Trading position (short-term; our opinion): Short positions with a stop-loss order at $45.32 and profit-take order at $35.72 are justified from the risk/reward perspective.

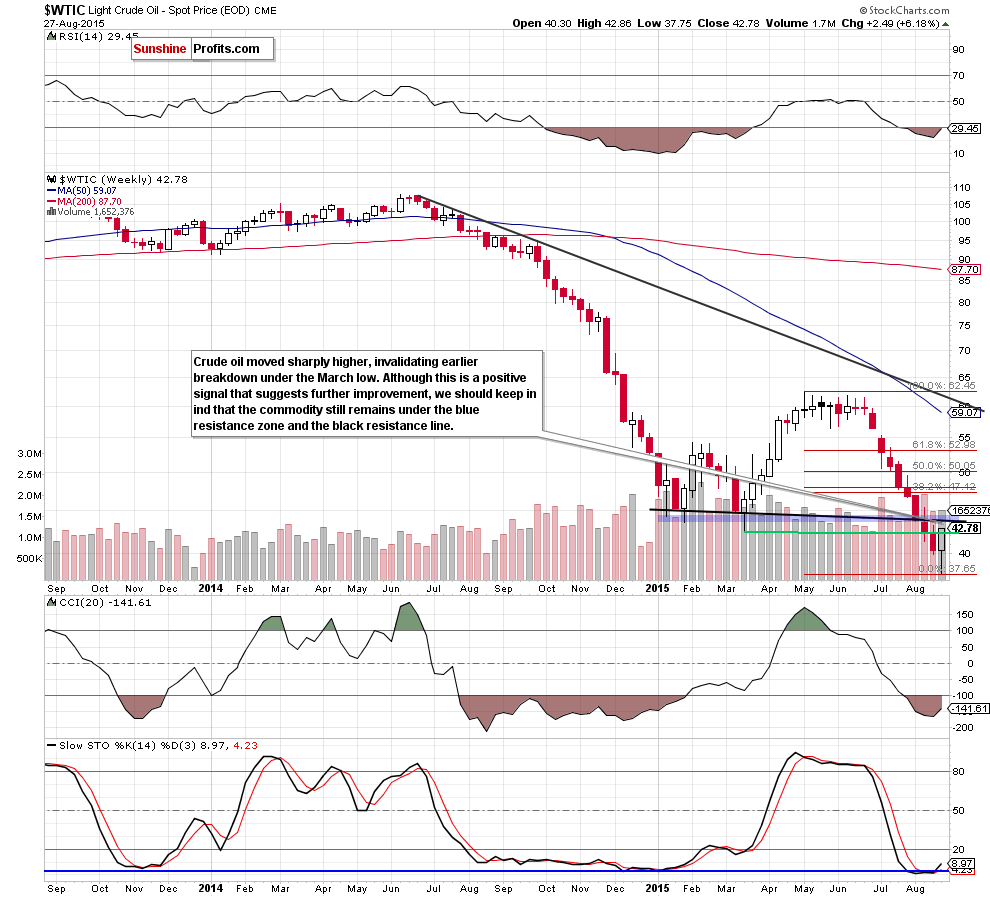

On Thursday, crude oil moved sharply higher supported by global stock markets’ rally. In this environment, light crude invalidated earlier breakdown below the barrier of $40 and climbed above the March high. But is it enough to trigger a trend reversal?

Yesterday, the Shanghai Composite rallied more than 5% and came back above the critical 3,000-level. Additionally, Germany's DAX rallied more than 3%, while France’s CAC 40 and London's FTSE 100 were both up around 2.5%. Moreover, we could see this upbeat sentiment also in U.S., where the Dow and S&P 500 increased sharply after the session open, extending strong gains from the previous session. Thanks to these circumstances, light crude rallied to an intraday high of $42.86, invalidating earlier important breakdowns. But are there any technical factors on the horizon that could stop oil bulls in the coming days? (charts courtesy of http://stockcharts.com).

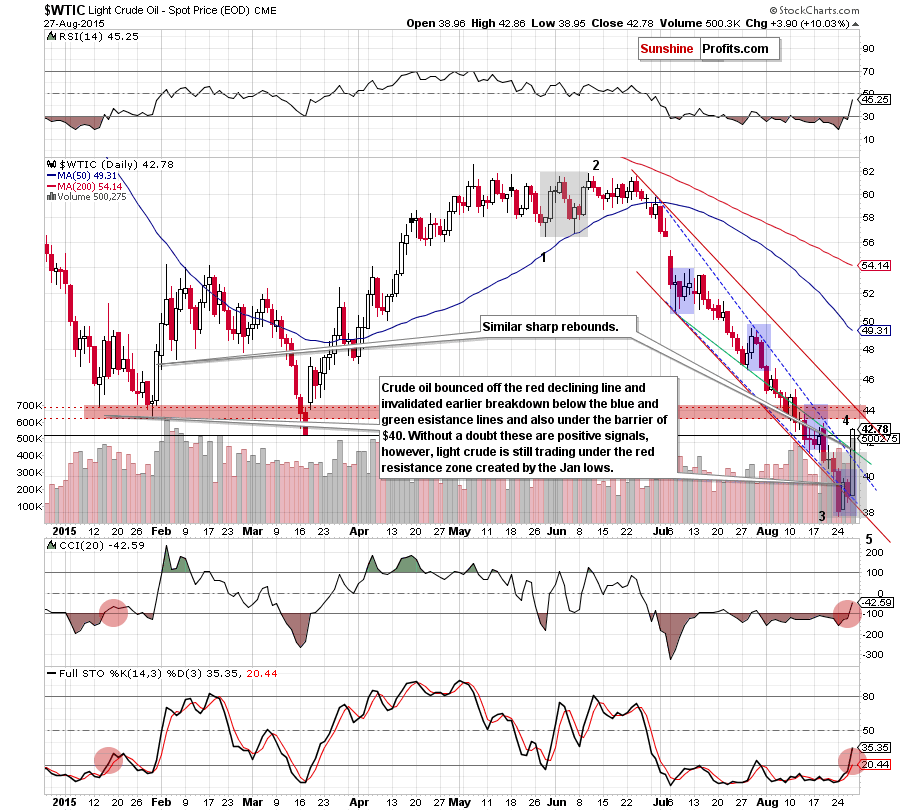

Looking at the daily chart we see that crude oil bounced off the previously-broken red and blue declining support lines, which encouraged oil bulls to act and resulted in a sharp rally in the following hours. With this upswing, light crude invalidated earlier breakdown under the barrier of $40, the March low and also the breakdown below the green and blue resistance lines. On top of that, yesterday’s move materialized on sizable volume, which confirmed oil bulls’ strength. Without a doubt these are positive signals, which suggest further improvement. But will we see such price action?

Despite yesterday’s increase, the commodity remains under the red resistance zone created by the January lows. And speaking of January… When we focus on the daily chart, we notice that the recent price action is quite similar to what we saw in mid-January (and also later at the end of the month). Back then, light crude rebounded sharply, making a bigger corrective upswing (additionally, the CCI and Stochastic Oscillator generated buy signals – just like they did yesterday). What happened later? Despite this sharp rally, light crude reversed and declined to fresh lows.

Taking this fact into account, we decided to take a closer look at the above chart from the Elliott’s waves perspective. In our opinion, the downward move in May was the first downward wave in the current downtrend. After that, we saw extended correction, which erased most of the wave 1 (the wave 2 is usually quite deep). In mid-Jun, crude oil stared the wave 3, which took the commodity below the March low and the barrier of $40, pushing light crude to a fresh multi-month low of $37.75. In our previous alerts we wrote that there wasn’t bigger corrective upswing since June, which meant that the wave 3 was still underway, suggesting lower values of crude oil. However, the situation changed earlier this week when light crude reversed and rebounded sharply. In our opinion, although this rally looks quite bullish, it is nothing more than the wave 4 (it has a completely different shape than the correction from June – it is quick and sharp, which increases the probability of the above assumption). If this is the case, we may see further improvement and a test of the red resistance zone (based on the Jan lows) and the upper border of the red declining trend channel, which intersects this area at the moment.

Summing up, crude oil rebounded sharply, invalidating earlier breakdown under important support levels, which suggests further improvement. However, as long as there is no daily close above the upper border of the red declining trend channel, another downswing is likely.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $45.32 and profit-take order at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts