Bitcoin Trading Alert originally sent to subscribers on April 18, 2014, 12:14 PM.

Cutting right to the chase: short positions might be the way to go now (stop-loss at $550).

A group of investors has come up with an initiative to convince the Tokyo Distric Court to not liquidate Mt. Gox’s assets but instead give a go-ahead to the plan to rehabilitate the failed exchange. A website Save Gox has been set up and the plan has been outlined on it. We can read:

Under our proposal, MtGox's remaining assets would be distributed to customers immediately. Creditors would be made whole over time by sharing revenue generated from business operations and from other recovery programs, such as participating in the upside if they continue doing business with the rebuilt exchange.

We are prepared to invest heavily in this business once we have conducted a full accounting of MtGox's assets and legal liabilities. When MtGox was hacked, customer balances potentially were altered, resulting in the deficits that forced the exchange to shut down. Until a qualified audit has been undertaken by a suitable internationally recognized auditor, the size of those liabilities will remain unknown.

Our group would like to begin this due diligence immediately. Only then will we know the extent of the risks and the capital required to rebuild the business. Once the valuation is completed, our goals are to:

1. Remove the information vacuum by disclosing in a timely fashion what happened to the missing bitcoins, the true status of MtGox assets and by providing creditors with audited statements of their balances.

2. Relaunch MtGox with a rebuilt and secure platform that will incorporate security, compliance, treasury and risk functions not previously in place.

3. Administer the recovery fund to repay customers who lost money, with ongoing monitoring by a public auditor.

This is only a plan but it points out that the liquidation of assets of Mt. Gox might not be the best idea. It is unclear how much worth of bitcoins actually is in Mt. Gox’s accounts. At one point in time we thought there were none but afterwards, the exchange pulled 200,000 coins out of an old wallet. A complete audit of the exchanges assets and liabilities is a must now.

A plan to rehabilitate the exchange would possibly allow its customers to participate in any kind of future revenues the restored entity would be able to generate. This would definitely be better for the creditors than getting only a part of what they are owed.

As much as we would like to see the creditors’ claims satisfied, there also are a couple of hurdles along the way. First of all, the audit might not be just as easy as it looks on paper. Also, there is the investigation into what actually happened with the missing coins. Any rehabilitation could run into problems since both procedures can take a long time to complete.

Then again, even the liquidation procedure would require an audit of the exchanges accounts, so the difference between the two scenarios, liquidation and rehabilitation, might boil down to the time necessary for the new entity to generate cash flow.

Considering the pros and cons, it seems that if the exchange can be rehabilitated, this would probably be the option allowing creditors to “squeeze the most juice” out of their claims. In any case, they won’t see any of their money soon.

Now, let’s take a look at the charts.

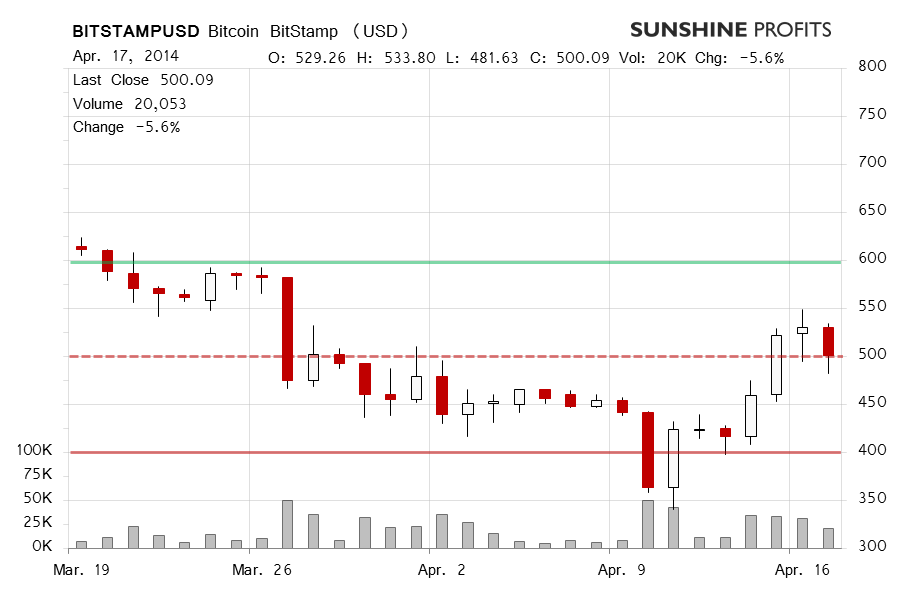

Bitcoin moved lower yesterday on BitStamp but the currency closed marginally above $500 (dashed red line on the chart). The short-term outlook was bearish but not confirmed by a close below $500 or an increase in volume – the trading yesterday was significant but weaker than on the day before. Consequently, short positions didn’t seem warranted.

Today, we’ve seen a move down, 4.1% so far (this is written after 11:15 a.m. EDT). We’ve seen weakness but not strong volume. Yesterday, in our Bitcoin commentary, we wrote:

We haven’t seen a particularly strong (in terms of volume) move down yet and the price is still at $500, so the outlook is not decidedly bearish at this time. If we see a move below $500 today, the short-term situation will become bearish and we might go short.

It seems as though Bitcoin is going to stay below $500 today. If this is the case, one might want to go short in our opinion.

BTC-e saw more depreciation than BitStamp yesterday, precisely speaking the exchange rate went down 7.8%. The volume was significant but falling. Importantly, Bitcoin managed to close below $500 (dashed red line on the chart). The short-term outlook was bearish.

Today, we’ve seen more selling but the overall volume of transactions has been lower than yesterday. The one thing that might be bothering is the fact that we haven’t seen a confirmation of a move down in volume – today’s levels are lower than yesterday’s. On the other hand, ot seems like Bitcoin is done correcting for now and a move lower might be continued, if not immediately than in the nearest future.

Taking into account the whole picture, we are of the opinion that short positions might become profitable in the nearest future.

Summing up, in our opinion short positions might be justified at this time.

Trading position (short-term, our opinion): short, stop-loss at $550. We’re betting on a move down to follow, if not right away, than in the near future.

Thank you.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts