That’s why I called BUY on the Nasdaq. Days like Tuesday (Mar. 9) are why you buy the dips. It was nothing short of a reverse rotation from what we’ve seen as of late. Bond yields moved lower while struggling tech stocks popped.

Inflation fears and the acceleration of bond yields are still a concern. But it looks as if things are stabilizing, at least for one day. The lesson here, though, is to be bold, a little contrarian, and block out the noise.

Unless you’ve been living under a rock, you know that recent sessions have been characterized by accelerating bond yields driving a rotation out of high growth tech stocks into value and cyclical stocks that would benefit the most from an economic recovery. The Nasdaq touched correction territory twice in the last week and gave up its gains for the year.

But imagine if you bought the dip as I recommended.

The Nasdaq on Tuesday (Mar. 9) popped 3.7% for its best day since November. Cathie Wood’s Ark Innovation ETF (ARKK) surged more than 10% for its best day ever after tanking by over 30%. Semiconductors also rallied 6%.

Other tech/growth names had themselves a day too: Tesla (TSLA) +20%, Nvidia (NVDA) +8%, Adobe (ADBE) +4.3%, Amazon +3.8%, Apple (AAPL) +4.1%, and Facebook (FB) +4.1%.

In keeping with the theme of buying the dip, do you also know what happened yesterday a year ago to the date? The Dow tanked 7.8%!

There’s no way to time the market correctly. If you bought the Dow mirroring SPDR DJIA ETF (DIA) last March 9, you’d have still seen two weeks of pain until the bottom. However, you’d have also seen a gain of almost 36% if you bought that dip and held on until now.

Look, I get there are concerns and fears right now. The speed at which bond yields have risen is concerning, and the fact that another $1.9 trillion is about to be pumped into a reopening economy makes inflation a foregone conclusion. But let’s have a little perspective here.

Bond yields are still at a historically low level, and the Fed Funds Rate remains 0%.

So is the downturn overblown and already finished?

Time will tell. I think that we could still see some volatile movements over the next few weeks as bond yields stabilize and the market figures itself out. While I maintain that I do not foresee a crash like what we saw last March and feel that the wheels remain in motion for an excellent 2021, Mr. Market has to figure itself out.

A correction of some sort is still very possible. I mean, the Nasdaq’s already hit correction territory twice in the last week and is still about 3-4% away from returning to one. But don’t fret. Corrections are healthy and normal market behavior. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

Most importantly, a correction right now would be an excellent buying opportunity. Just look at the Nasdaq Tuesday (Mar. 9).

It can be a very tricky time for investors right now. But never, ever, trade with emotion. Buy low, sell high, and be a little bit contrarian. There could be some more short-term pain, yes. But if you sat out last March when others bought, you are probably very disappointed in yourself. Be cautious, but be a little bold too.

You can never time the market.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. The market has to figure itself out. A further downturn is possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

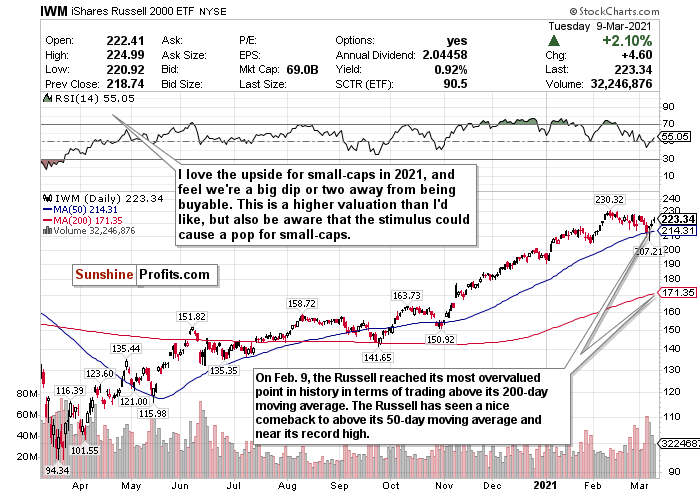

When Will the Russell Be Buyable?

Figure 1- iShares Russell 2000 ETF (IWM)

I want to buy the Russell 2000 so badly, especially now that the $1.9 trillion stimulus bill passed the Senate.

I think we’re just about there. For now, I’m keeping this a HOLD. However, I am monitoring the Russell 2000 closely. I’ve learned this index doesn’t behave quite like the Nasdaq when it comes to the RSI. Aggressive stimulus, friendly policies, and a reopening world bode well for small-caps in 2021. I think this is something you have to consider for the Russell 2000 and maybe overpay for.

That does not mean, though, that I’m ready to recommend a BUY call for the small-cap Russell 2000 unequivocally. That only means I’ll probably more aggressively initiate positions the next time it dips, even if it isn’t necessarily a 10% correction.

There’s a theme for today’s newsletter if you can’t tell- trying to time the market is pointless.

As tracked by the iShares Russell 2000 ETF (IWM), small-cap stocks have been on a rampage since November.

Since the market’s close on October 30, the IWM has gained about 46.34% and more than doubled ETFs’ returns tracking the larger indices.

Not to mention, year-to-date, it’s already up approximately 15.42%. That’s not quite buyable to me.

I wouldn’t fault you at all if you started initiating positions. But I will be staying patient to see if there’s any way I can get in at a better entry point.

HOLD, but if it dips enough again, start BUYING based on the stimulus package and what it should do for small-cap stocks.

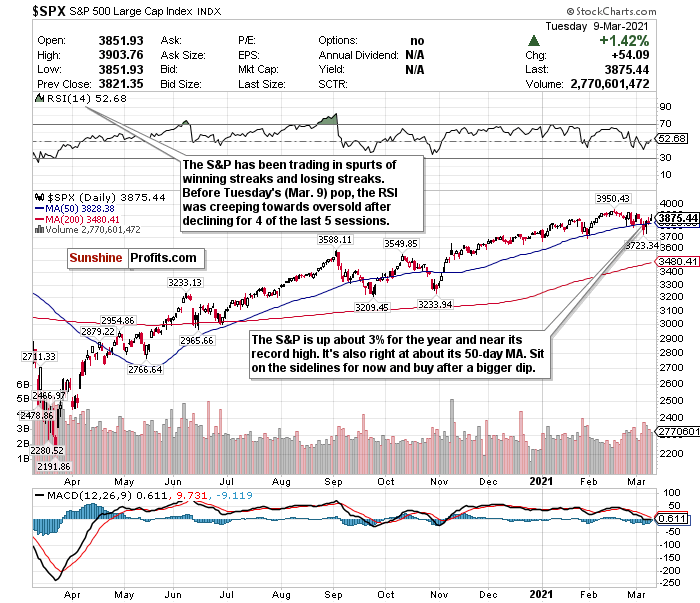

Where Could the Streaky S&P Go?

Figure 2- S&P 500 Large Cap Index $SPX

The S&P 500 is a complex index to call. It’s incredibly streaky and is between a rock and a hard place right now.

Before Friday’s (Mar. 5) reversal upwards, the large-cap benchmark declined for 3 days in a row and 5 of 6 sessions.

Before Tuesday’s (Mar. 9) pop, it had declined in 4 of 5 sessions.

See where I’m going with this? To me, this is not behaving like a buyable index right now. I feel it’s best to sit and wait this out and monitor what happens. The first week of March has started with ups and downs, but March 1 also saw the S&P’s best one-day gain since June.

Consider this too. Despite the gains of March 9, there was not a lot of breadth and depth. Only 49% of S&P stocks finished higher, while only 7 out of 11 S&P sectors finished in the green.

Unless I see some sort of buy or sell signal for the S&P 500, I think we’ll keep playing this streaky sideways game.

HOLD for now, but be prepared to either BUY or SELL depending on its moves. For an ETF that attempts to directly correlate with the performance of the S&P 500, the S&P 500 SPDR ETF (SPY) is a great option.

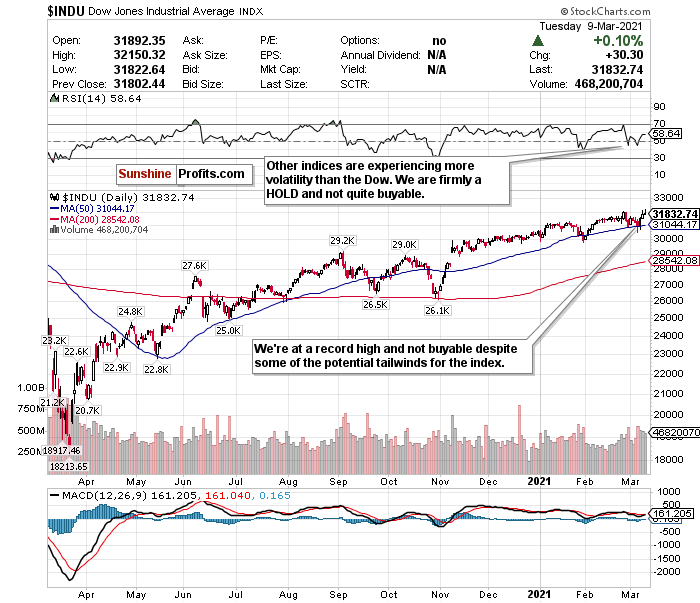

The Dow- Top March Performer, Record-High, Not Buyable

Figure 3- Dow Jones Industrial Average $INDU

While month-to-date, the S&P, Nasdaq, and Russell are all negative, the Dow Jones has managed to outperform and rise about 1%. It’s also at a record high and has been behaving more stable than the other indices.

While month-to-date, the S&P, Nasdaq, and Russell are all negative, the Dow Jones has managed to outperform and rise about 1%. It’s also at a record high and has been behaving more stable than the other indices.

However, reflecting the reverse rotation, the Dow significantly lagged behind the other indices Tuesday (Mar. 9) and barely eked out a gain.

We’re not buyable right now, even though it could also greatly benefit from this stimulus package due to all of the cyclical stocks in its index.

Where do we go from here?

Like the S&P, the Dow is between a rock and a hard place right now. But the Dow is not as close to buyable. It’s trading comparatively dull; we’re above the 50-day moving average, at a record high, and with an RSI indicating HOLD.

Yes, there are underlying concerns, and the market is more of a house of cards than anyone realizes. But the Dow is still comparatively stable to the others, and I can appreciate that.

Many analysts believe the index could end the year at 35,000, and the wheels are in motion for a furious rally for the second part of the year. But you could do better for a buyable entry point.

There are some Dow stocks at a decent entry point right now. But as an index, I would like the Dow to see a deeper pullback.

From my end, I’d prefer to assess the situation.

My call on the Dow stays a HOLD, but this could change soon.

For an ETF that aims to correlate with the Dow’s performance, the SPDR Dow Jones ETF (DIA) is a reliable option.

Beware of Inflation

For a day, we forgot about inflation. That was fun.

Now that I have your attention again, let me be a Debbie Downer for a second. We are already experiencing inflation, and soon it will permeate our entire society. I think we're genuinely underestimating this.

Bloomberg claims that food prices are soaring faster than inflation and incomes. The January Consumer Price Index data also found that the cost of food eaten at home rose 3.7 percent from a year ago — more than double the 1.4 percent year-over-year increase in all goods included in the CPI.

The Economic Research Service for the U.S. Department of Agriculture also believes that the food cost from grocery stores will rise 1 to 2% this year.

Plus, Moody's Analytics chief economist Mark Zandi feels that investors have not fully grasped that inflation is "dead ahead" and are grossly underestimating its seriousness and effect on every sector in the market.

I have been calling out Jay Powell for weeks on this. I feel he is being cavalier in his inflation thoughts, and I did not buy what he was selling a few weeks ago. Good for him that inflation hasn't hit his magic 2% target yet. But he essentially admitted last Thursday (Mar. 4) what the worst kept secret in the book was- that we could see "temporary inflation."

"Temporary inflation"? We weren't born yesterday. Inflation isn't "temporary" unless you drastically hike rates. Once that happens, then all bets are off for stocks.

How long will the Fed do this song and dance? Who knows. They said they'd keep rates at 0% through 2023, but if inflation gets really bad, there's no way this can be sustainable.

Pent-up consumer demand is great. Retail sales crushing expectations reflect this. However, bond yields rising as fast as they have coupled with a Fed showing no signs of hiking interest rates is as strong a sign of inflation as you can get.

Bond yields are rising because investors expect inflation to return and almost desire higher interest rates sooner rather than later.

Five-year inflation expectations have also more than doubled from last year's low and are now at around their highest levels since 2013.

"The rich world has come to take low inflation for granted. Perhaps it shouldn't." -The Economist.

As hedges against inflation, consider BUYING the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and the iShares Cohen & Steers REIT ETF (ICF).

Mid-Term/Long-Term

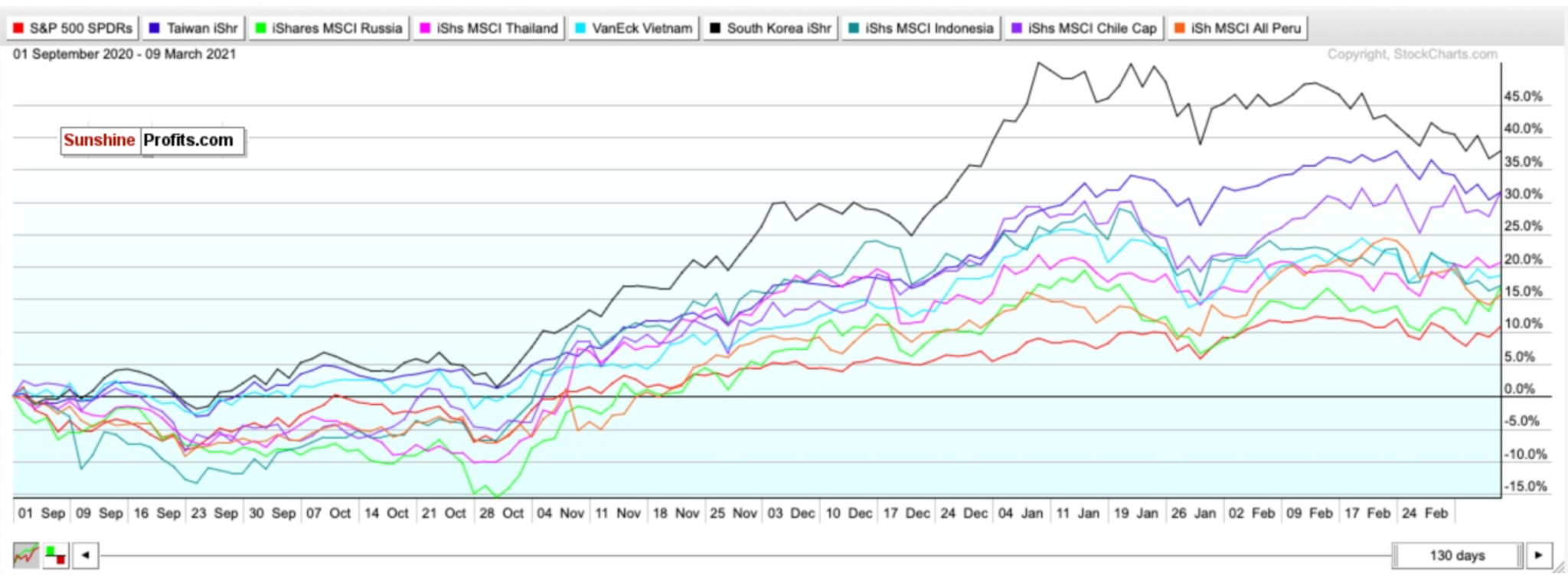

Add Emerging Market Exposure- Period

Figure 4- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- Sep. 1, 2020-Present

Since September, the SPDR S&P 500 ETF (SPY) has gained around 10.71%.

But if you compare that yield to that of my top emerging market picks for 2021, it has underperformed.

Only the iShares MSCI Russia ETF (ERUS) and the iShares MSCI Peru ETF (EPU) come close with returns of 16.82% and 15.6%, respectively, in that same timeframe.

The difference? Russia may be undervalued and have more than a 35% upside for its equities in the long-term, while Peru sits on some of the most robust and in-demand mineral reserves in the world.

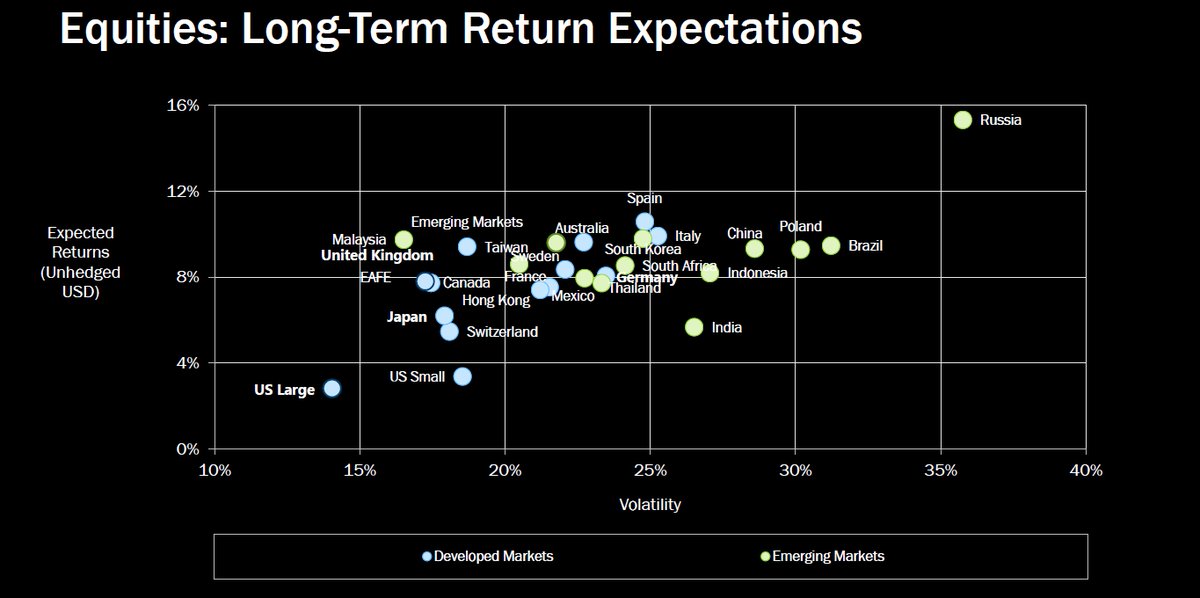

Figure 5- Equities: Long-Term Return Expectations Developed Markets/Emerging Markets

But these are only two examples of emerging markets with strong potential.

Consider this too.

With inflation on the horizon, a surge in commodity prices combined with shifting demographics could send other emerging markets upwards long-term. Plus, with birth rates plummeting during the pandemic in developed markets, it could mean long-term upside for emerging markets.

PWC echoes this sentiment and believes that emerging markets (E7) could grow around twice as fast as advanced economies (G7) on average in the coming decades.

For 2021, the following are my BUYs for emerging markets and why:

iShares MSCI Taiwan ETF (EWT)- Developing country, with stable fundamentals, diverse and modern hi-tech economy, regional upside without China’s same geopolitical risks.

iShares MSCI Thailand ETF (THD)- Bloomberg’s top emerging market pick for 2021 thanks to abundant reserves and a high potential for portfolio inflows. Undervalued compared to other ETFs.

iShares MSCI Russia Capped ETF (ERUS)- Bloomberg’s second choice for the top emerging market in 2021 thanks to robust external accounts, a robust fiscal profile, and an undervalued currency. Red-hot commodity market, growing hi-tech and software market, increasing personal incomes. Compared to many other developed and emerging markets,

VanEck Vectors Vietnam ETF Vietnam (VNM)-Turned itself into an economy with a stable credit rating, strong exports, and modest public debt relative to growth rates. PWC believes Vietnam could also be the fastest-growing economy globally. It could be a Top 20 economy by 2050.

iShares MSCI South Korea ETF (EWY)- South Korea has a booming economy, robust exports, and stable yet high growth potential. The ETF has been the top-performing emerging market ETF since March 23.

iShares MSCI Indonesia ETF (EIDO)- Largest economy in Southeast Asia with young demographics. The fourth most populous country in the world. It could be less risky than other emerging markets while simultaneously growing fast. It could also be a Top 5 economy by 2050.

iShares MSCI Chile ETF (ECH)- One of South America’s largest and most prosperous economies. An abundance of natural resources and minerals. World’s largest exporter of copper. Could boom thanks to electric vehicles and batteries because of lithium demand. It is the world’s largest lithium exporter and could have 25% of the world’s reserves.

iShares MSCI Peru ETF (EPU)- A smaller developing economy but has robust gold and copper reserves and rich mineral resources.

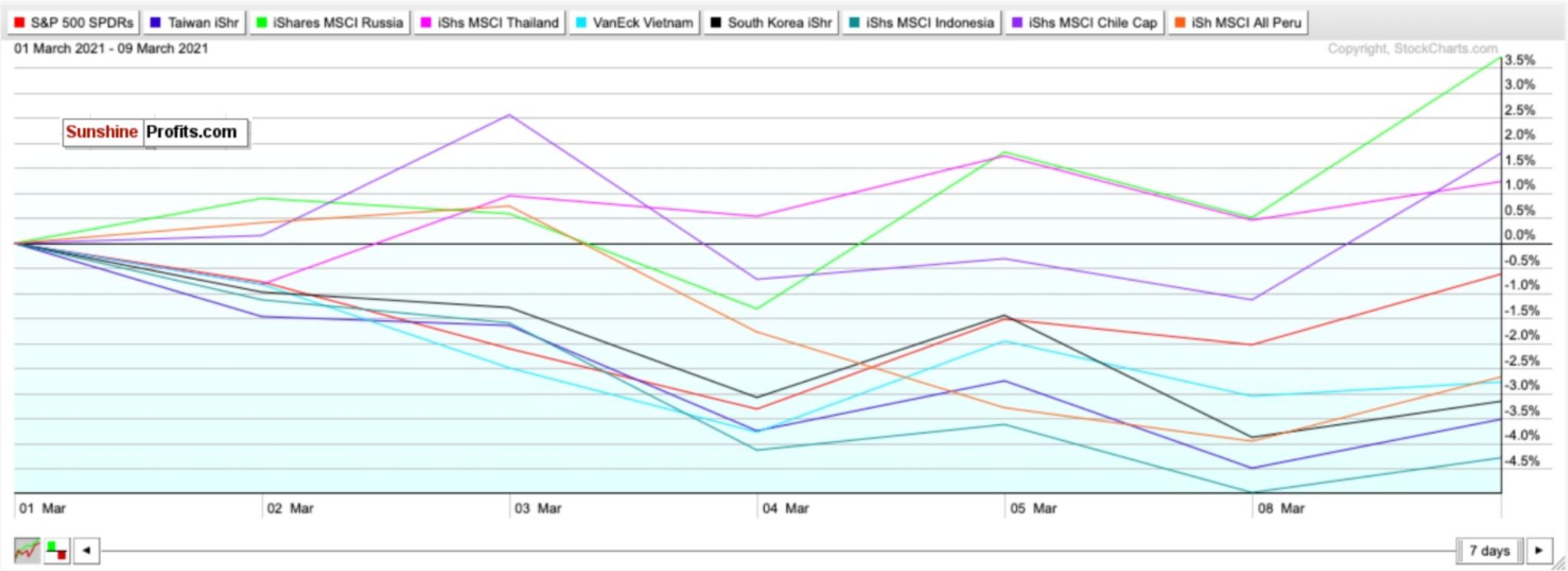

Let’s take a look at how these emerging markets have performed in March so far.

Figure 6- SPY, EWT, ERUS, THD, VNM, EWY, EIDO, ECH, EPU comparison chart- March month-to-date

While copper was the story of February, oil is the story of March. That’s why Russia is leading the way thus far this month.

Boris Schlossberg, managing director at BK Asset Management, told CNBC’s “Trading Nation” that the rise in oil is very beneficial for Russia’s growth.

“It’s pretty clear that oil has really found a very, very strong consolidation of the $60 level ... if you’re a big believer that oil stays, these levels go higher. It’s very positive for Russia, very positive for the Russian economy.”

Schlossberg also looked at Goldman’s call for commodities to return 15.5% over the year as strong for Russia.

“Goldman’s thesis that commodities are entering into a very strong bull market because of infrastructure needs all across the world only helps Russia.”

Plus, the ERUS have more than doubled the S&P’s returns thus far in 2021.

Outside of the aforementioned country-specific ETFs, you can also BUY the iShares MSCI Emerging Index Fund (EEM) for broad exposure to Emerging Markets.

Long-Term

I remain convinced that the economic recovery is going better than expected as the progress in administering the vaccines improves. But it’s a blessing and a curse if it goes “too well.”

Continue to pay attention to complacency, overvaluation, bond yields, and especially inflation.

Time will tell what happens with the market. There could be more short-term pain. But slowly but surely, we are seeing more and more long-term buying opportunities. I will have a much better feeling for even more stocks and sectors for the second half of the year if they cool down even more, as I hope.

I think another down week or two could come before entering a powerful buying opportunity for the second half of the year. We may be at the beginning of the end of the pandemic, and despite the choppy waters right now, 2021 should be a big year for stocks.

Summary

I can’t stress this enough. Days like Tuesday (Mar. 9) are why you buy the dips, and why you can never try to time the market.

I’m still concerned about bond yields and inflation, and what the next few weeks could bring, but I feel this will eventually stabilize.

The crash and subsequent record-setting recovery we saw in 2020 is a generational occurrence. I can’t see it happening again in 2021.

Do not get caught up in fear and most of all:

NEVER TRADE WITH EMOTIONS.

Consider this too. You can sit out and be scared and wait for the perfect buying opportunity. But since markets bottomed on March 23rd, ETFs tracking the indices have seen returns like this: Russell 2000 (IWM) up 126.75%. Nasdaq (QQQ) up 83.82%. S&P 500 (SPY) up 75.87%. Dow Jones (DIA) up 73.83%.

Nobody knows “where” the actual bottom is for stocks. In the long-term, markets always move higher and focus on the future rather than the present.

To sum up all our calls, I have a BUY call for

- the Invesco QQQ ETF (QQQ)- but buy selectively.

I have HOLD calls for:

- The iShares Russell 2000 ETF (IWM)

- the SPDR S&P ETF (SPY), and

- the SPDR Dow Jones ETF (DIA)

I am more bullish for all of these ETFs for the second half of 2021 and the long-term.

I also recommend selling or hedging the US Dollar and gaining exposure into emerging markets for the mid-term and long-term.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI Taiwan ETF (EWT),

- the iShares MSCI Thailand ETF (THD),

- the iShares MSCI Russia ETF (ERUS),

- the VanEck Vectors Vietnam ETF (VNM),

- the iShares MSCI South Korea ETF (EWY),

- the iShares MSCI Indonesia ETF (EIDO),

- the iShares MSCI Chile ETF (ECH),

- and the iShares MSCI Peru ETF (EPU)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist