Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective.

On Wednesday, crude oil lost 1.20% as a stronger greenback continued to weigh on the price. In this environment, light crude declined once again and closed the day on the key support line. What’s next?

Ongoing expectations that the economic recovery in the U.S. would accelerate the timeline for higher interest rates continued to support the greenback also yesterday. As a result, the USD Index moved higher once again, hitting a fresh 4-week high and making crude oil less attractive for buyers holding other currencies. Thanks to these circumstances, light crude declined and closed the day on the key support line. What’s next? (charts courtesy of http://stockcharts.com).

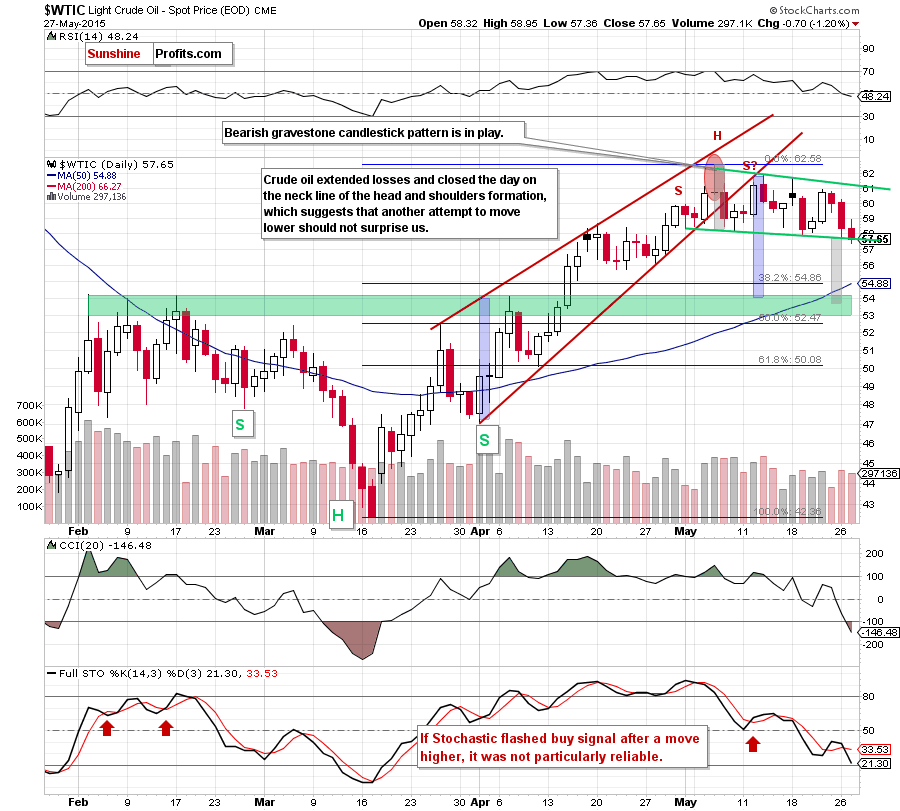

Lookig at the daily chart, we see that the overall situation in the very short term hasn’t changed much as crude oil declined once again and closed the day on the neck line of the head and shoulders formation. Taking into account the long- and medium-term pictures (an invalidation of the breakout above the Dec 15 and Dec 22 highs and its negative impact on future moves is in effect), and combiing it with sell signals generated by the indicators (weekly and daily), we think that oil bears will not give up and push the commodity lower in the coming days.

If this is the case, and we see a breakdown under the green support line based on the May lows (the neck line of the formation - currently around $57.70), the current decline will accelerate and we’ll see a drop to the 38.2% Fibonacci retracement (based on the entire Mar-May rally) or the green support zone created by the Feb highs (in this area the size of the downward move will correspond to the height of the rising wedge – marked with blue).

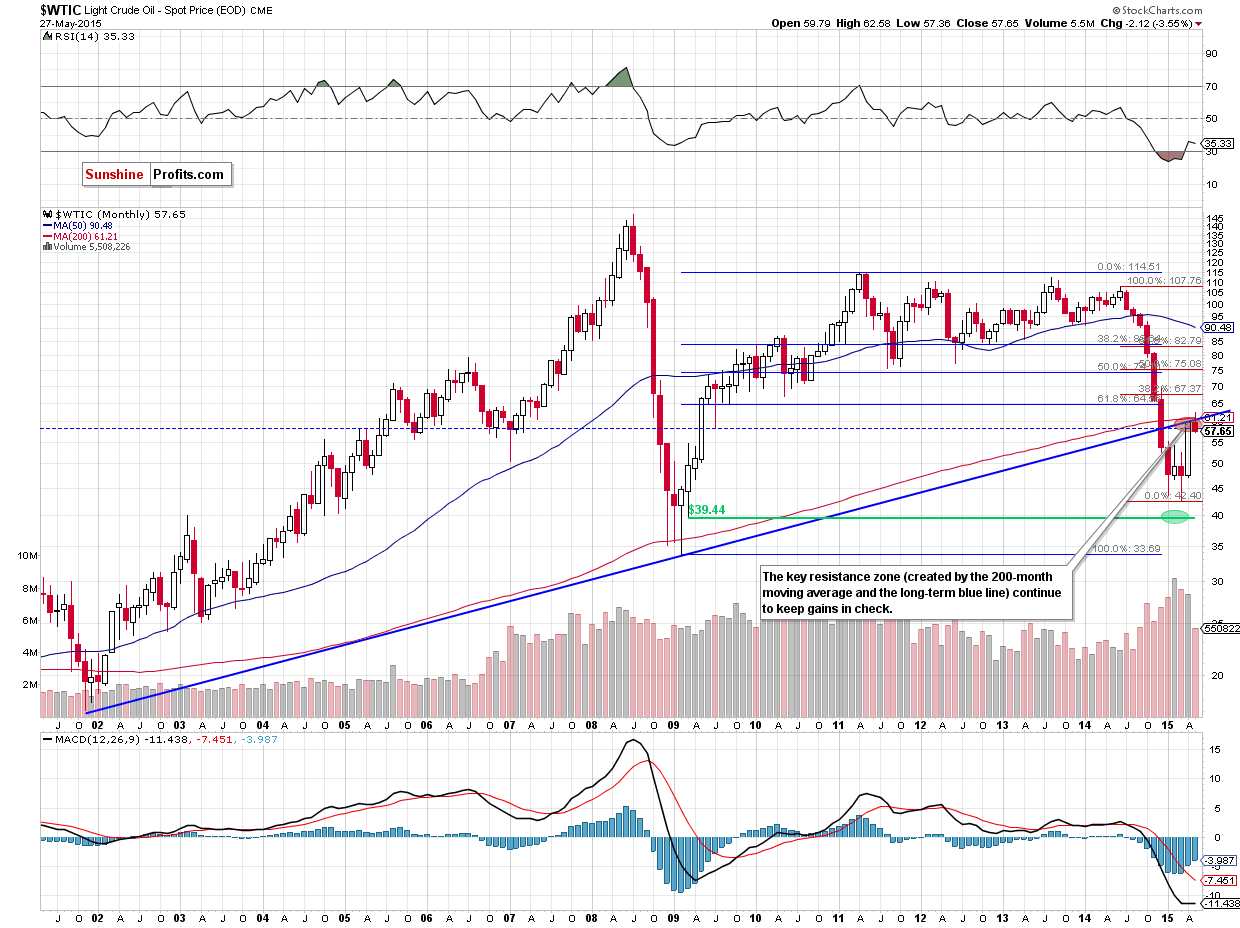

Finishing today’s alert, please keep in mind that even if crude oil rebounds from here, the space for growth is limited by the green resistance line (the upper line of the declining trend channel) and the major resistance zone marked on the monthly chart below.

Taking into account that the overall situation hasn’t changed, we summarize today’s alert just like yesterday:

Summing up, crude oil moved sharply lower and reached the the neck line of the head and shoulders formation once again. Although the commodity could rebound from here (simiarly to what we saw in the previous weeks), we believe that the space for further gains is limited and a breakdown below the neck line of the formation is only a matter of time (especially when we factor in sell signals generated by the weekly indicators).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $65.23 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts