Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,410, and profit target at 2,200, S&P 500 index).

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year's all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

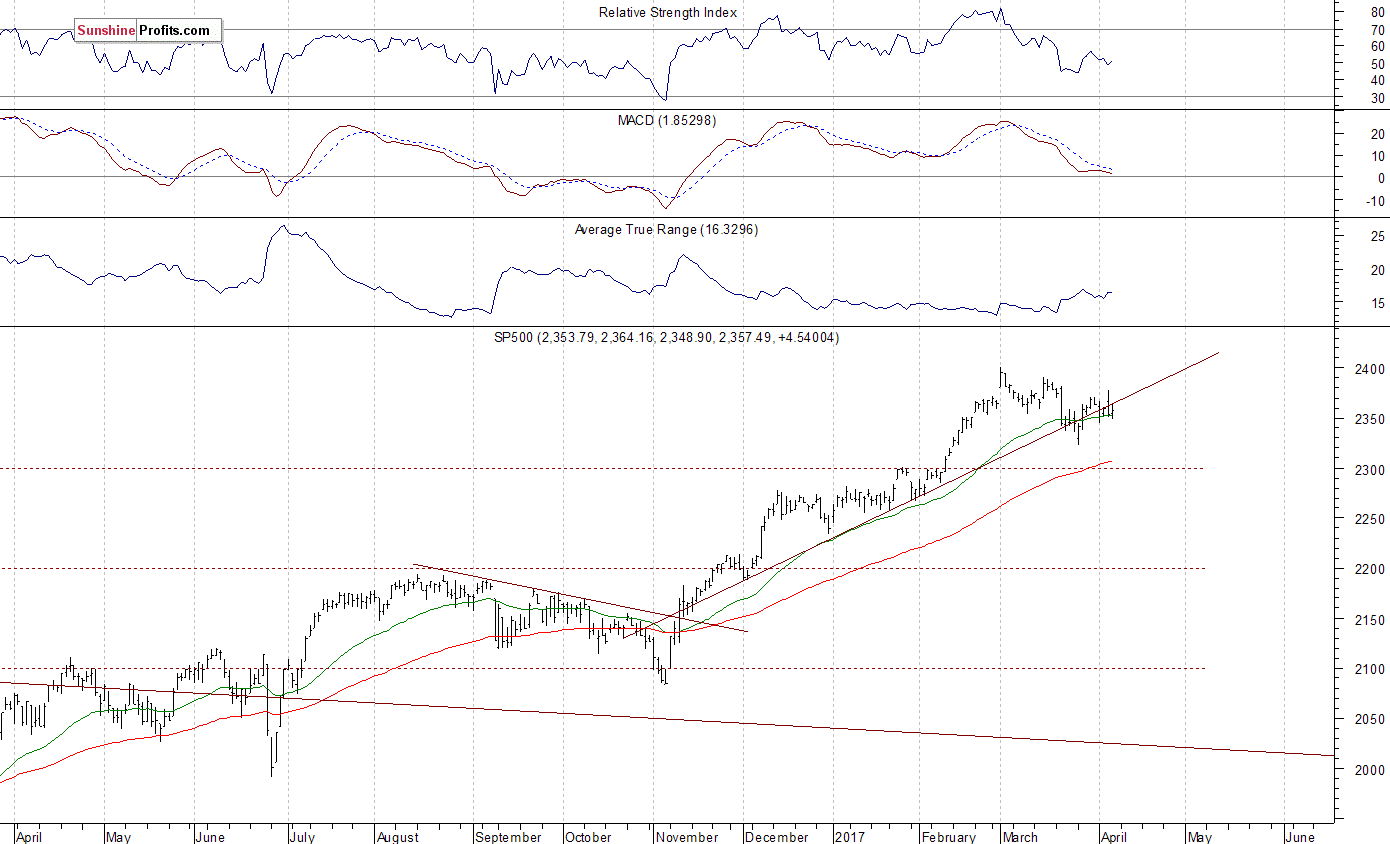

The main U.S. stock market indexes were mixed between 0.0% and +0.2% on Thursday, retracing some of their Wednesday's decline following FOMC Minutes announcement, as investors reacted to further economic data releases, among others. The S&P 500 index extended its short-term uptrend on Wednesday, before going closer to its recent local lows and support level of 2,350. It slightly extended this move down on Thursday. The index remains around 2% below March 1 all-time high of 2,400.98. The Dow Jones Industrial Average closed below 20,700 mark again, and technology Nasdaq Composite index remained below 5,900, following Wednesday's move to new record high. Is this a new uptrend or just upward correction within new medium-term downtrend? The nearest important level of support of the S&P 500 index is at around 2,350, marked by the above-mentioned local lows. The next support level is at 2,335-2,340, marked by local lows. The support level is also at 2,320, marked by February 13 daily gap up of 2,319.23-2,321.42 and last week's Monday's local low. On the other hand, the nearest important level of resistance is now at 2,370, marked by short-term local highs. The next resistance level is at 2,380-2,400, marked by all-time high, among others. We can see some short-term volatility following five-month-long rally off last year's November low at around 2,100. Is this a topping pattern before downward reversal? The uptrend accelerated on March 1 and it looked like a blow-off top pattern accompanied by some buying frenzy. The S&P 500 index continues to trade along its medium-term upward trend line, as we can see on the daily chart:

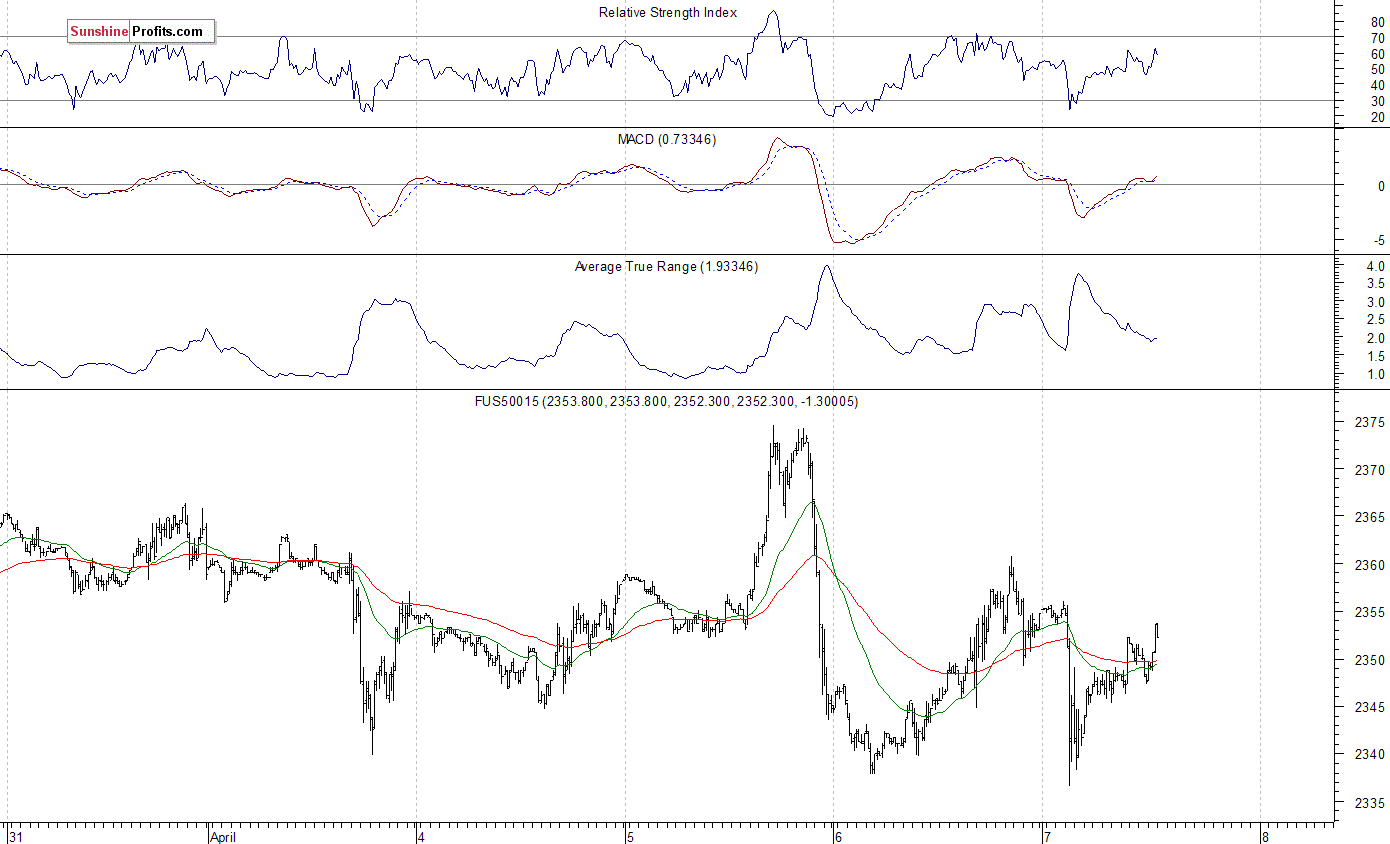

Expectations before the opening of today's trading session are virtually flat, with index futures currently between -0.1% and 0.0%. The European stock market indexes have been mixed so far. Investors will now wait for some important economic data announcements: Nonfarm Payrolls, Unemployment Rate at 8:30 a.m., Wholesale Inventories at 10:00 a.m. The market expects that Nonfarm Payrolls were +174,000 in March, and the Unemployment Rate was 4.7%. The S&P 500 futures contract trades within an intraday uptrend, following an overnight move down and rebound off support level at 2,335-2,340. The nearest important level of resistance is at around 2,355-2,360, marked by short-term local high. The next resistance level is at 2,370-2,375, marked by Wednesday's local highs. The resistance level is also at 2,380-2,400, marked by topping consolidation along record high. On the other hand, support level is now at around 2,335-2,340, marked by short-term local lows. The next support level is at 2,300-2,320, marked by some late March local lows. The market continues to trade within a short-term consolidation, following last week's move up. Is this a topping pattern or just flat correction before another leg higher?

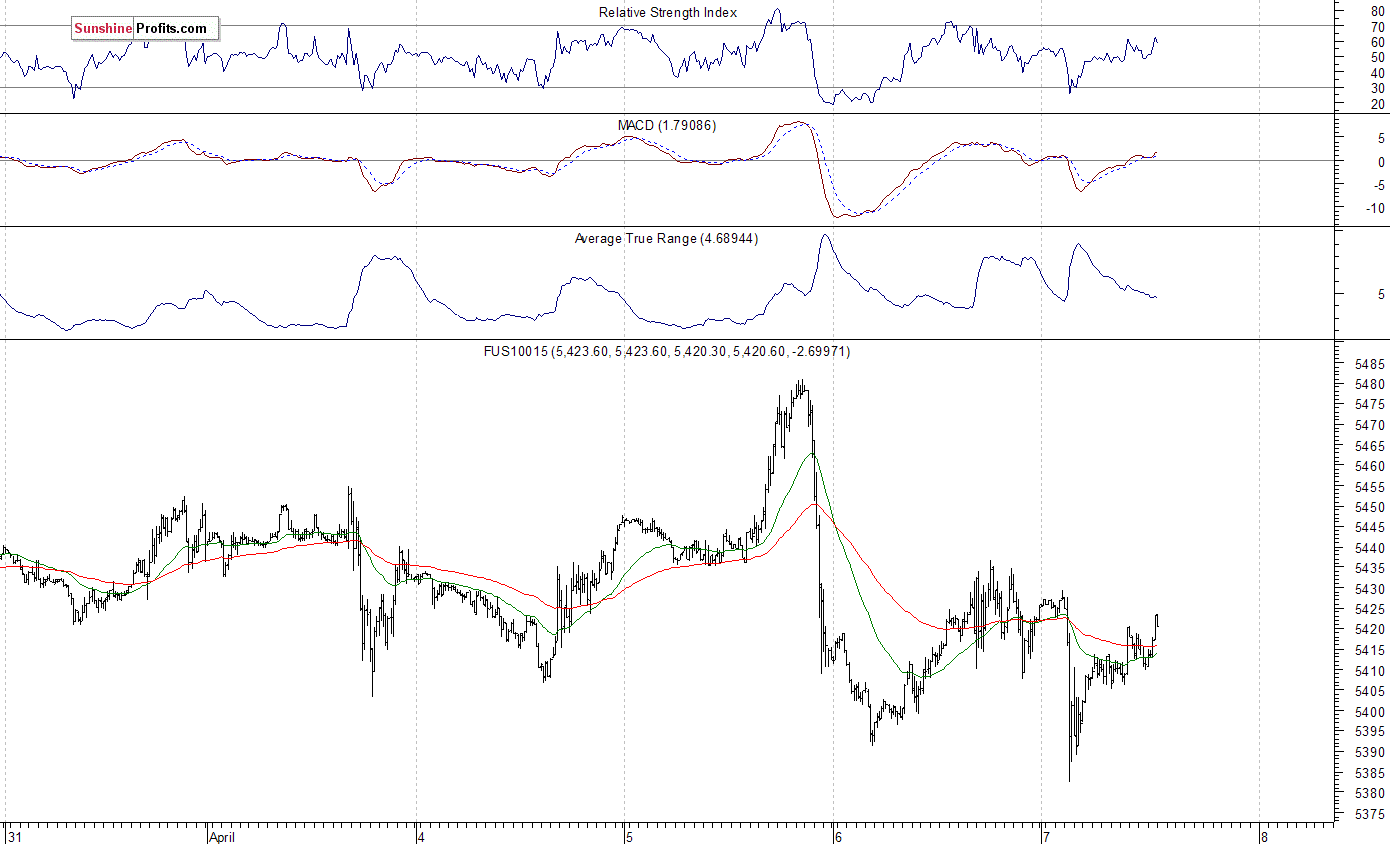

The technology Nasdaq 100 futures contract remains relatively stronger than the broad stock market, as it continues to trade above the level of 5,400. It has reached new all-time high above the level of 5,480 on Wednesday. The nearest important level of resistance is at around 5,440-5,450, and the next resistance level is at 5,480-5,500. On the other hand, support level is at 5,380-5,400, marked by short-term local lows, as the 15-minute chart shows:

Concluding, the S&P 500 index continued to trade within a short-term consolidation on Thursday, following Wednesday's volatility. Will it continue lower or just extend five-week-long fluctuations? The broad stock market remains close to its five-month-long medium-term upward trend line. There have been no confirmed short-term positive signals so far. However, we still can see medium-term overbought conditions along with negative technical divergences. Therefore, we continue to maintain our speculative short position (opened on February 15 at 2,335.58 - opening price of the S&P 500 index). Stop-loss level is at 2,410 and potential profit target is at 2,200 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

To summarize: short position in S&P 500 index is justified from the risk/reward perspective with the following entry prices, stop-loss orders and profit target price levels:

S&P 500 index - short position: profit target level: 2,200; stop-loss level: 2,410

S&P 500 futures contract (June) - short position: profit target level: 2,197; stop-loss level: 2,407

SPY ETF (SPDR S&P 500, not leveraged) - short position: profit target level: $220; stop-loss level: $241

SDS ETF (ProShares UltraShort S&P500, leveraged: -2x) - long position: profit target level: $15.47; stop-loss level: $12.98

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts