Briefly: In our opinion speculative short positions (full) in gold, silver, and mining stocks are justified from the risk/reward perspective.

We normally post alerts only on US trading days however, we thought that you might find an earlier alert to be even more useful – so here we are. Also, there will be no alert on Monday, due to your Editor’s Holiday travel plans – we apologize for the inconvenience.

This week was quite important for the precious metals sector and everyone at least interested in investing in it. Let’s see once again what actually happened (charts courtesy of http://stockcharts.com.)

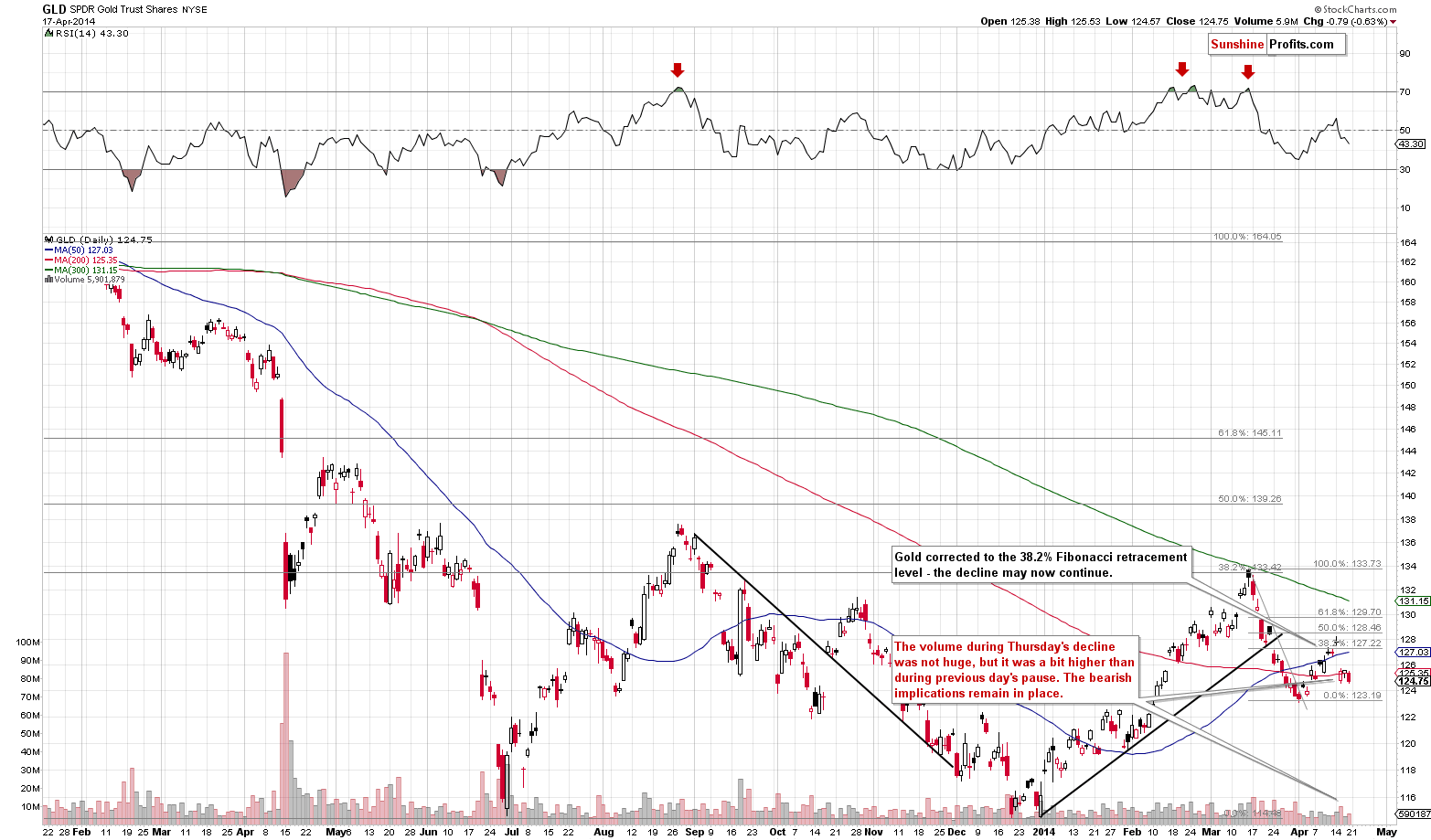

Gold started the week with a move higher, but we warned that it was not likely to last. The volume was rather low and the rest of the precious metals sector didn’t follow gold higher. The most important price action was seen on Tuesday, when gold declined well below $1,300. The move took place on strong volume, which was a sign that this was the real direction in which the market was moving. The following days didn’t bring much new – gold paused on Wednesday on low volume, and then declined a bit on Thursday, on higher volume.

The outlook for the coming weeks remains bearish.

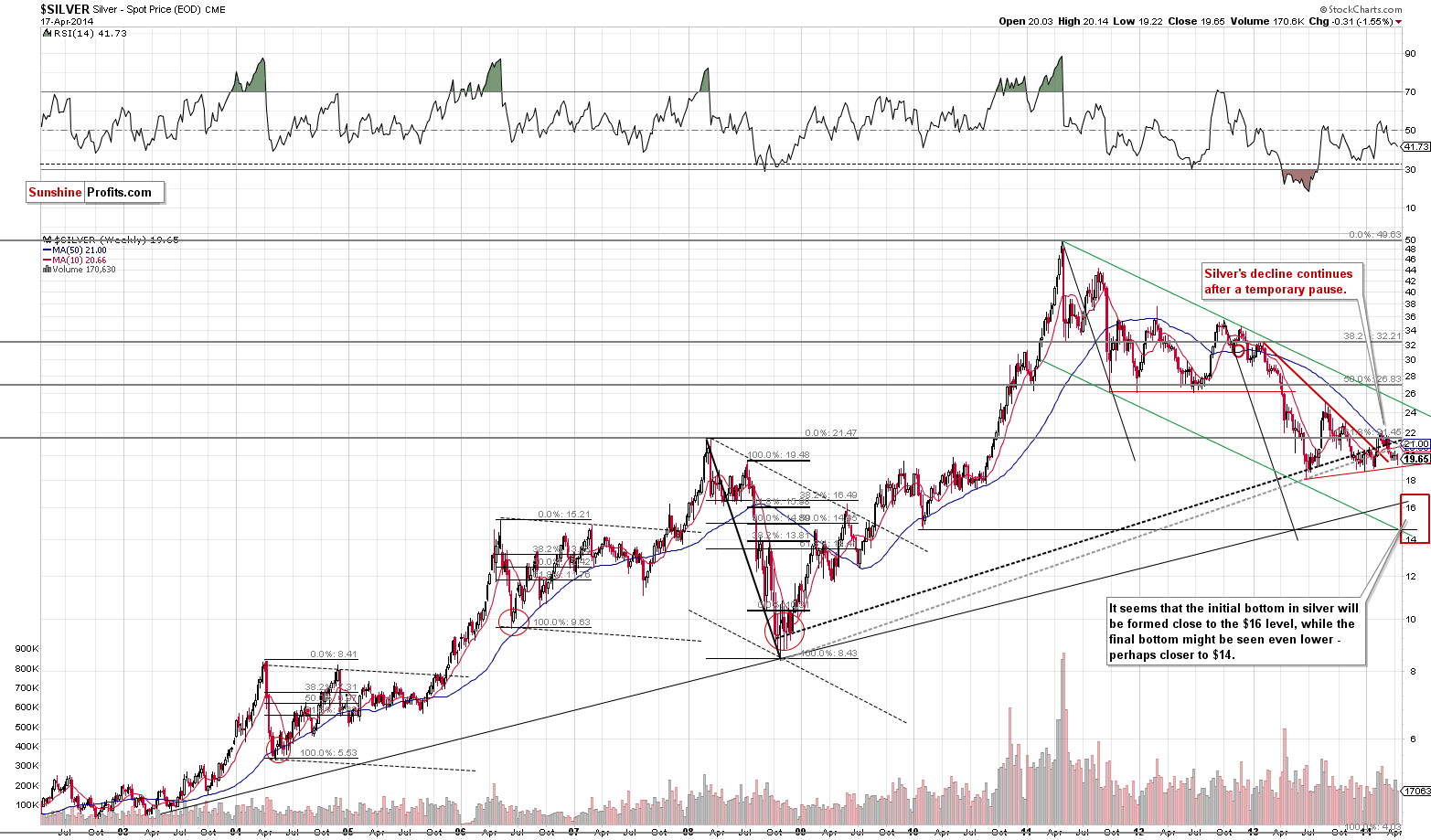

Silver’s move lower was slightly different, as there was no rally on Monday, but the overall implications remain the same – they are bearish. Taking the weekly closes into account, silver was previously in a few-week long consolidation without a meaningful move in any direction and it finally declined this week. The decline seems to be continuing.

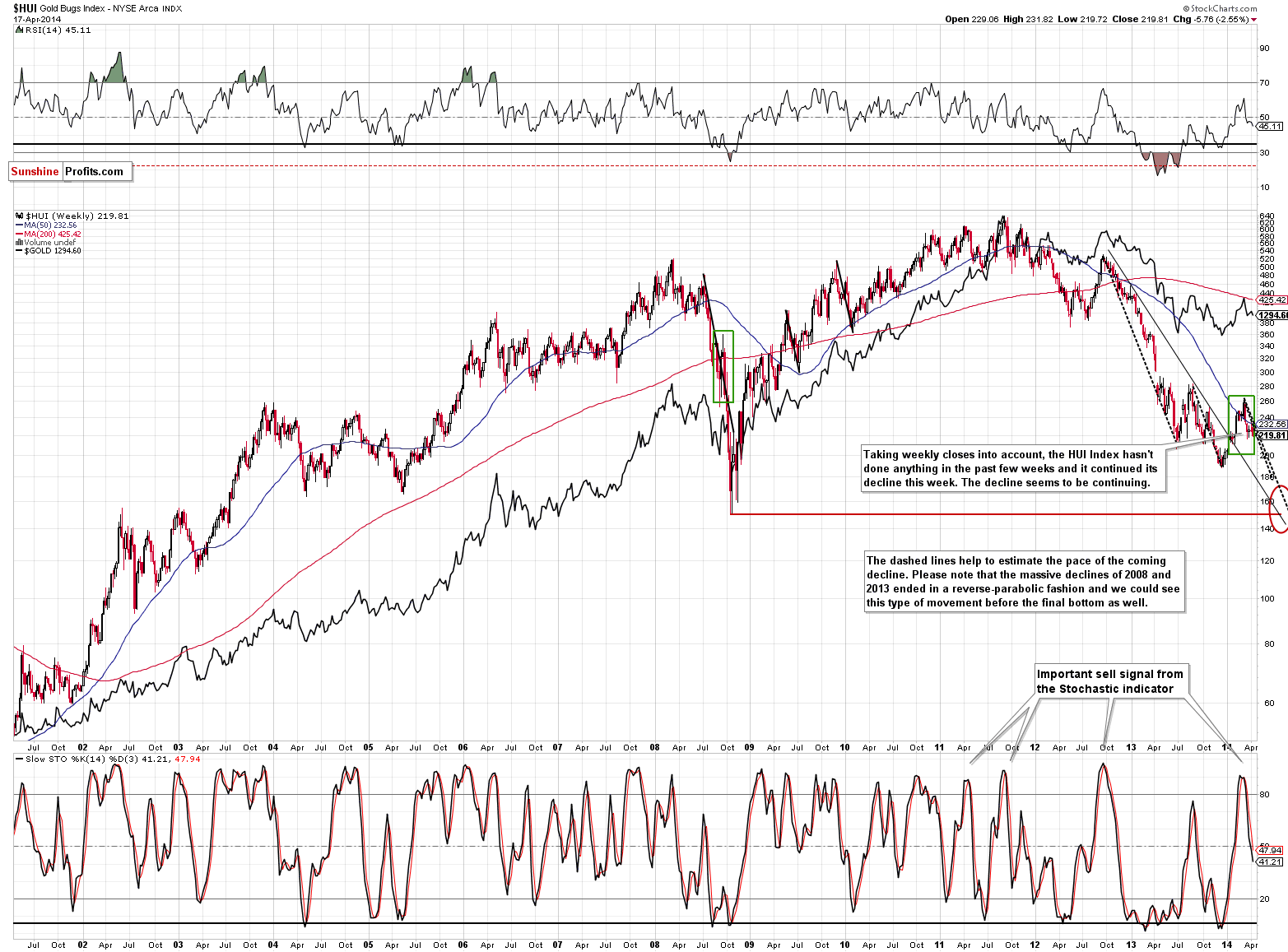

In the case of gold stocks (the HUI Index), we saw similar action to the one in silver. The last few weeks had been just a pause when viewed from the long-term perspective, and this week the decline resumed.

In terms of weekly closing prices we’ve already saw a breakdown below the March lows, but not in terms of intra-day lows. Once miners move below them, the decline is likely to accelerate.

In general, the outlook for the precious metals sector remains bearish.

To summarize:

Trading capital (our opinion): speculative short positions (full) in gold, silver, and mining stocks. You will find our take on many trading vehicles in our Precious Metals ETF Ranking.

In our opinion it’s not too late to enter the above-mentioned positions as the initial target levels ($1,210 in gold, $18.60 in silver, and 197 in the HUI Index) are still relatively far away.

Stop-loss details:

- Gold: $1,353

- Silver: $20.86

- GDX ETF: $26.2

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

The next alert is scheduled for Tuesday, April 22, 2014.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts