Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Thursday, crude oil gained 1.53% as shares in China moved sharply higher. As a result, light crude re-tested the resistance zone, but will we see an invalidation of the breakdown in the coming week?

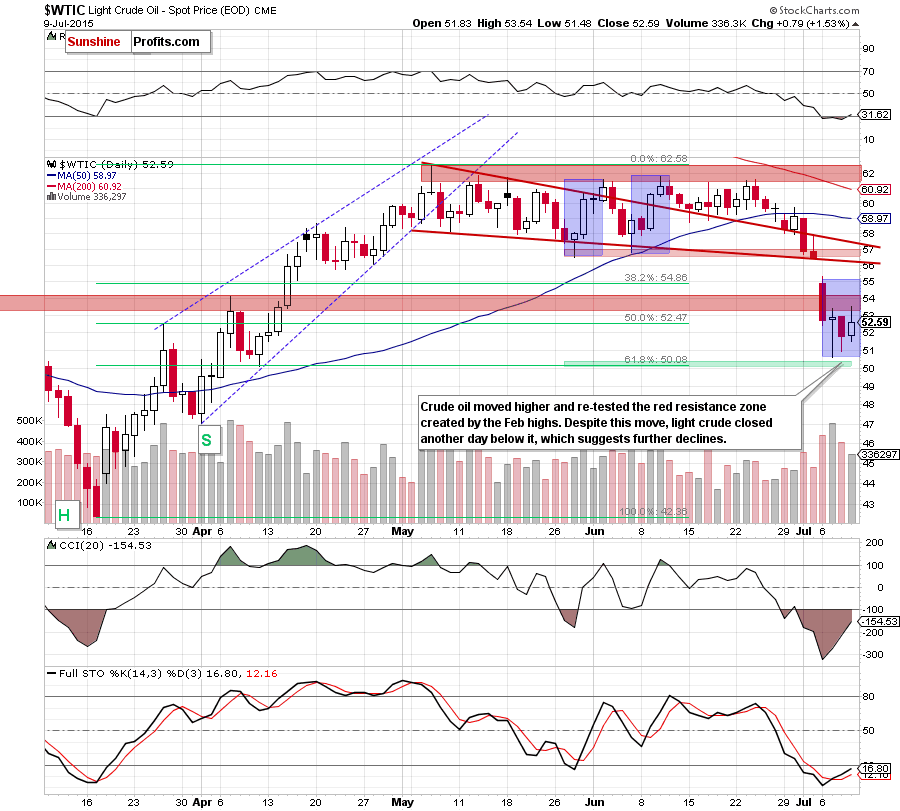

In the recent weeks, equity markets in China have lost more than 30% , fueling worries that the plunge in the stock market could spread to other parts of the Chinese economy and affect negatively the country’s demand for oil. Therefore, yesterday’s sharp rally in the Shanghai Composite (nearly 6%) faded these concerns and supported the price of the commodity. Because of these circumstances, light crude climbed to an intraday high of $53.53 and re-tested the resistance zone, but did this move change anything? (charts courtesy of http://stockcharts.com).

The situation in the long- and medium-term hasn’t changed much as crude oil is trading below the previously-broken lower border of the consolidation and the zone based on the Feb highs. Additionally, sell signals generated by the weekly indicators remain in place, supporting oil bears and further deterioration.

What impact did yesterday’s drop have on the very short-term picture? Let’s examine the daily chart and find out.

Yesterday, crude oil moved higher and re-tested the strength of the red resistance zone based on the Feb highs. Despite this move, the commodity closed another day below it, which suggests that yesterday’s upswing could be nothing more than another verification of the breakdown.

Taking this fact (and also the long- and medium-term pictures) into account, we believe that what we wrote in our previous Oil Trading Alert is up-to-date:

(…) as long as there is no invalidation of the breakdown below the Feb highs a sizable upward move is not likely to be seen. Nevertheless, another acceleration of declines will be more likely if light crude closes the day under the green support zone. Will we see such price action? In our opinion it is just a matter of time. Why? (...) this year’s rally is simply a sizable correction of the previous massive decline (...) there was no major breakout and the trend remains down, (...) as crude oil didn’t move above the long-term rising resistance line and the 200-month moving average.

(…) we would like to draw your attention to the fact that yesterday’s upswing is much smaller than the previous upward moves, which we saw at the end of May and later in June (all marked with blue on the daily chart). This means that the short-term downward trend remains in place, suggesting lower values of the commodity

Summing up, in our opinion, short positions in crude oil are justified from the risk/reward perspective as crude oil verified the breakdown under the zone created by the Feb highs. Additionally, not only the long-term, but also short-term downward trend remains in place, suggesting lower values of the commodity in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts