Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Tuesday's session brought us another day of strong selling that overpowered whatever buying attempts emerged. And it turned out that yesterday's premarket upswing was the key one. Before the closing bell, stocks slid through not one, but two important supports. Will today's overnight recovery have a different fate?

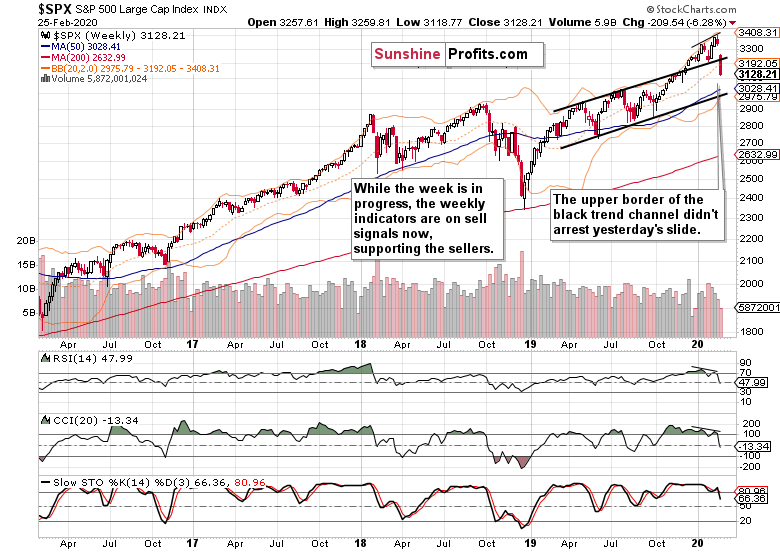

Regardless of the week being very much in progress, let's check yesterday's price action in the weekly chart's context (charts courtesy of http://stockcharts.com).

Yesterday's slide turned the weekly indicators' sell signals even more into negative territory. The bulls woefully failed to lift prices and this week's sizable bearish gap stands unchallenged. Both the gap and the indicators continue to support the bears.

The resolution to the preceding divergencies hasn't stopped yesterday. Let's quote our Monday's observations when we discussed the comparison between:

(...) the levels of both of these indicators with the price action. Stocks have been rising while both the RSI and CCI made lower highs. You can see it marked on the above chart with thin black lines. We have two divergences here - in other words, they didn't confirm the price advance.

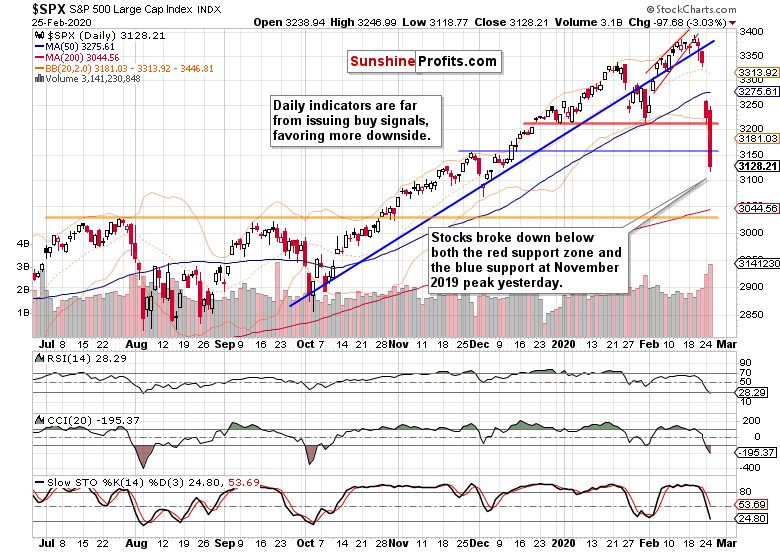

Now, let's see yesterday's session playing out on the daily chart. Where are the nearest supports?

Stocks stopped for a moment above the red support zone, yet the bears powered through early into the session. The plunge continued unabated and neither the blue support zone stopped it.

Today's premarket bounce appears too weak to take stocks back above the blue support. In essence, it follows in the footsteps of the previous premarket recovery that reached 3260 before fizzling out. And the current one looks running out of breath as well - stock futures are trading at around 3140 as we speak.

The only difference between the two is the presence of a significant support. Yesterday, we had that, today there's none to stop another wave of selling should the bears take over again.

Where is the nearest support that the bulls can rely on? In our opinion, the horizontal one marked by the early-December bottom, is too weak to count. The orange support zone created by the July and September 2019 tops, is much stronger. Additionally, the lower border of the rising black trend channel on the weekly chart, is relatively nearby.

The bears showed strength with yesterday's close near the session lows. The volume has overcome preceding day's one, confirming the bears' strength. The daily indicators also universally support them. As a result, we can expect more downside.

And how did yesterday's slide reflect upon the market breadth indicators?

The advance-decline line, the advance-decline volume and new highs minus new lows - they're all scoring new lows. They have overcome the panic lows reached at the end of January and all their 2019 readings. Is that a signal that the selloff is over now?

Our answer is the same as yesterday - not necessarily. Moreover, the slide just seen flipped the bullish percent index below 50%, which marks bearish territory and changing short-term character of the market. The bears are holding the upper hand at this moment.

Let's quote from our yesterday's Alert where we wrote that:

(...) The takeaway for the coming sessions is that buy-the-dip mentality won't probably rule as strongly as before. While we're still in a bull market, the bulls need to stabilize prices first.

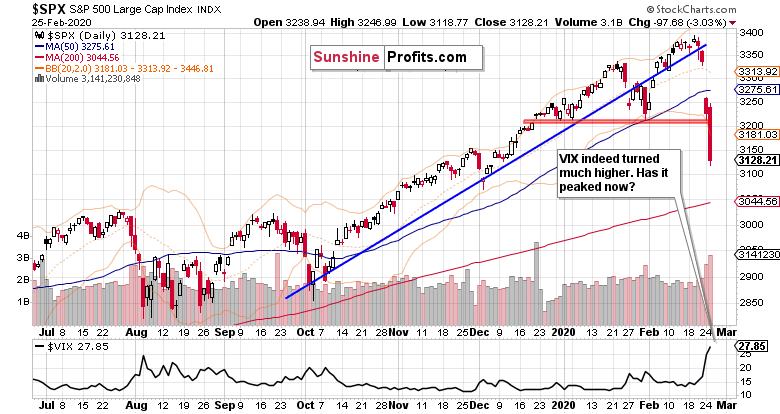

Would the VIX support the view that prices have stabilized now?

The volatility measure has overcome its August highs. On a daily basis, that could mark the top. But our yesterday's observations remains valid also today:

(...) on a weekly basis, volatility could spike even more to match the December 2018 highs.

But that's not everything to story.

As stocks started their recovery earlier in February, it was driven by the widespread assessment that coronavirus would be contained and dealt with within China. That has clearly not happened and there're multiple signs that the crisis is far from over. So are its economic costs and supply chain disruptions.

Let's recount the facts. The Iranian coronavirus strain is different from the Wuhan one, highlighting its ability to mutate. We now face self-sustaining outbreaks around the world. Just how have they leapfrogged the harsh quarantines in China? The fear around the world is palpable and the US is starting to catch up. Incidentally, the CDC announcement that it's a question of when rather than if coronavirus reaches America, poured fuel to the fire.

And the array of industries affected by the hits to their production and logistics lines is growing. That affects both product rollouts and earnings expectations. We've seen that earlier e.g. with Apple. The virus fallout is growing, and the narrative has taken over the market place. US - China trade war or other issues are very much on the back burner now. Unless the central banks step in more aggressively, the virus fallout recognition will rule the day.

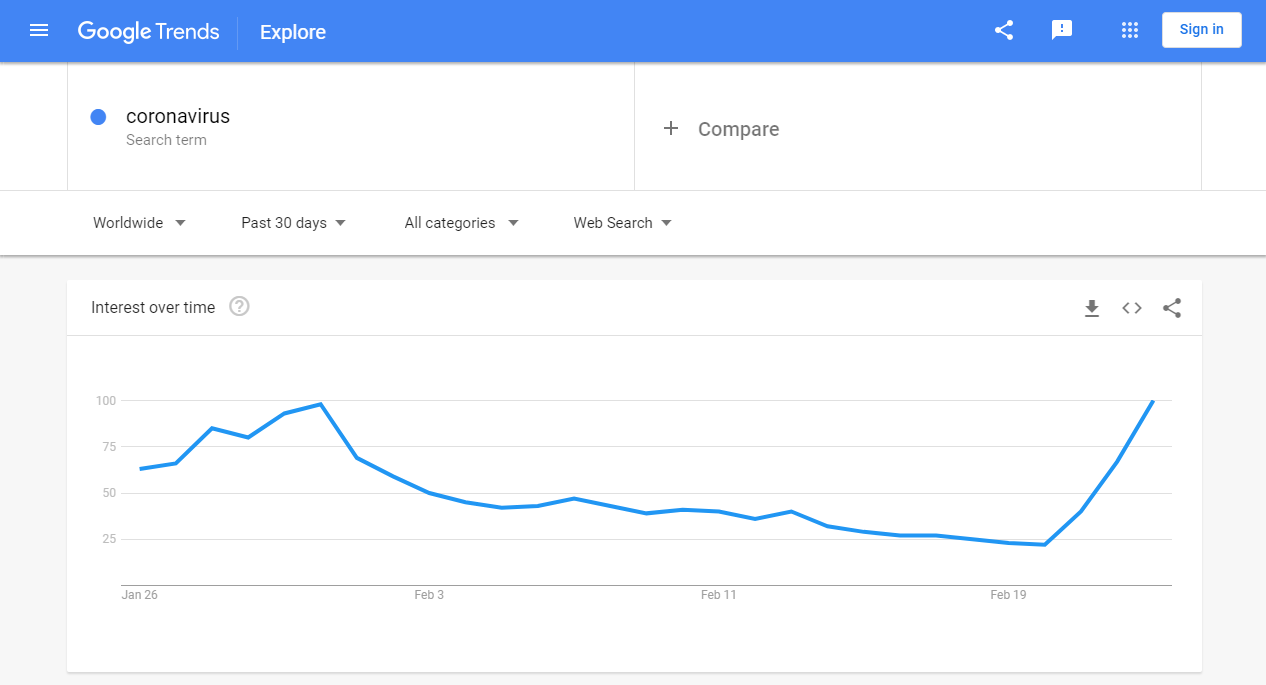

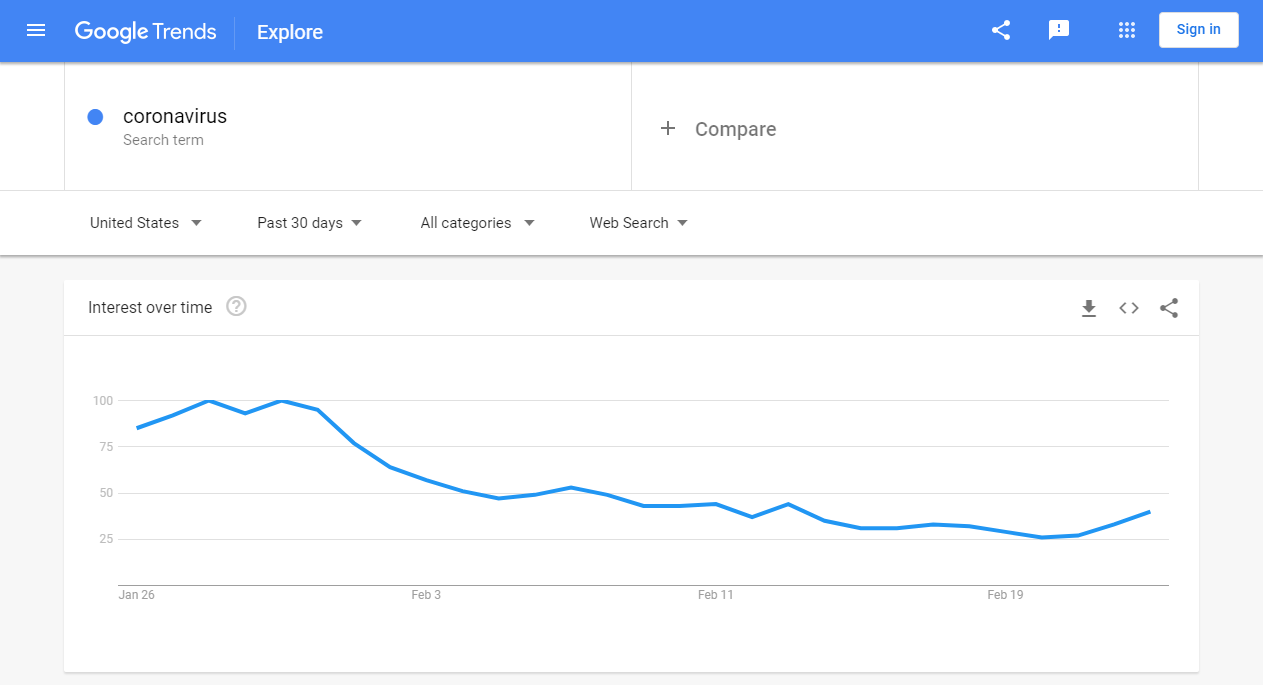

While the bets on Fed rate cuts coming soon have increased, we haven't seen any shift attributable to coronavirus in Fed governors' rhetorics just yet. As the charts below (courtesy of Google Trends) show, the US still remains relatively complacent on coronavirus compared to the rest of the world. Human nature is universal, and once confirmed positives start cropping up, the Americans' fear level will move higher as well.

And taking into account that the second wave of spike in fears is virtually guaranteed to surpass the first one, we've quite a way to go in the States. With the speading count of infections in various countries, the world is becoming recognized as coronavirus' oyster now. And this would bring more attention and consequences than when it was perceived as a China affair only.

On top of all the above, that's one more reason for why the panic selling isn't likely over yet. Remember, we haven't seen a buying catalyst, and yesterday's session proves that the bulls gave up on an important support without much of a fight.

Also, the coronavirus knock-on effects could be more than on par with the Fed tightening-triggered stock selloff in December 2018. After all, the central banks can flood the markets with liquidity, lower rates, turn them negative et cetera, but they just can't print goods to keep the factories running, supply smooth and maintain confidence in general that it's all really contained now.

Unless we see response on par with the People's Bank of China interventions, which would radically change the game, S&P 500 rallies should be viewed with a hefty dose of skepticism.

Let's recall our yesterday's notes:

(...) Downside moves during bull markets are here to either scare you out, or wear you out. This is the formed case. Let's remember the big picture though - we're in a stock bull market, actually the longest-running one, and there're sizable gains ahead to enjoy down the road.

That's true despite all the damage we would see on the monthly chart when February is over, but arguably, we've not yet reached the moment of blood in the streets. Yesterday's notable absence of the bulls is a not-so-subtle proof of that.

While it's true that markets and forward-looking and discounting mechanisms, they appear not to have yet digested the coronavirus impact whose count is rising day-by-day.

Therefore, it makes sense to look for an opportunity to sell the rally and ride the very likely downswing all the way to the next important support. Depending on the commitment of the bulls and breaking announcements, we'll manage the would-be open trade accordingly.

Summing up, the medium-term S&P 500 outlook has shifted to bearish, and more downside remains probable before this correction is over both in time in in price. Both the daily and weekly charts attest to that. The divergencies between RSI, CCI and stock prices are yet finished being resolved to the downside. Two important supports haven't arrested the slide yesterday. While the daily volatility is at recent record highs, the weekly one still has a way to go. The notable absence of the bulls yesterday favors more downside before the panic selling is over. We've not yet seen a catalyst that would facilitate the reversal higher, and buy-the-dip mentality didn't exactly win the day yesterday. While the stock bull market remains intact in the long term, it appears too early to bet on letting its many bullish factors work to our benefit today.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care