Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Friday, crude oil extended losses and hit a fresh multi-month low, re-testing the barrier of $50 as a stronger greenback continued to weigh on the price. Although the commodity rebounded slightly later in the day, light crude lost 0.27% and closed the week at its lowest level since Apr. Where will crude oil head next?

On Friday, economic data showed that the U.S. consumer price index rose 0.3% in June (on a yearly basis, the index rose by 0.1%), while core consumer prices (without food and energy) increased by 0.2% in the previous month. Additionally, a separate report showed that U.S. housing starts rose by 9.8%, and U.S. building permits increased by 7.4beating analysts’ expectations. Thanks to these bullish numbers, the USD Index broke above the May high and climbed to a fresh multi-month high, making crude oil less attractive for buyers holding other currencies. As a result, light crude declined below the Jul low and re-tested the barrier of $50. What impact did this move have on the short-term picture of the commodity? (charts courtesy of http://stockcharts.com).

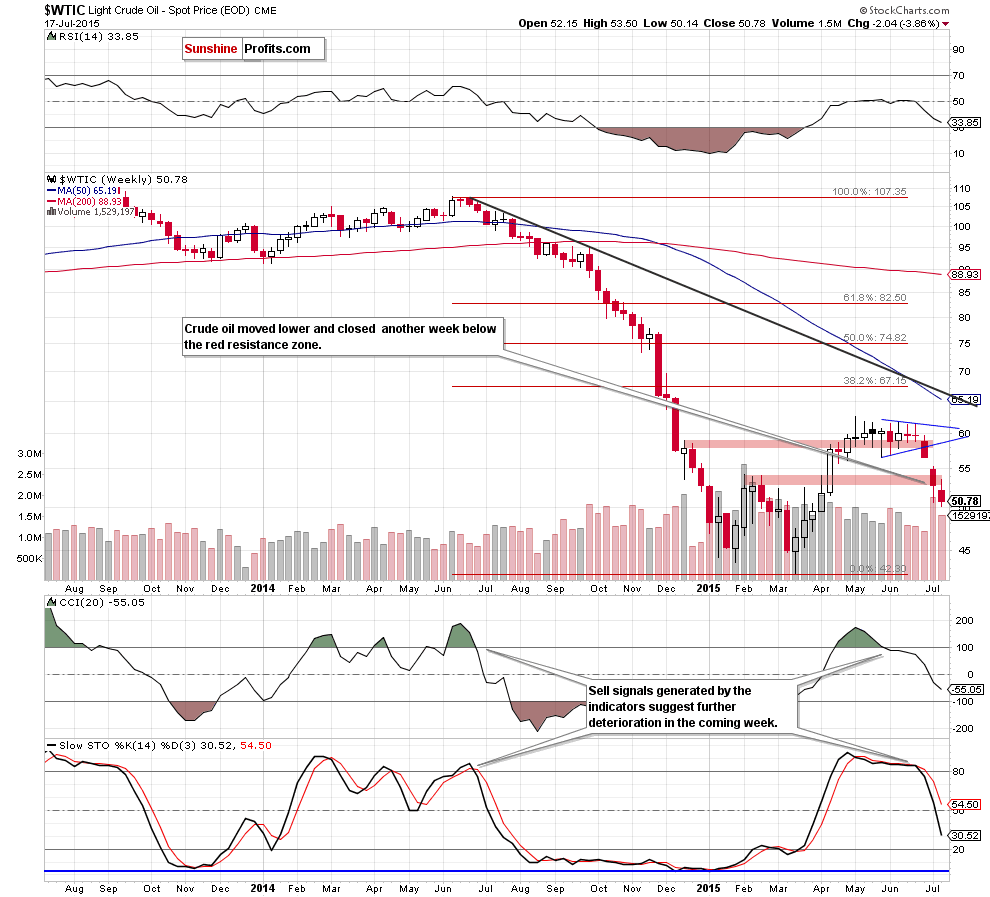

As you see on the weekly chart, crude oil extended losses and closed another week below the previously-broken red resistance zone. Additionally, sell signals generated by the indicators remain in place, supporting the bearish case.

Having said that, let’s focus on the very short-term changes.

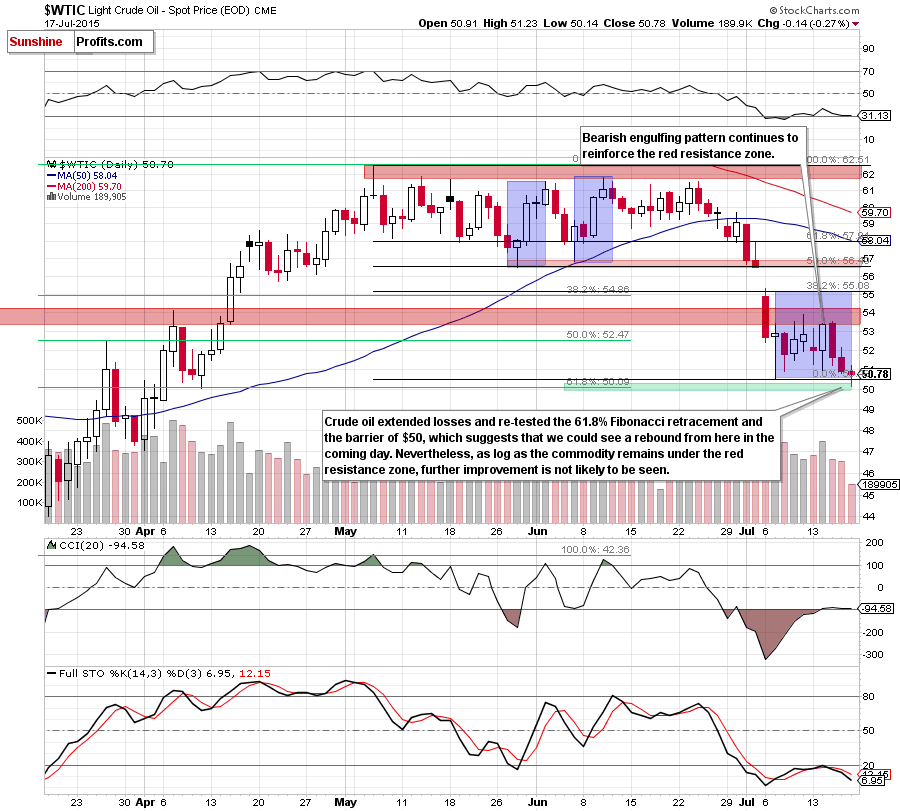

Looking at the daily chart, we see that crude oil extended losses (making short positions even more profitable) braking below the Jul 7 low and almost touched the 61.8% Fibonacci retracement. This support level, in combination with the level of $50, encouraged oil bulls to act. As a result, light crude rebounded slightly, invalidating earlier small breakdown below the previous low.

Athough this is a positive signal, which suggests further improvement, we should keep in mind that the commodity is trading well below the red resistance zone (created by the Feb highs) and the short-term downward trend remains in place, which together suggests that lower values of light crude are just around the corner. Nevertheless, in our opinion, another acceleration of declines will be more likely if crude oil closes the day under the psychologically important barrier of $50 and the 61.8% Fibonacci retracement.

Summing up, short positions in crude oil are justified from the risk/reward perspective as the commodity declined once again and closed the previous week at its lowest level since Apr. This confirms that the downtrend remains in place, suggesting lower values of the commodity in the coming days (especially when we factor in sell signals generated by the weekly indicators).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts