Briefly: In our opinion speculative short positions (full) in gold, silver, and mining stocks are justified from the risk/reward perspective.

The precious metals sector moved lower at the beginning of the week which coincided with a small move higher in the USD Index. There were no meaningful breakdowns / breakouts, though – with the exception of the platinum market. Let’s take a closer look (charts courtesy of http://stockcharts.com.)

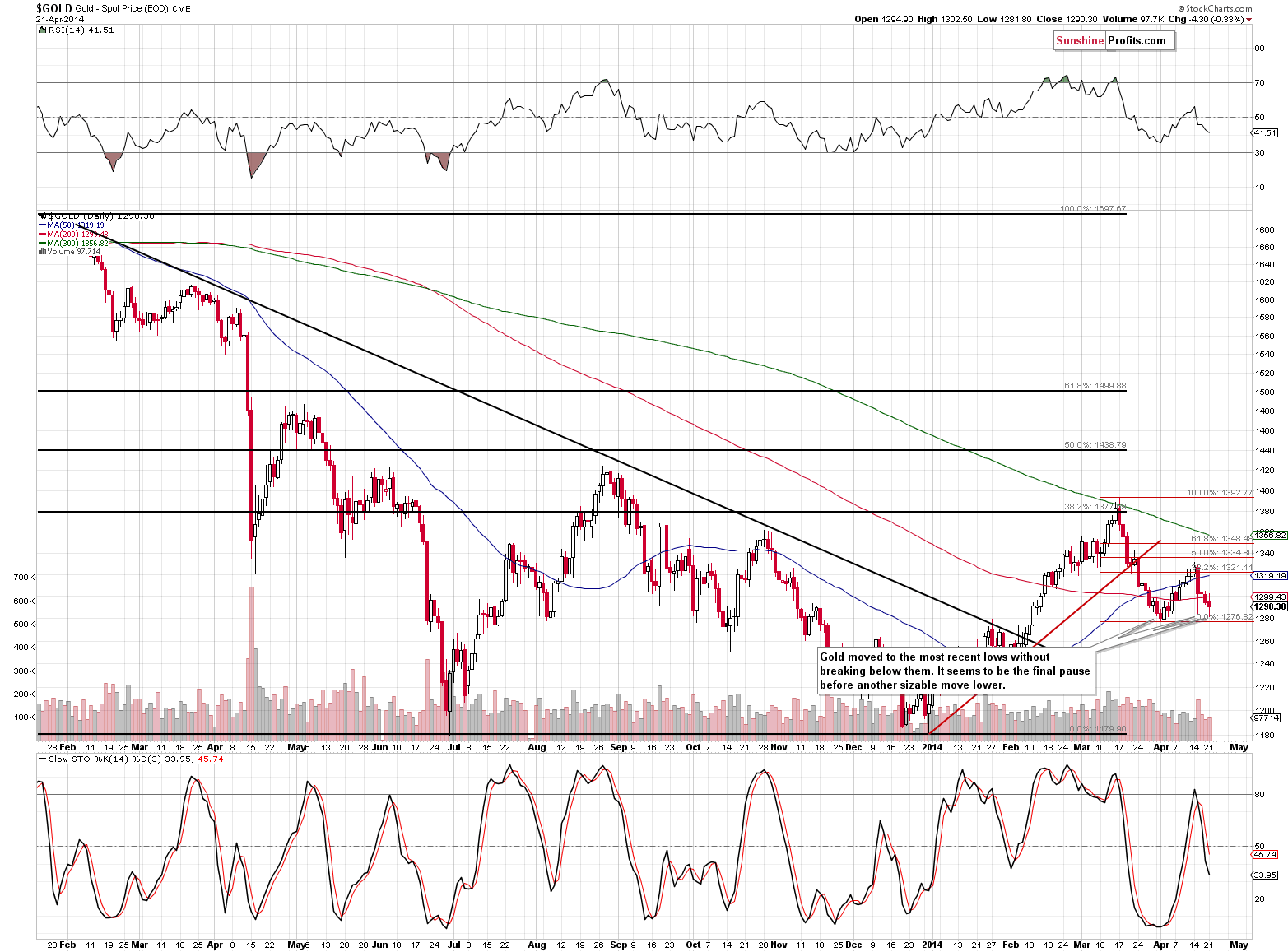

Gold moved to its recent lows, but didn’t move below them. Technically, the situation hasn’t changed because of that, and thus, the outlook remains bearish, but it’s still possible that we will see some sideways movement or a small move higher before the decline really continues.

We can say exactly the same about silver and mining stocks. Let’s take a look at the latter.

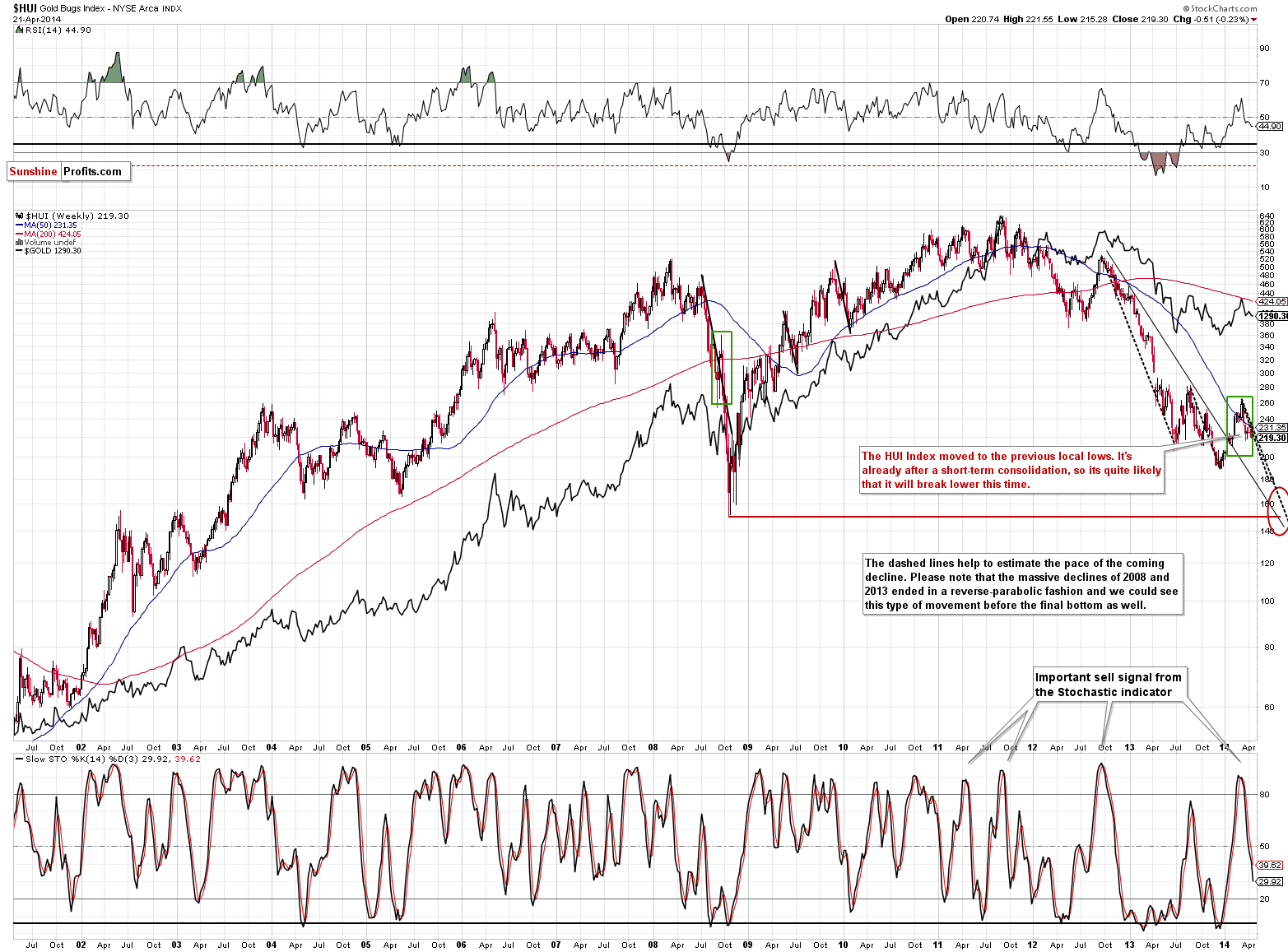

Gold stocks moved slightly lower this week but failed to close below the previous lows. One might view this as a short-term bullish sign, or simply as the final pause before the trend continues. The preceding move was down, so we are likely to see it once again, as soon as the consolidation is over.

Either way, the very short-term is rather unclear, but in the coming weeks we should see much lower mining stock values.

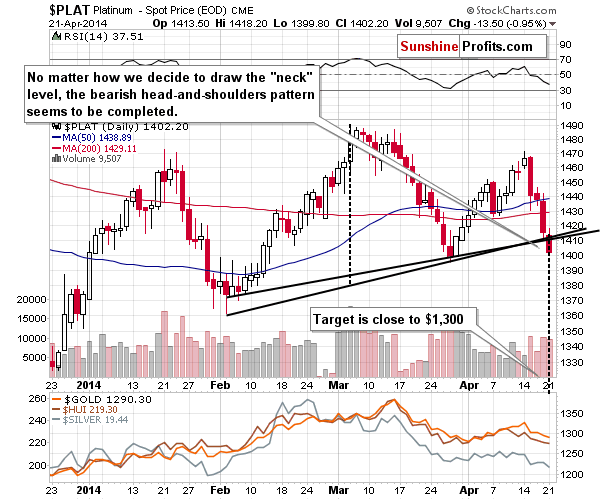

Meanwhile, the platinum market provides a decisive and bearish signal.

We see a quite clear head-and-shoulders pattern in the platinum market, which formation was just completed, and this has bearish implications. The price target based on the formation alone is close to $1,300, which means that we are likely to see a sizable decline sooner rather than later. This serves as a confirmation of the bearish trends observed in gold, silver, and mining stocks.

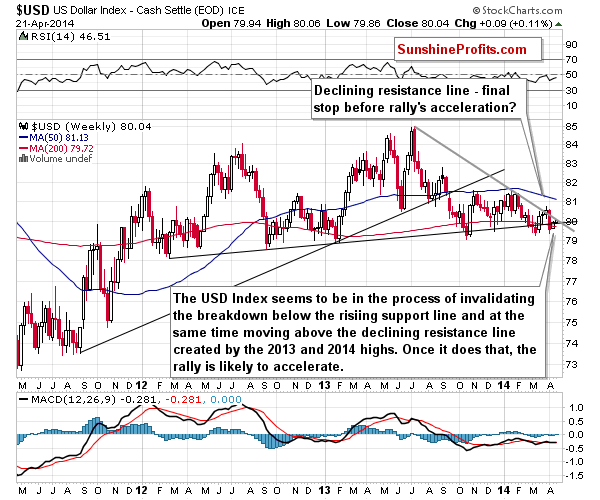

If you’re wondering why there was not decisive breakdown in case of the rest of the precious metals sector, you will find the answer on the below chart.

The USD Index moved higher this week, but not high enough to do 2 things: to invalidate the move below the rising support line and to move above the declining resistance line. With the situation being unclear here, it seems no wonder that there was no decisive move in metals and miners. Once the USD rallies above the support/resistance levels, breakdowns in metals and miners are likely to follow, just as platinum suggests.

In general, the outlook for the precious metals sector remains bearish, but we may see a couple of days of sideways movement or slightly higher prices.

To summarize:

Trading capital (our opinion): speculative short positions (full) in gold, silver, and mining stocks. You will find our take on many trading vehicles in our Precious Metals ETF Ranking

In our opinion it’s not too late to enter the above-mentioned positions as the initial target levels ($1,210 in gold, $18.60 in silver, and 197 in the HUI Index) are still relatively far away.

Stop-loss orders:

- Gold: $1,353

- Silver: $20.86

- GDX ETF: $26.2

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts