchase power of the currencies; central banks are still accumulating gold; real interest rates are still negative so investors don’t give up any interest rate by investing in gold.

However, there are several things that have been affecting gold negatively over the past few months, much to our dismay. One of them is the dollar’s strength against the euro and gold's recent tendency to move inversely to the dollar and in line with more risk-linked assets. This has undermined some of its safe-haven appeal.

You can observe that for example in the HUI Index. Gold stocks are not only declining, but they once again do so faster than gold.

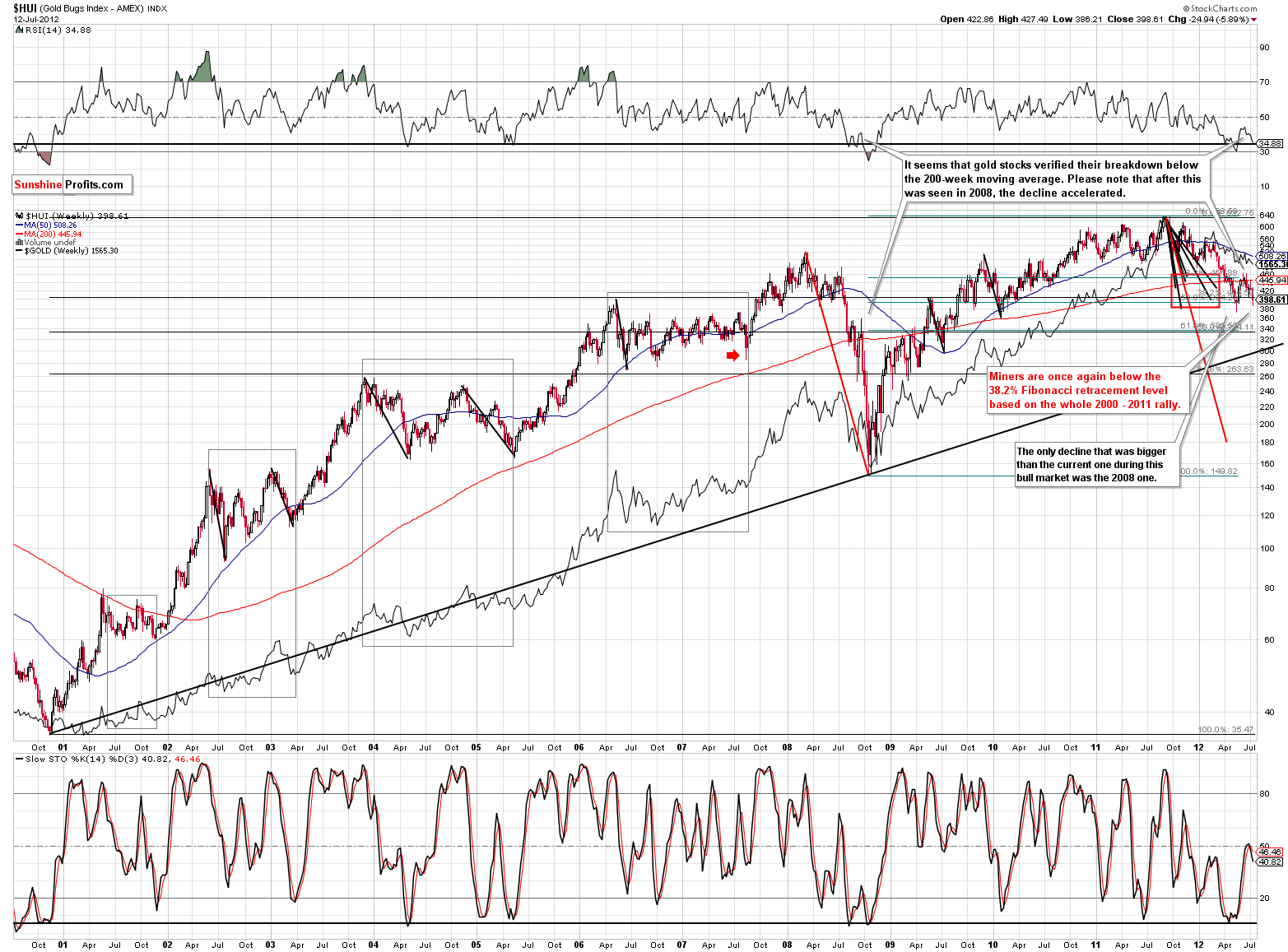

Let’s take a look at the HUI Index chart (charts courtesy by http://stockcharts.com.) The miners have moved lower, declining for six consecutive days now. On Thursday, they closed below the 400 level. This is an important and bearish development.

The bullish, intra-day reversal seen on Thursday does not change the medium-term bearish picture which is in place here. A pullback has been seen recently following the significant March - May decline and it seems that a continuation of the decline may now be seen.

This is in tune with what was seen in 2008 but declines and rallies are less volatile this time as they are taking more time to play out. Nonetheless, the bearish implications remain, and mining stocks’ investors should seriously consider limiting exposure if this has not yet been done.

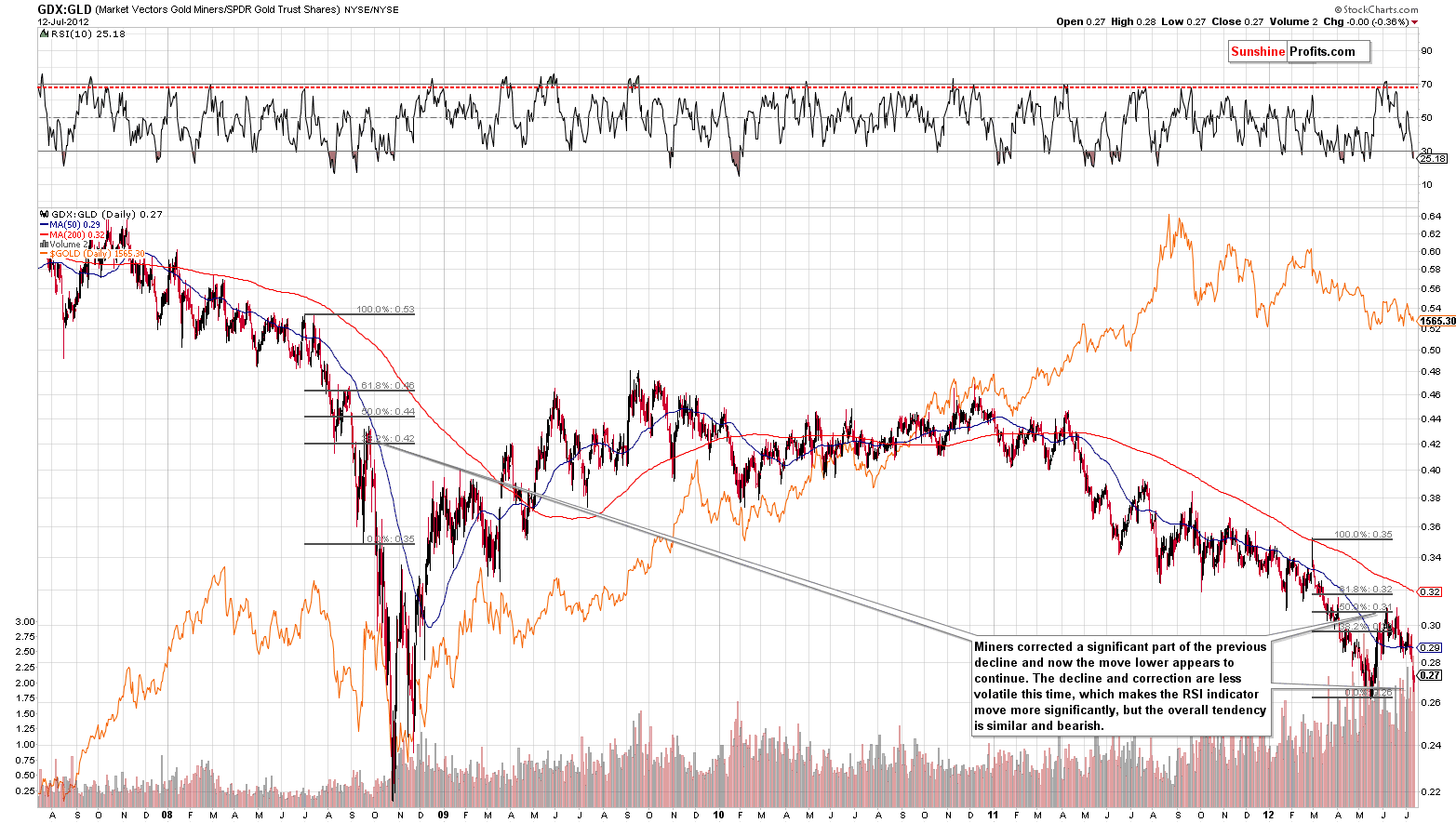

Let us now move on to miners to gold ratio chart to see if miners are really underperforming gold.

In the above chart we see that the ratio declined heavily this week. This means that gold stocks declined much more than gold.

The ratio also had a pullback in 2008 – consequently, what we have seen since May is not overly surprising. The trend remains down and right now we appear to be in another wave lower within a bigger downtrend.

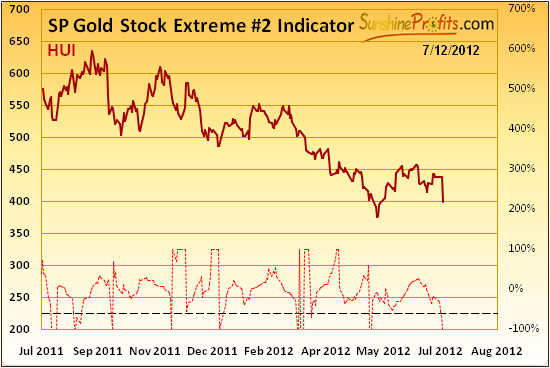

To finish off today’s essay let us have a glance at our in-house developed technical indicator that was designed to detect extreme situations on the precious metals market.

Looking at the SP Gold Stock Extreme #2 Indicator, we see that it has suggested at least a temporary rally in the mining stocks – the indicator moved below the dashed line based on Wednesday’s closing prices. The intra-day decline on Thursday followed by higher prices later in the session may have been what was suggested by this indicator a few days ago – the second part of the session.

Maybe more short-term rally will be seen or maybe not – at this time, it is unclear in our view as we have already seen a rally – in the final hours of Thursday’s session.

Summing up, the outlook for the mining stocks is bearish for the medium term. The short term is a bit unclear based on the intra-day developments seen on Thursday. While situation in the mining stocks is important, the situation in Europe and in the main currency indices is truly critical as far as impact on precious metals sector is concerned. This is one of the things that we discuss in today’s Premium Update.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Mining stock declined heavily this week and miners are once again underperforming gold. Is this a temporary phenomenon or is this tendency here to stay for much longer? This is an important question for all precious metals investors, not only for those interested in mining companies, because the relationship between gold and gold stocks used to indicate important moves in the whole sector in the past.

What's even more important is the situation in Europe, and most of all - in the Euro and USD indices. This is something that we elaborate on in today's Premium Update. Whether or not USD Index manages to break above June high will likely have profound implications on gold, silver and mining stocks. In today's issue we explain what type of price action is likely to follow in the currency indices and how will that translate into precious metals price moves.

Additionally, we discuss the situation in the crude oil, general stock market and we cover several key ratios that each precious metals investor and trader should follow.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.