Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Monday, crude oil lost 0.71% as a stronger greenback and worries over a supply glut continued to weigh on the price. In this environment, light crude closed another day under the March low and re-tested its major support line. Will it withstand the selling pressure in the coming days?

Yesterday, the National Association of Home Builders reported that its Housing Market Index for July rose to 61, which was its highest level since Dec 2005. Thanks to this news, the USD Index moved higher, making crude oil more expensive for investors holding other currencies. As a result, the commodity re-tested its major support line. Will it encourage oil bulls to act? (charts courtesy of http://stockcharts.com).

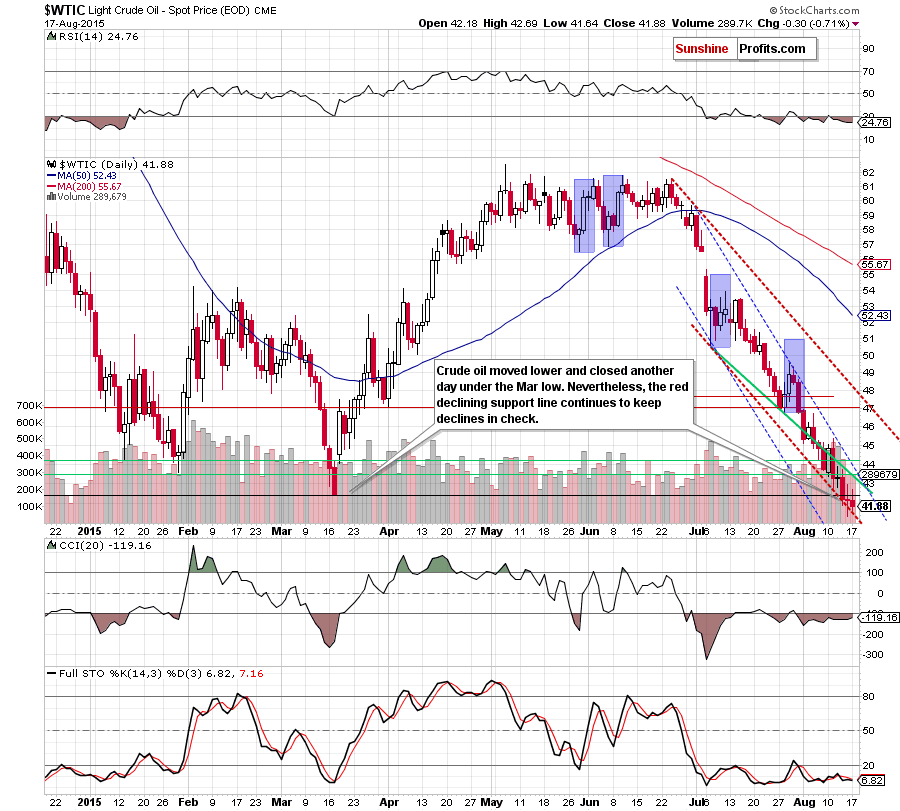

Looking at the daily chart we see that crude oil moved lower and closed another day under the March low. Although this is a negative signal, which suggests further deterioration, light crude is still trading above the key support – the red declining line, which continues to keep declines in check. On top of that, yesterday’s move didn’t materialize on huge volume, which suggests that we’ll likely see similar price action to what we saw in January 2015. Let’s consider the quote from our Friday‘s Oil Trading Alert:

(...) Black gold declined sharply at first, but the final days (and weeks) of the decline were not sharp – crude oil declined slowly and the thing that was indeed sharp, was the corrective upswing that we saw in the final part of the month. We wouldn’t want to be holding short positions should something like that happened once again and the risk of such action is not negligible.

Nevertheless, if the commodity closes the week below the March low or declines below the key support line on sizable volume, we’ll consider re-entering short positions. Until this time, in our opinion, the risk is too high.

Summing up, crude oil moved lower once again, but the commodity remains above its key support line. Therefore, in our opinion, as long as there is no confirmed breakdown (on sizable volume) below the red declining support line (or a weekly close under the March low) the outlook for crude oil is not bearish enough to justify opening another short positions. We will continue to monitor the market, look for another profitable trading opportunity and report to you accordingly.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts