Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

In the previous alerts we commented on the consolidation in the crude oil market, however based on today’s price action it seems that the long wait for the next big move may be over. In what direction will crude oil head next?

Probably down, but the signal that we’re seeing today is not confirmed, so even though it looks promising (with the promise of another trading opportunity being just around the corner), it’s not yet confirmed, so it’s too early to say that the move is really beginning… But it looks like we might finally see some action next week.

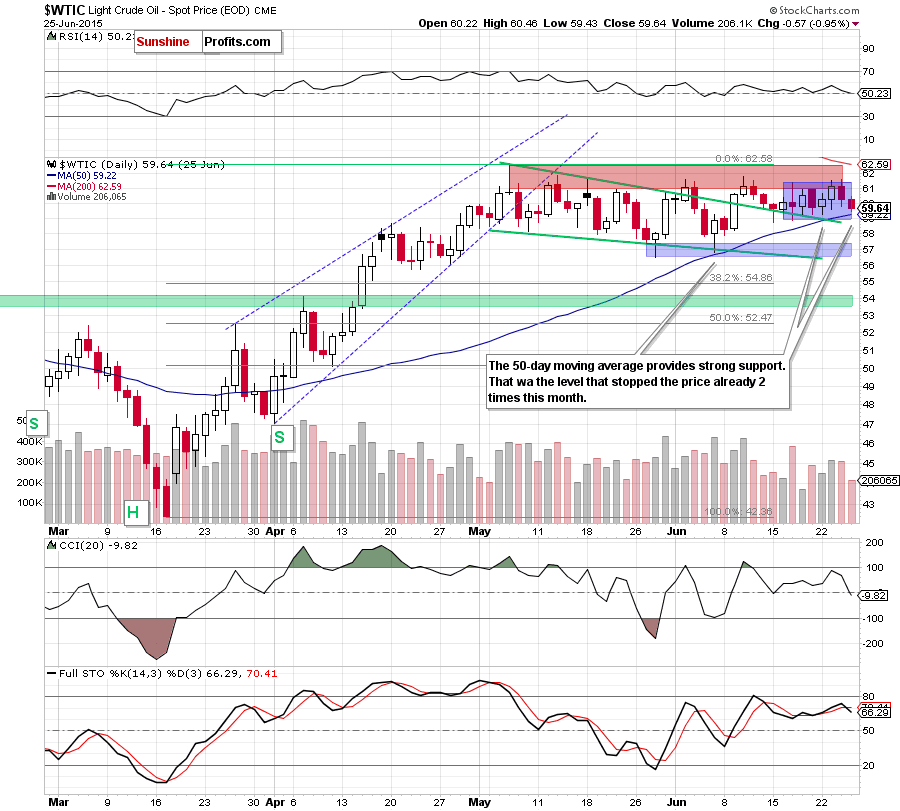

The signal that we described above is today’s move below the 50-day moving average. Let’s take a closer look (charts courtesy of http://stockcharts.com).

While we don’t see today’s price movement on the above chart, we see that the 50-day moving average is at $59.22. At the moment of writing these words, crude oil is already below this level – at $58.94. The session is not over yet, so we don’t know if we’ll see a daily close below this important support, but if we do, it will be a significantly bearish development (both: daily and weekly close below it).

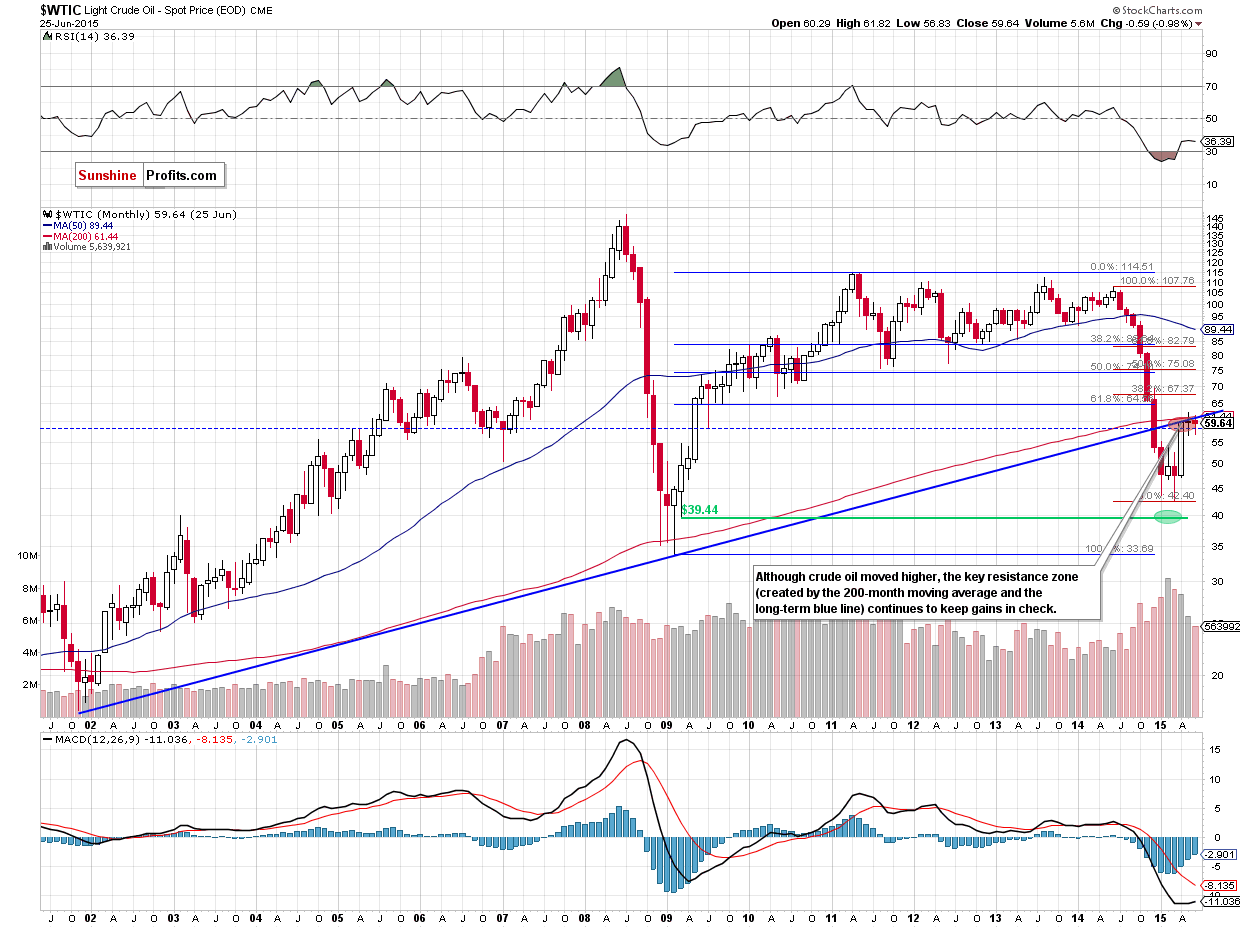

Consequently, it seems that the outlook will soon deteriorate, but it’s too early to say that just yet. It has been likely that the short-term outlook would deteriorate, as crude oil didn’t move above the long-term rising resistance line and the 200-month moving average.

As you can see on the above chart, this year’s rally is simply a sizable correction of the previous massive decline. There was no major breakout, so the trend remains down.

Summing up, the outlook for crude oil has been bearish and it deteriorated further based on today’s intra-day price move. If we see a daily and weekly close below the 50-day moving average, the outlook will deteriorate even further, which would confirm our bearish outlook and make it much more likely that we will see more gains from our short positions in the near future. As always, we’ll keep you – our subscribers – updated.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts